- Ethereum’s netflows to derivatives and increased leverage point to potential volatility and market risk.

- Retail interest in Ethereum remains strong despite recent price challenges, with active addresses reaching new highs.

Ethereum [ETH] has faced challenges in recent weeks, struggling to reclaim its highs above $3,000. Since falling below this level, the cryptocurrency has hovered under this mark, experiencing a 5.8% decline over the past week.

Ethereum was trading at $2,478 at press time, a 2.7% dip over the last 24 hours. This price performance has generated mixed reactions within the Ethereum community, with analysts providing varying outlooks on the asset’s near-term trajectory.

ETH’s increase in netflow

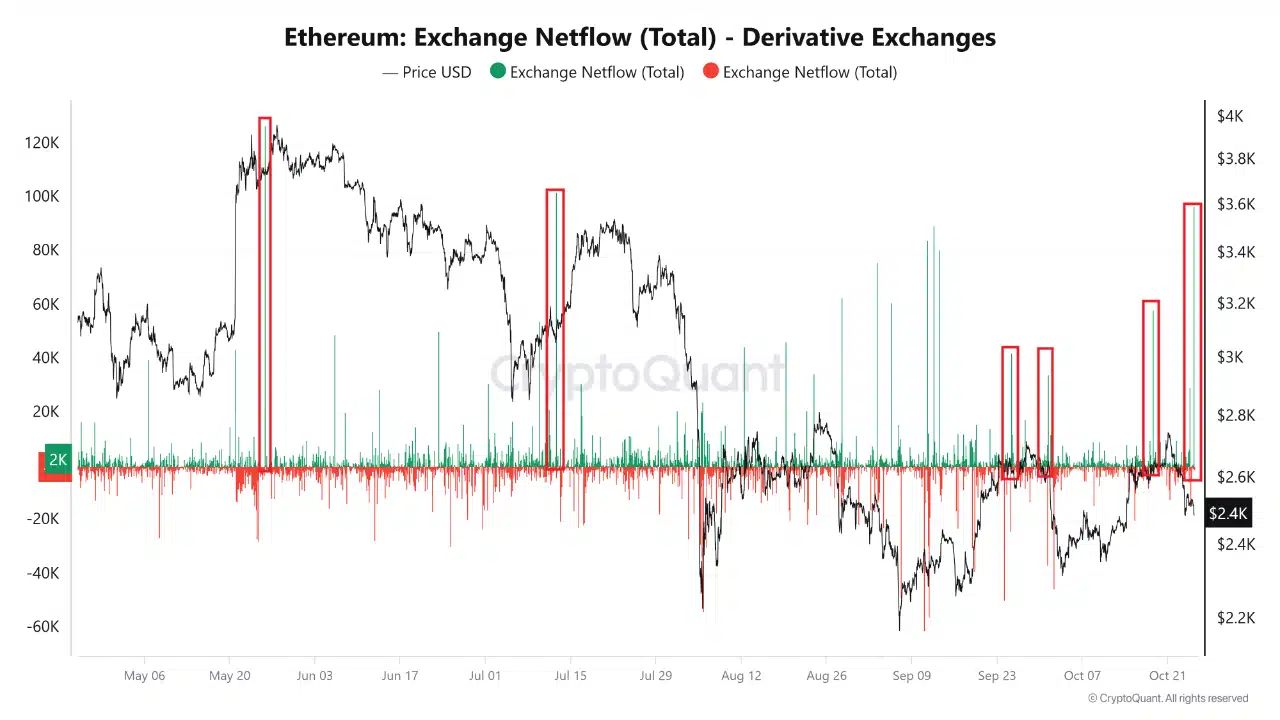

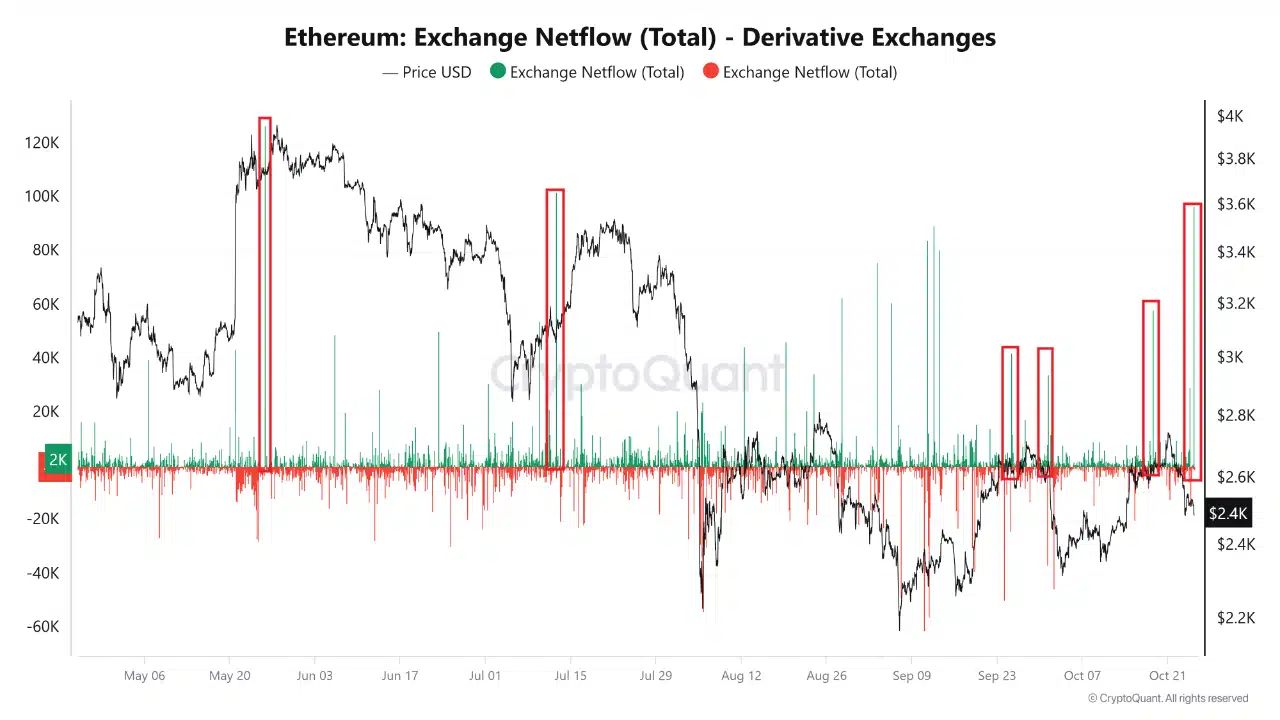

According to CryptoQuant analyst Amr Taha, recent spikes in Ethereum netflows to derivative exchanges signal potential for increased market activity. Taha highlighted a substantial inflow of 96,000 ETH to derivatives exchanges, marking the largest recent netflow.

Historically, spikes in netflows, such as those observed in May and July, have coincided with increased volatility and subsequent price corrections for Ethereum. This movement suggests that traders may be positioning for potential downturns in the asset’s price.

Source: CryptoQuant

Taha noted that the latest netflow could indicate heightened volatility, adding that trader sentiment within derivatives markets often acts as an early indicator of upcoming price trends for Ethereum.

Beyond netflows, Taha examined Ethereum’s futures sentiment, noting a series of peaks in the sentiment index that may serve as contrarian indicators. These peaks have historically signaled local market tops, as bullish futures sentiment often precedes price pullbacks.

This trend suggests that heightened optimism among futures traders may indicate a possible price correction for Ethereum.

Taha added that the sentiment spikes marked in red on the futures sentiment chart are reflective of moments when the market has leaned overly optimistic, creating an environment conducive to market reversals.

Ethereum retail interest and leverage ratio

Meanwhile, other on-chain metrics for Ethereum provide additional insights into the current market dynamics.

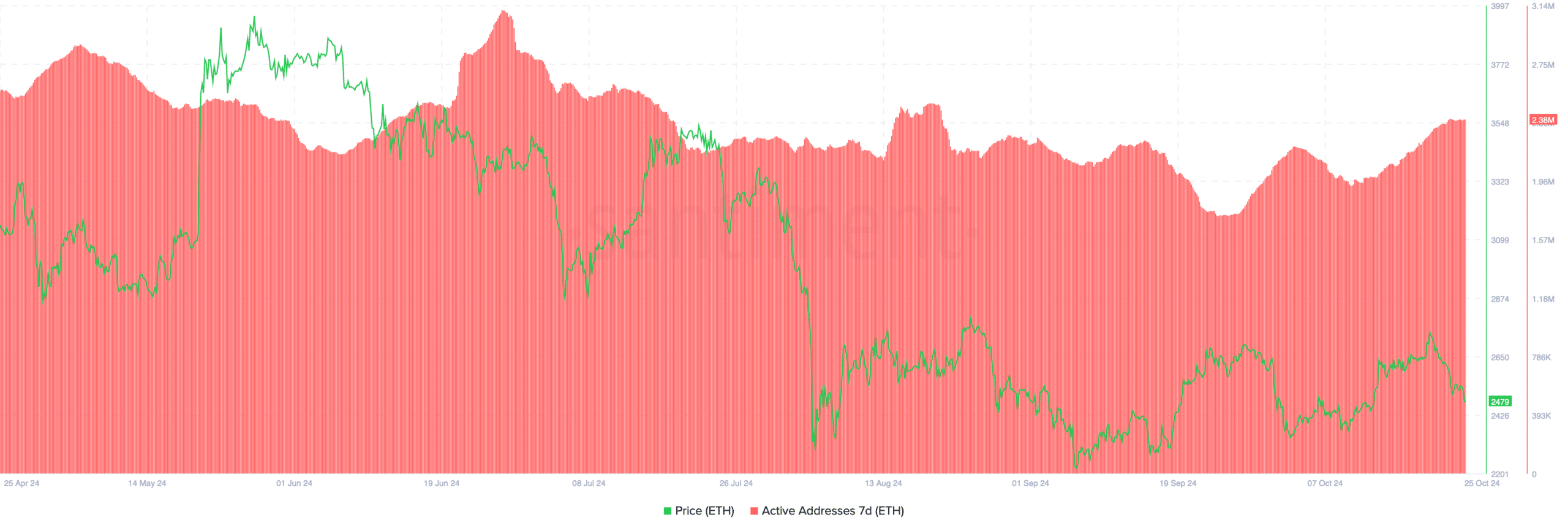

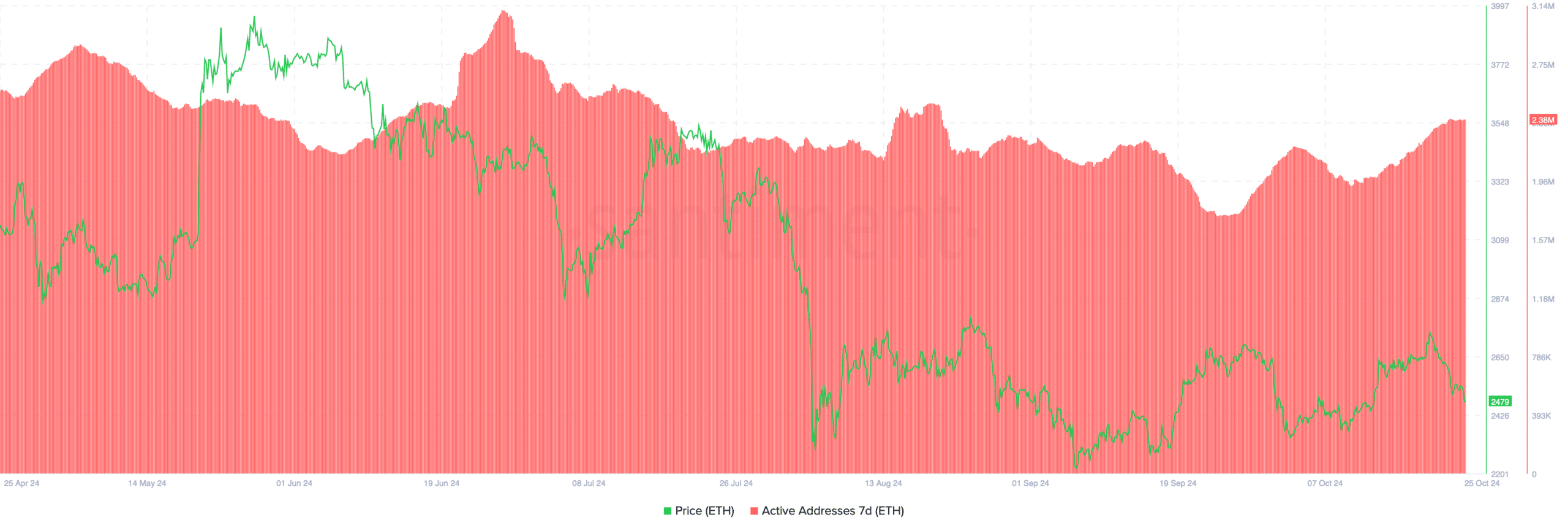

According to data from Santiment, Ethereum’s retail interest has increased in recent weeks, with the number of active addresses rising from under 1.80 million last month to approximately 2.38 million today.

Source: Santiment

This rise in active addresses reflects growing interest in Ethereum from retail investors, potentially indicating stronger demand in the spot market.

An increase in active addresses is often seen as a positive indicator for asset liquidity and market engagement, hinting at sustained interest in Ethereum despite recent price declines.

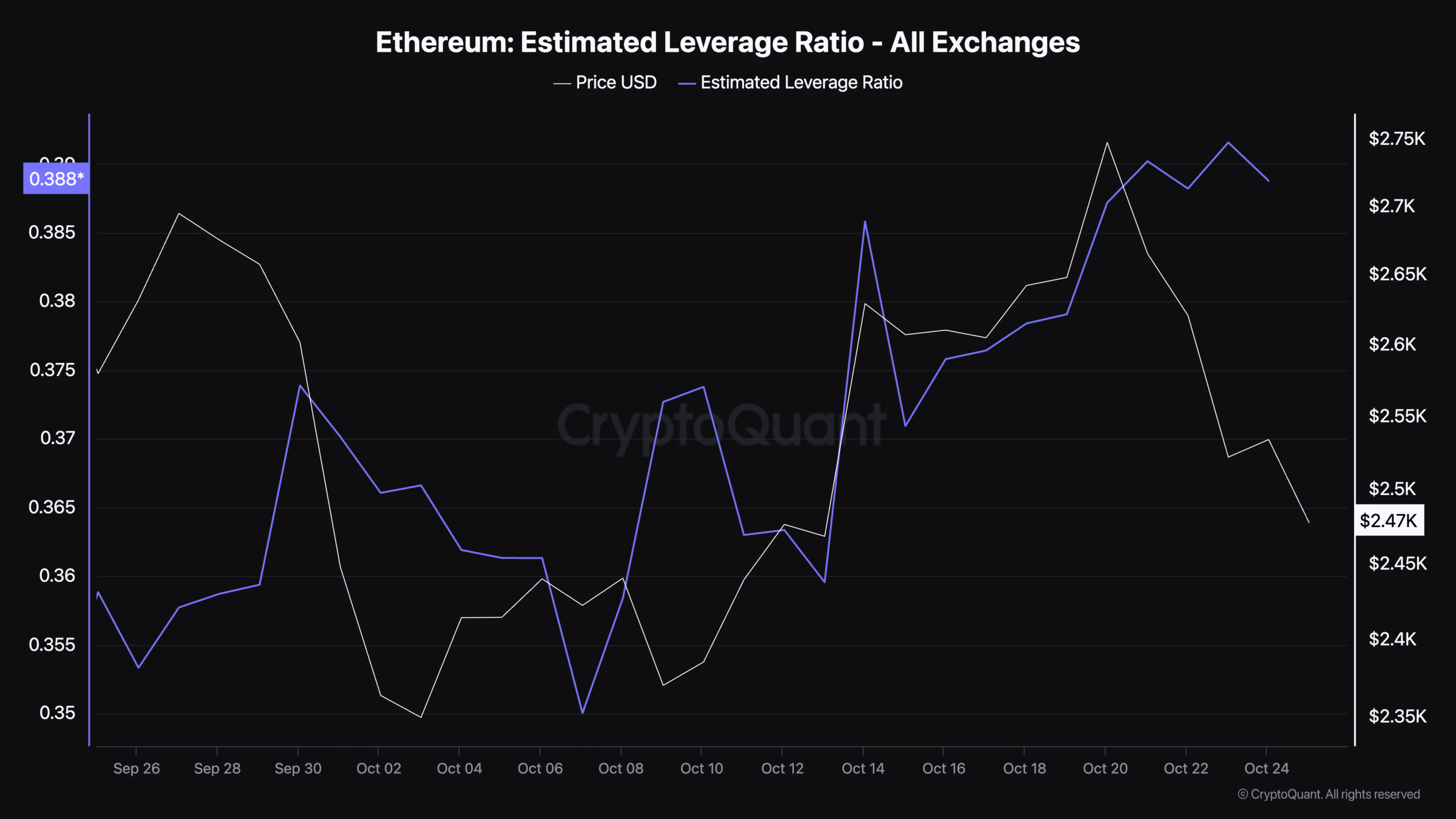

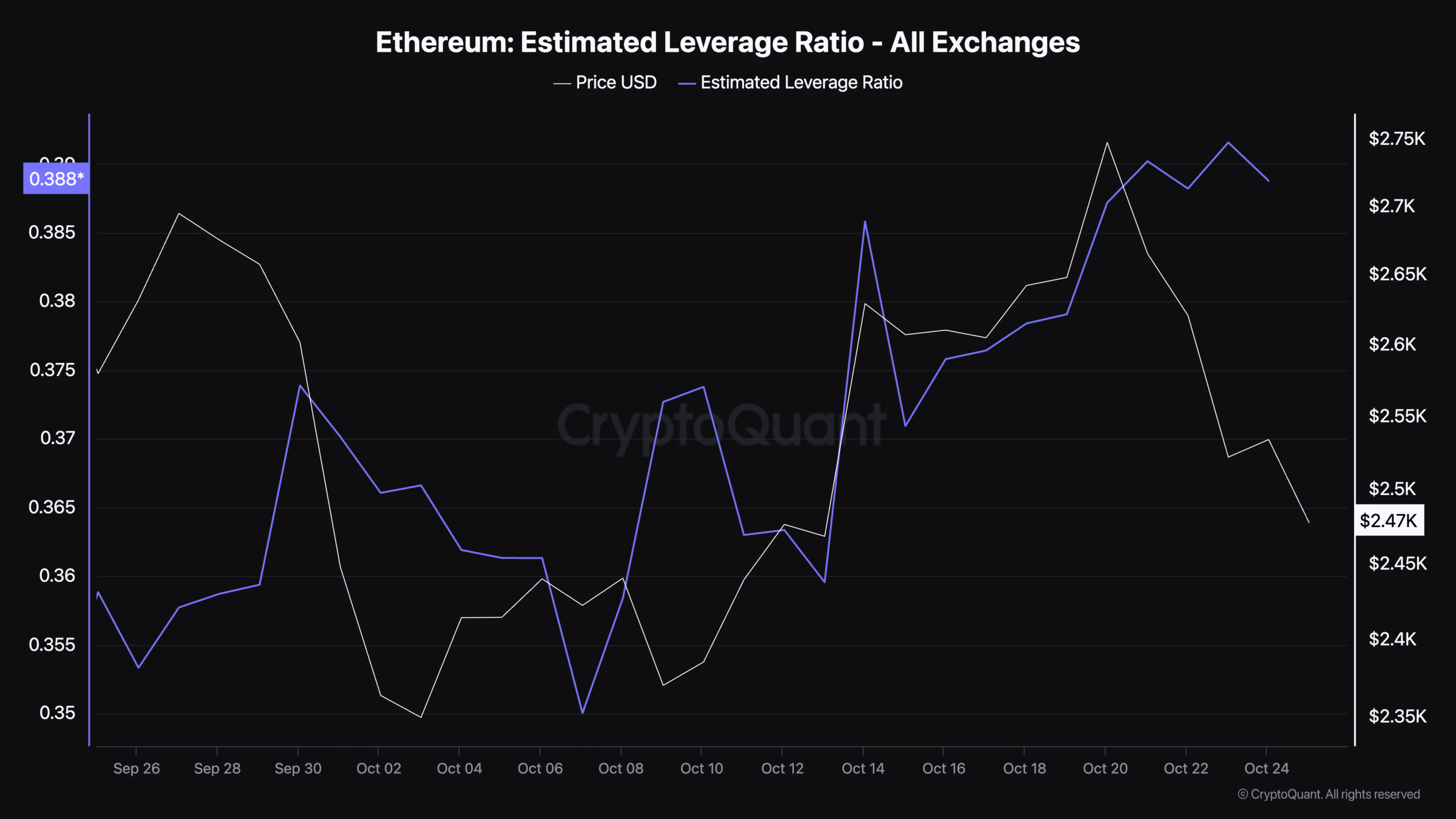

In addition to retail interest, estimated leverage ratio has also risen recently, with the metric currently standing at 0.38.

This ratio, provided by CryptoQuant, measures the degree of leverage used in Ethereum trades, which can indicate the level of risk within the market.

Read Ethereum’s [ETH] Price Prediction 2024–2025

A higher leverage ratio suggests that traders are increasingly using borrowed funds to amplify their positions.

Source: CryptoQuant

While this can lead to higher returns in bullish markets, it also amplifies losses during downtrends, adding to market risk. The current leverage ratio indicates that traders may be taking on increased exposure in anticipation of market movements.