- Ether could rise to the $2,900 level if it maintains itself above the $2,570 level.

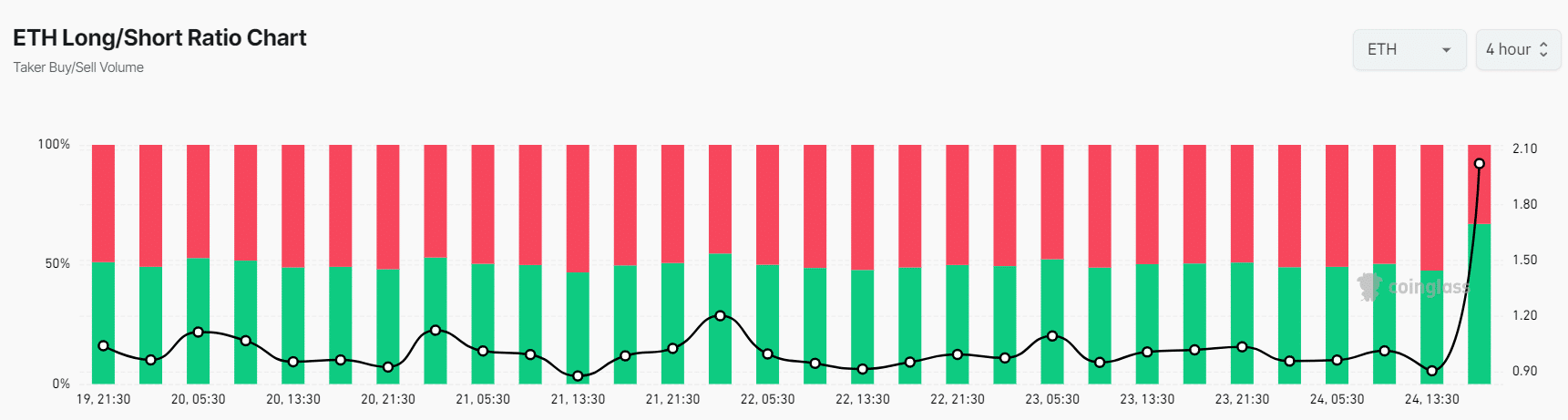

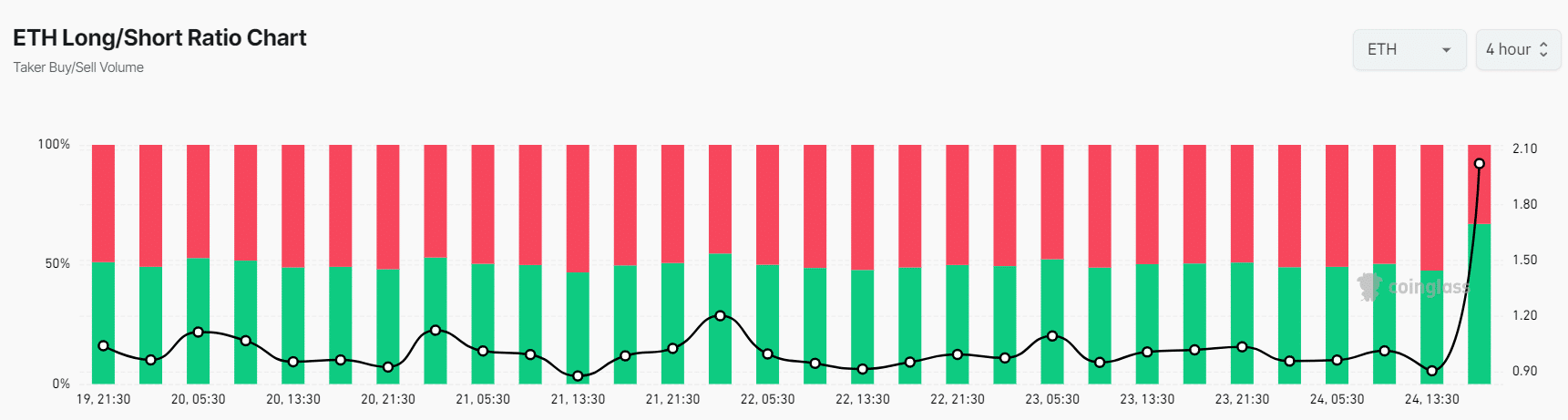

- ETH’s Long/Short Ratio currently stands at 2.023, indicating extremely bullish market sentiment among traders.

Ethereum [ETH], the world’s second-biggest cryptocurrency by market cap, is on the radar of whales, who are on a buying spree likely due to its bullish on-chain metrics.

Ethereum whale on a buying spree

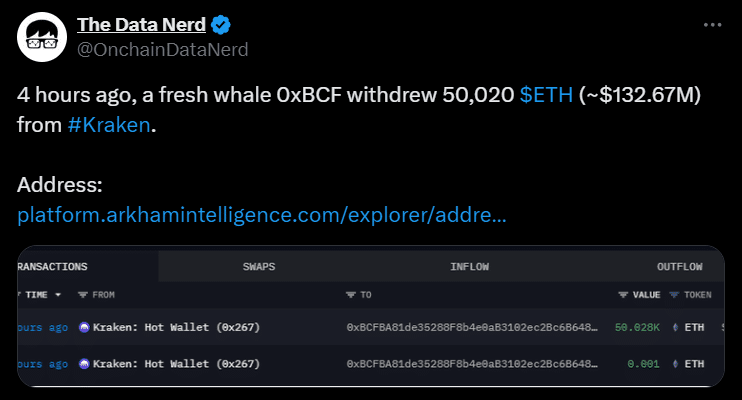

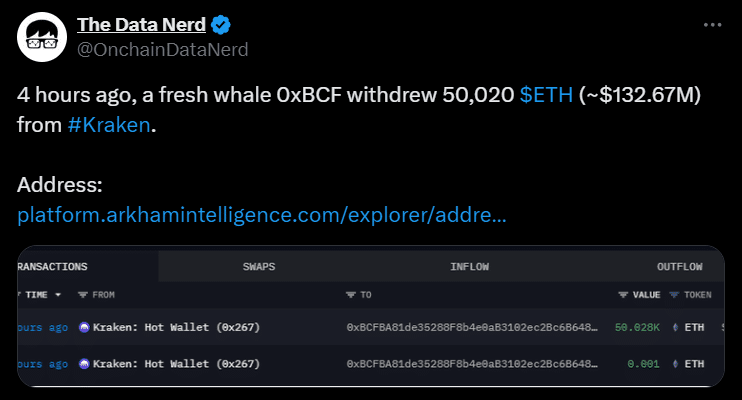

On the 24th of September, on-chain analytic firm TheDataNerd made a post on X (Previously Twitter) that whale wallet address “0xBCFB” had purchased a significant 50,020 ETH worth $132 million from Kraken.

Source: X

This massive purchase occurred as ETH broke its two-day consolidation following the breakout of the $2,570 level.

However, some crypto whales look at the current price level as an opportunity and are heavily accumulating, while some others continue to dump their holding, believing the price will decline further in the coming days.

Key levels

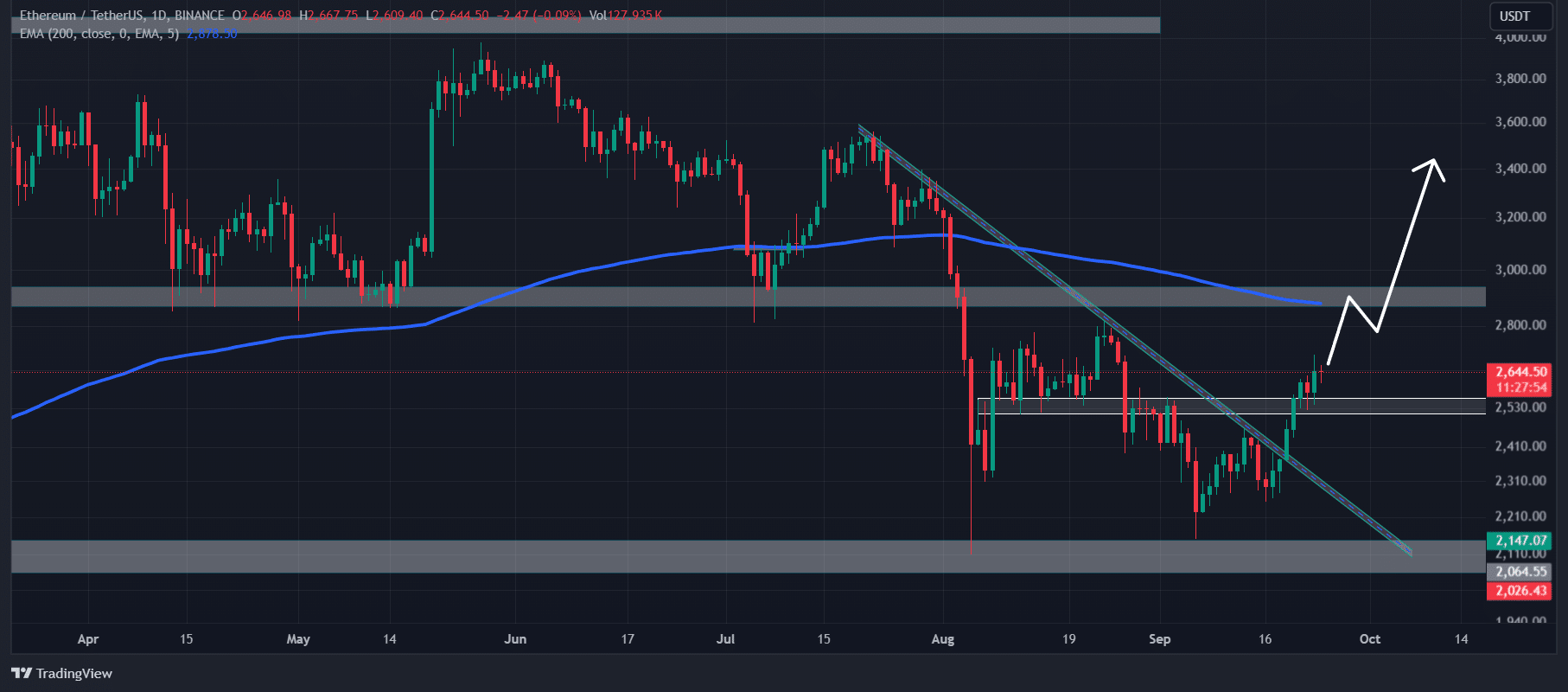

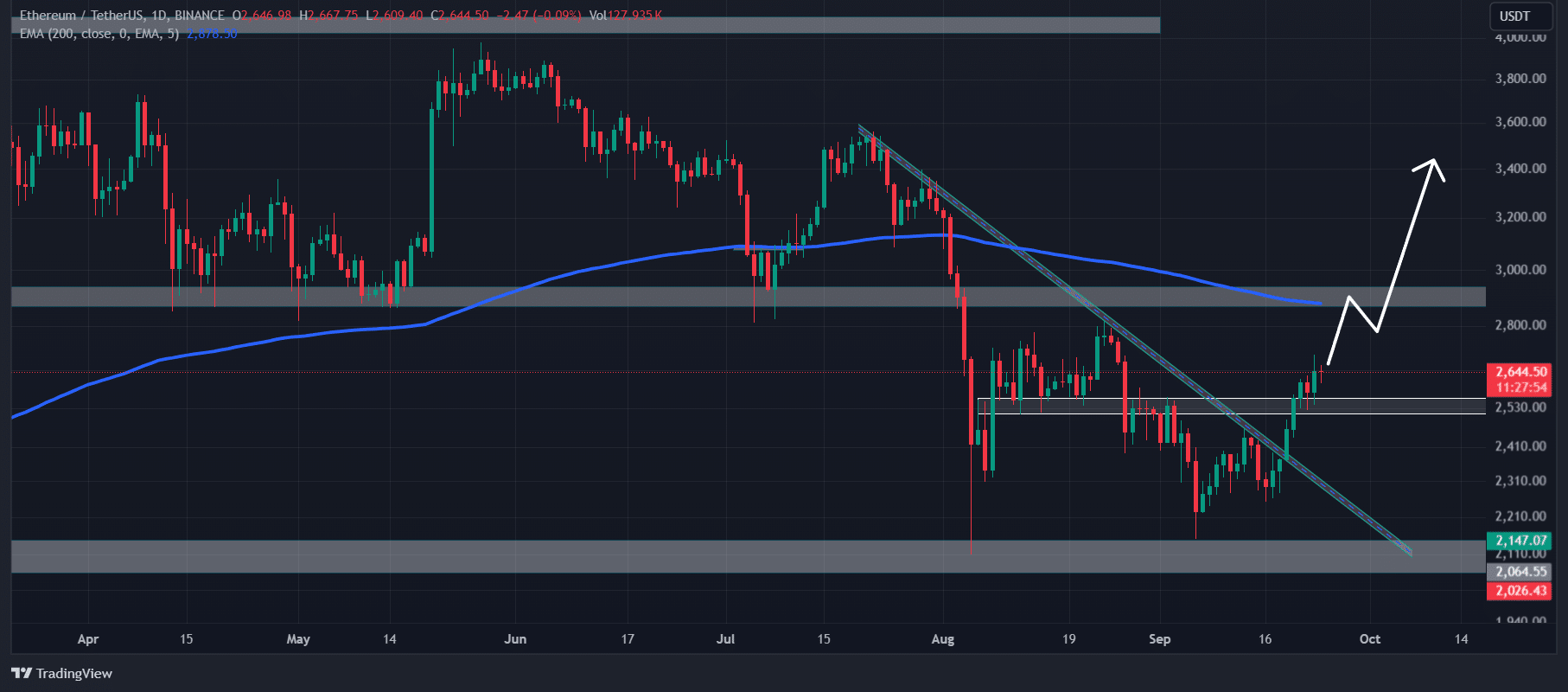

According to AMBCrypto’s technical analysis, ETH appears bullish despite trading below the 200 Exponential Moving Average (EMA) on a daily time frame.

The 200 EMA is a technical indicator used to determine whether an asset is in an uptrend or downtrend.

Source: TradingView

The recent breakout of the crucial resistance level of $2,570 level and the small consolidation suggest a potential upside rally.

Based on the historical price momentum, if ETH maintains itself above the resistance level, there is a strong possibility it could rise to the $2,900 level, and even higher if the market sentiment remains favorable.

ETH’s bullish on-chain metrics

This positive outlook is further supported by on-chain metrics. Coinglass’s ETH Long/Short Ratio was 2.023 at press time, indicating extreme bullish market sentiment among traders.

Additionally, its Futures Open Interest increased by 3.2% in the last 24 hours.

Source: Coinglass

Traders and investors often use the combination of rising Futures Open Interest and a Long/Short Ratio above 1 when building long positions.

Read Ethereum’s [ETH] Price Prediction 2024–2025

At press time, 66.93% of top traders held long positions, while 33.07% hold short positions. This on-chain data suggests that bulls are currently dominating the asset.

At press time, ETH is trading near the $2,640 level, and has remained stable over the past 24 hours. During the same period, its trading volume dropped by 7%, indicating lower participation from traders.