- Realized price of Ethereum suggests ETH is in a bull trend right now

- Ethereum’s price action and on-chain analysis seemed to support this analysis.

Ethereum [ETH] has remained resilient, holding above its realized price on the charts to highlight a bullish trend. This, despite a sharp decline over the past five months.

Ethereum’s price action sitting above its realized price is a positive sign. Especially as historically, altcoin bull markets have begun whenever ETH has maintained strength above this level.

Additionally, at the time of writing, the broader altcoin market cap was at an uptrend support level – Indicating potential opportunities for long-term investments in altcoins.

Source: CryptoQuant

Is ETH in a bull market?

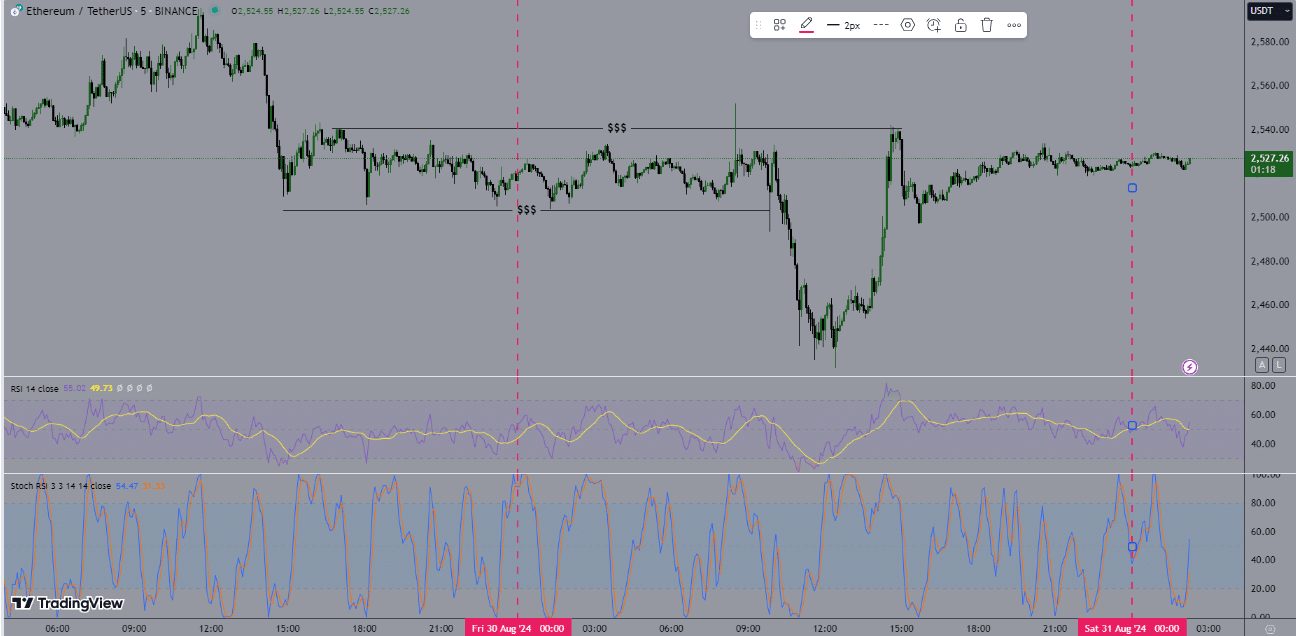

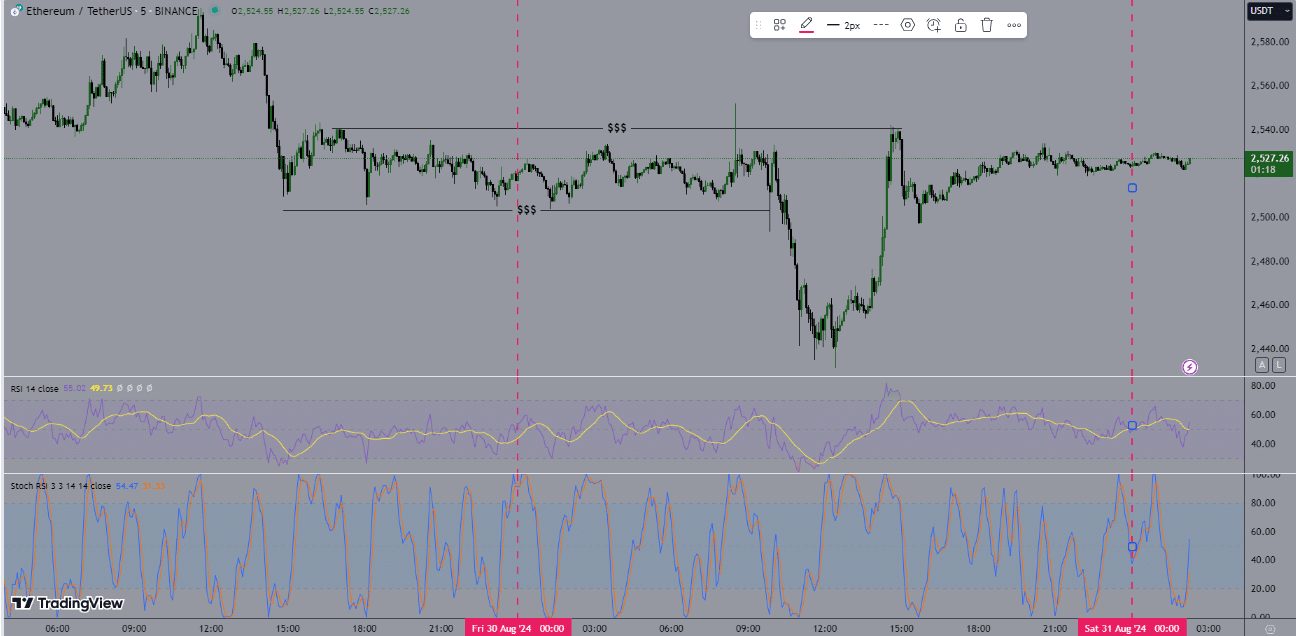

Examining Ethereum’s price action with the ETH/USDT pair, the daily candle closed with a Doji. Also, on the 5-minute timeframe, a head and shoulders pattern emerged, signaling a possible reversal.

The critical question is whether ETH is in a bull market. The answer is yes, but it’s currently at crucial levels that, if broken, could end the bull market.

This makes Ethereum an attractive opportunity for crypto traders, especially as the stochastic RSI on the daily timeframe pointed to a reversal from an oversold region. This can often be seen to indicate market bottoms.

Source: TradingView

Ethereum’s supply crisis

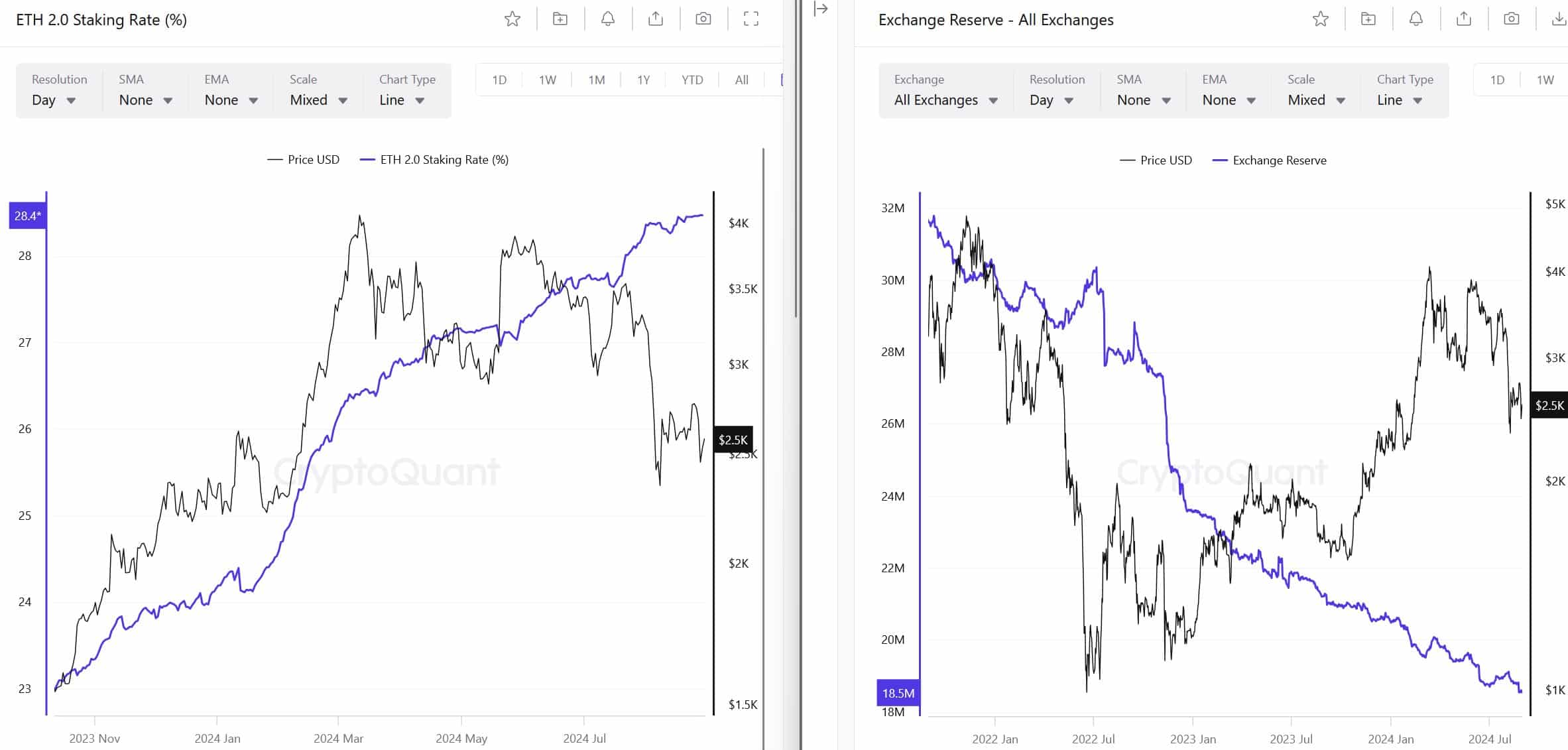

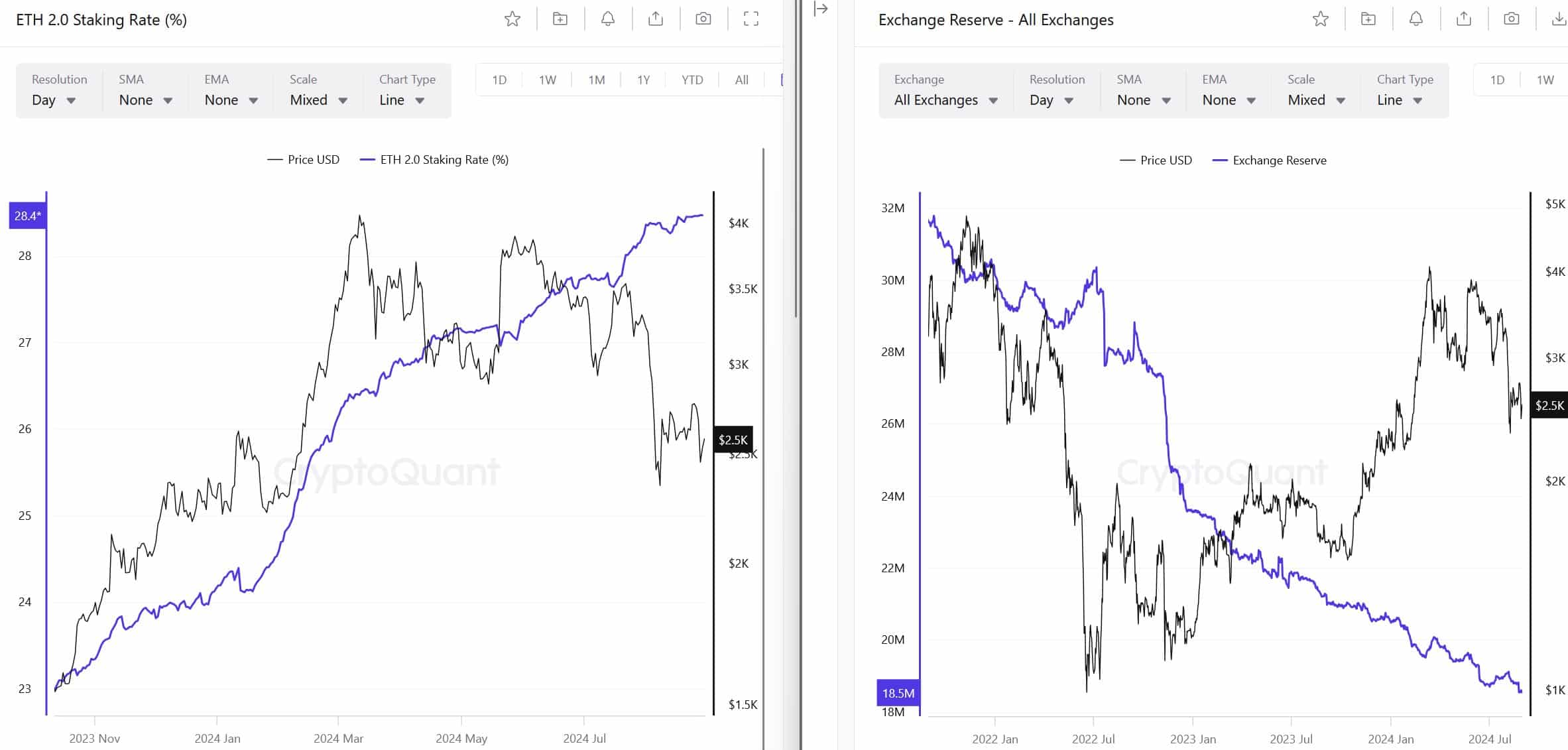

The bullish outlook for Ethereum is further supported by a looming supply crisis. Two key factors, ETH staking and exchange reserves, indicated that Ethereum is in a serious supply shortage.

Staking rates are rising, and exchange reserves are dwindling, meaning that as soon as sellers are exhausted and demand increases, ETH is likely to soar.

A huge portion of ETH that left centralized exchanges (CEXs) has moved into Liquid Staking Tokens (LSTs) – Further tightening the supply.

Source: CryptoQuant

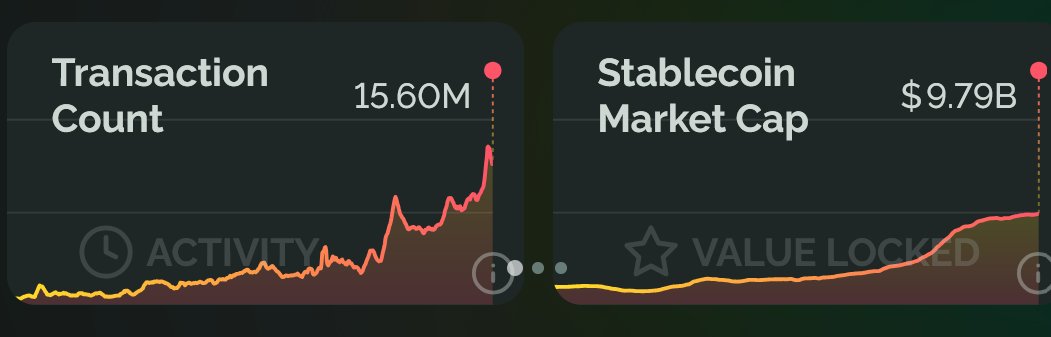

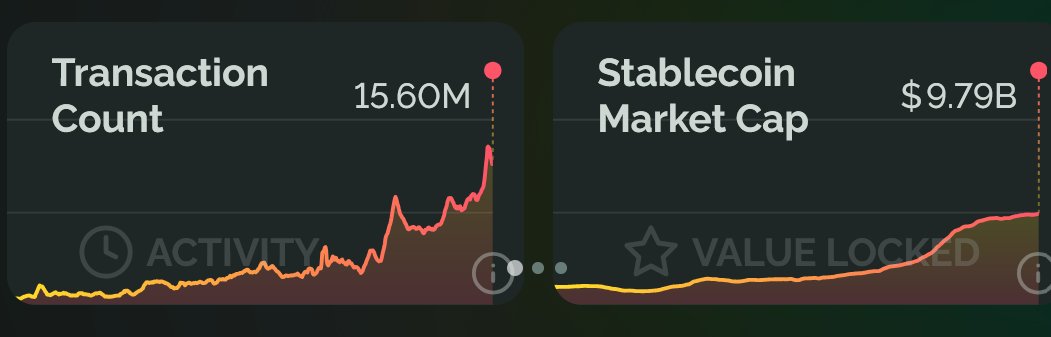

Stablecoin market cap & ETH transactions at ATH

Ethereum, a major player in the stablecoin ecosystem, has also seen significant growth in transaction volume.

Despite its bearish price action, the Ethereum ecosystem is thriving, with transaction counts reaching an all-time high of 15.60 million.

The stablecoin market cap is also at an all-time high of $9.79 billion, showcasing strong fundamentals that could support a higher ETH price.

Source: growthepie

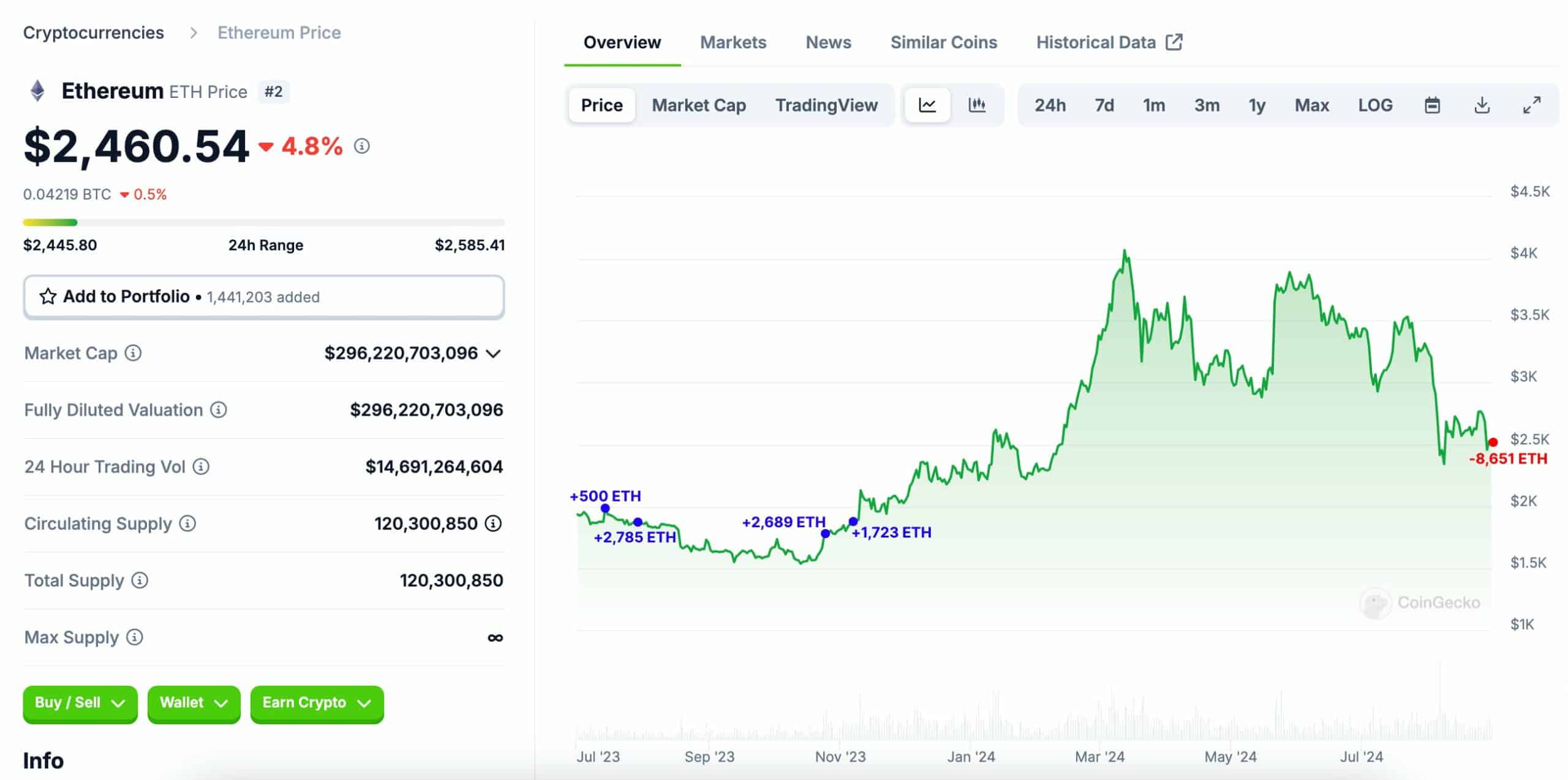

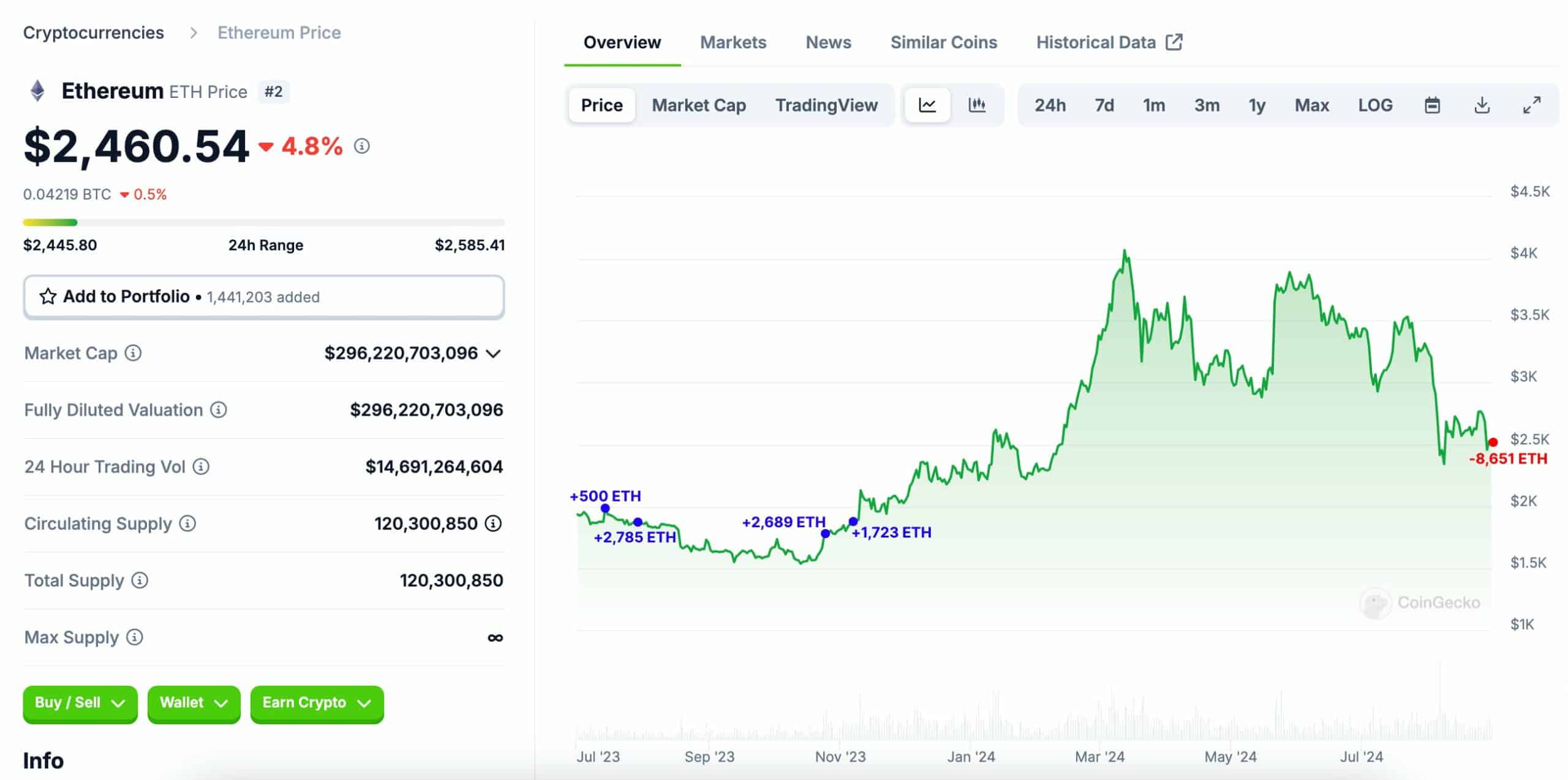

Rising whale activity

Whale activity has been on the rise too, with a notable whale recently depositing 8,651 ETH ($21.47 million) into Coinbase, making a profit of approximately $5 million.

This whale had previously withdrawn 7,697 ETH ($14.3 million) from Coinbase at $1,859 between 14 July and 6 November, 2023.

The whale’s profit on ETH exceeded $16 million at its peak. This spike in whale activity suggested that the price of ETH could see a significant surge in the near future. Especially as more large holders begin to move their assets.

Source: Coingecko x Lookonchain