- ETH made moderate gains on the monthly charts, hiking by just 2.89%

- Analyst believes ETH must stay above $2300 to avoid mass sell-offs

While Bitcoin [BTC] has declined over the past week, Ethereum [ETH] has taken a different path. By doing so ETH registered moderate gains on its monthly price charts.

At the time of writing, Ethereum was trading at $2,404. This marked a 1.06% hike on the weekly charts, with the altcoin gaining on the daily charts too.

Despite these gains, however, ETH remains significantly below its recent high of $2,700 and 50.7% from its ATH of $4878. As expected, these market conditions have left analysts talking. One of them is popular crypto analyst Ali Martinez, according to whom, $2,300 remains ETH’s key support level.

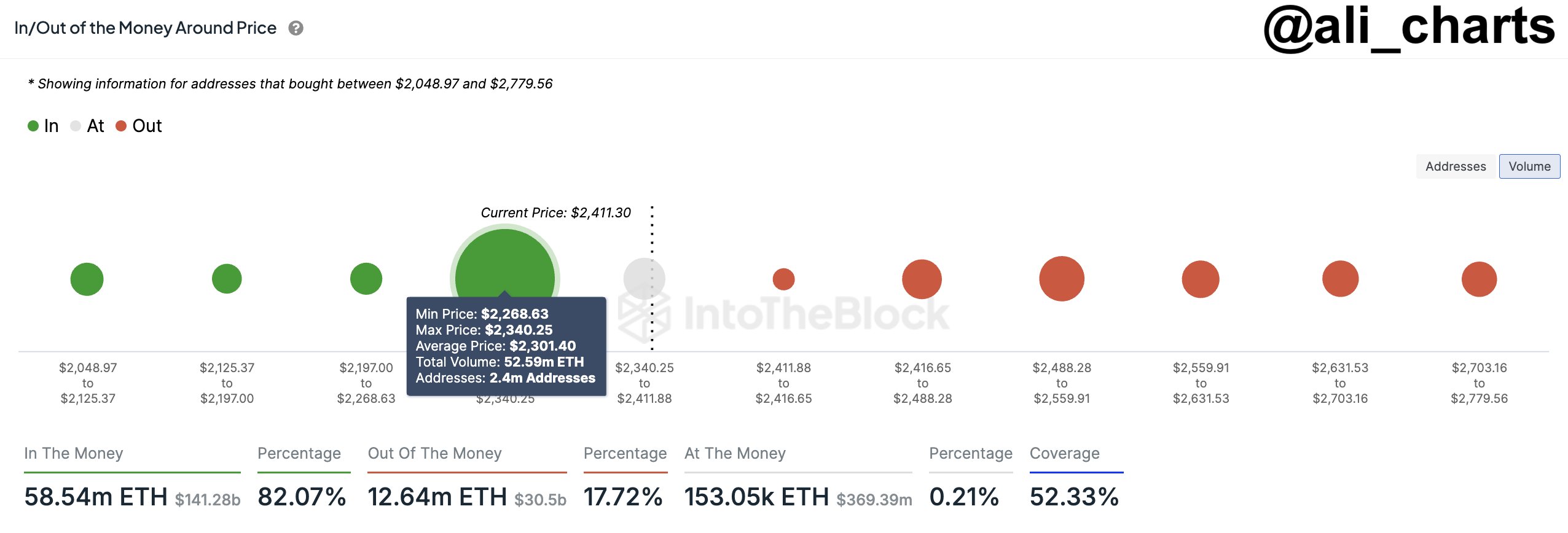

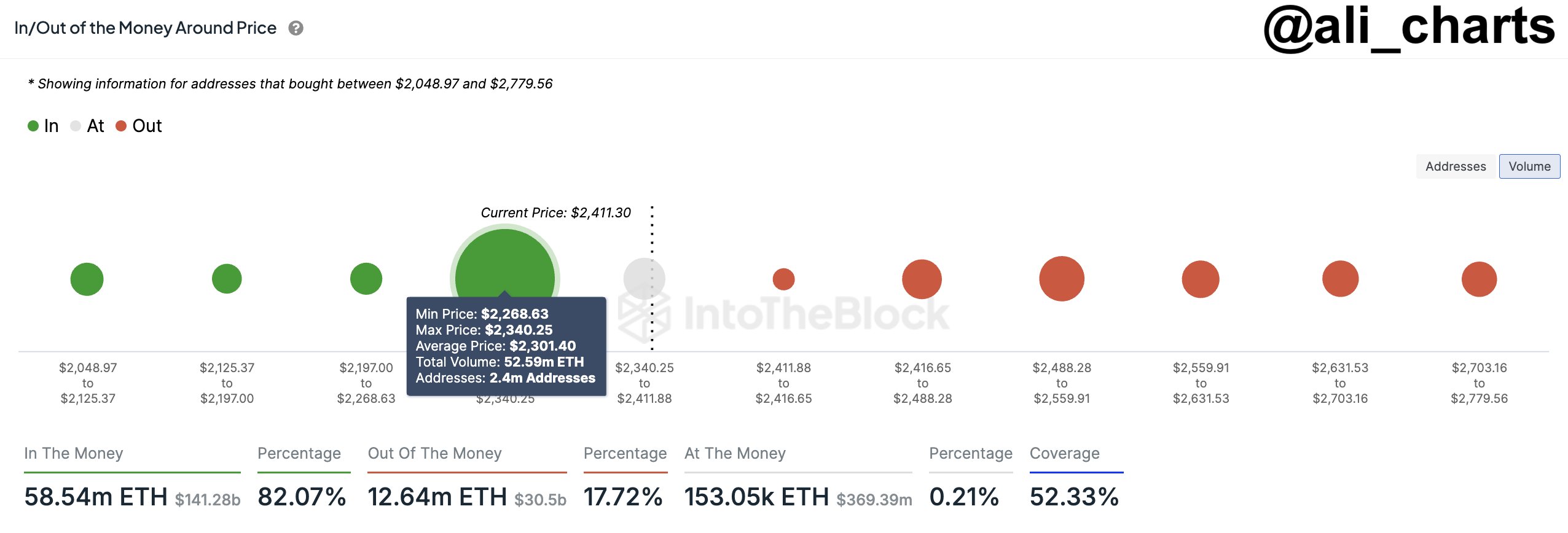

Why 2.4 million addresses are key

In his analysis, Martinez cited 2.4 million addresses that purchased 52.6 million ETH tokens at $2,300. According to him, ETH must hold above this level as it remains the most critical support level for the altcoin.

Source: X

Consequently, if the altcoin fails to hold this demand zone, ETH will record a massive sell-off. A drop below this level will push investors into panic selling as they attempt to minimize losses.

In a such scenario, Ethereum will see selling pressure, thus driving prices further down the charts.

What does ETH’s chart say?

Now, although the aforementioned observation by Martinez pointed to a potential market sell-off, it’s essential to cross-check and determine what other market indicators suggest.

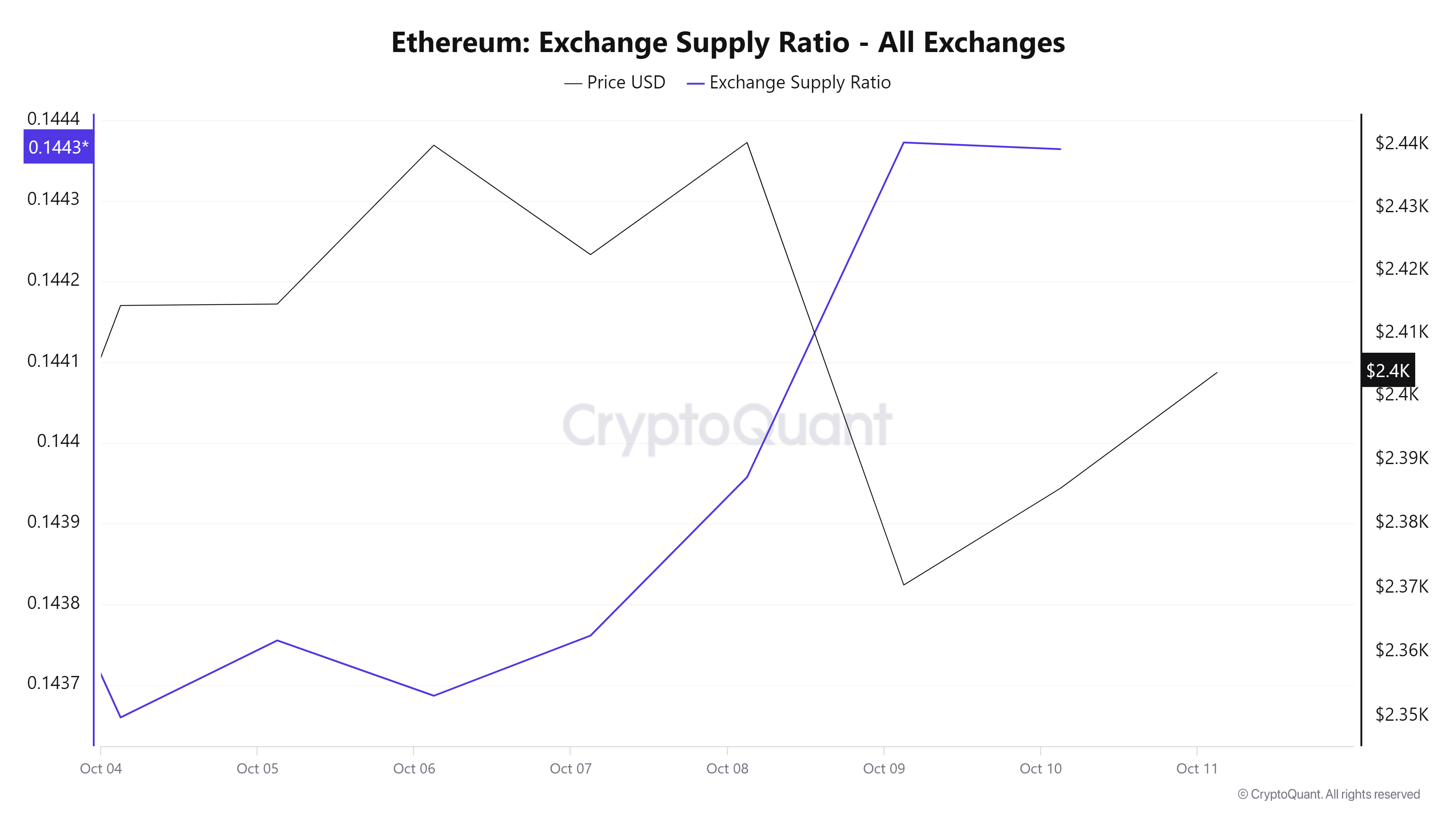

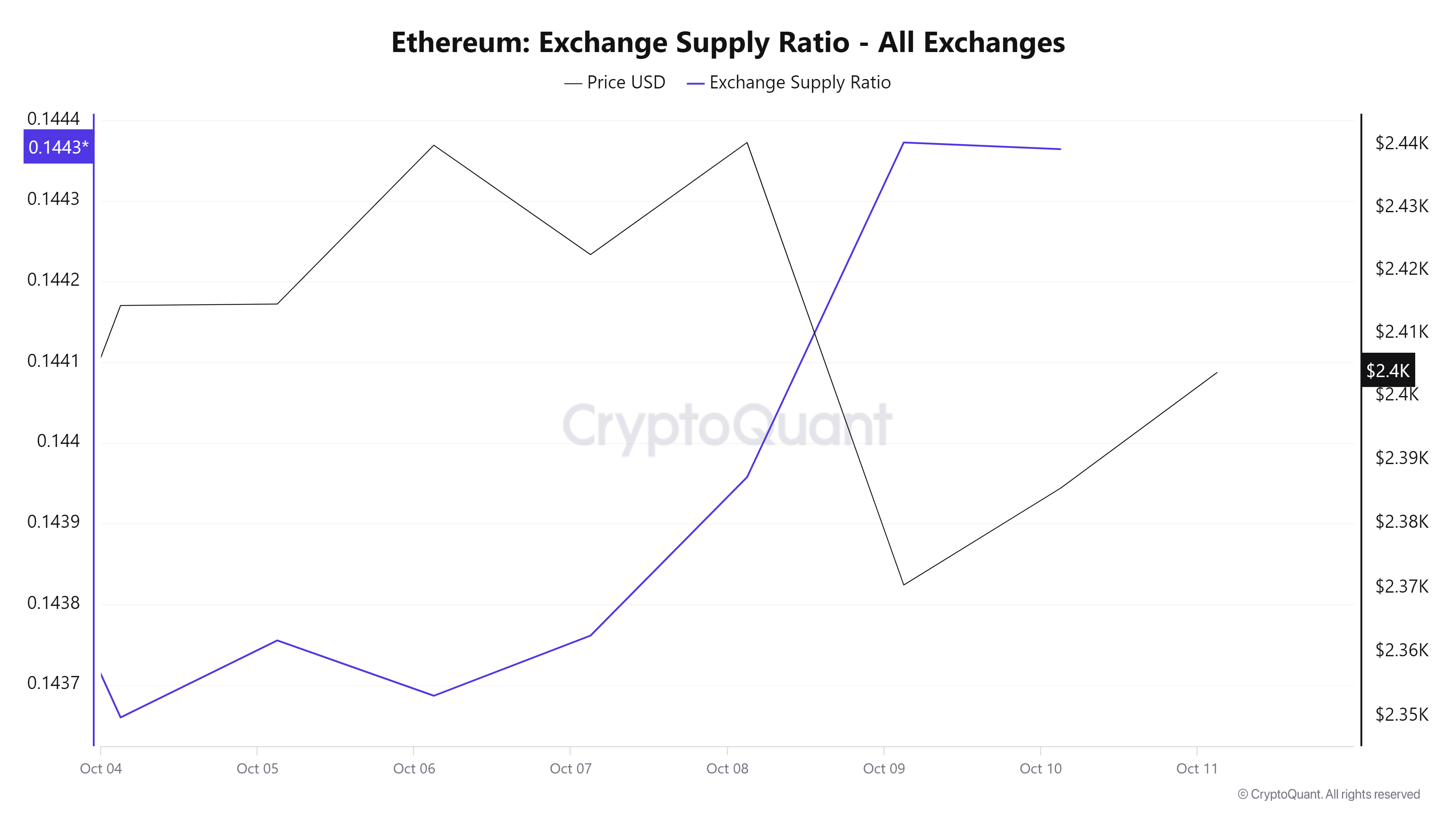

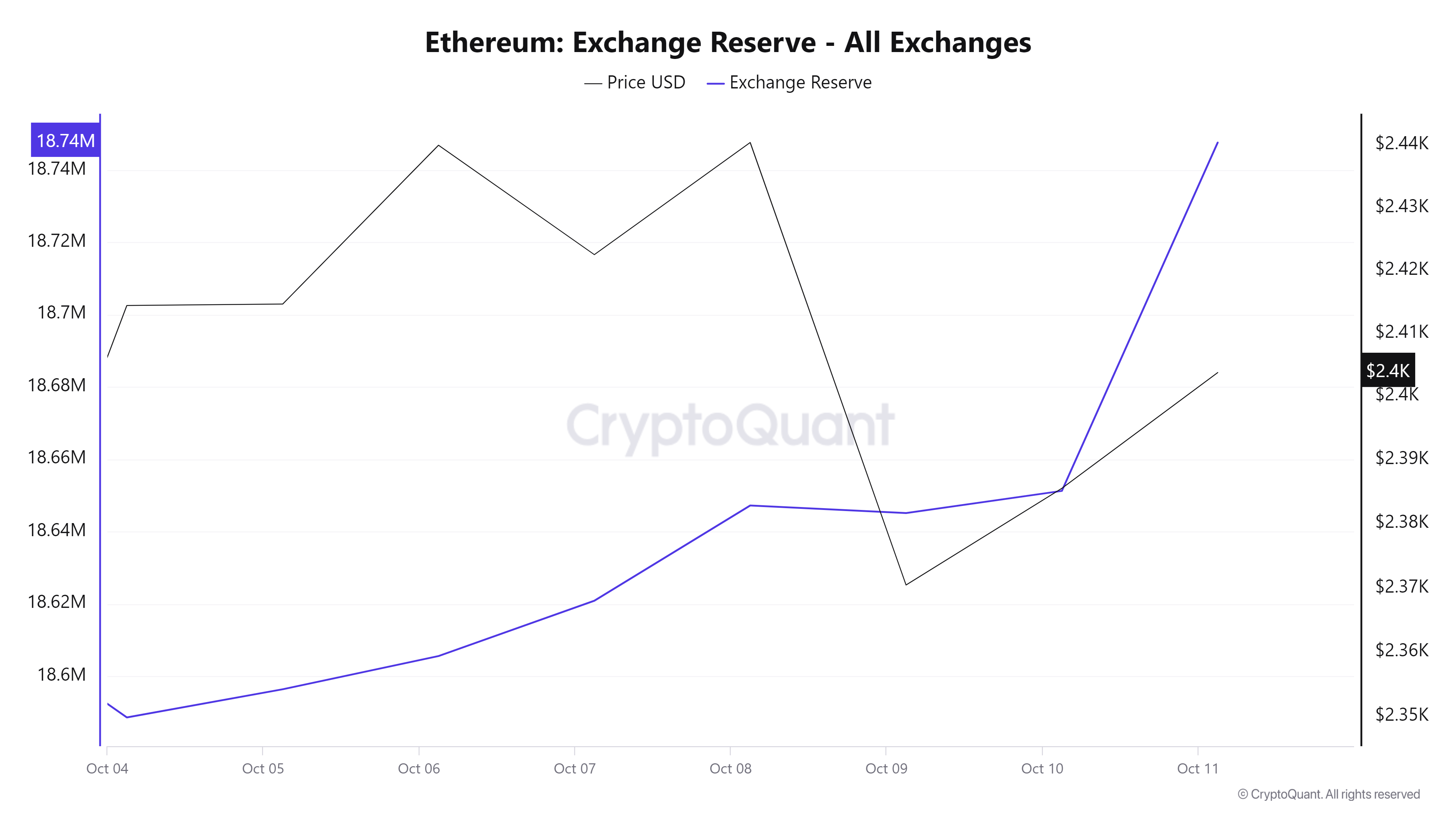

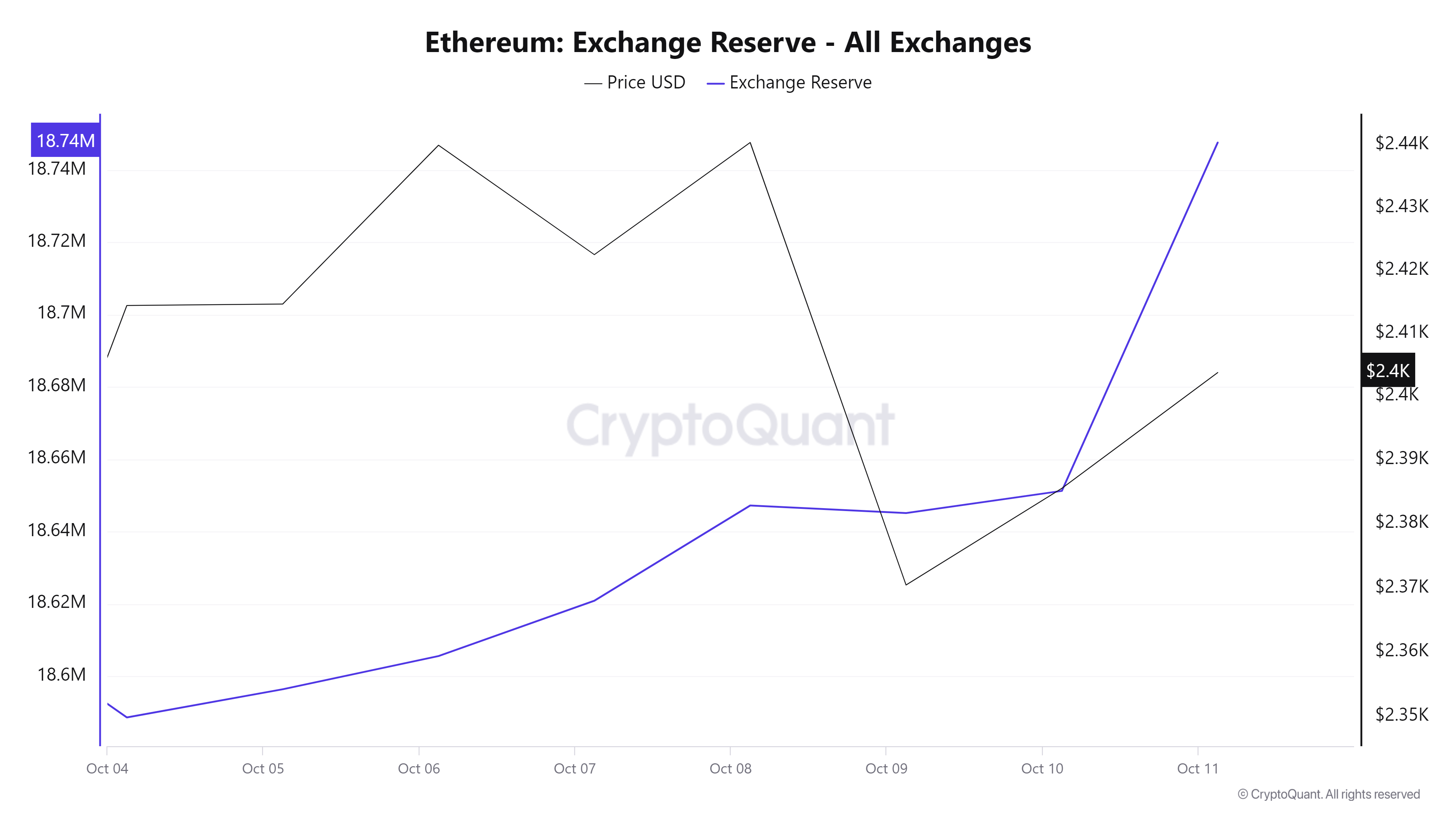

Source: Cryptoquant

For example, Ethereum’s Exchange Supply ratio spiked over the past week from 0.143 to 0.1443. The uptick in the exchange supply ratio suggested that holders may be preparing to sell or take profits.

This is usually a bearish signal as investors move their ETH from private wallets to exchanges.

Source: Cryptoquant

Additionally, Ethereum’s Exchange Reserve has been rising throughout the week, with the same hitting figures of $18.7 million at press time. As observed earlier with a spike in exchange supply ratio, this further supported our observation that investors are transferring their ETH to exchanges.

This type of market behavior would potentially lead to selling pressure, thus pushing prices down.

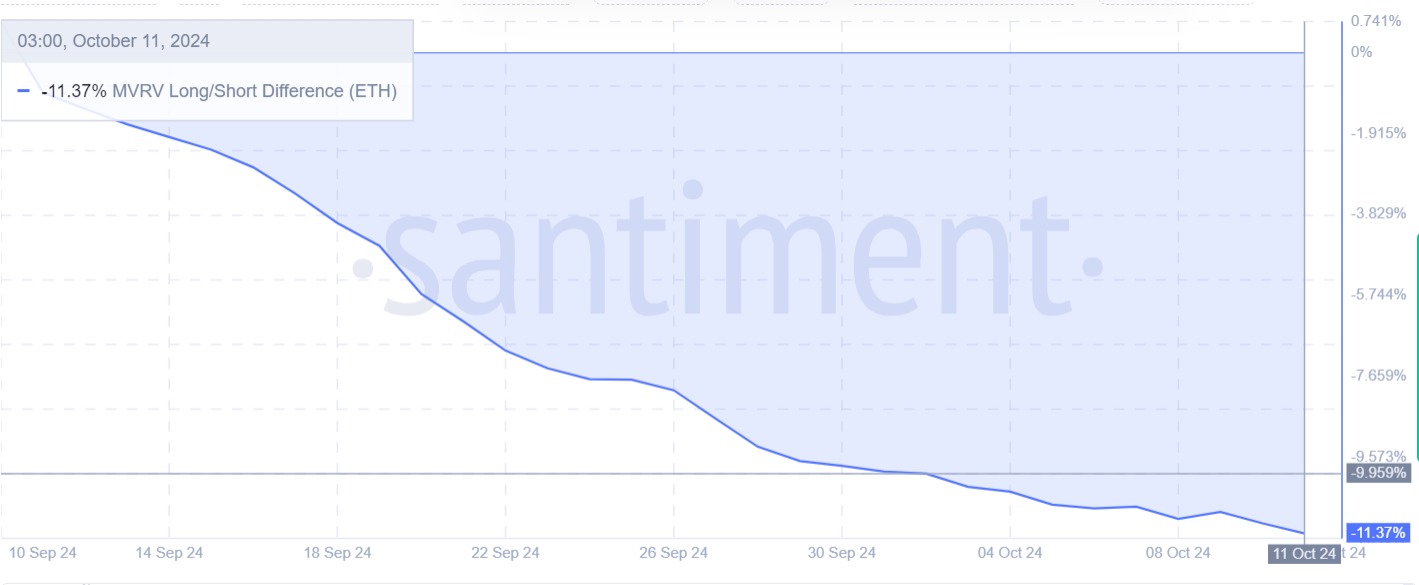

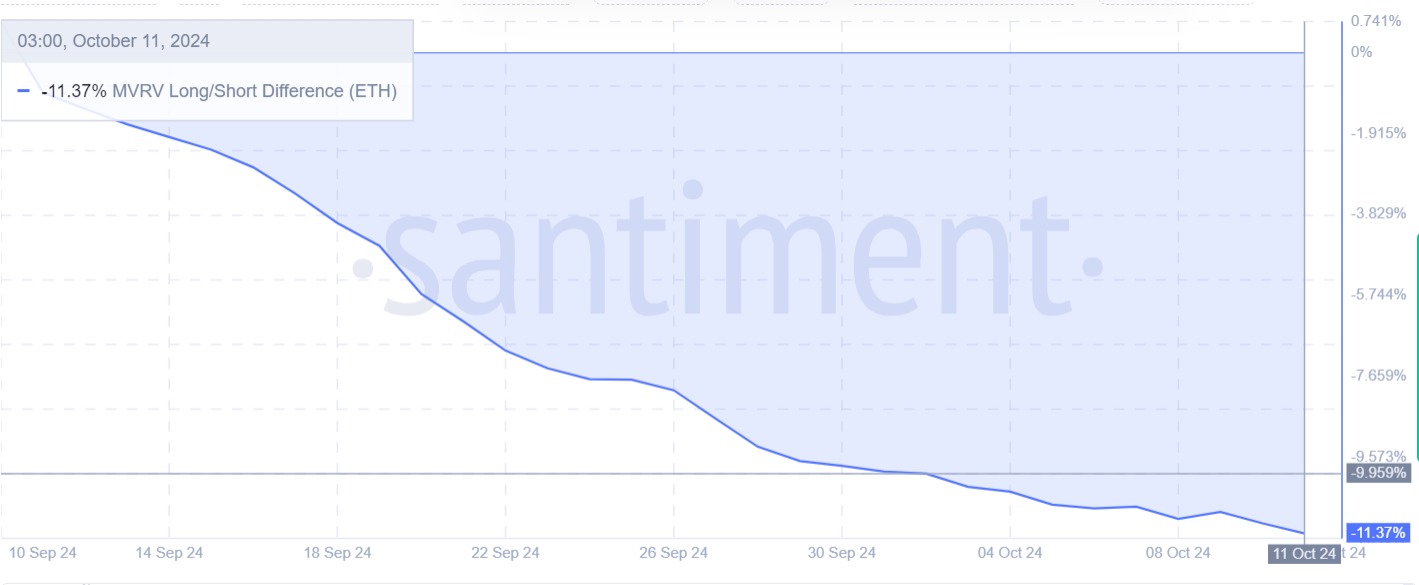

Source: Santiment

Finally, Ethereum’s MVRV long/short difference has remained negative over the past month. Usually, when long-term holders are seeing losses while short-term holders are profitable, it leads to long-term holder capitulation. This results in greater selling pressure as they attempt to minimize their losses.

As such, capitulation by long-term holders results in a temporary bottom as they close their positions, risking driving prices lower in the short term.

Simply put, according to AMBCrypto’s analysis, ETH has been trading within a multi-month descending channel. Accompanied by negative market sentiment, Ethereum could decline before a breakout from this trend. If it sees a pullback, ETH will find the net support at $2,325.