- Ethereum traders turned bearish as demand in puts grew.

- Price of ETH did not witness much volatility, retail investors continued to accumulate ETH.

Ethereum [ETH] witnessed a massive surge in interest as bullish sentiment around the crypto sector grew, which was led by the approval of the Bitcoin ETF. However, as time passed, it seems that the bullish tides have changed with respect to Ethereum.

Interest in puts on the rise

According to QCP’s data, ETH risk reversals to negative suggests an increased demand for put options as a safeguard against potential losses from speculative long positions.

Altcoin speculators may also be acquiring ETH puts to hedge against downward movements in altcoin prices. These trends raise concerns about a potential market correction, particularly given the considerable leverage in the market.

However, it is anticipated that the market will respond robustly to any downward movements.

The shift to bearish sentiment may be due to upcoming events that could cause volatility in ETH’s price. One of them would be the upcoming Dencun upgrade which is set to go live at 13:55 UTC and may impact price and sentiment.

The anxiety around the upgrade is expected as not all of the upgrades have had a bullish impact on ETH’s price. For instance, the Merge update, which intended to shift Ethereum from a Proof of Work cryptocurrency to a Proof of Stake network resulted in a massive correction.

These fears, coupled with the uncertainty around the approval of Ethereum ETF applications can cause FUD in the market.

How is ETH doing?

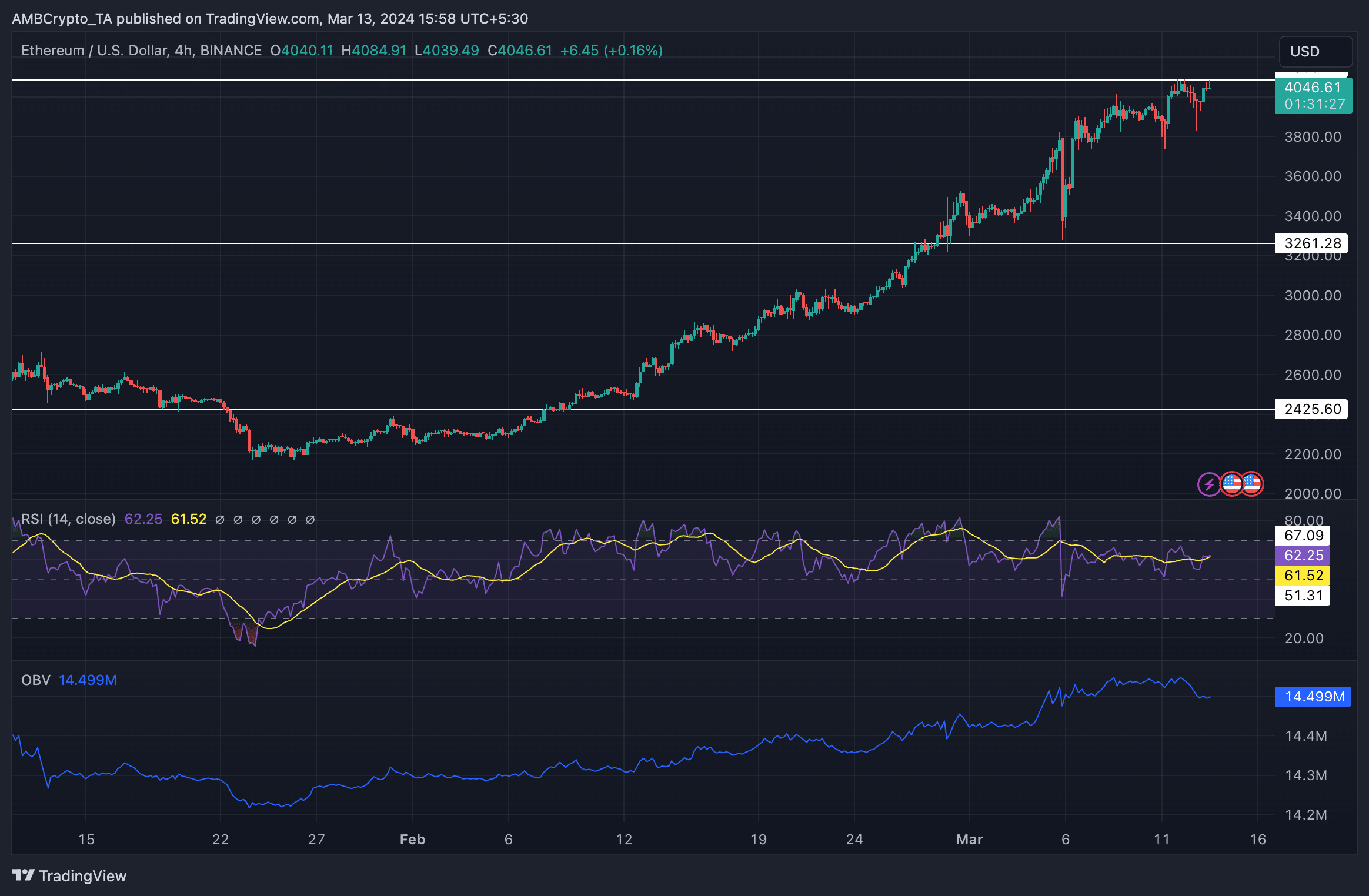

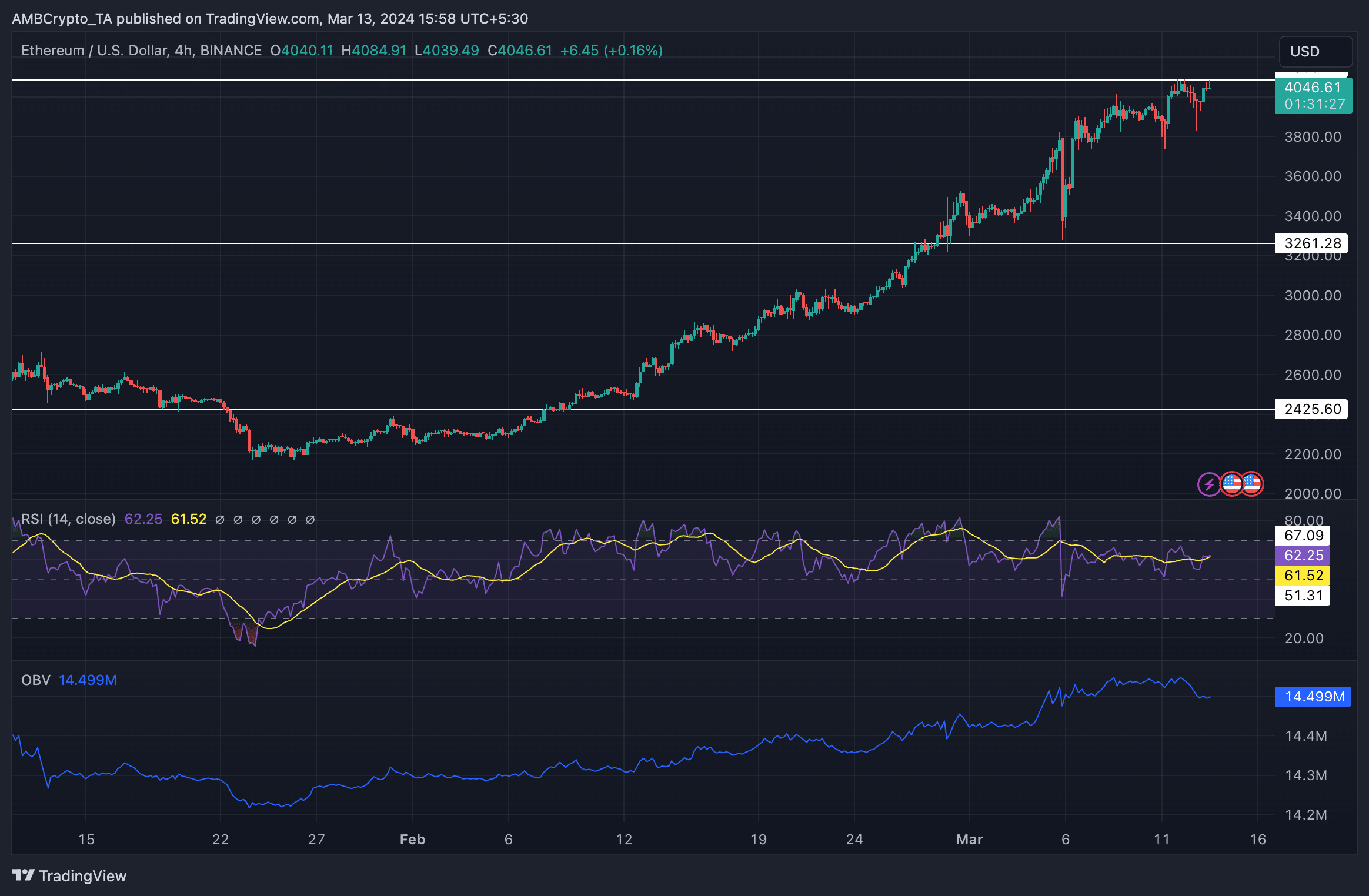

At press time, ETH was trading at $4046 and had steadily climbed to this price level. Despite making a few minor corrections, the overall trend remained bullish.

However, the OBV (On Balance Volume) for ETH declined significantly over the last few days. This suggests that the selling pressure outweighed the buying pressure, potentially indicating a weakening trend or a forthcoming price decline.

Source: Trading View

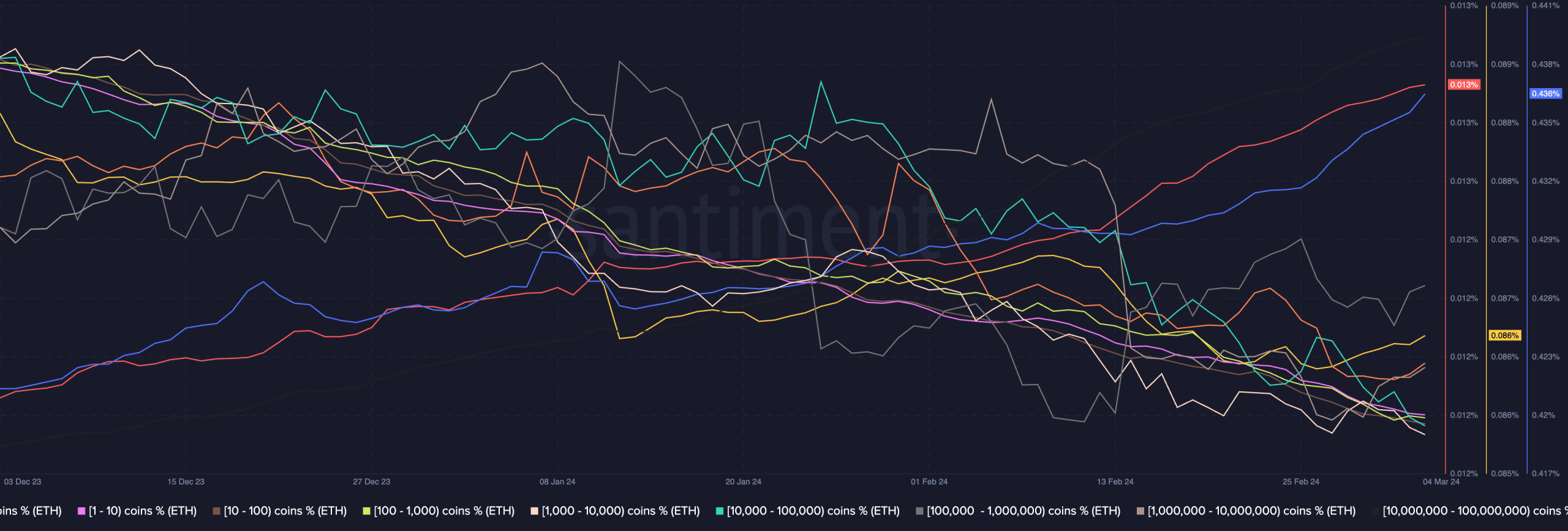

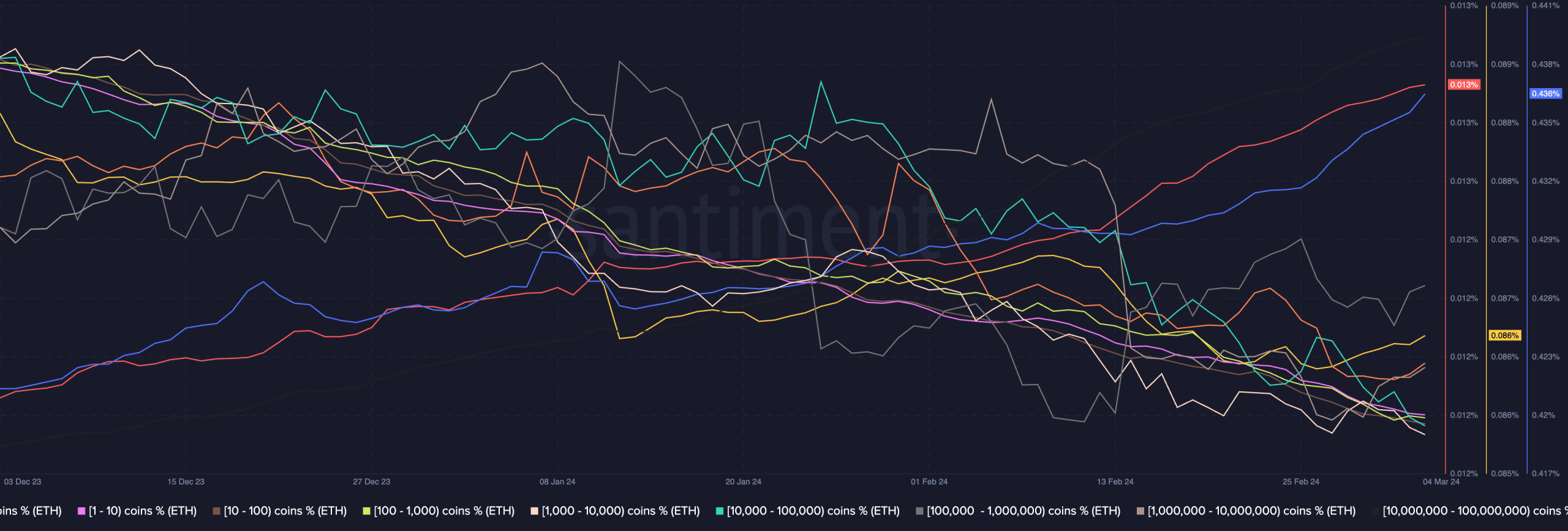

Retail continues to accumulate

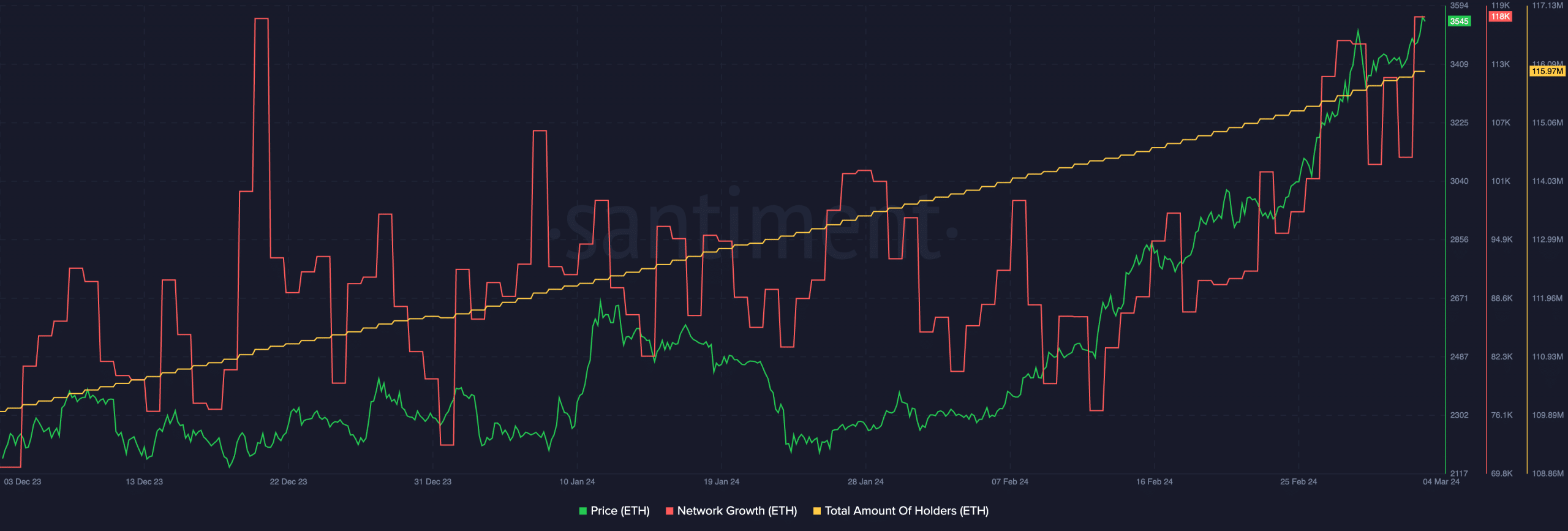

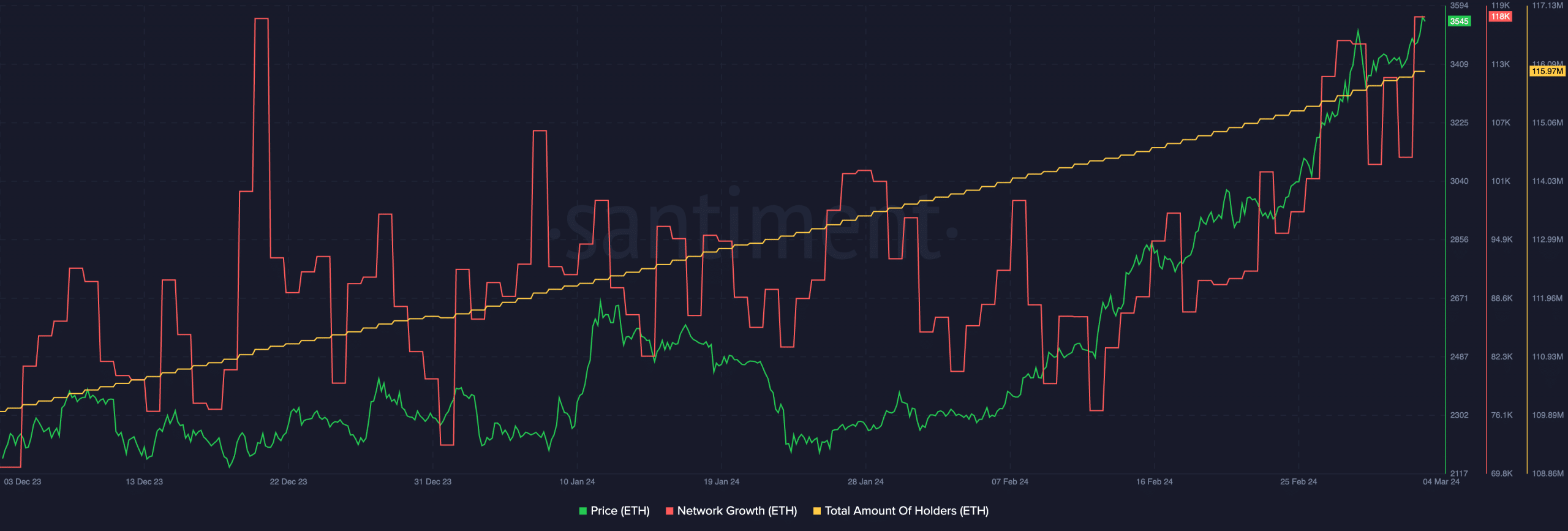

The network growth for ETH had also grown suggesting that new addresses were continuing to show interest in ETH. Coupled with that, the total number of holders accumulating ETH had also surged.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

However, while looking at the behavior of addresses as a whole, it was observed that it was retail investors that were showing more interest in ETH.

Whales on the other hand were not showing similar interest and were not accumulating at the same rate.

Source: Santiment