- Ethereum on-chain activity reaches new highs.

- Ethereum sees an increase in involvement of traders on DEX.

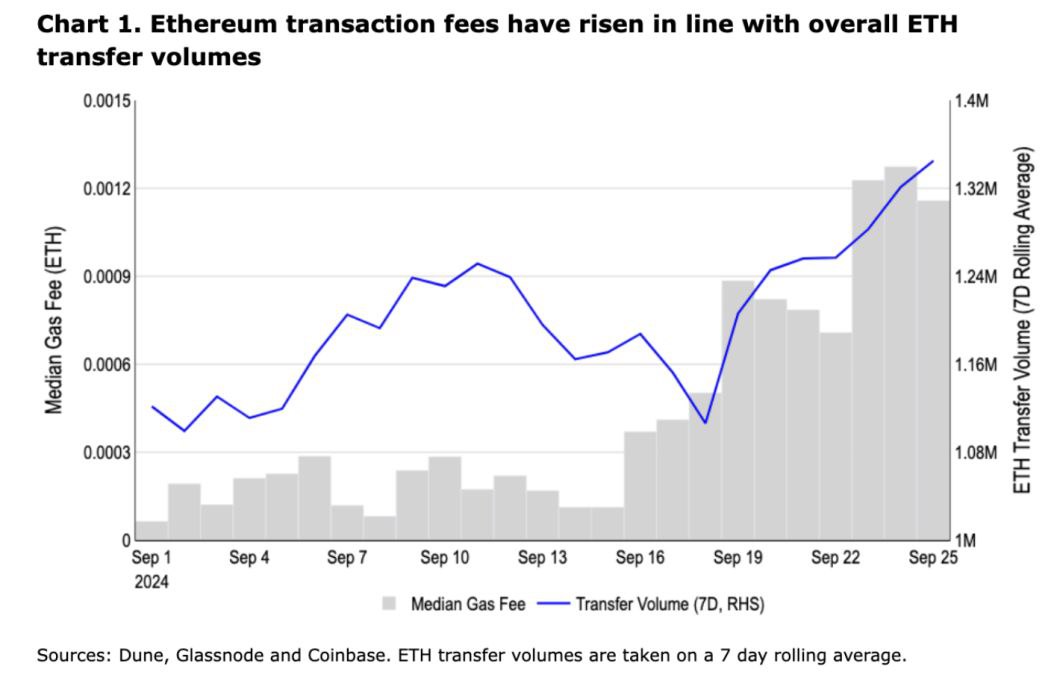

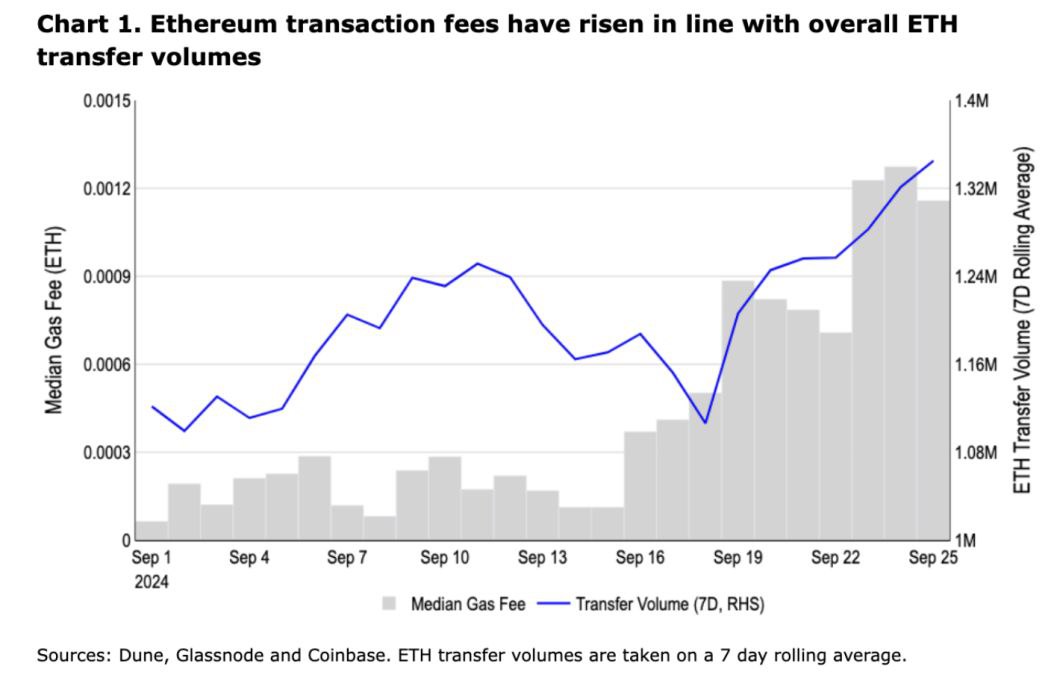

Ethereum [ETH], the leading blockchain for smart contracts, is seeing an increase in on-chain activity. This rise is driving higher transaction fees, especially as more traders leverage decentralized finance (DeFi) platforms that rely on Ethereum’s network.

ETH has been on an upward trajectory, mirroring the broader crypto market in anticipation of a bullish final quarter.

With Ethereum gaining traction and seeing large transaction volumes, the skyrocketing fees raise concerns, particularly with the increasing involvement of traders.

Source: Dune, Glassnode, Coinbase

While analysts have not attributed this surge to one cause, the rise in decentralized exchange (DEX) volumes and the increased usage of the ETH network have contributed significantly to the higher transaction fees.

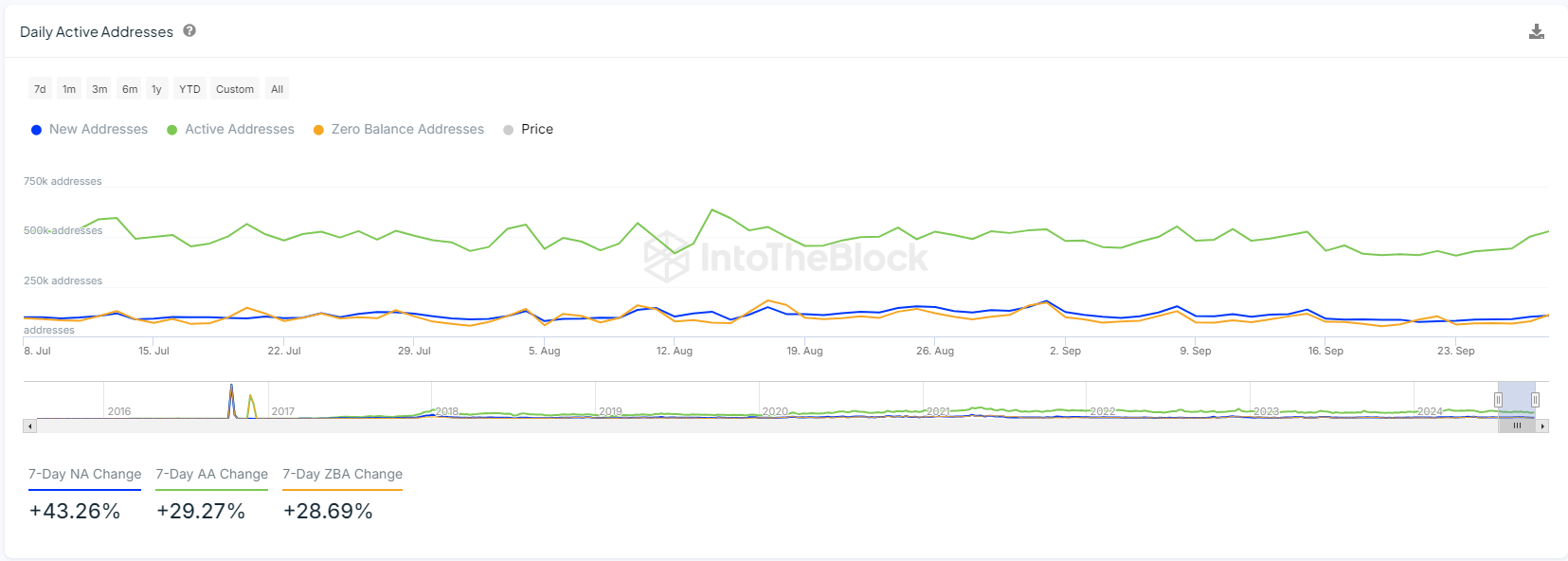

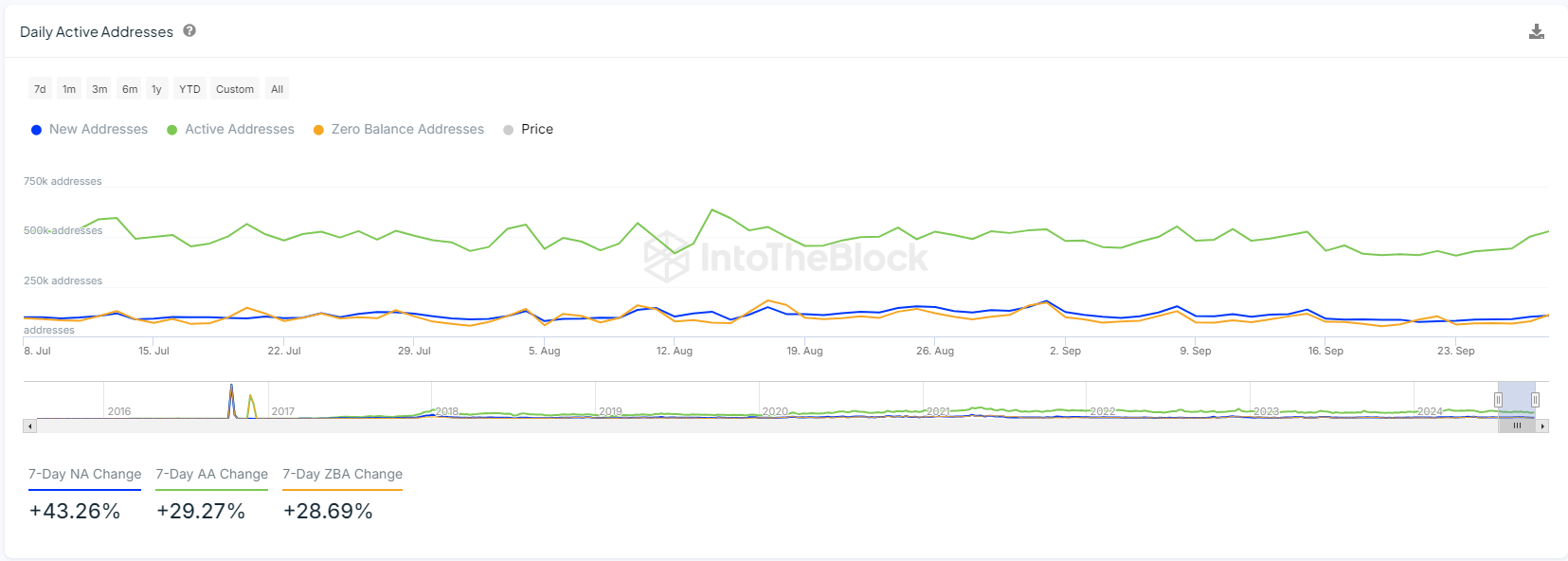

Active addresses rising

One key on-chain metric contributing to the rising fees is the analysis of Ethereum addresses. Daily active addresses are increasing rapidly, showing a 29% growth, while new addresses have risen by 43%.

Even zero-balance addresses have grown by 28%, but active addresses remain at the highest levels. This suggests heightened activity on the network, with more transactions being carried out simultaneously.

The more active the network, the more difficult it becomes to verify transactions, which, in turn, drives up transaction fees.

Source: IntoTheBlock

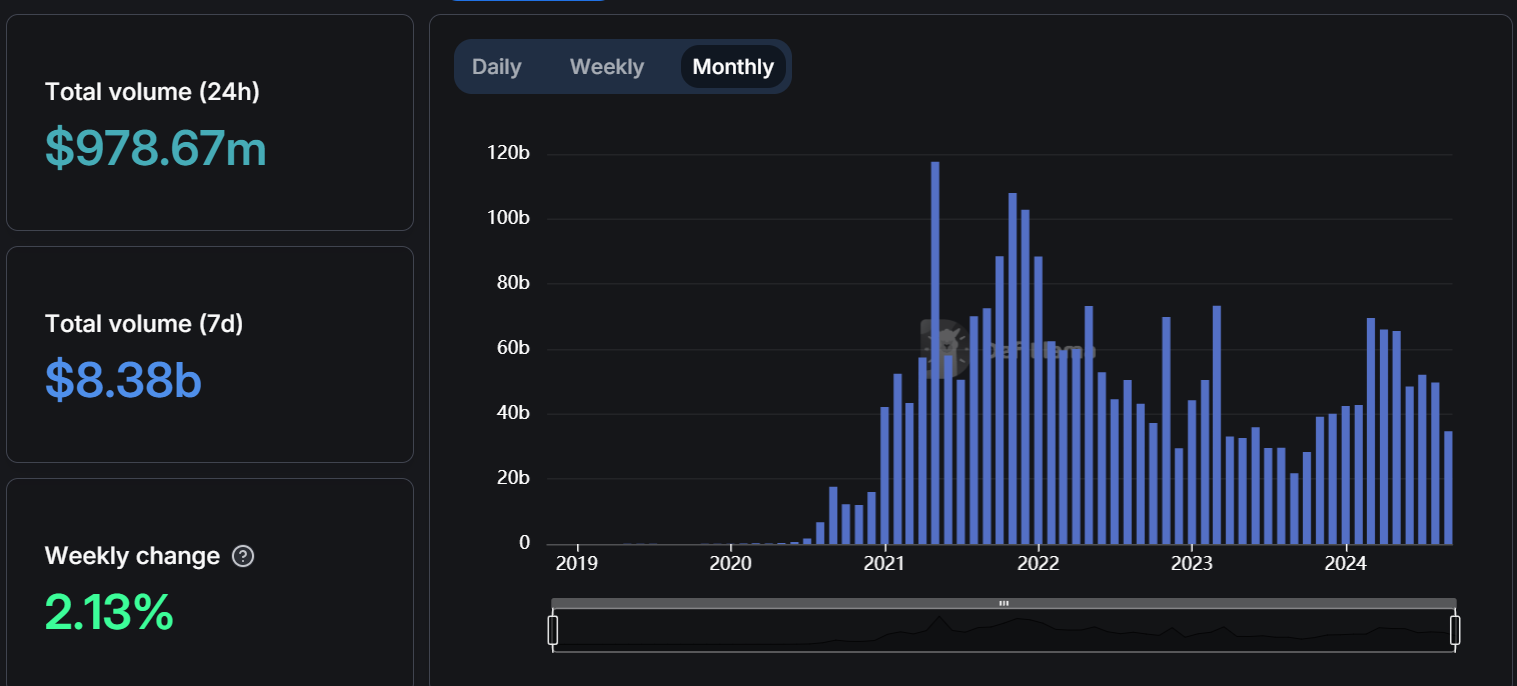

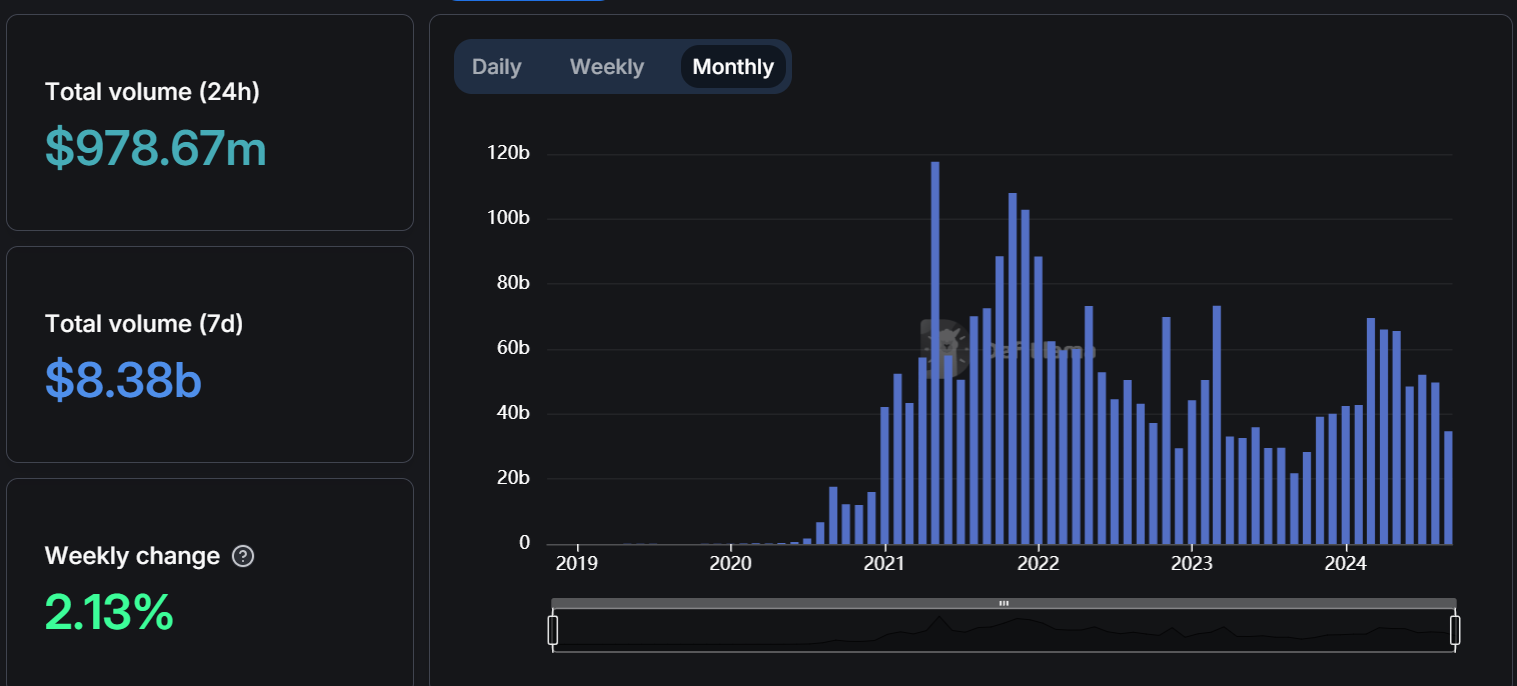

The surge in DEX volumes

Another contributing factor to the rise in Ethereum transaction fees is the surge in DEX volumes. The total volume of ETH traded on DEXs in the last 24 hours stood at $978 million, with the weekly volume hitting $8.38 billion, marking a 2.13% increase.

The monthly volume bars also indicate steady growth in ETH trading across DEXs. As decentralized exchanges play a significant role in Ethereum’s network activity, their growth leads to more congestion, which increases transaction costs.

Source: DefiLlama

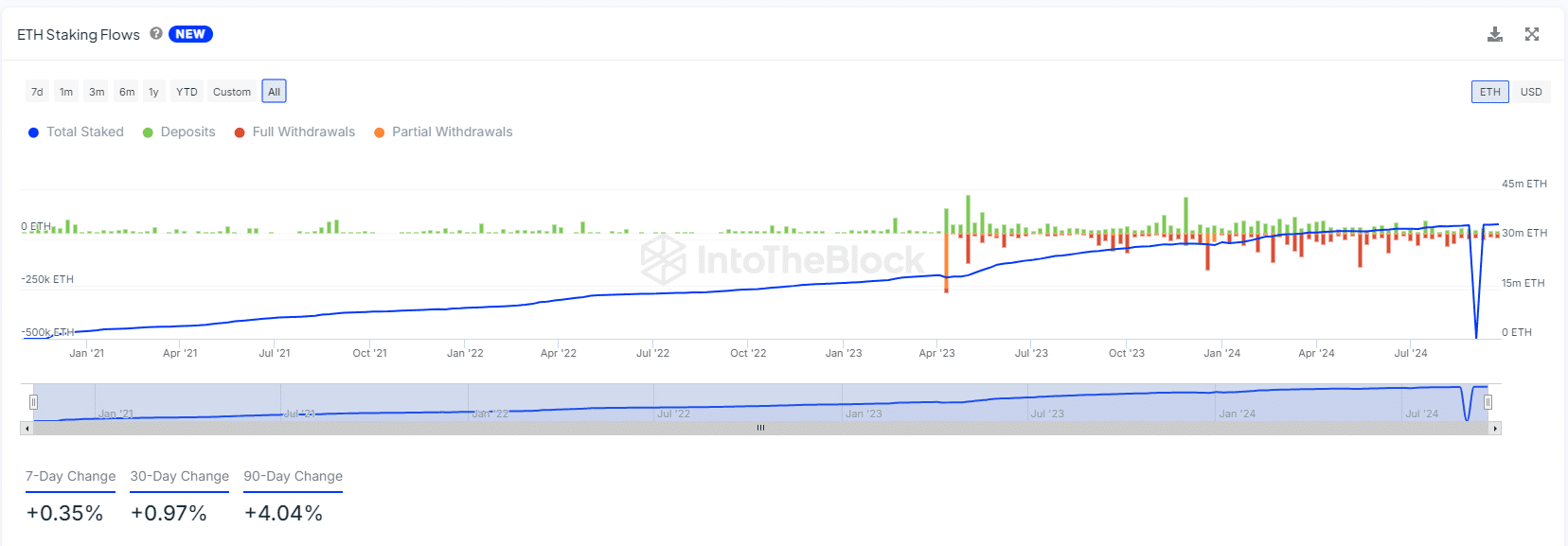

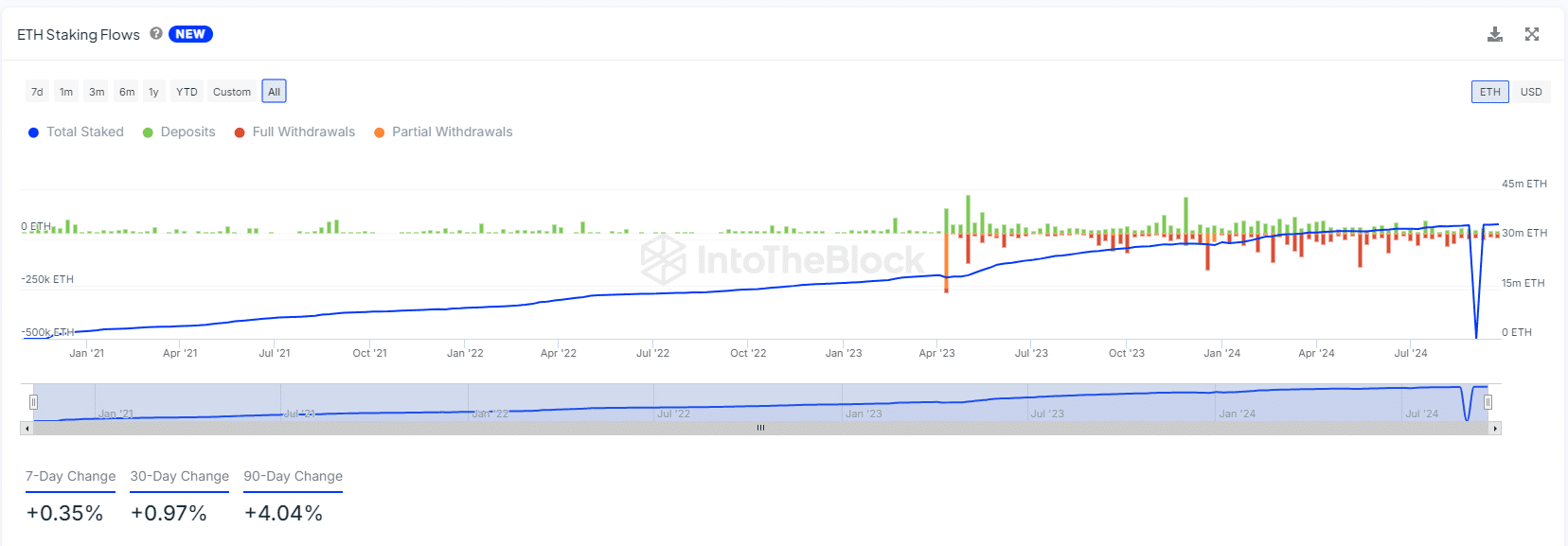

ETH staking flows

Additionally, the recent changes in ETH staking flows are also contributing to the increased fees. During the bear market, outflows dominated the staking landscape, reflecting the falling prices of ETH.

However, there has been a shift, with outflows now balancing inflows, signaling renewed interest in staking. This increase in staking activity leads to more transactions on the Ethereum network, adding further strain and pushing transaction fees higher.

The total staked ETH has now returned to its all-time high after a sharp decline during the previous market crash. As more people engage in staking, it adds to the congestion on the network, further driving up costs.

Read Ethereum’s [ETH] Price Prediction 2024-25

Source: IntoTheBlock

Ethereum’s current price trajectory, along with rising transaction fees, reflects the increased activity on its network. Key on-chain metrics, such as active addresses, DEX volumes, and ETH staking, all play a role in the recent price movements and fee hikes.

With the broader crypto market anticipated to boom in the final quarter, Ethereum could continue to see higher prices, even as users grapple with increasing fees.