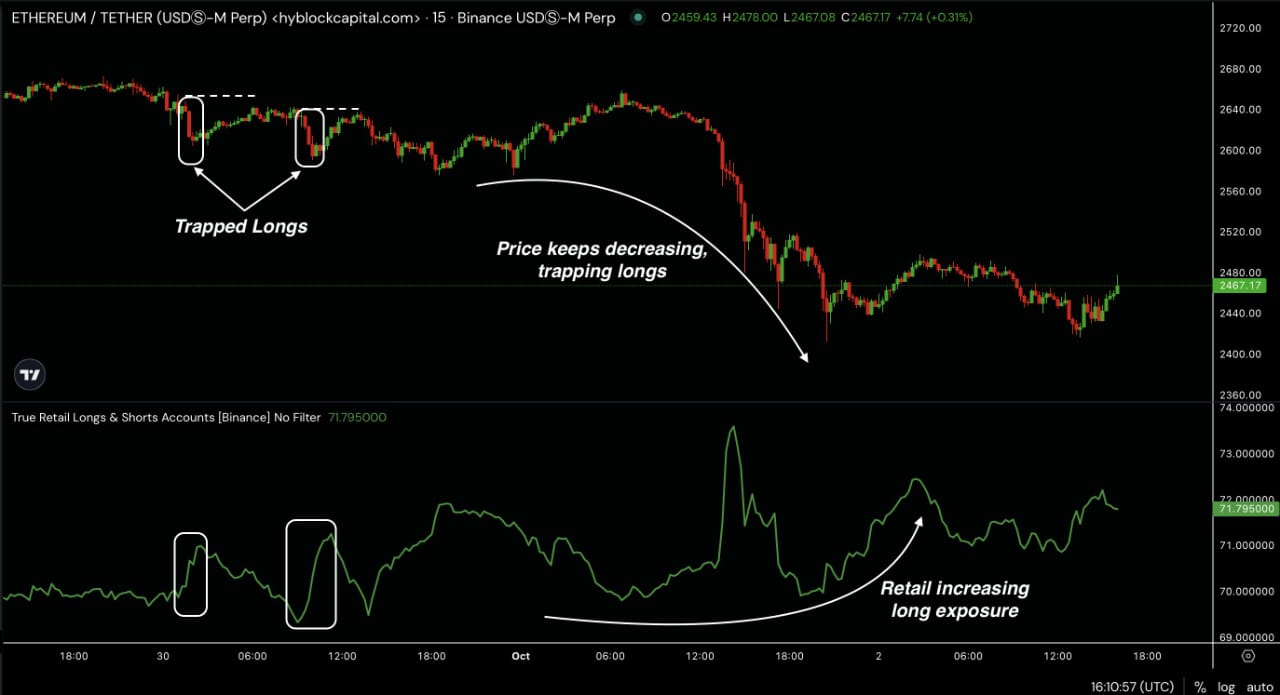

- Ethereum traders trapped in longs as market declines.

- Ethereum shows strength in revenue and TVL dominance.

Ethereum [ETH] continues to play a major role in the cryptocurrency market, and as we enter the last quarter of the year, several key factors are expected to influence its price movement.

Toward the end of September, retail traders increased their exposure to Ethereum, trying to capitalize on price dips. However, this led to many being trapped in losing positions as ETH continued to decline.

With similar patterns reappearing, traders are cautious about whether ETH will continue to fall in the final months of the year.

Source: Hyblock Capital

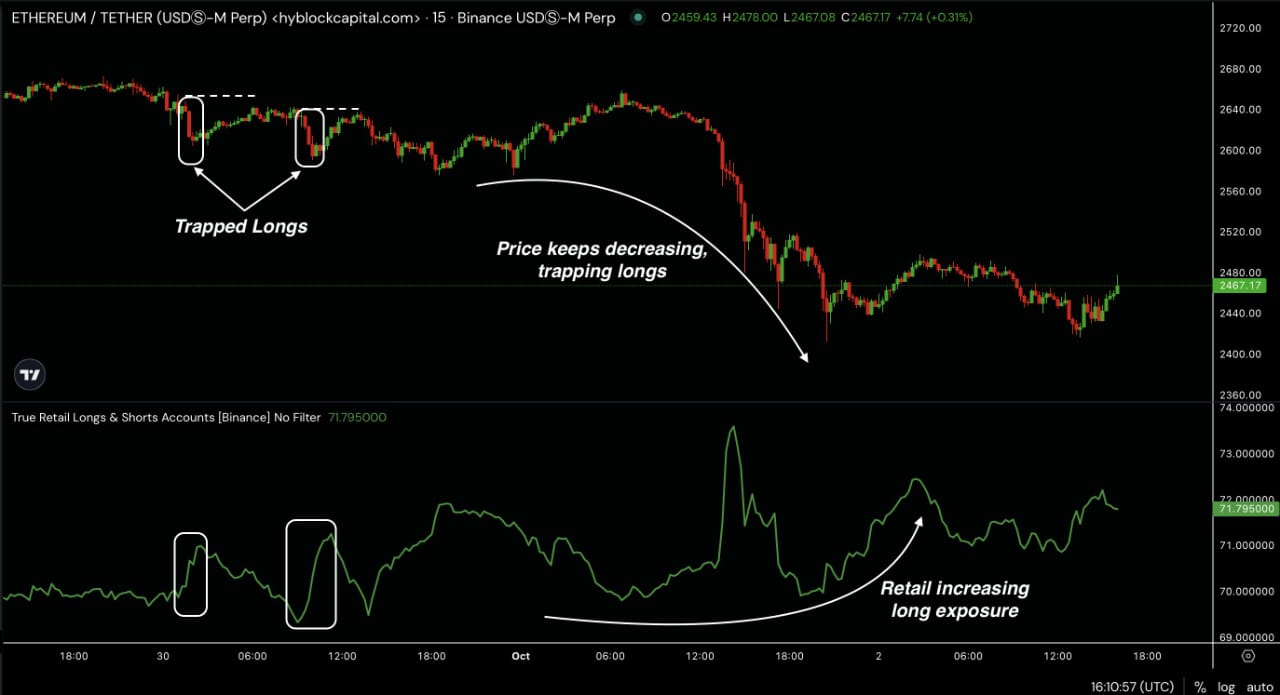

ETH price action signals bearishness

Looking at Ethereum’s recent price action, it seems likely that the ETH/USD pair could continue to decline. On the daily chart, ETH is trading below the 150, 50, and 20 exponential moving averages (EMAs), signaling a bearish trend.

This is further confirmed by the S&P 500 (SPX) index, which has also flipped below the 150 EMA, adding more weight to the negative outlook.

Additionally, volume bars show that sellers remain in control, reinforcing the idea that ETH could disappoint traders by continuing to drop.

Source: TradingView

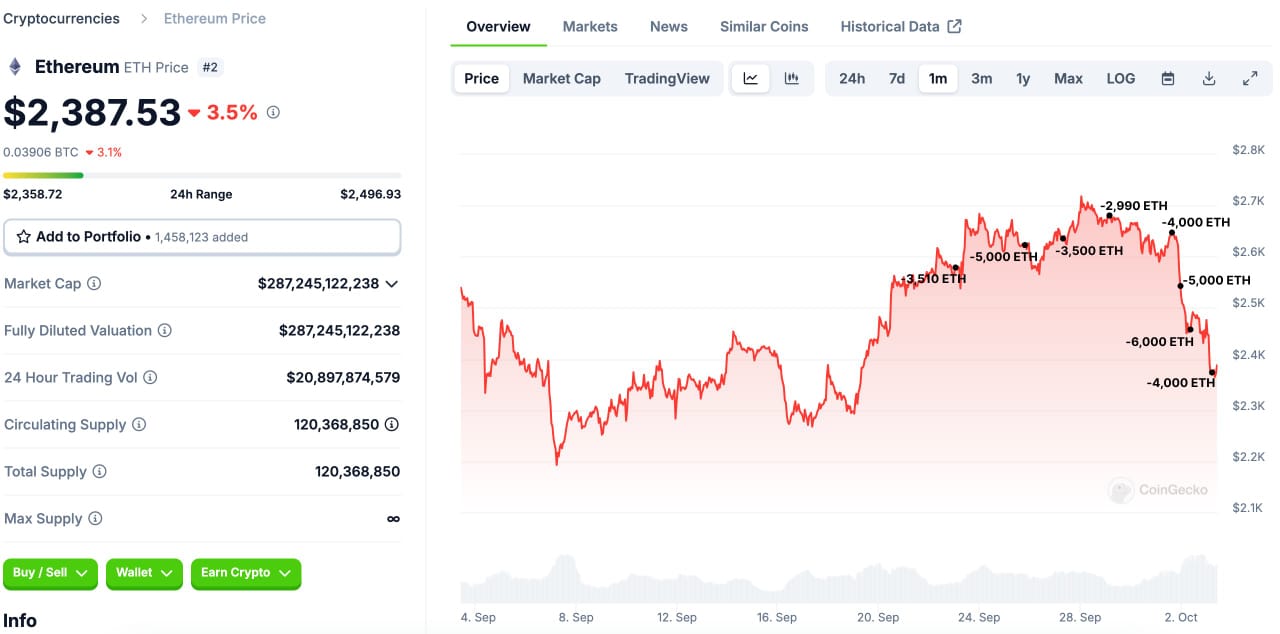

Impact of ICOs and Grayscale on ETH

On-chain data adds to the bearish sentiment, particularly concerning initial coin offerings (ICOs) and Grayscale’s activity. A significant Ethereum ICO participant recently sold 19,000 ETH, worth around $47.54 million.

This participant initially received 150,000 ETH during the ICO, with a purchase price of $46,500, now valued at $358 million.

The fact that early Ethereum whales are selling off their holdings contributes to the downward pressure, especially since ETH was bearish during the entire fourth quarter after a green September in past years.

Source: Lookonchain

In addition, two dormant Grayscale ETF wallets have deposited 5837 ETH, worth $14.17 million, into Coinbase according to Onchain Lens.

These wallets had previously held 23026 ETH, purchased at an average price of $1,593 a year ago.

The movement of these funds, coupled with the wallets still holding 17,189 ETH, further indicates that large investors are making moves that could impact ETH’s price.

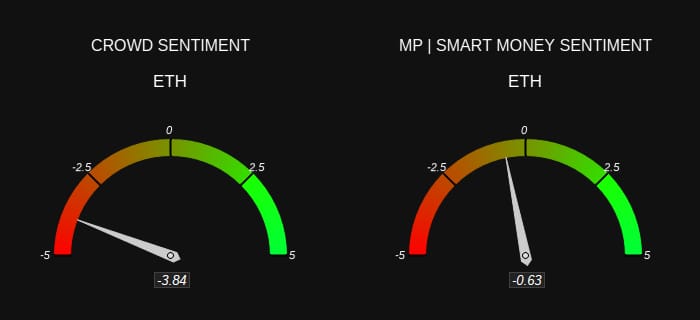

Sentiment among traders

Both retail traders and larger investors seem to share a bearish sentiment regarding Ethereum’s price. This shift occurred after recent geopolitical events caused a downturn in the broader crypto market.

As a result, ETH is expected to face more selling pressure, which could lead to further price declines in the fourth quarter.

Source: Market Prophit

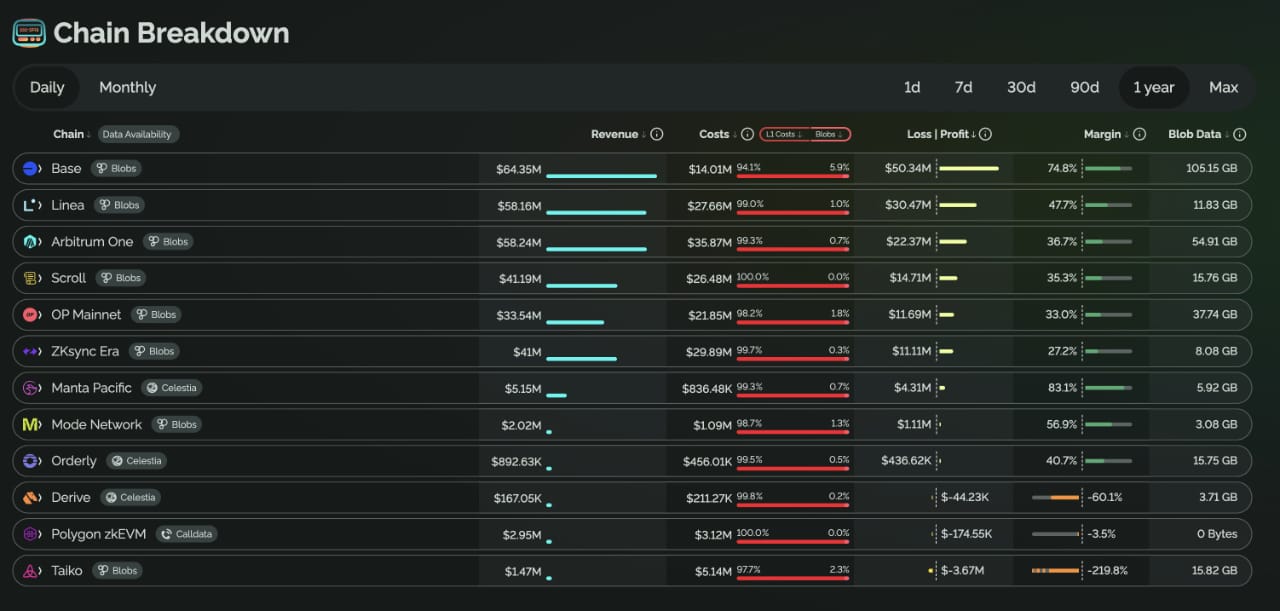

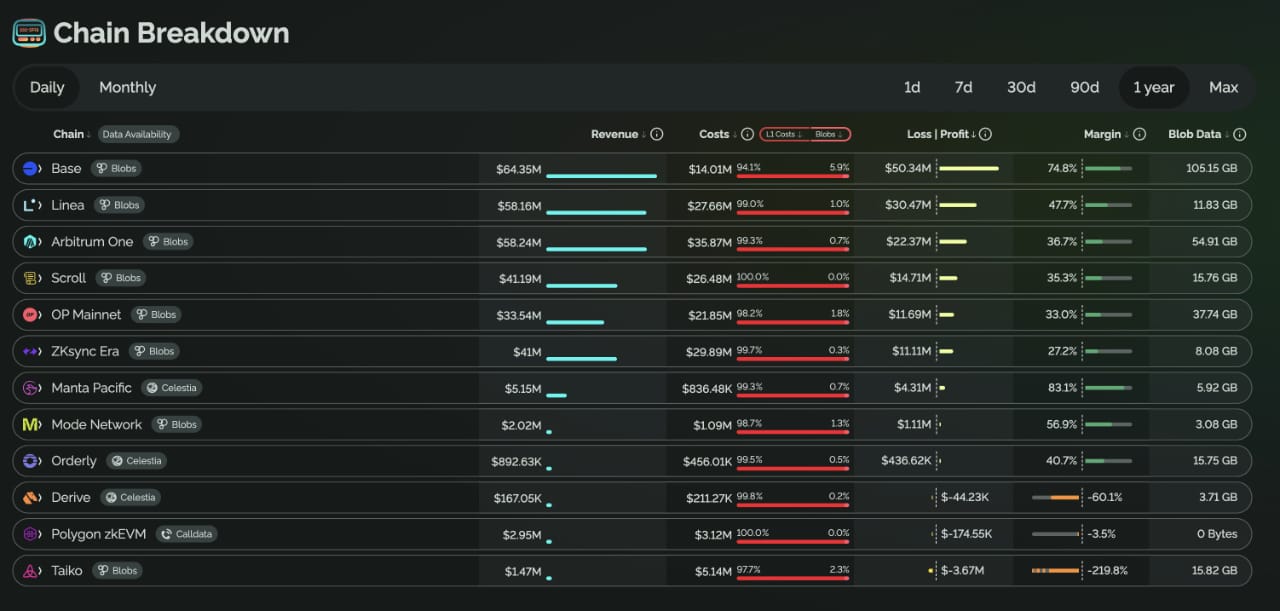

Ethereum’s revenue strength and TVL dominance

Despite the bearish outlook, Ethereum has shown resilience in other areas. The platform has generated over $140 million in gross profits across nine different chains over the past 12 months.

As a federated network of economies with ETH as its currency, Ethereum remains a “land of opportunity,” which could eventually reverse the negative trend.

Moreover, Ethereum continues to dominate in total value locked (TVL) compared to other Layer 1 blockchains. Its market cap of $48.7 billion far exceeds competitors like Solana ($5.4 billion) and Sui ($984 million).

Source: X

This strength in TVL dominance shows that ETH is still leading the market, despite the bearish signals and challenges posed by newer blockchains.

Read Ethereum’s [ETH] Price Prediction 2024–2025

While Ethereum faces bearish sentiment in the short term, its strong fundamentals and market position may allow it to bounce back in the long run.

However, traders should remain cautious as market dynamics continue to evolve.