Inflows into the newly approved spot Ethereum exchange-traded funds (ETFs) suggest ETH could be on the cusp of a price uptick, according to the crypto analyst Michaël van de Poppe.

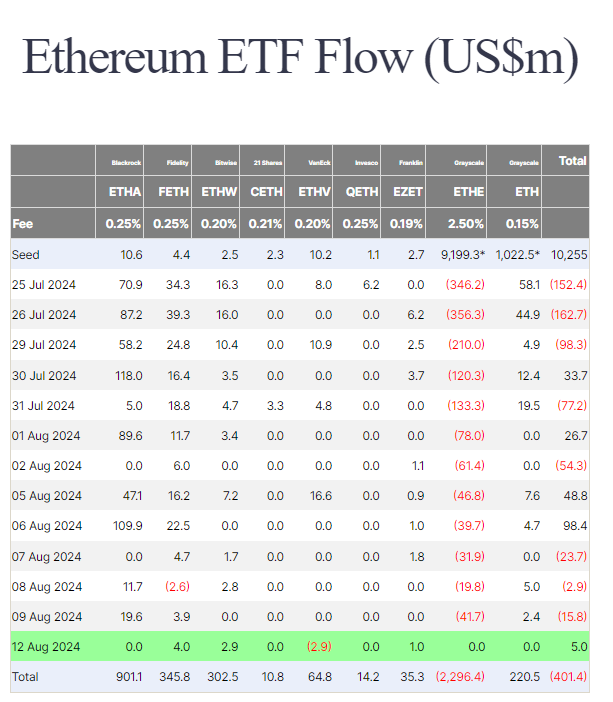

Van de Poppe tells his 723,100 followers on the social media platform X that Monday marked the first day of zero outflows on the Ethereum ETFs.

“This is an important week. If this week is a positive net inflow week of more than $50 million, I think we’re on the edge of having a strong upward trend for the Ethereum ecosystem.”

The crypto analyst notes that ETH ETFs have been following the same path as Bitcoin (BTC) ETFs until now.

Two weeks of down only, after which a slow upwards grind should start with constant inflow.

Positive: Grayscale outflow has slowed down substantially. Going to be some great weeks.

Van de Poppe also draws attention to Ethereum ETF inflows compared to staking.

“The amount of ETH staked: 30%

The increased supply in 2024: ~$170 million.

The inflow in the past 10 days in the ETF: $130 million.

If this inflow starts to pick up momentum, the impact on Ethereum’s price is going to be significantly bigger than Bitcoin.”

ETH is trading at $2,674 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3