- ETH was up by nearly 7% in the last seven days.

- Whales have increased their accumulation over the past week.

Ethereum’s [ETH] price rallied last week, allowing it to sit comfortably above the $3.5k mark. Though this already looked optimistic, things might get even better as the big players stockpile more ETH.

Whale activity is rising

According to CoinMarketCap’s data, ETH investors earned profits last week as its value surged by nearly 7%. At the time of writing, ETH was trading at $3,520.80 with a market capitalization of over $422 billion.

Interestingly, while the token’s price increased, whale activity around the token also increased.

Lookonchain’s recent tweet revealed that whales have started to accumulate ETH. As per the tweet, a whale withdrew 22,251 ETH, worth $80.06 million, from exchanges.

Another whale also withdrew 3,092 ETH, which was worth $11.12 million from Binance. This suggested that whales were confident in ETH and expected its price to rise further, hinting that ETH might soon reach $4k.

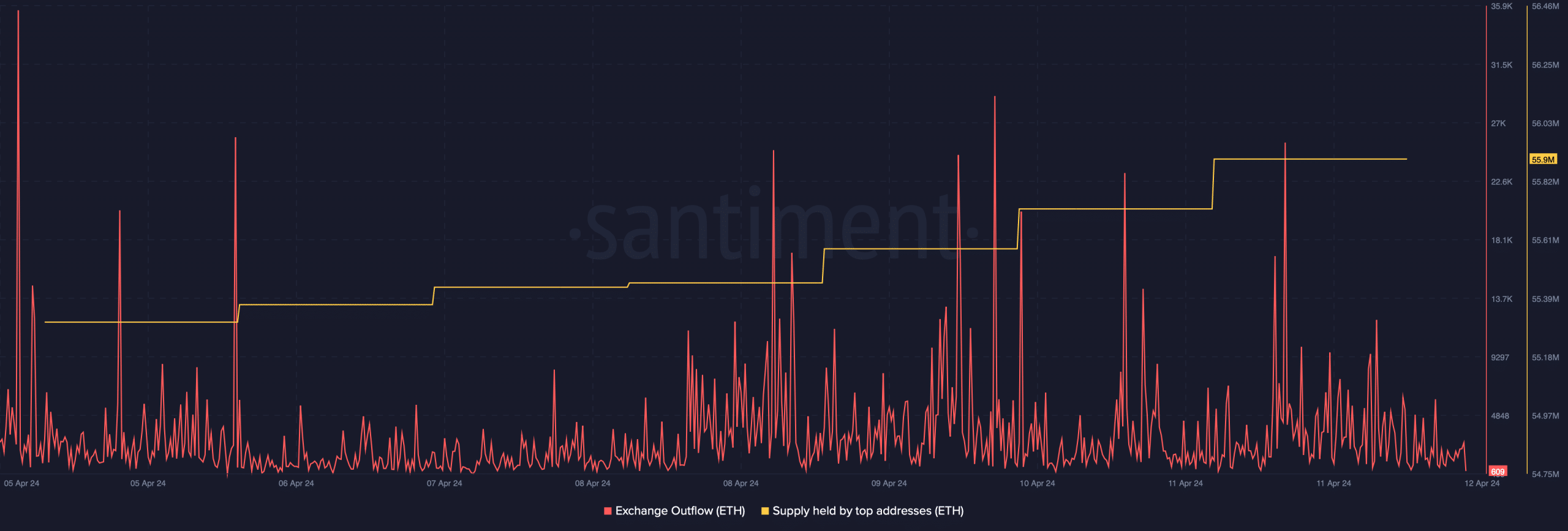

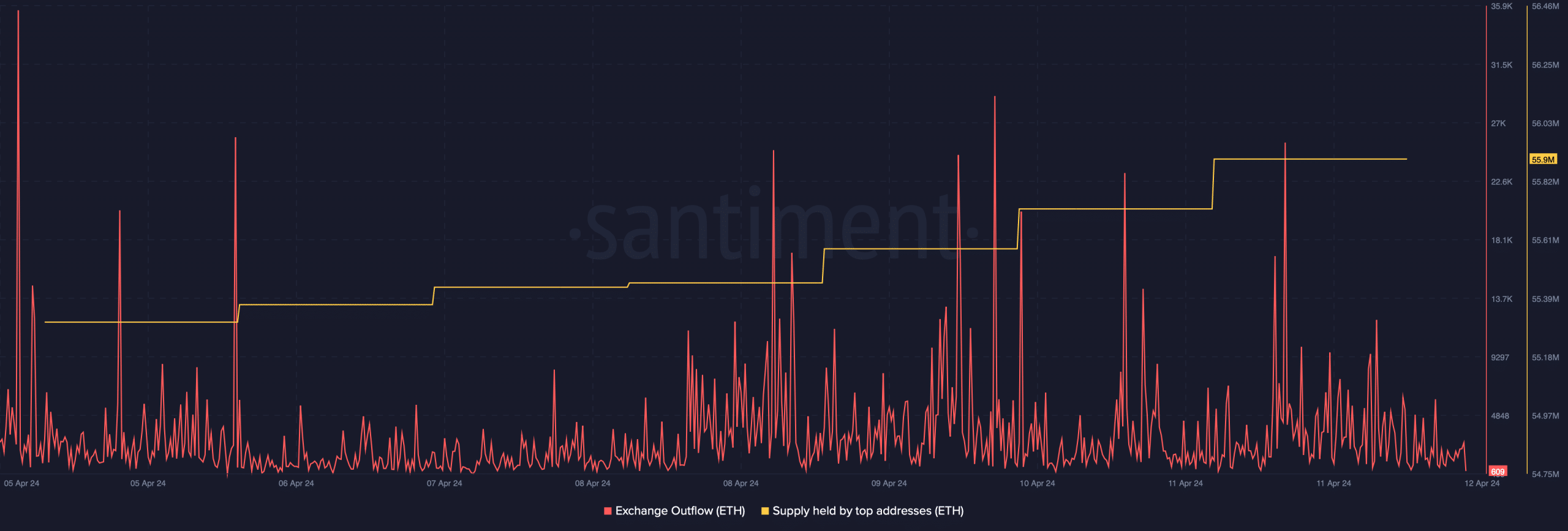

To see whether buying pressure from whales was high, AMBCrypto took a look at Santiment’s data. We found that ETH’s supply held by its top addresses increased over the last week. Its exchange outflow also spiked, signaling a rise in buying pressure.

Source: Santiment

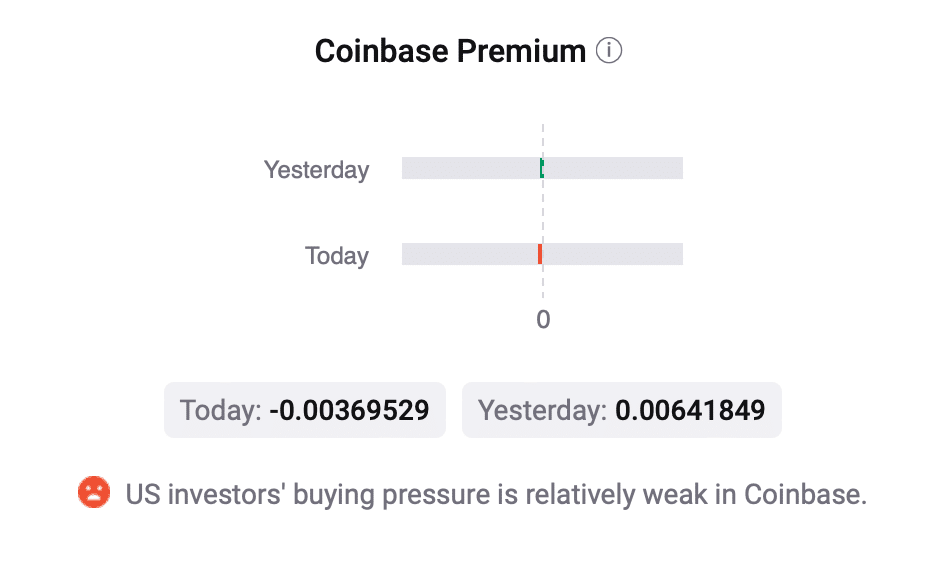

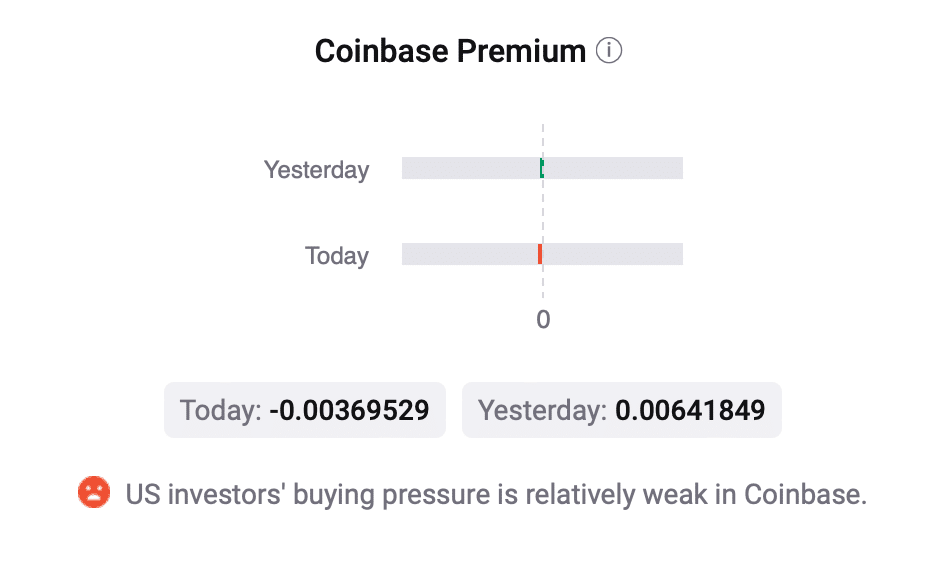

Our analysis of CryptoQuant’s data also showed a similar trend. Ethereum’s exchange reserve was dropping. However, it was surprising to see that ETH’s Coinbase Premium turned red. This meant that selling sentiment was dominant among US investors.

Source: CryptoQuant

Ethereum’s next target: $4k?

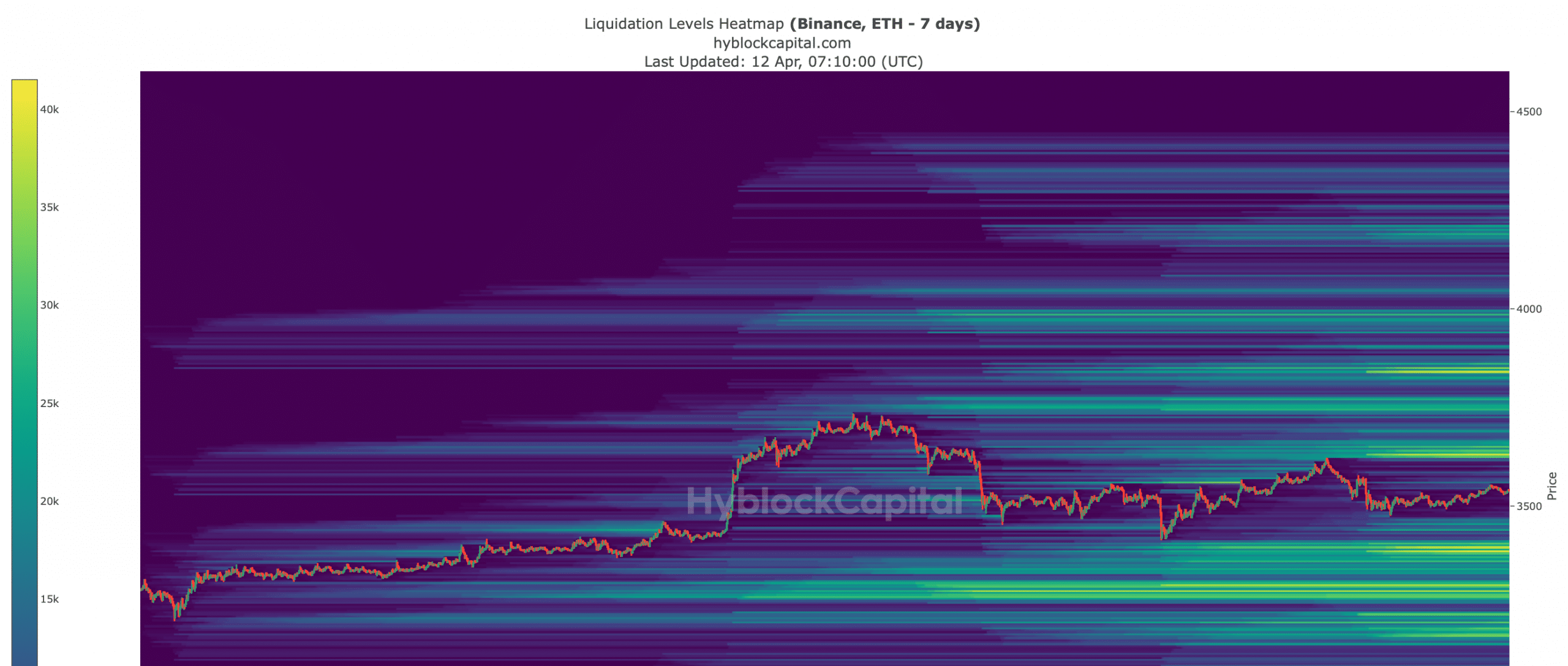

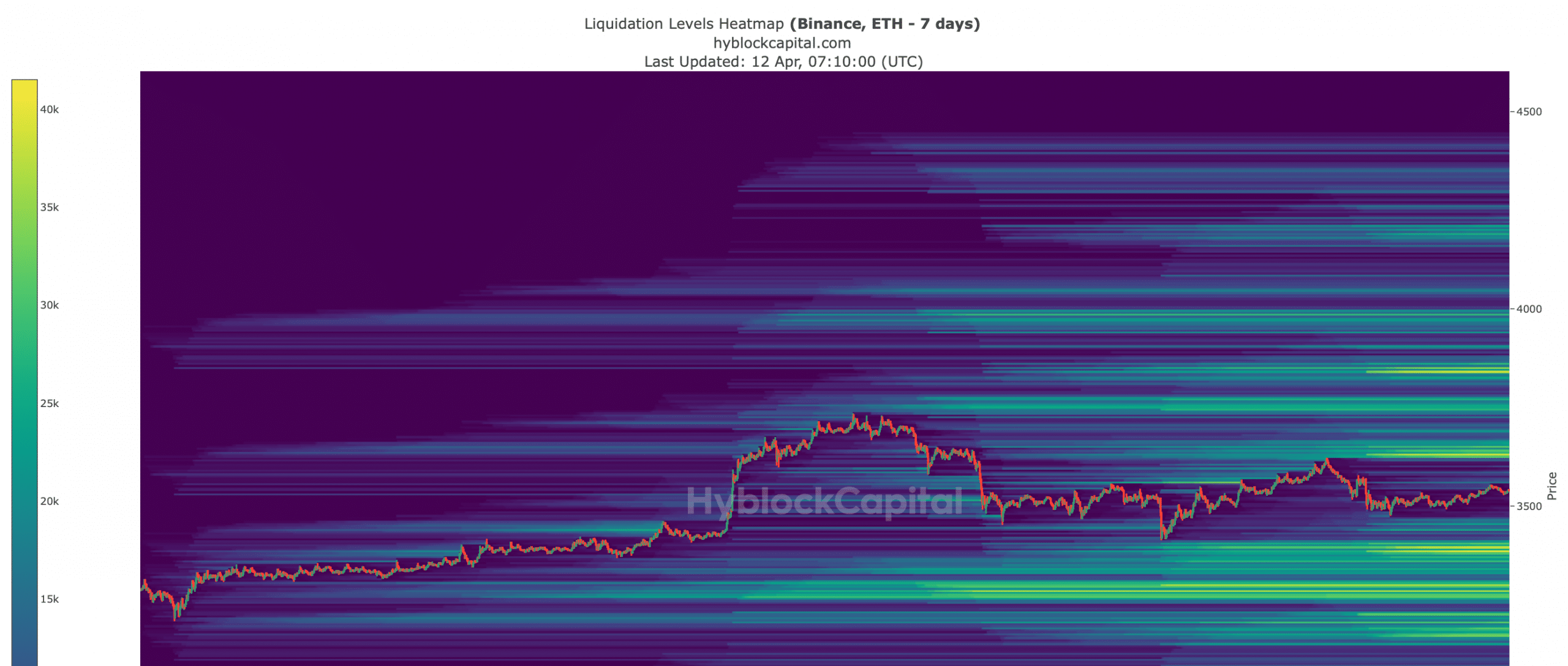

AMBCrypto then checked Hyblock Capital’s data to find the possible targets ETH might reach if whale accumulation translates into a bull rally.

We found that before hitting $4k, ETH has to go above a few key resistance levels. If a bull rally happens, it will be important for ETH to reach $3.65k and $3.8k before touching $4k, as ETH’s liquidations will increase at those levels.

Source: Hyblock Capital

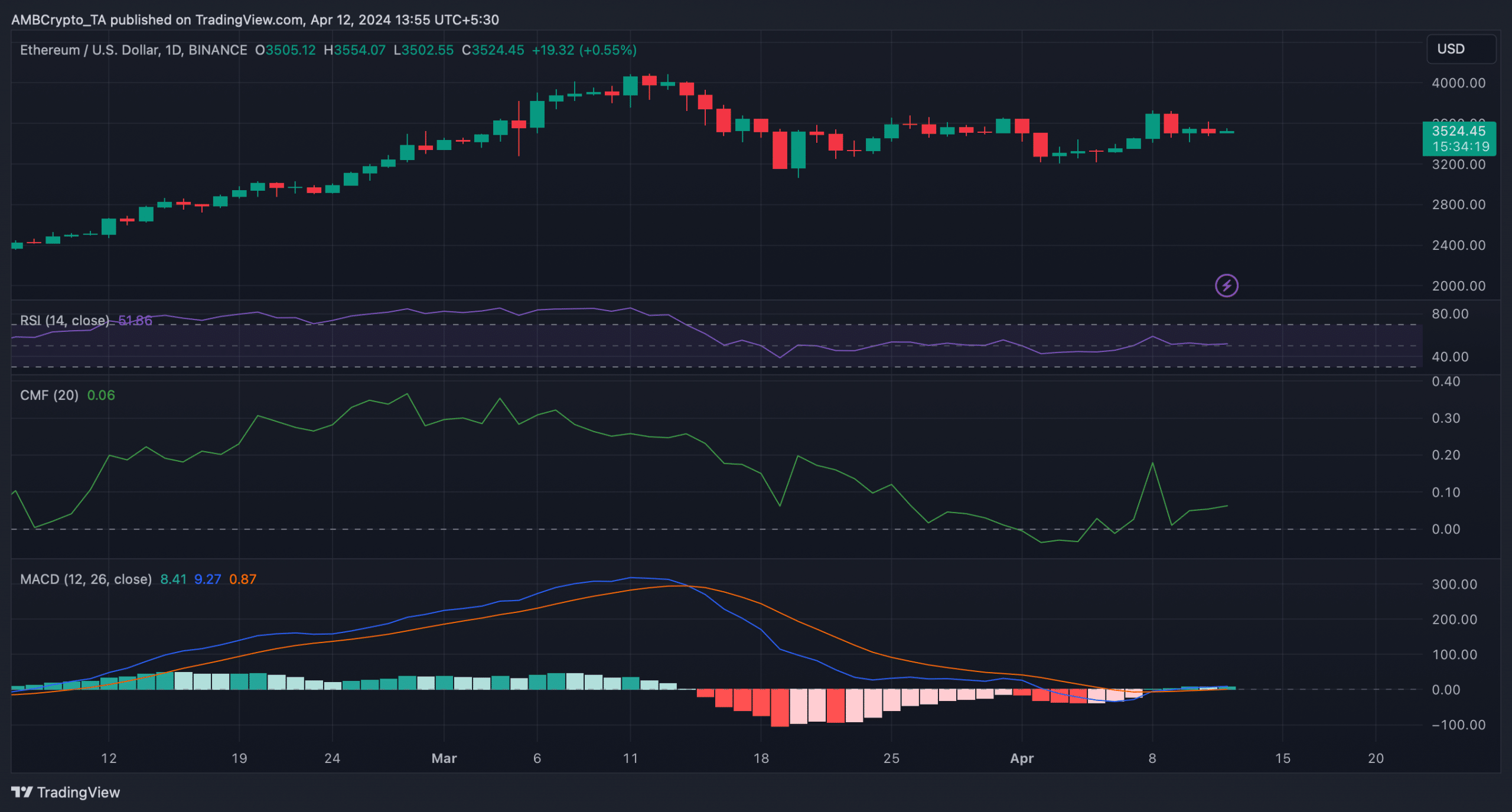

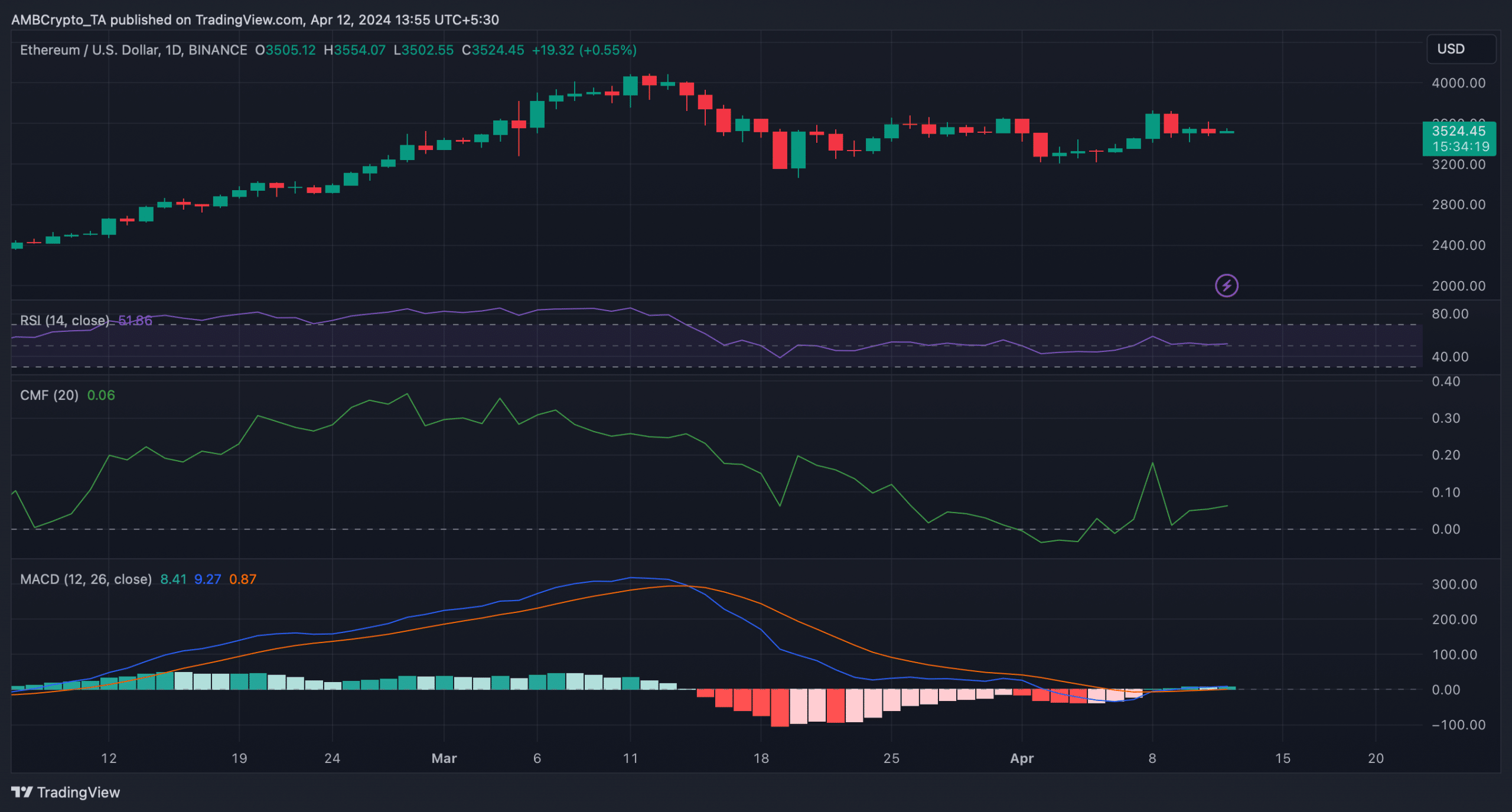

To see how likely it is for Ethereum to begin a bull rally, we then analyzed the token’s daily chart. Our analysis revealed that Ethereum’s Relative Strength Index (RSI) has been moving sideways for multiple days in a row.

Read Ethereum’s [ETH] Price Prediction 2024-25

Additionally, its MACD displayed that the bulls and the bears were in a tussle to gain an advantage over each other. However, the Chaikin Money Flow (CMF) looked bullish as it registered a sharp uptick.

If the CMF is to be believed, the chances of ETH gaining bullish momentum seem likely in the coming days.

Source: TradingView