- Whales began selling their ETH at a loss.

- Network Growth for ETH declined, while interest in the NFT sector waned.

Ethereum [ETH] slipped past the $3,000 mark recently, causing uncertainty and FUD in the market. Due to this, whales started fleeing away from ETH. However, not all whales have been profitable.

Whales sell their holdings

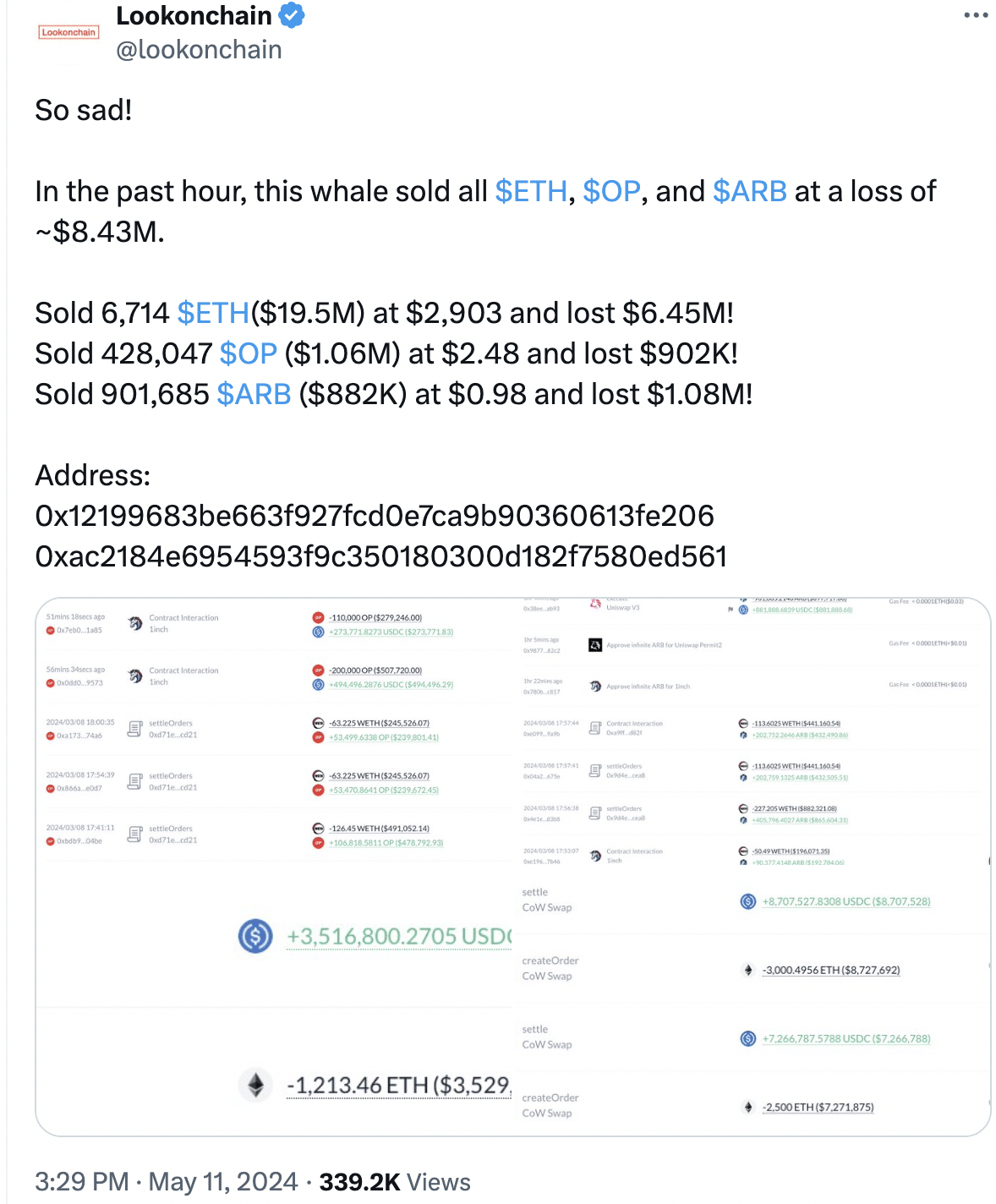

According to Lookonchain’s data, a massive whale sold its holdings of 6,714 ETH amounting to $19.5 million at $2,903 and lost $6.45 million.

When whales sell large amounts of ETH, it creates significant sell pressure in the market. This can drive down the price of ETH, as there are more sellers than buyers.

The fact that this whale was willing to sell its holdings at a loss could cause further uproar in the market.

Source: X

These kinds of sell-offs can result in a cascading effect and can impact the price of ETH even further as more whales gather to sell their holdings.

At press time, ETH was trading at $2,918.79 and its price had declined by 5.64% in the last seven days. The volume at which ETH was trading at had also fallen by 48% during the same period.

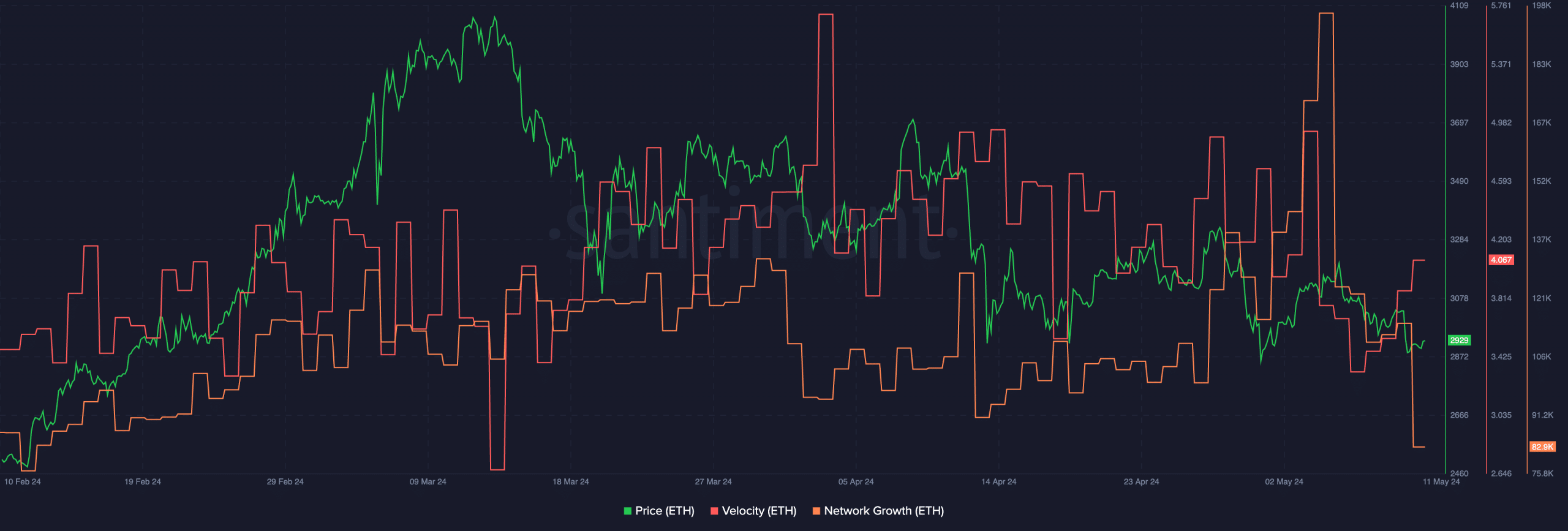

Coupled with that, the king of altcoin’s Network Growth had declined, meaning that new addresses were losing interest in ETH.

So, in another surprising sign, new addresses seemed uninterested in ETH despite its lower prices.

On a positive note, the velocity at which ETH was trading at had surged, as implied by its rising velocity.

Source: Santiment

NFT sector takes a hit

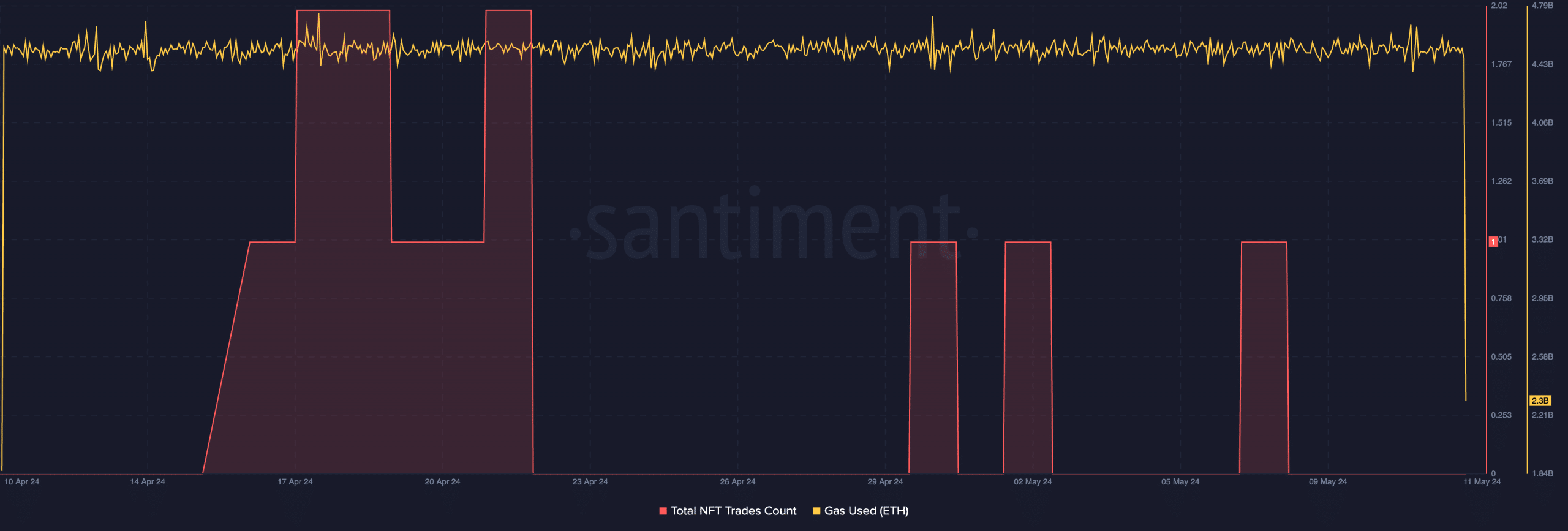

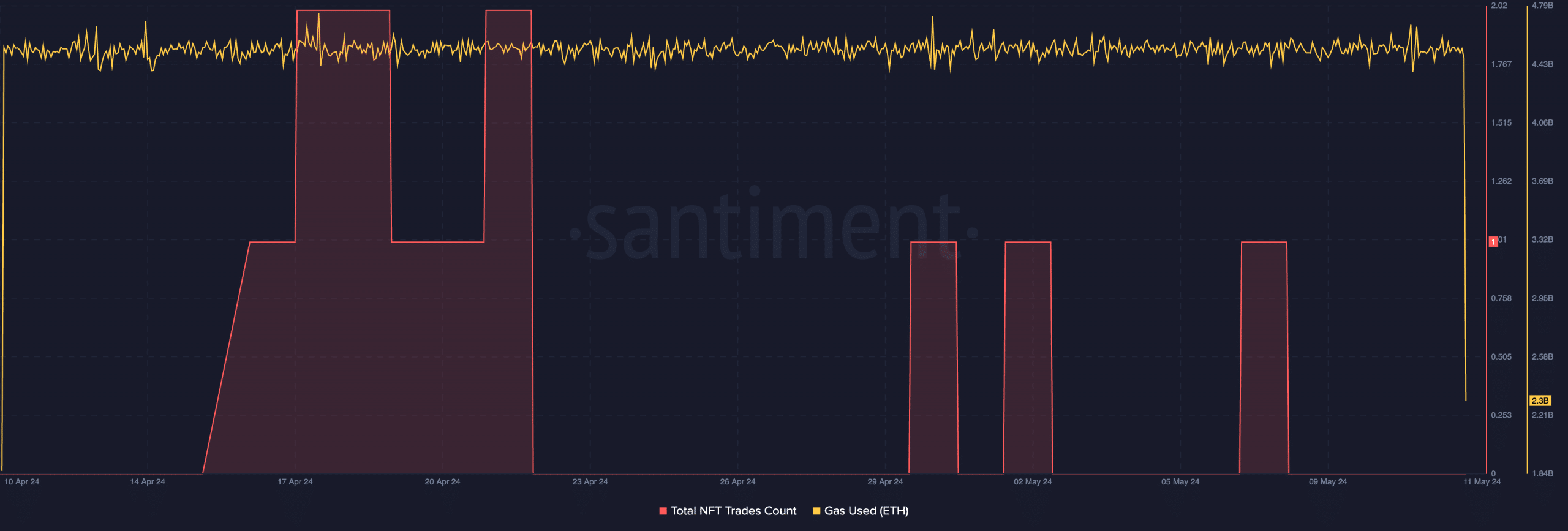

In terms of the overall activity on the network, it was seen that the gas usage on the network had remained the same, suggesting that usage had not significantly declined.

Read Ethereum’s [ETH] Price Prediction 2024-25

However, one alarming trend was the declining number of NFT trades occurring on the network. Popular NFT collections such as BAYC and MAYC were not garnering attention on any marketplaces.

Other networks such as Bitcoin [BTC] and Solana [SOL] were doing relatively better than Ethereum [ETH] and had captured a large amount of market share in the last few days.

Source: Santiment