- ETH hit a roadblock near $2700 after the October recovery.

- Options market priced lower odds of ETH hitting $3K before US elections.

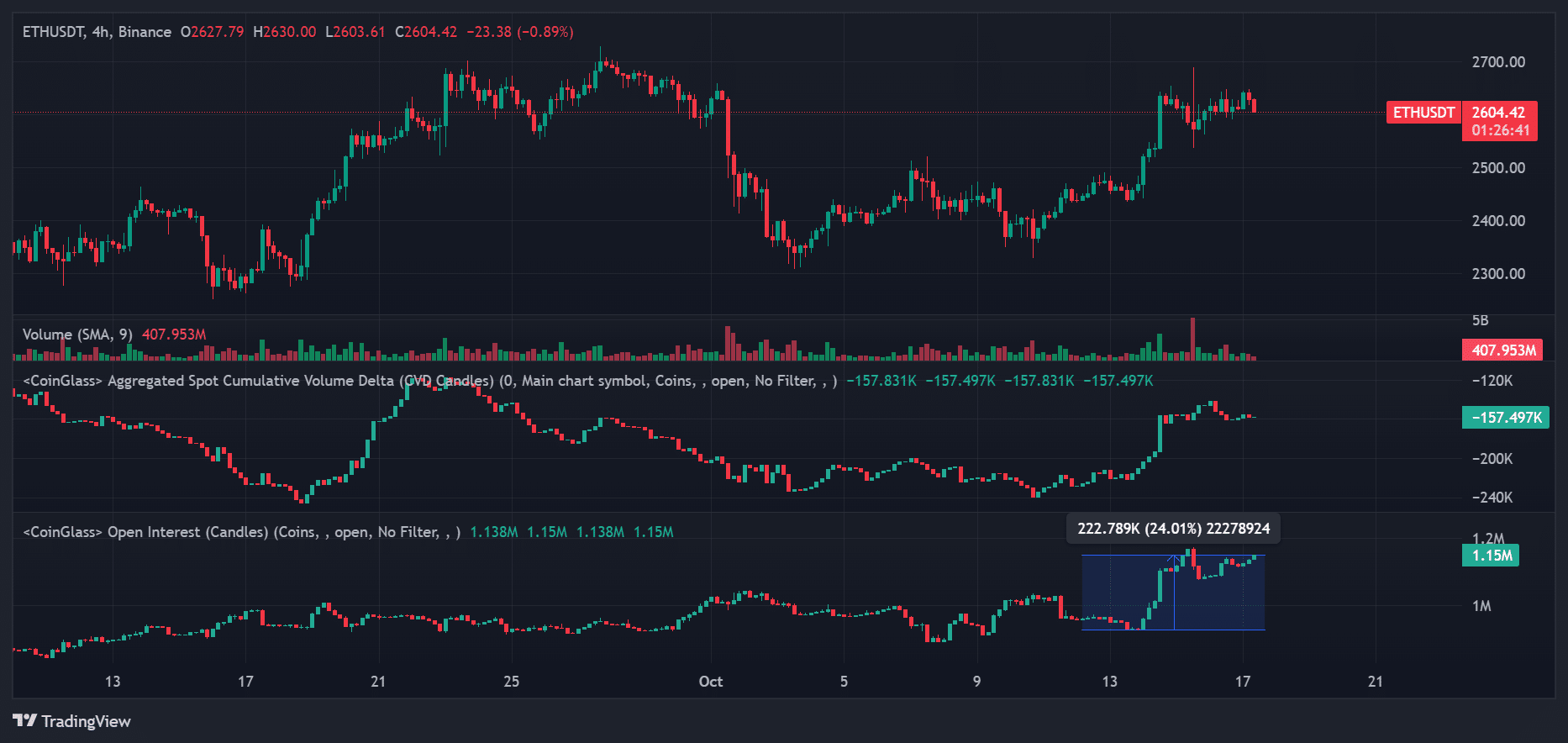

Ethereum [ETH] was back to $2.6K after reversing losses in the first half of October. The largest altcoin logged about 12% in recovery gains after jumping from $2.3K to over $2.6K.

At press time, ETH was valued at $2,614 but hit a key roadblock below $2700.

Ethereum price prediction

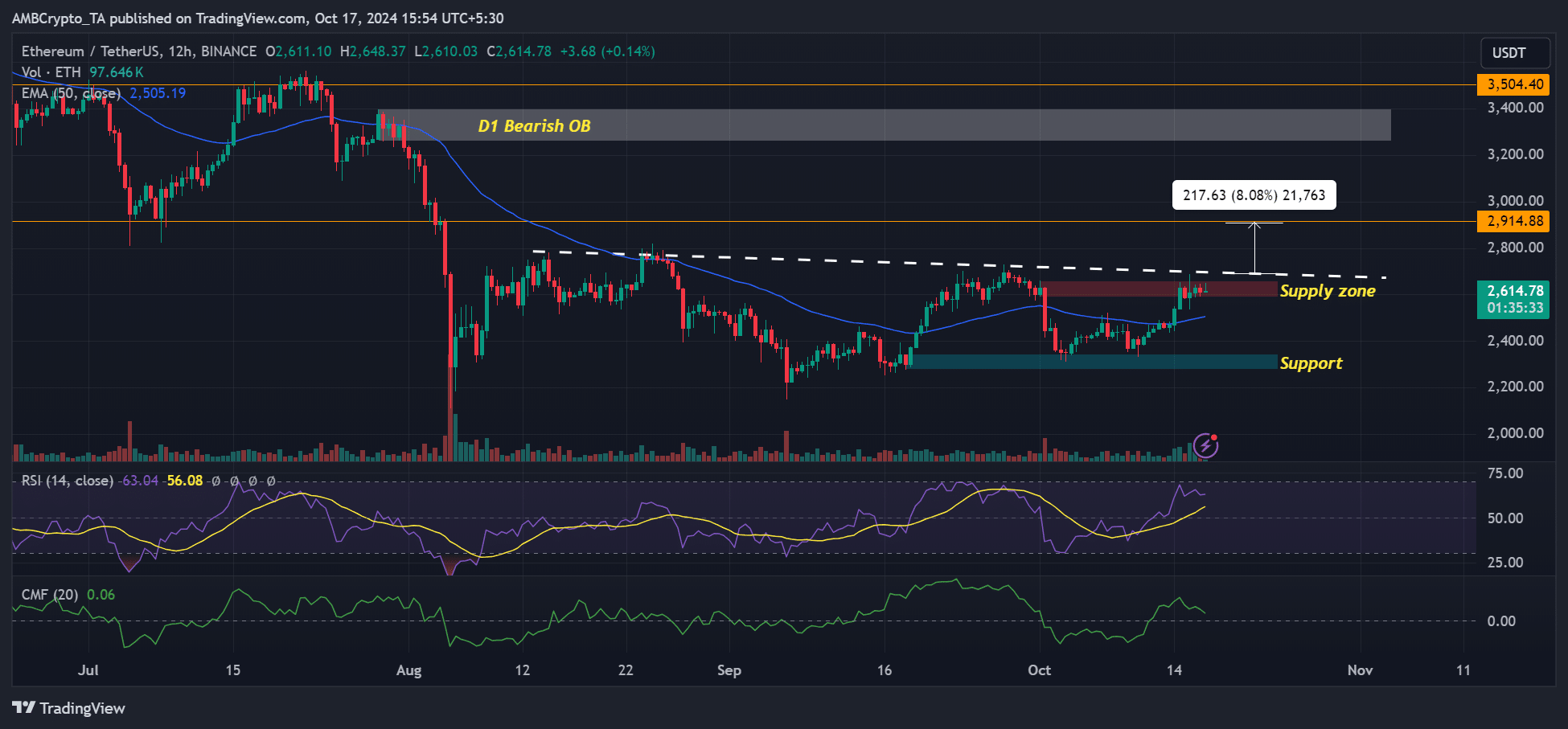

Source: ETH/USDT, TradingView

Since the 9th of October, ETH has recorded increased capital inflows, as shown by the rising Chaikin Money Flow. However, the indicator eased in the past two days, suggesting the inflows tapered off slightly.

This could derail ETH’s strong move above the roadblock and supply zone (marked red), which doubled up as a bearish order block. The supply zone was also a confluence with trendline resistance (dotted white line).

This meant that the roadblock could trigger a price rejection toward the 50-day EMA (Exponential Moving Average) at $2.5K (blue line).

However, ETH could attempt to crack the hurdle if Bitcoin [BTC] extended its bullish streak above $68K. If so, ETH might tuck an extra 8% if it hits $2.9K.

Options data suggests…

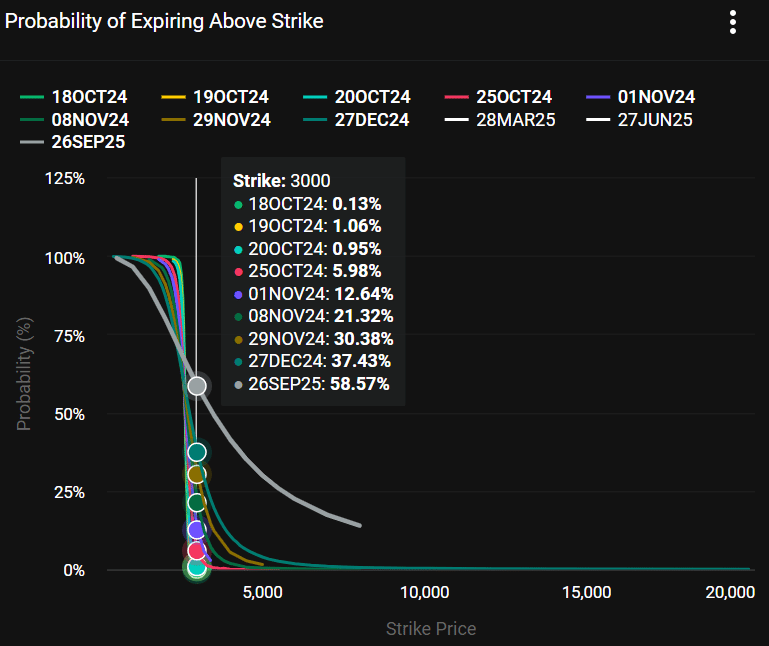

Source: Deribit

That said, according to options data from Deribit, ETH might not see a strong breakout in October. The options market was less optimistic about ETH crossing $3K before the end of the month, at 6%.

On the contrary, the odds of $3K per ETH were 21% by the 8th of November, just after the US elections.

Put differently, a strong ETH move above $3K might be possible only after the U.S. elections, as the next administration will determine DeFi regulation.

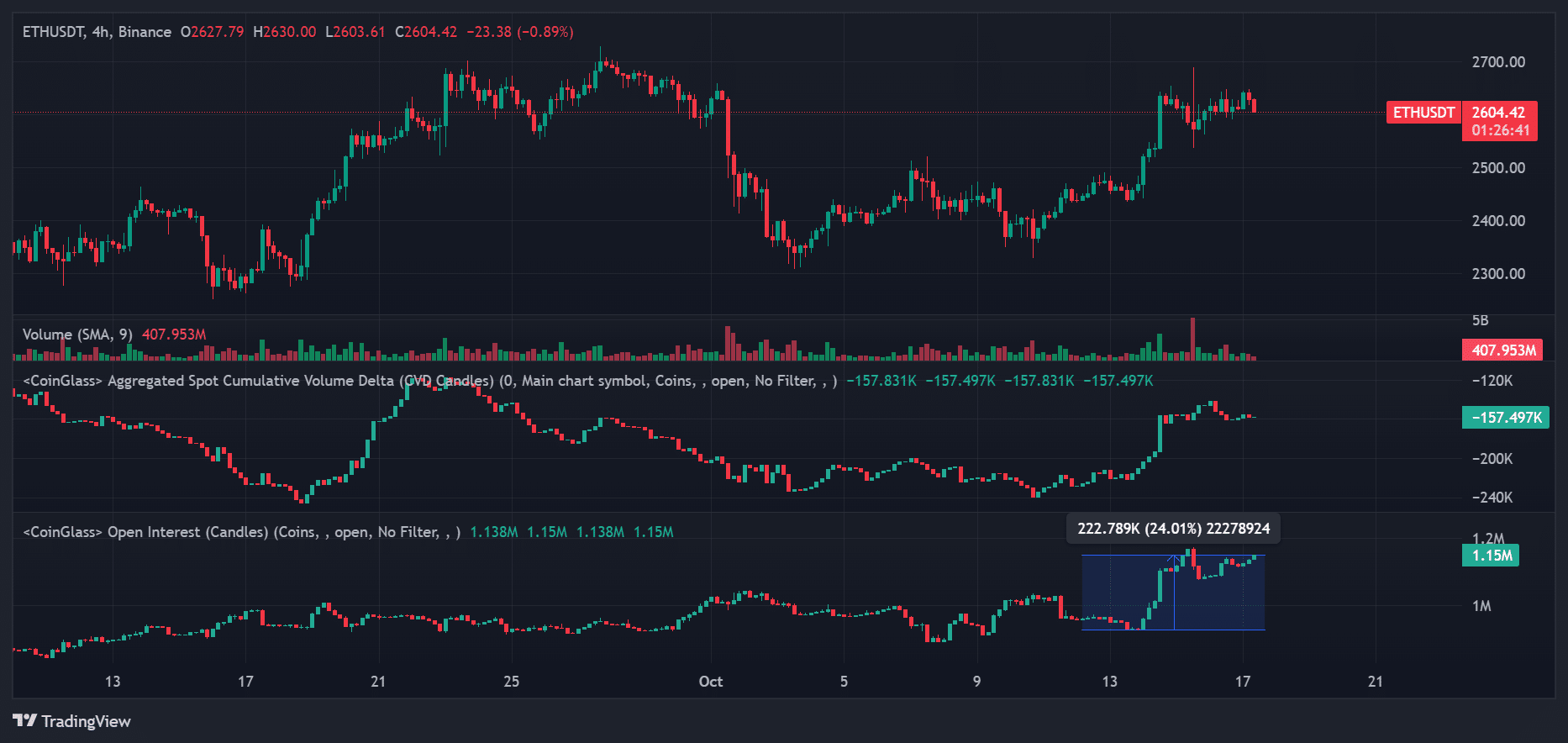

In the meantime, this week’s 8% run-up saw over 220K ETH of Open Interest added on the Binance exchange.

Although this indicated bullish bets, given the uptick in price and rising spot demand (CVD), it doesn’t paint any price direction for ETH in the future.

Read Ethereum [ETH] Price Prediction 2024-2025

But the high leverage meant high levels of liquidation risk, especially if the ETH price dragged lower and dumped harder.

So, the support at $2300, the 50-day EMA, and the roadblock could be key interest levels in the short term.

Source: TradingView

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion