- Ethereum has a bearish market structure.

- The magnetic zone below $2.9k signaled further losses were likely.

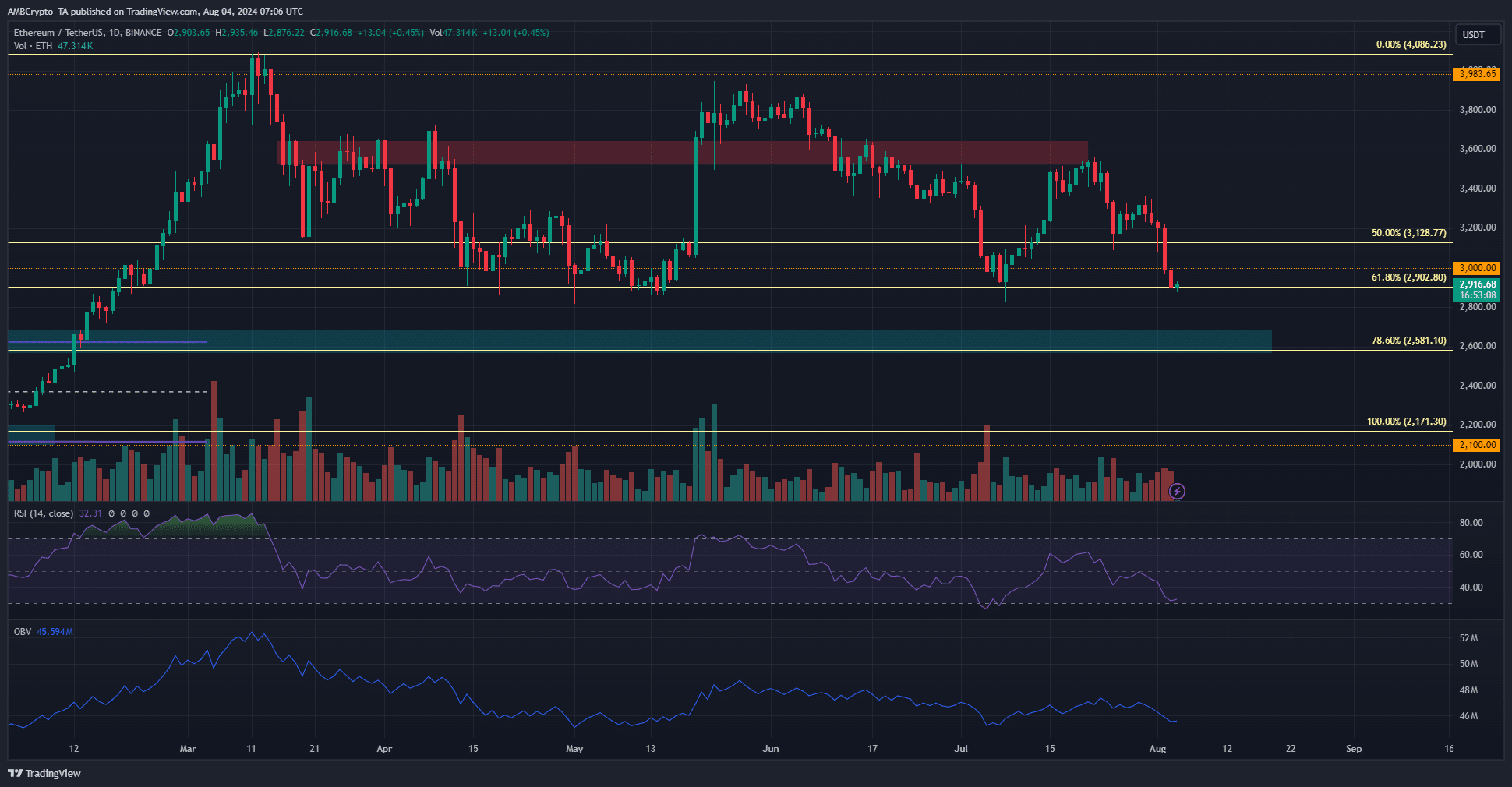

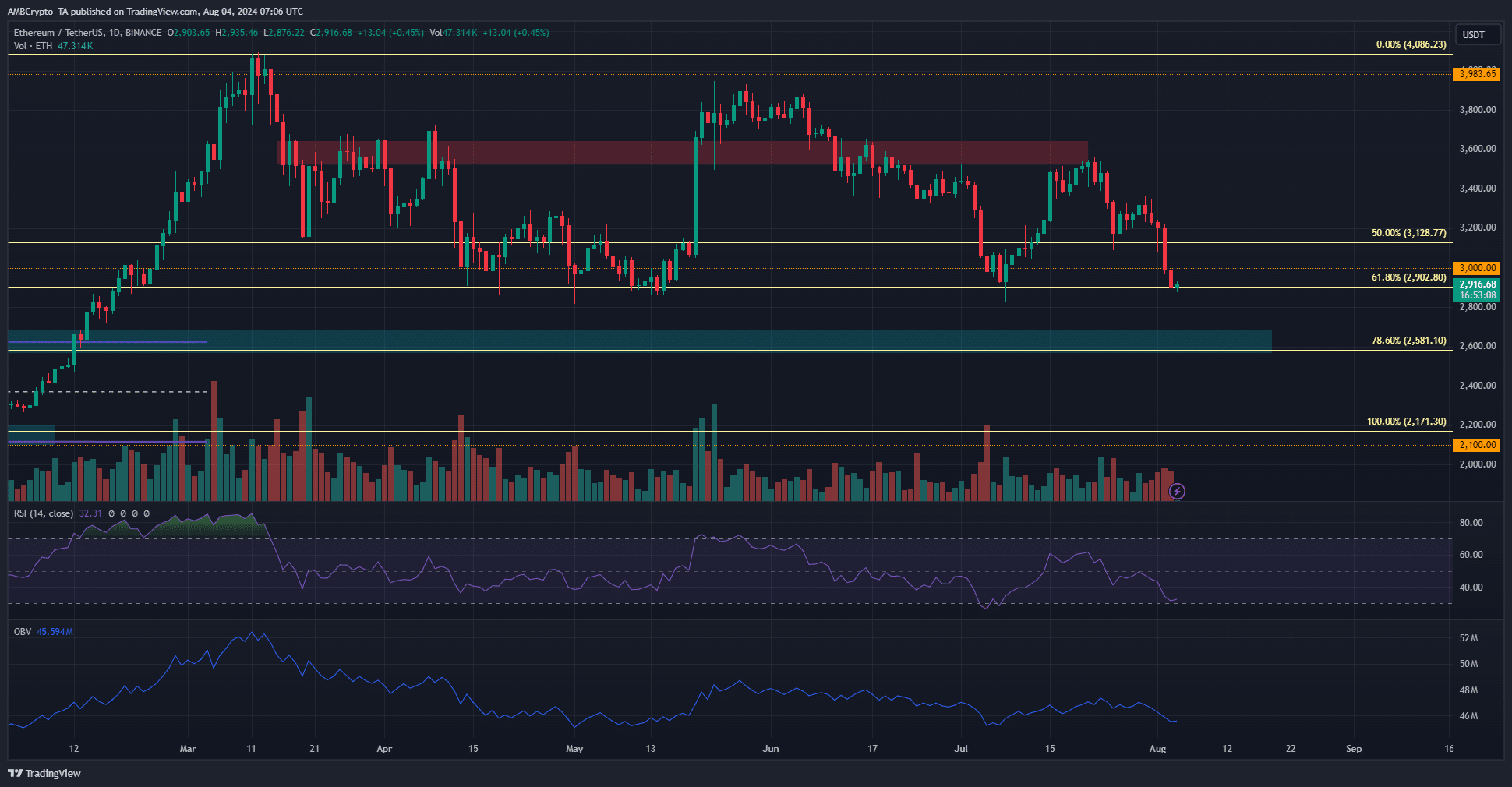

Ethereum [ETH] was again trading at the $2.9k support level. It had previously visited this level on the 5th of July. In the following weeks, the bulls drove prices as high as $3.5k before faltering.

Should we expect a bounce to $3.5k this time? The network activity has dropped in recent months, but smart money activity gave a bullish signal. The technical indicators continued to forecast bearishness.

Potential for short-term volatility and an ETH dip below $2.9k

Source: ETH/USDT on TradingView

At press time, Ethereum was trading at $2916. It had a bearish market structure on the daily timeframe. Below the $2.9k level, the next significant support zone is at $2.6k. The price action showed that such a dip is possible.

The daily RSI was just above oversold conditions and the OBV has steadily slid downward since June. Together they indicated further losses were coming.

The $2.9k support is also the 61.8% Fibonacci retracement level and has been defended since April. Hence, there is a good chance that the bulls manage to defend it again.

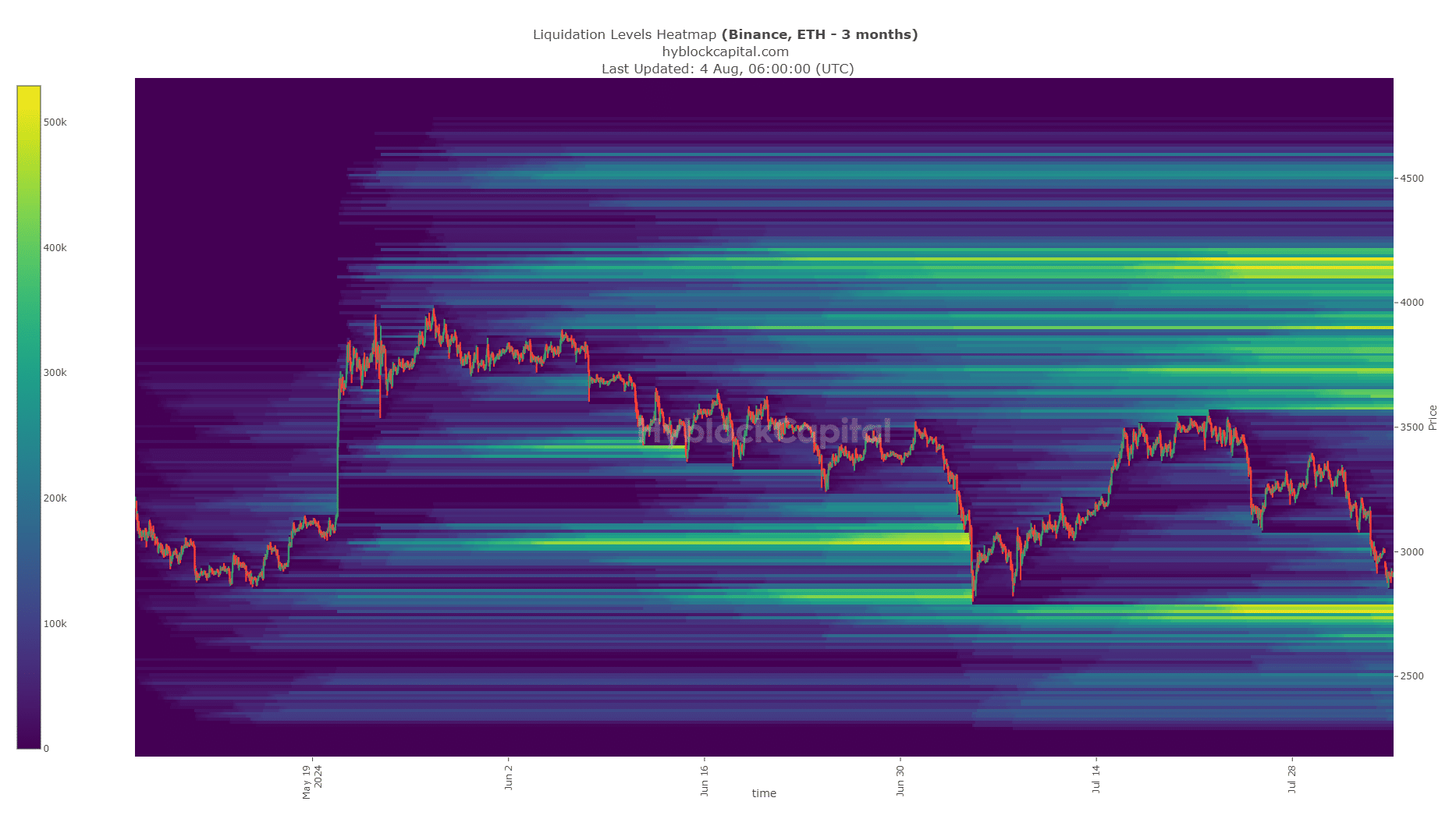

Potential for volatility due to a liquidation cascade

Over the past six weeks, the cluster of liquidation levels at the $2.8k zone has increased. Prices are inevitably attracted to these liquidity pools, making them magnetic zones. Even though $2.9k is a strong support, it is highly likely that the $2740-$2800 region is visited.

Read Ethereum [ETH] Price Prediction 2024-25

A bullish reversal from there is expected, but traders should be wary of lower timeframe volatility.

A day or two of trading to establish $2.7k-$2.8k as support alongside an influx of demand could encourage swing traders to go long.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.