- Jump Trading’s ETH selloff could impact Ethereum price and overall market sentiment negatively.

- Despite selloffs, most ETH holders were “in the money,” suggesting potential price recovery.

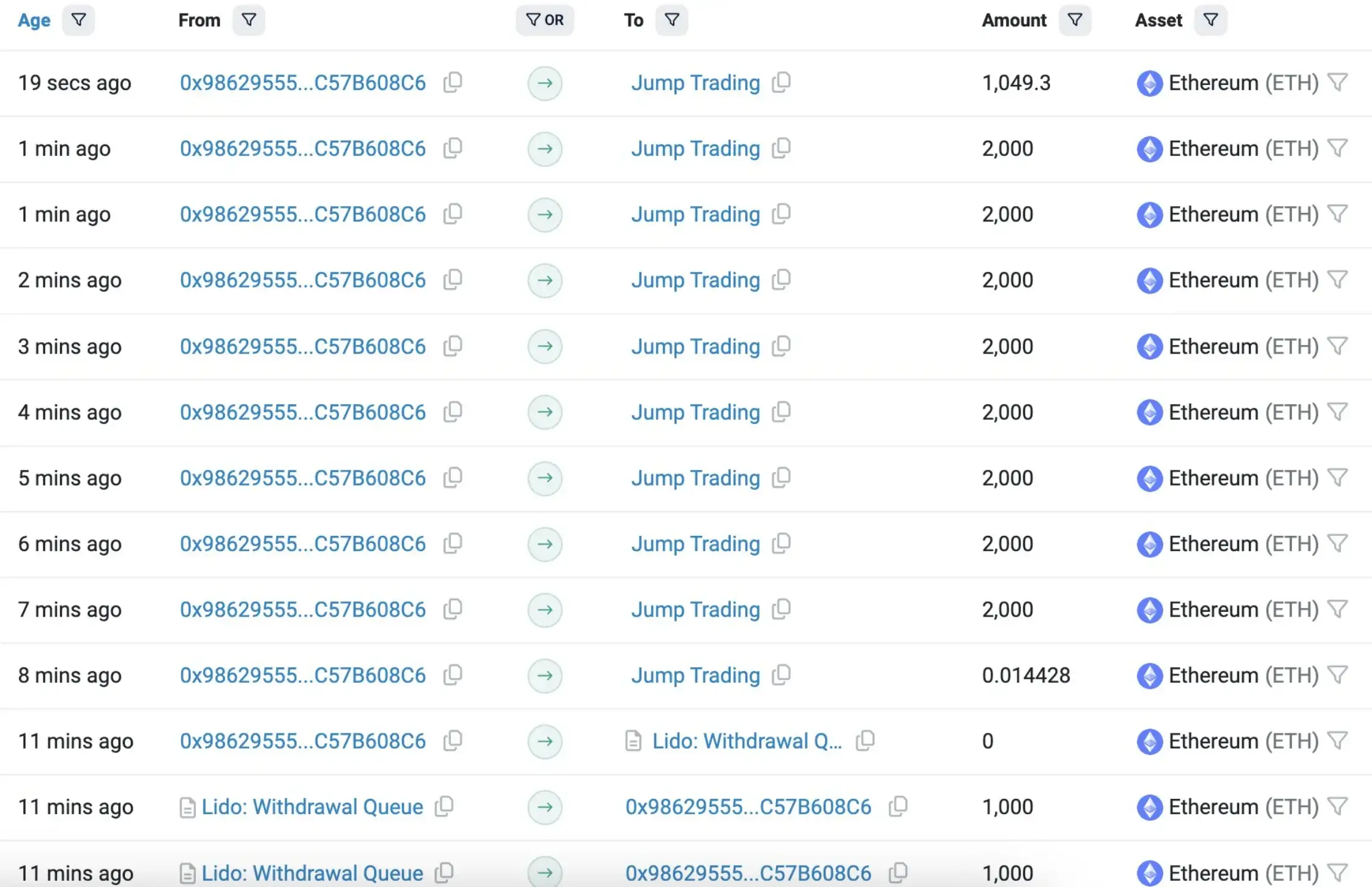

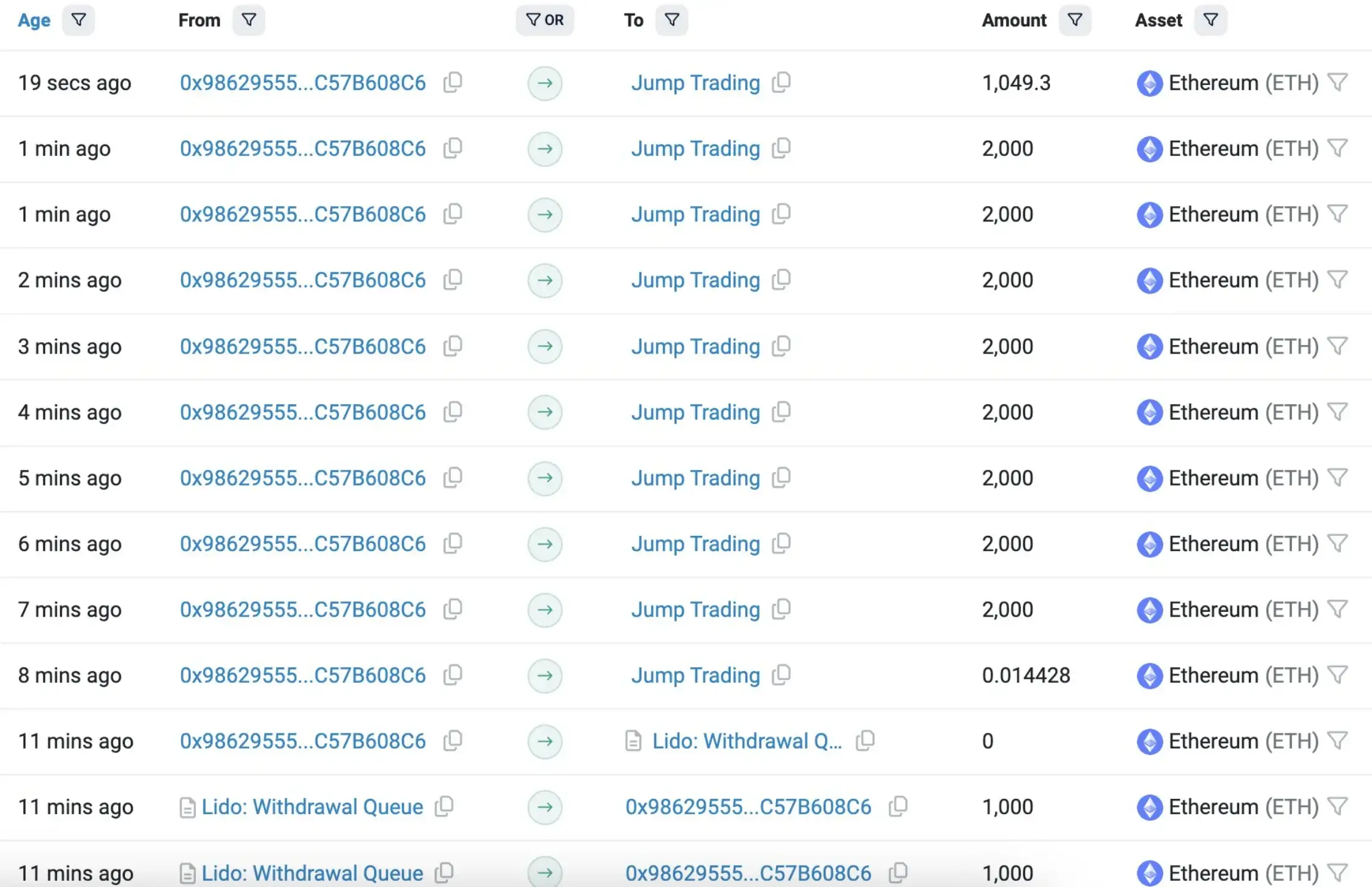

In a recent development involving Jump Trading, Lookonchain reported on X (formerly Twitter) that the prominent crypto market maker has ramped up its sale of Ethereum [ETH] assets.

Jump Trading’s move

This move indicated a significant shift in Jump Trading’s strategy, as the firm began to offload more of its Ethereum holdings amidst a period of market volatility.

The post from Lookonchain asserted,

“They claimed 17,049 $ETH($46.44M) from #Lido and transferred it out for sale.”

It further went on to say,

“Jump Trading currently has 21,394 $wstETH($68.58M) left.”

Source: Lookonchain/X

What’s more to it?

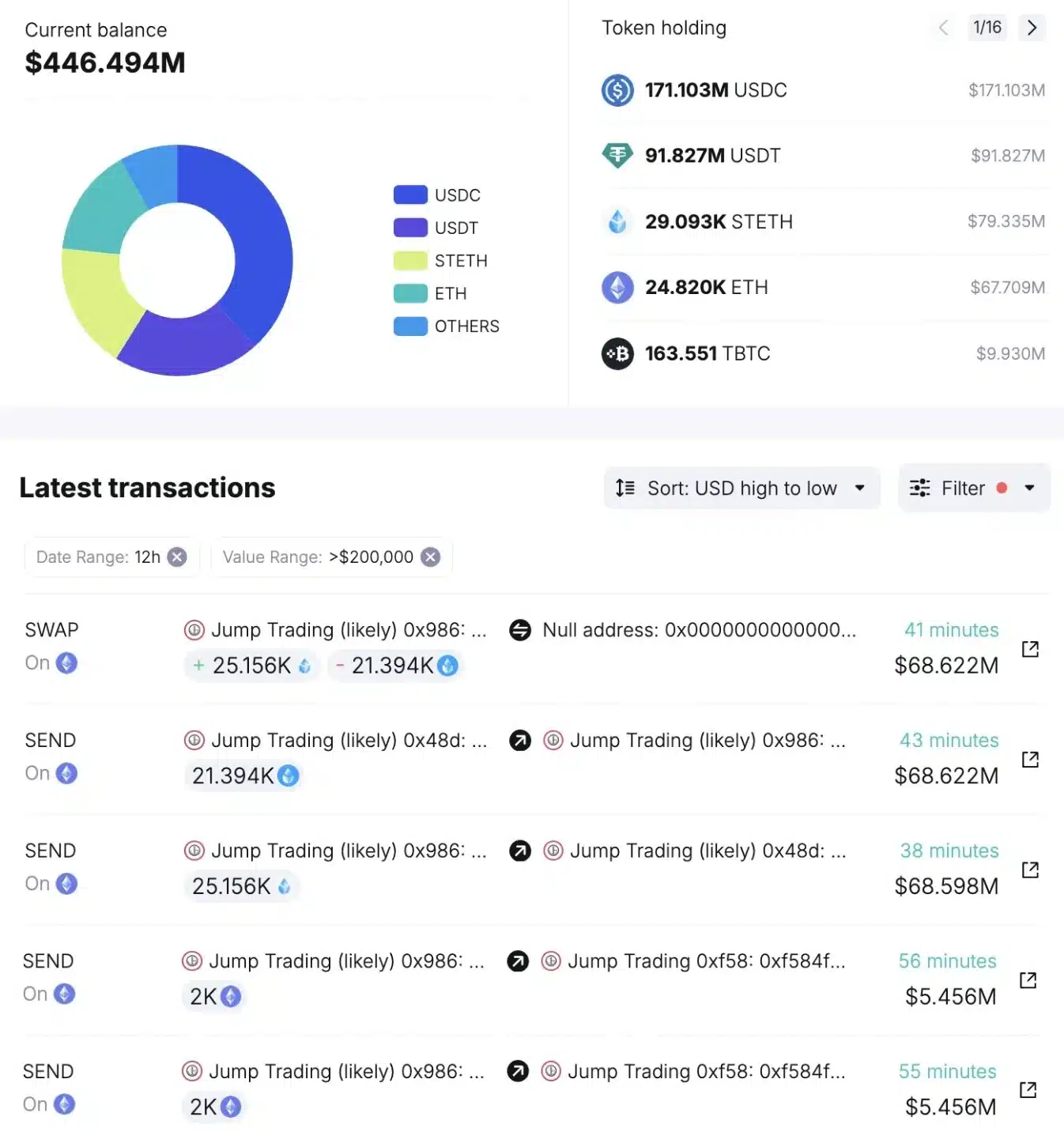

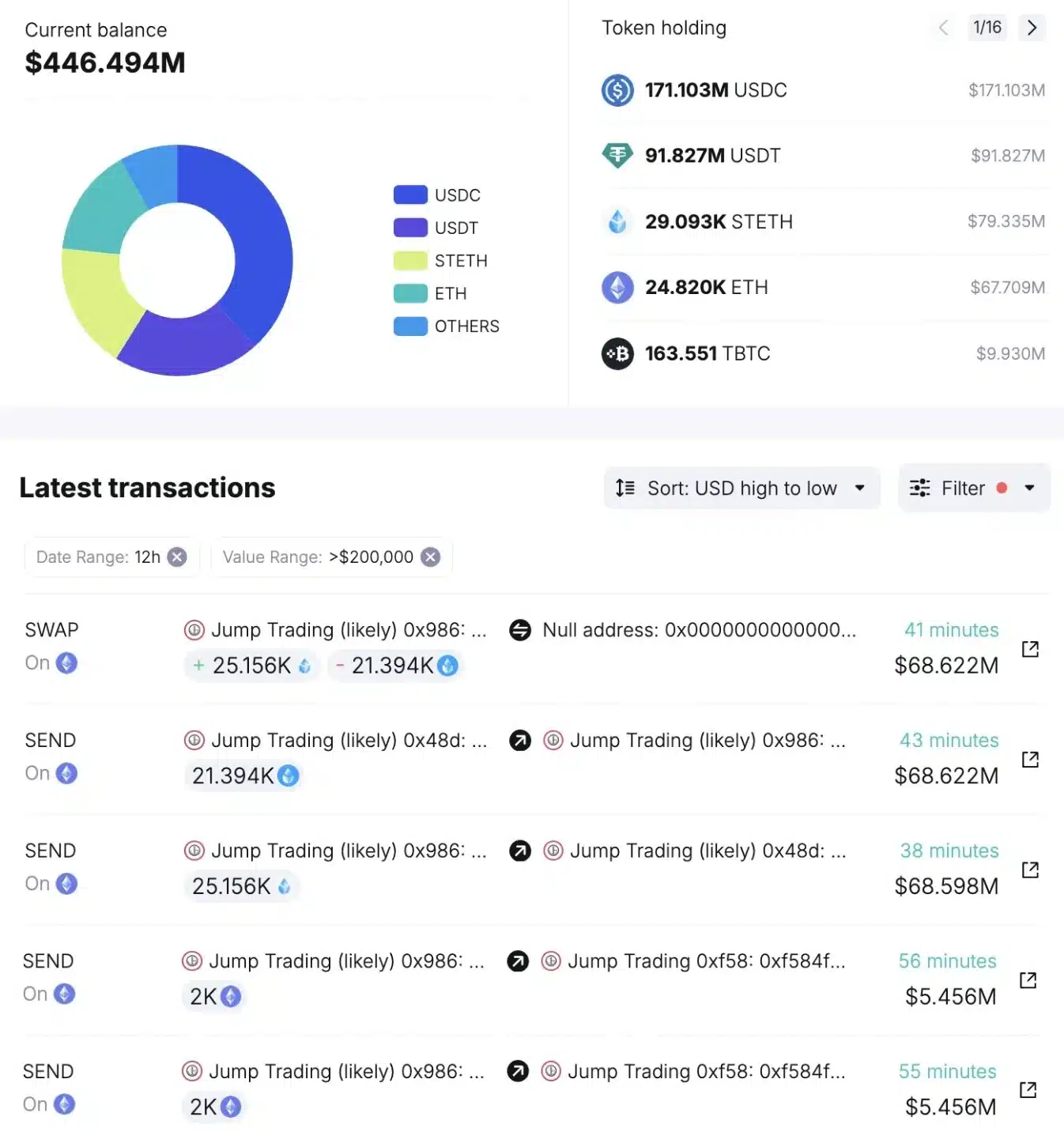

Additionally, Spot On Chain recently reported that Jump Trading has swapped 21,394 wstETH for 25,156 stETH, but did not make immediate withdrawal requests from Lido Finance as it had before.

Source: Spot On Chain/X

The firm currently holds around $148 million in Ethereum assets, with 24,993 ETH in wallet 0xf58, and 29,093 stETH staked with Lido.

The recent uptick in selloffs coincided with Kanav Kariya’s exit from Jump Crypto, which followed the initiation of a CFTC investigation into the firm in June.

Community reaction

Commenting on Jump Trading’s actions, X user DCinvestor tweeted,

“Jump Trading disorderly selling everything below $3K going to age poorly. good riddance to the most extractive actor in the space tbqh.”

Echoing this sentiment, an X user named Ace remarked,

“Manipulation. They are really just want to buy more.”

ETH’s price future outlook uncertain

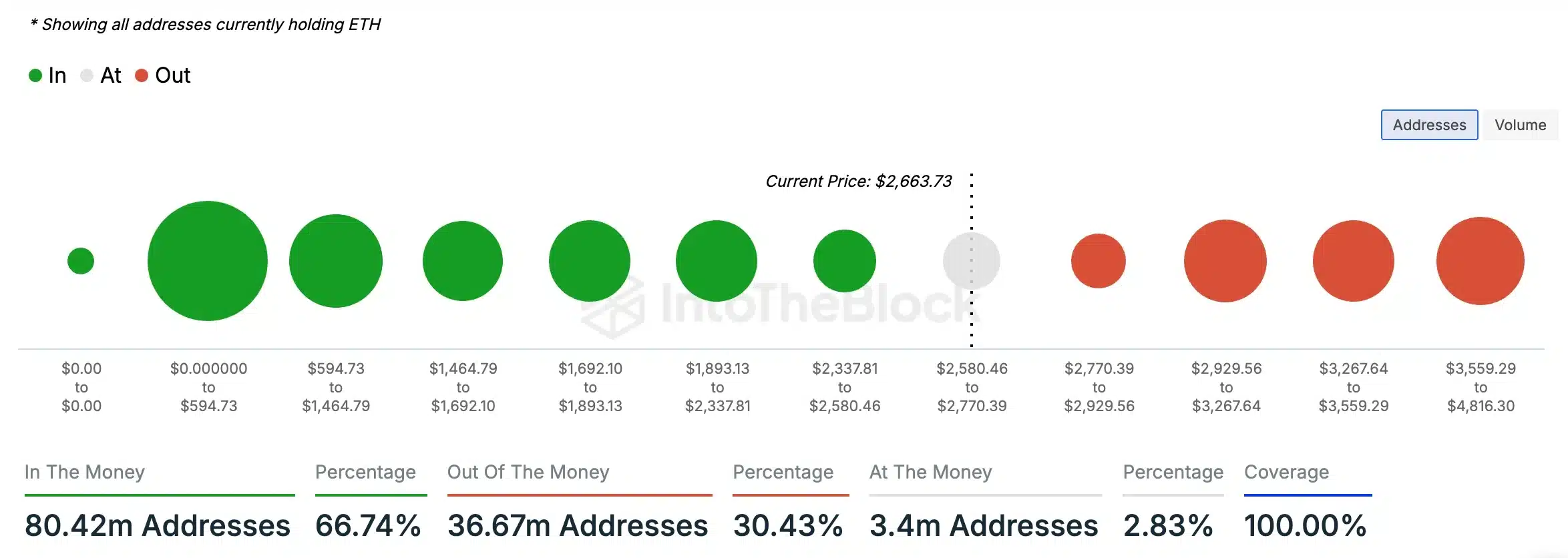

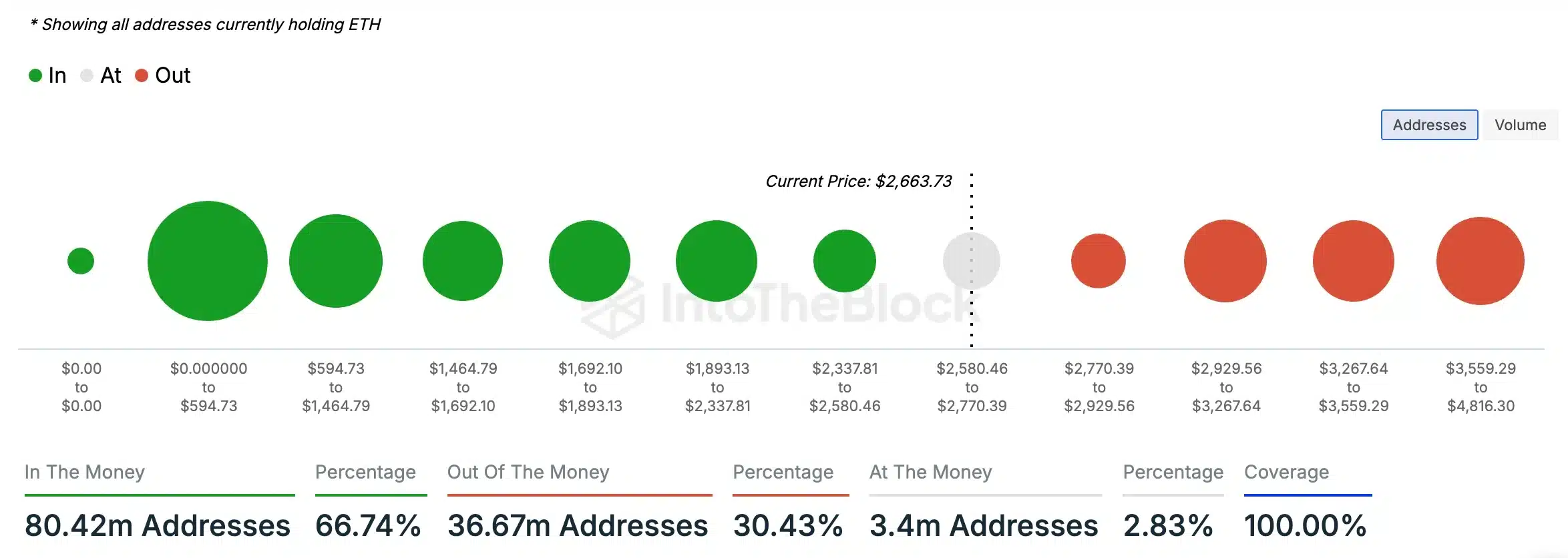

However, despite concerns over a potential Ethereum price drop due to Jump Trading’s sell-offs, recent data presented a more nuanced picture.

As of the time of writing, ETH was trading at $2,728, reflecting a modest 0.82% increase in the past 24 hours.

While the Relative Strength Index (RSI) remained below the neutral threshold, indicating lingering bearish sentiment, analysis by AMBCrypto revealed a more optimistic scenario.

Source: Trading View

A significant majority of ETH holders—66.74%—were “in the money” at press time, meaning their holdings were valued above their initial purchase price.

This suggested a generally positive outlook among investors, contrasting with the smaller 30.43% who were “out of the money.”

Source: IntoTheBlock