- Ethereum on a steady decline since dropping below $3400.

- The crowd is losing interest in ETH during this mild crypto slump.

Ethereum [ETH] has shown signs of weakness, even after recent gains failed to break above the $3,400 mark. This has raised concerns that ETH might enter a short-term correction phase, as suggested by various metrics.

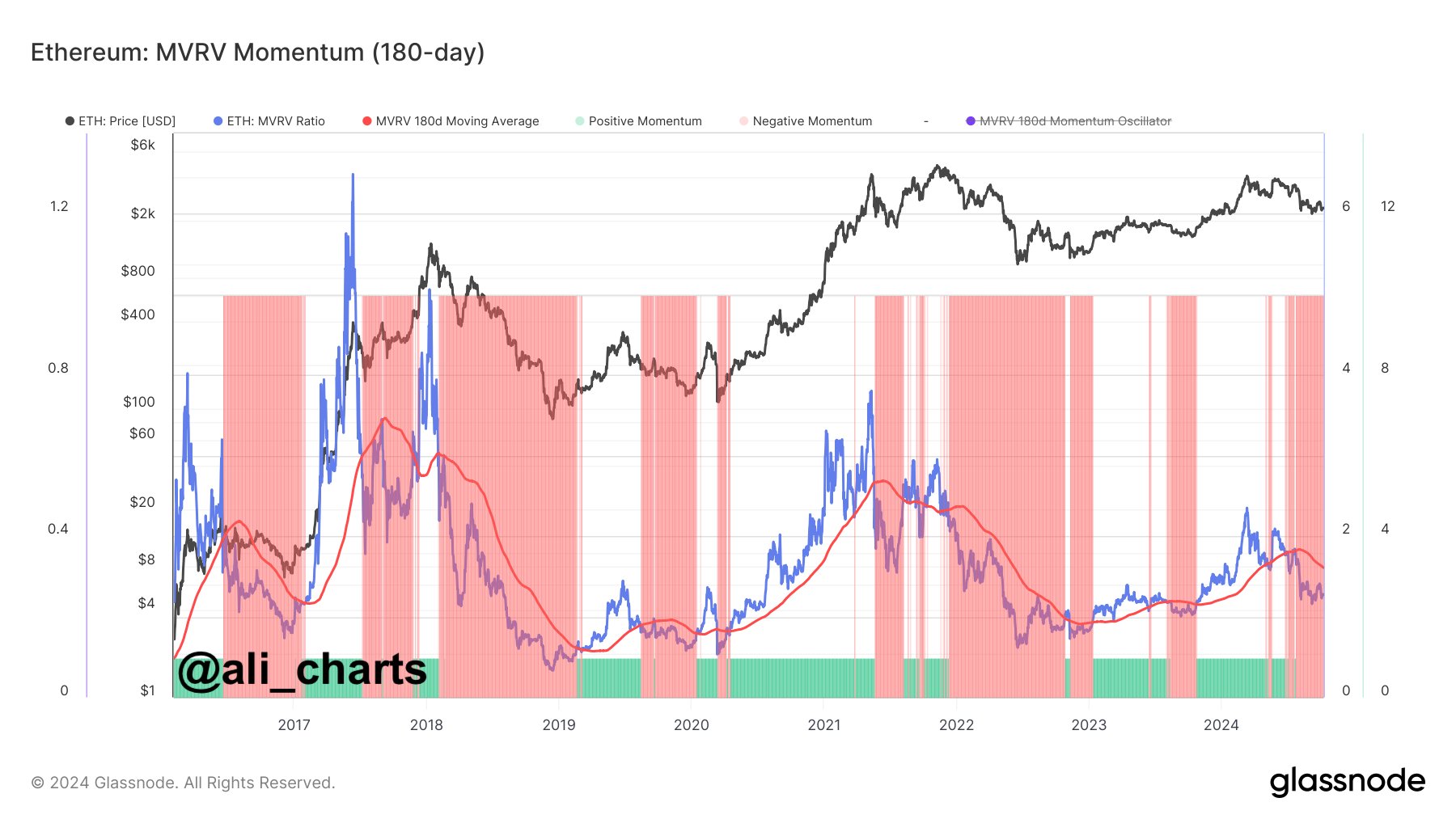

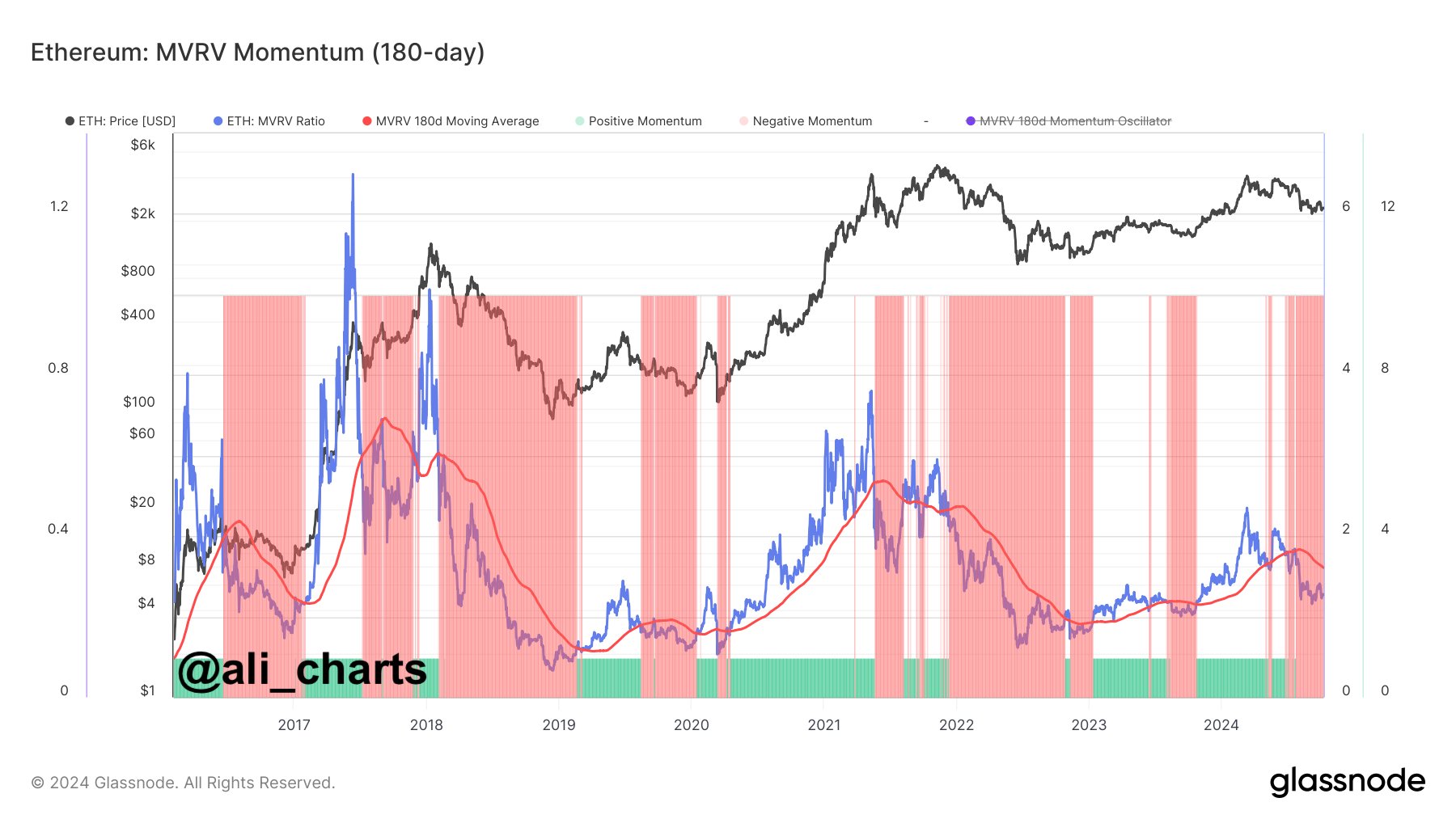

One key indicator, MVRV Momentum, highlights that Ethereum has been on a steady decline since it dropped below $3,400 on 23rd June, 2024.

This could indicate a potential downtrend for ETH, making it crucial for traders to be cautious while also identifying possible long-term buying opportunities if ETH reverses its current course.

Source: Ali/X

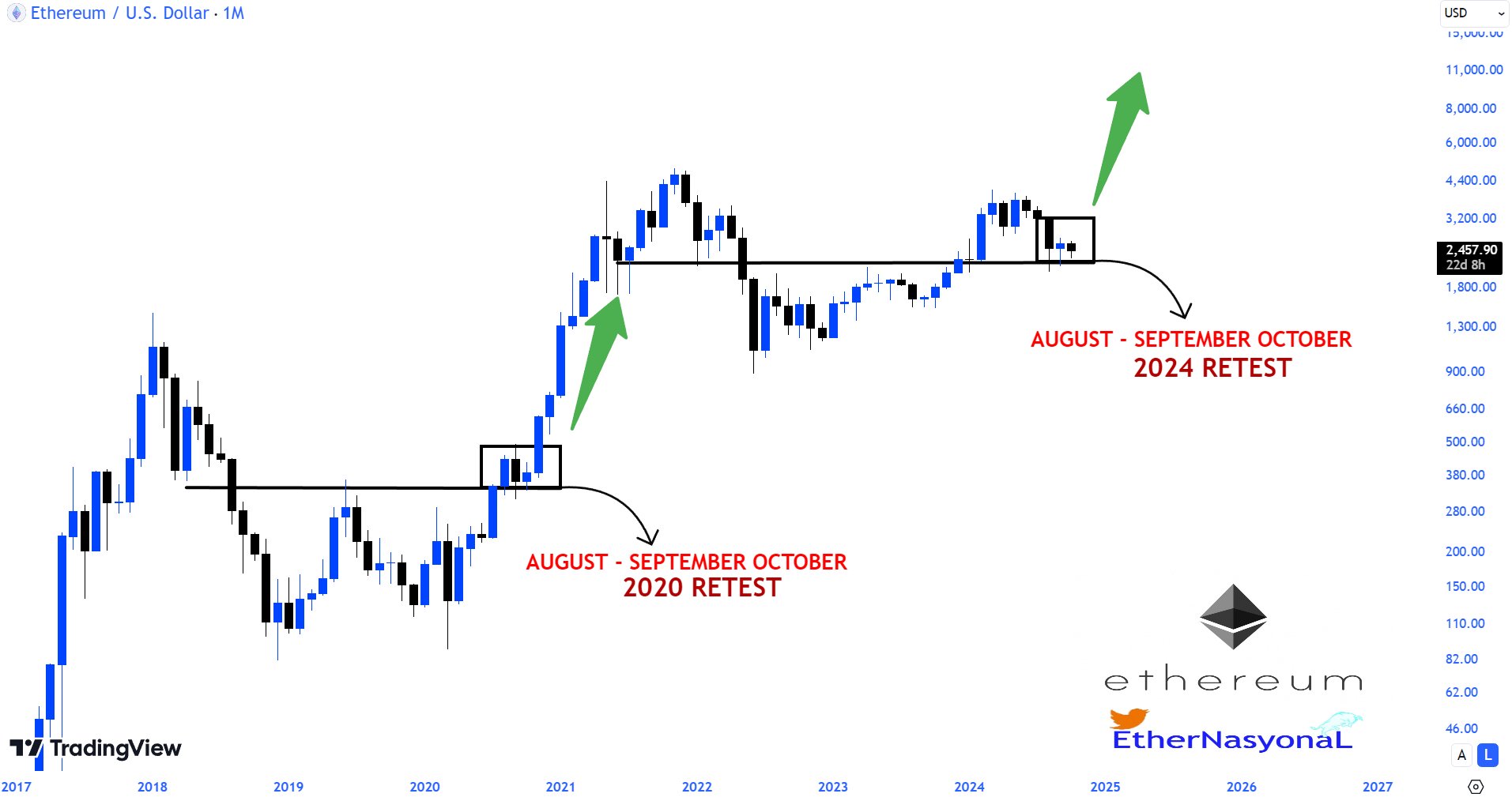

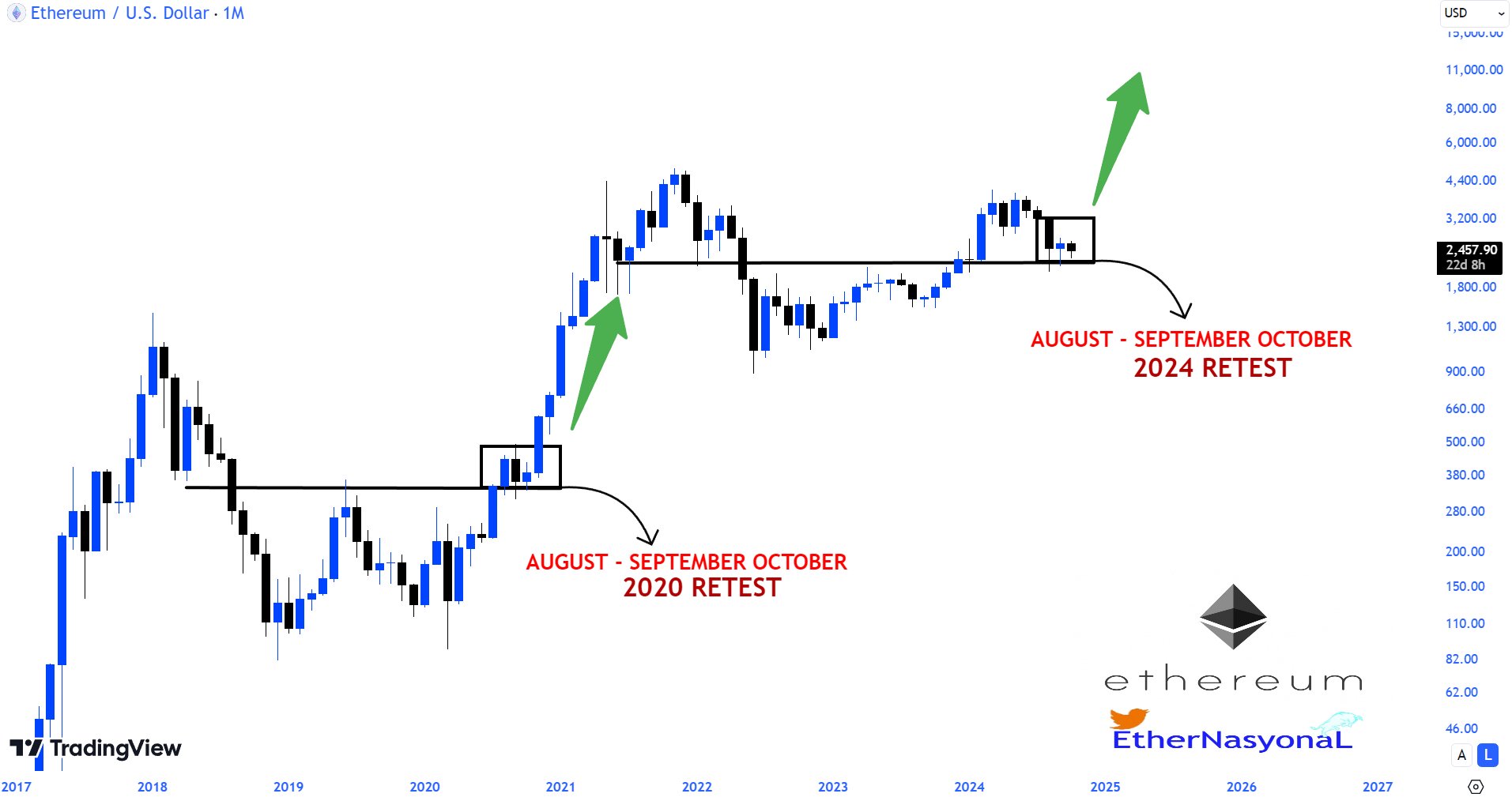

On the monthly timeframe, Ethereum is hinting at the possibility of a 2025 mega bull run. Similar to the 2021 bull market, ETH experienced a retest and accumulation phase in August, September, and October of 2020.

This year, ETH seems to be in a similar stage of retest and accumulation during these same months.

This pattern suggests that while Ethereum may face more declines in October, it could start reversing by the end of the year, setting the stage for future growth.

Source: TradingView

ETH valuation and social sentiment

Looking at Ethereum’s performance against Bitcoin (BTC), it appears the downtrend may continue.

ETH’s valuation against BTC has dropped to 0.000295, breaking below the 0.0004 mark, which was previously seen as a key support level.

This reinforces the idea that Ethereum might face further declines in the short term, as BTC continues to outperform ETH across most timeframes.

Source: IntoTheCryptoverse

Another factor adding to Ethereum’s bearish outlook is its place in social sentiment rankings.

Ethereum ranked second, just behind Chainlink, in the list of assets with the most negative crowd sentiment during this period of market uncertainty.

Historically, assets with strong bearish sentiment have often seen the best chances for a price rally. While this decline in sentiment could lead to further price drops, it also presents the potential for a turnaround.

Source: Santiment

If the bearish sentiment subsides, it could spark a rally that drives ETH to higher levels, possibly reaching new highs in 2025.

Read Ethereum’s [ETH] Price Prediction 2024–2025

While Ethereum is currently in a downtrend, the potential for a reversal exists, particularly with the 2025 bull market on the horizon.

Traders should remain cautious in the short term but keep an eye on key support levels, as they could provide early signals of a bullish reversal.