- ETH was down by more than 2% in the last 24 hours.

- Market indicators looked bearish on Ethereum.

Ethereum [ETH] recently managed to go above $3.6k mark as it closed last week. During that time, investors’ confidence in the king of altcoins rose sparkly as a key metric hit an all-time high. However, their confidence did not help ETH, as its daily chart turned red.

Ethereum investors are increasing

Santiment recently posted a tweet highlighting the fact that ETH took a jump this weekend, rebounding above $3.6K after dropping as much as 25% between 11th and 19th March.

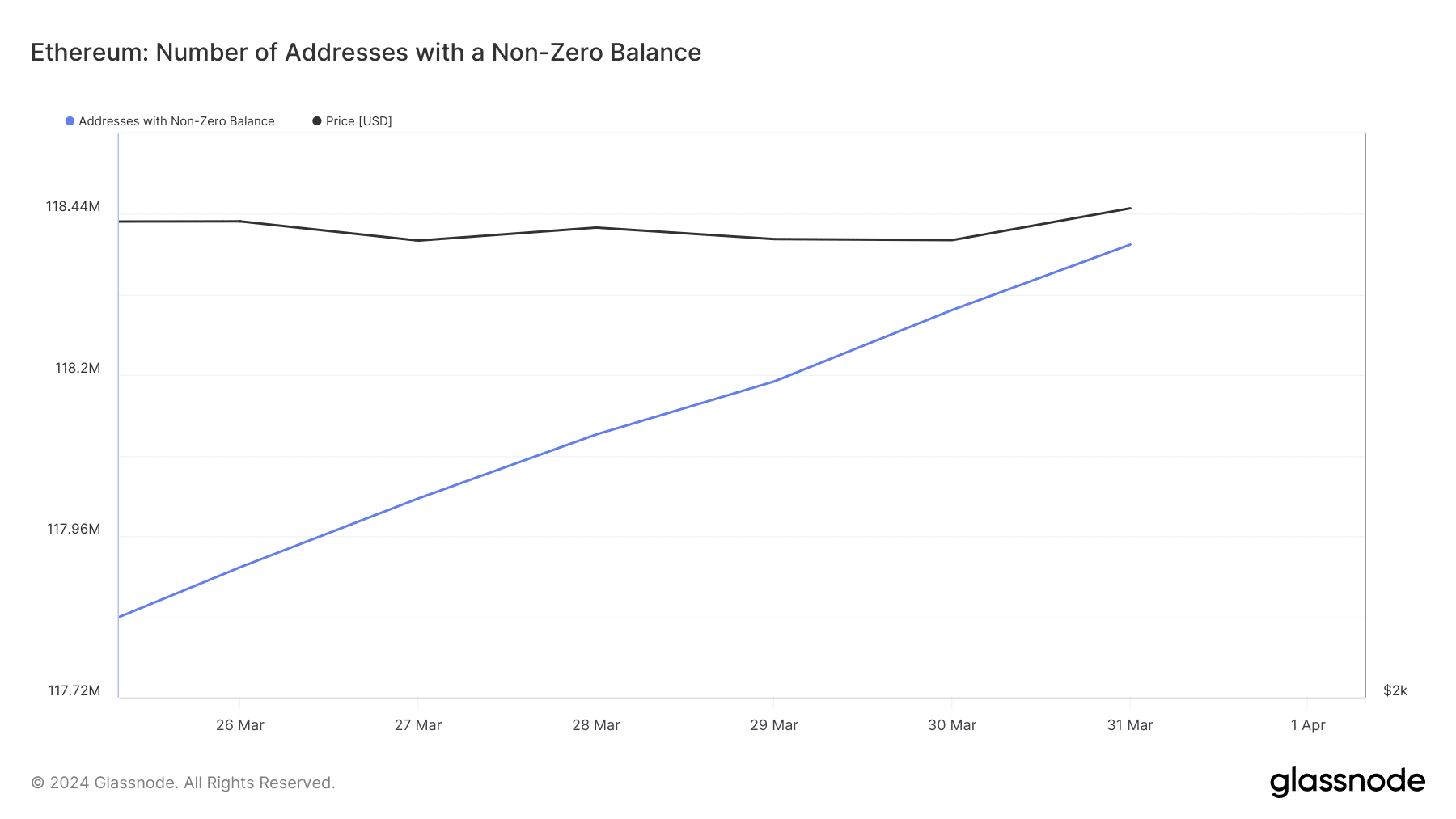

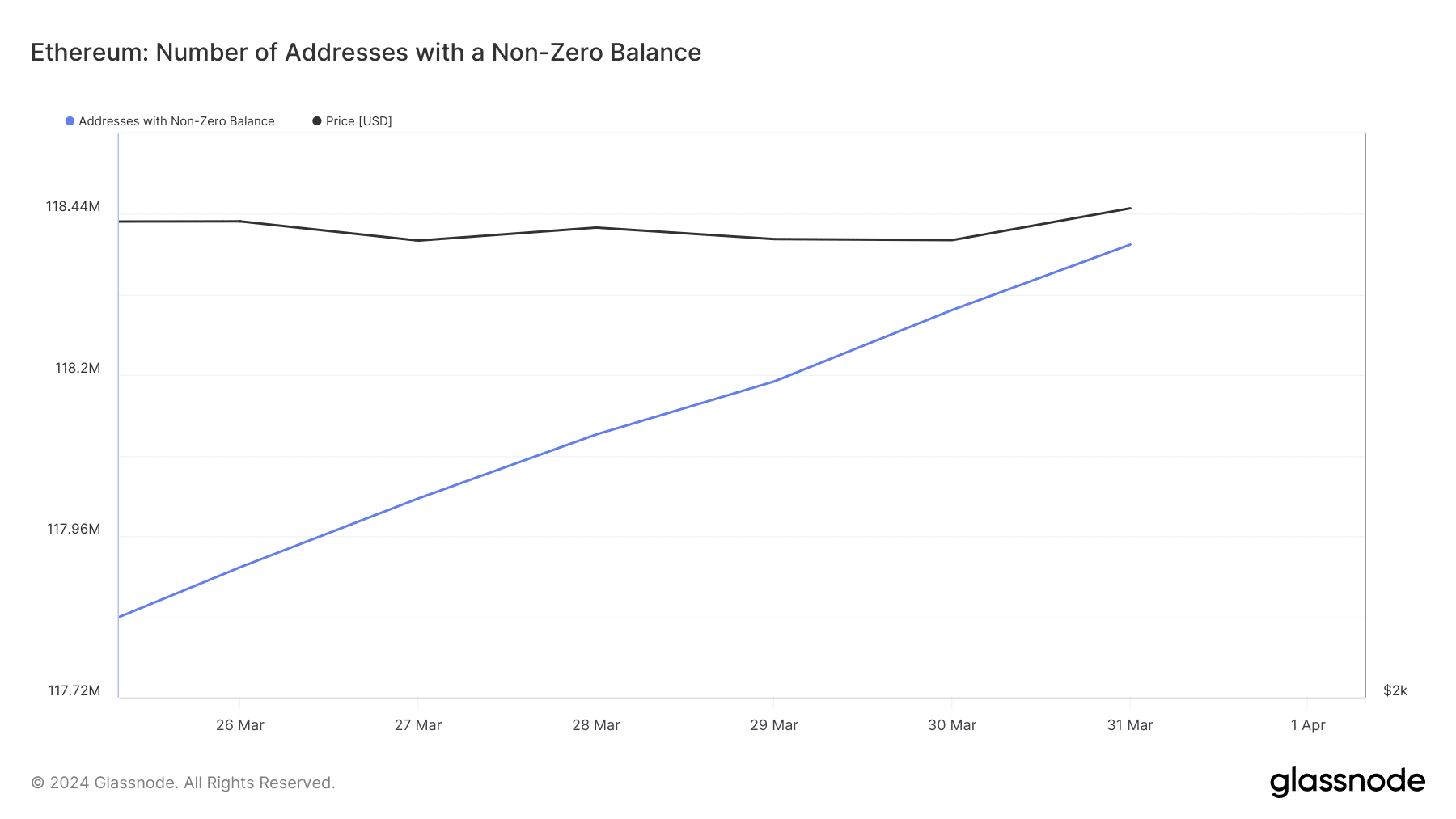

While the king of altcoin’s price recovered, its total number of addresses with non-zero addresses surged and exceeded 118.23K. Additionally, its mid-term MVRV ratio gave a slight bullish signal.

However, the reality turned out to be different as ETH’s price dropped by more than 2.4% in the last 24 hours as it plummeted under $3.6k according to CoinMarketCap.

At the time of writing, Ethereum was trading at $3,547.34 with a market capitalization of over $425 million. Despite the drop in price, it was interesting to note that ETH’s number of addresses with non-zero balances still continued to rise.

Source: Glassnode

What to expect from Ethereum

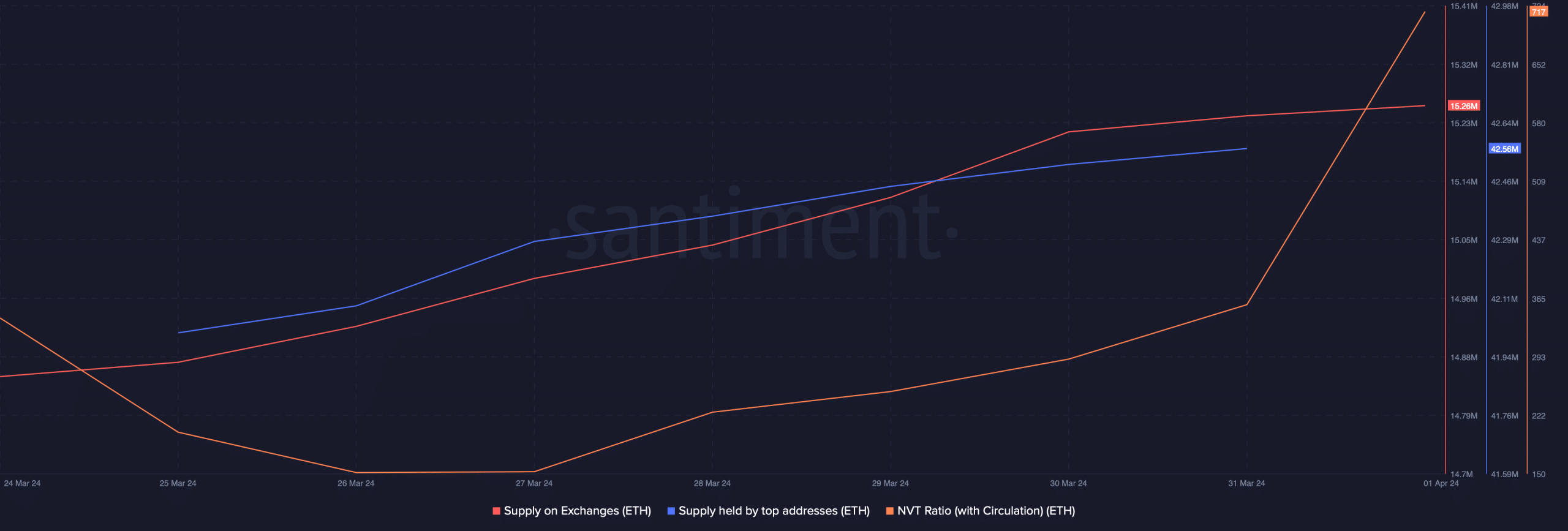

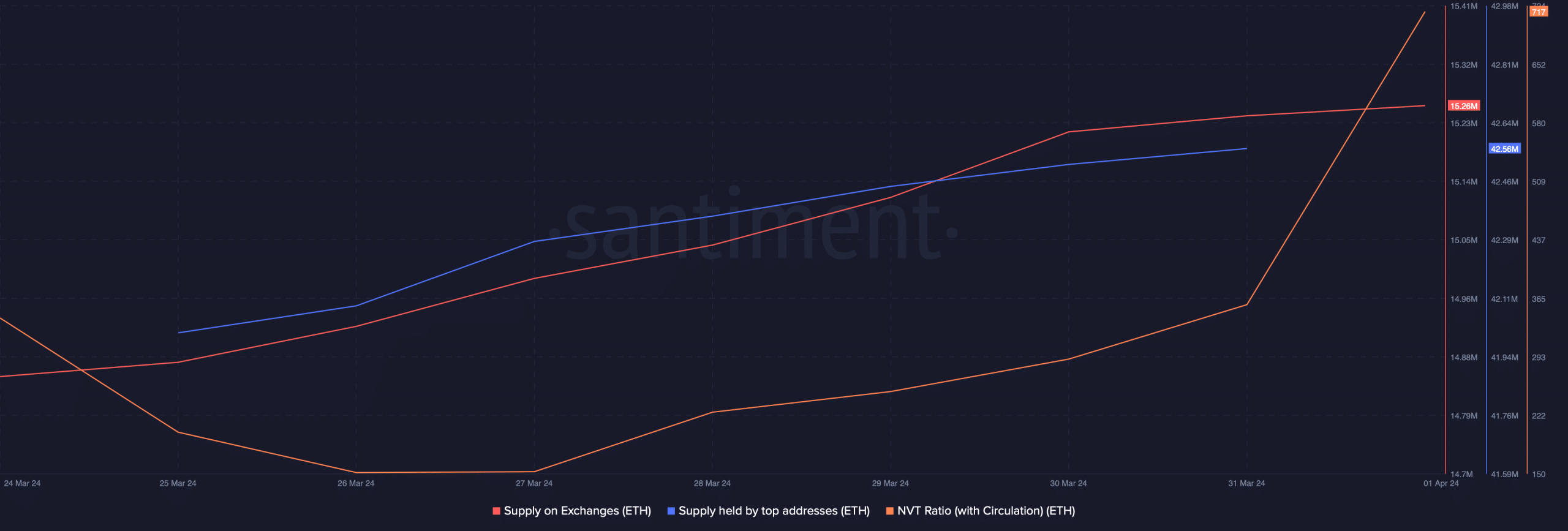

Since the token’s value dropped in the last 24 hours, AMBCrypto checked its metrics to see which way it was headed in April. We found that despite the rise in non-zero addresses, its supply on exchanges increased. This meant that selling pressure was high.

As per CryptoQuant’s data, ETH’s net deposit on exchanges was high compared to the last seven-day average, further suggesting that investors were selling ETH.

Interestingly, whales had confidence in Ethereum as its supply held by top addresses increased. Nonetheless, Ethereum’s network-to-value ratio registered a sharp uptick.

A rise in the metric means that an asset is overvalued, which suggests that the possibility of a price correction is high.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

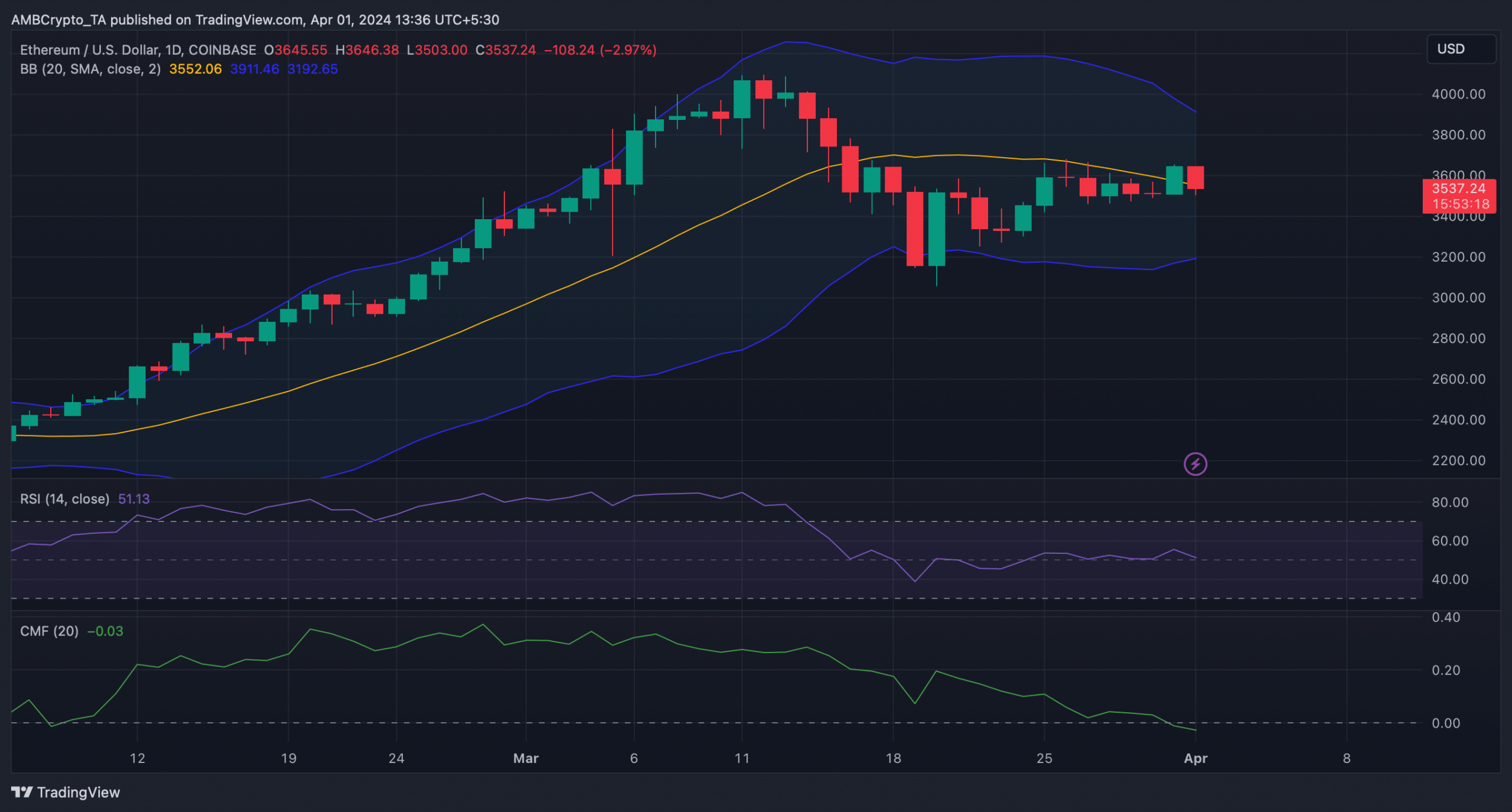

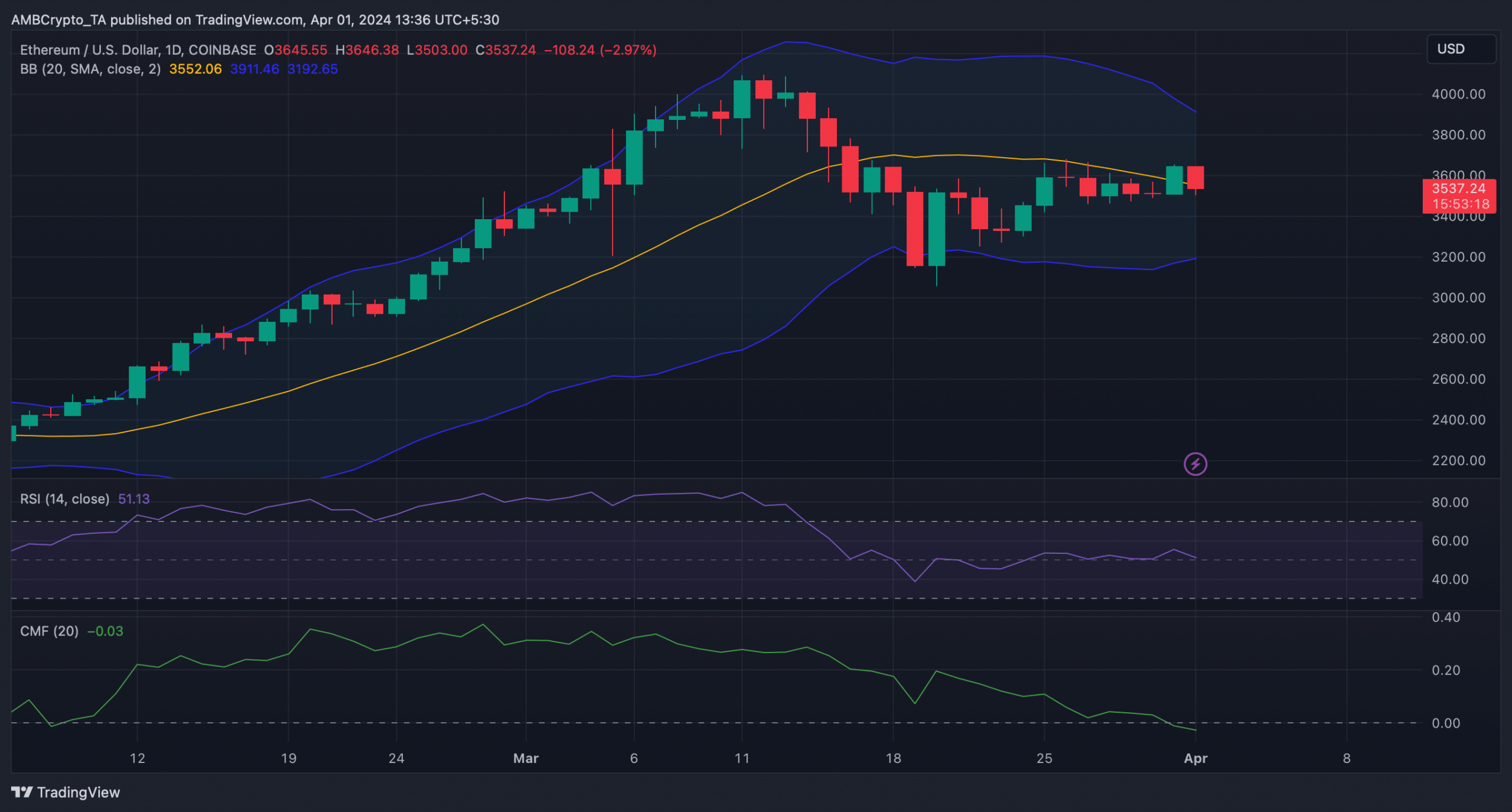

Our analysis of Ethereum’s daily chart revealed that its Relative Strength Index (RSI) went southward from the neutral mark. Its Chaikin Money Flow (CMF) also followed RSI and registered a sharp downtick.

Moreover, its Bollinger Bands revealed that ETH’s price was entering a less volatile zone, decreasing the chances of an unprecedented price uptick in the short term.

Source: TradingView