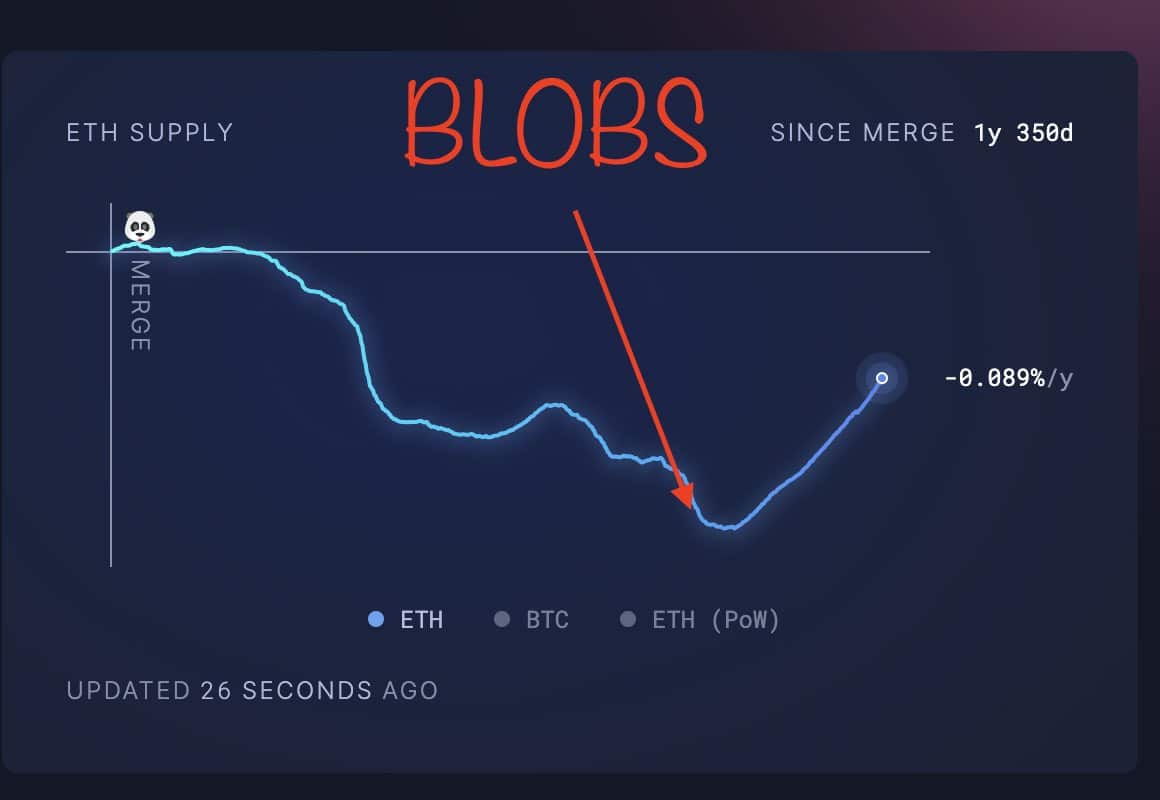

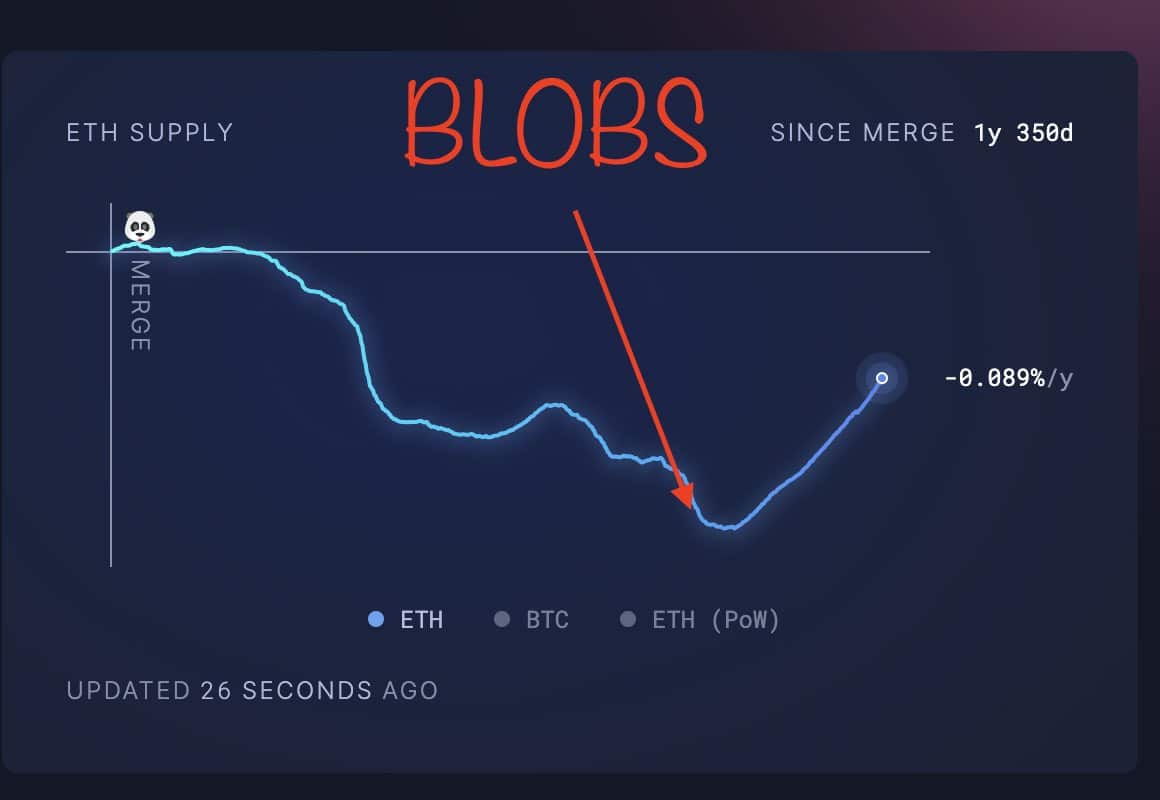

- ETH’s inflation remains elevated after the implementation of the blobs in March

- Analysts are divided on how to address inflation with the low-cost blobs

Analysts and insiders are calling for a revision of the current Ethereum [ETH] blobs to mitigate inflation and allow the second-largest altcoin to accrue value for its L2s (layer 2s).

Once praised for making L2s more efficient and significant transaction costs in the ecosystem, Ethereum blobs are now being scrutinized for escalating ETH inflation. In fact, one such analyst, Cygaar, believes that the current relationship between ETH and L2s is lopsided.

“Right now, the relationship between Ethereum L1 and its L2s is quite lopsided. L2s receive the benefits of Ethereum security without contributing much value back to ETH.”

The problem with Ethereum blobs

For context, before blobs, L2s were major ETH gas consumers. As part of Ethereum’s fee structure, the high gas usage also led to a high burn rate (removal of part of generated ETH from circulation). The net impact was deflationary to ETH.

However, blobs made heavy transactions on L2s relatively cheaper, reducing gas usage on L1 and affecting the burn rate. With a low ETH burn rate, the once deflationary asset turned inflationary since blob implementation in March 2024.

Source: Ultra Sound Money

Owing to the same, Cygaar suggested increasing blob fees in the short term.

“Perhaps more short-term, solution is to increase the base blob fee. L2s should have to pay some amount in fees to use Ethereum DA…I would argue that the chains that want to truly inherit Ethereum’s security will still pay these costs.”

He added that increasing L2 usage could hike the ETH burn rate and help achieve deflationary status in the long run.

“If demand and usage of L2s increases, we may reach a state where the blob pricing curve adequately prices DA blobs, leading to a healthy amount of ETH burning on L1.”

However, on the contrary, the likes of Ethereum community member Ryan Berckmans sees no need to decide on the situation just yet. He claimed,

“I don’t think there’s a decision to make here – we’re simply going through the initial launch phase of blobspace and L2 maturation…L2 growth stats are excellent and will inevitably lead to blob saturation. This will likely then lead to significant blob revenue for the L1.”

Berckmans added that a surge in demand for blob spaces would increase the burn rate and fees to L1.

For his part, Doug Colkitt, Founder of Ambient Finance, downplayed expectations that a surge in demand for blob space would increase the ETH burn rate. He did so by citing the dominance of small dollar-sized transactions on L2s.

“Unfortunately, blob saturation is unlikely to lead to any meaningful increase in Ethereum burn.”

That being said, the low-cost DA (data availability) blobs were introduced only five months ago. Conservatives like Berckmans feel that calling for re-adjustment in such a short period would be a hasty decision. However, other users believe ETH’s inflationary status should be addressed promptly.

Whether the community will reach a consensus on the way forward remains to be seen.

In the meantime, ETH is struggling to hold above $2.5k. The altcoin was down by 38% since blob implementation in March, at press time.