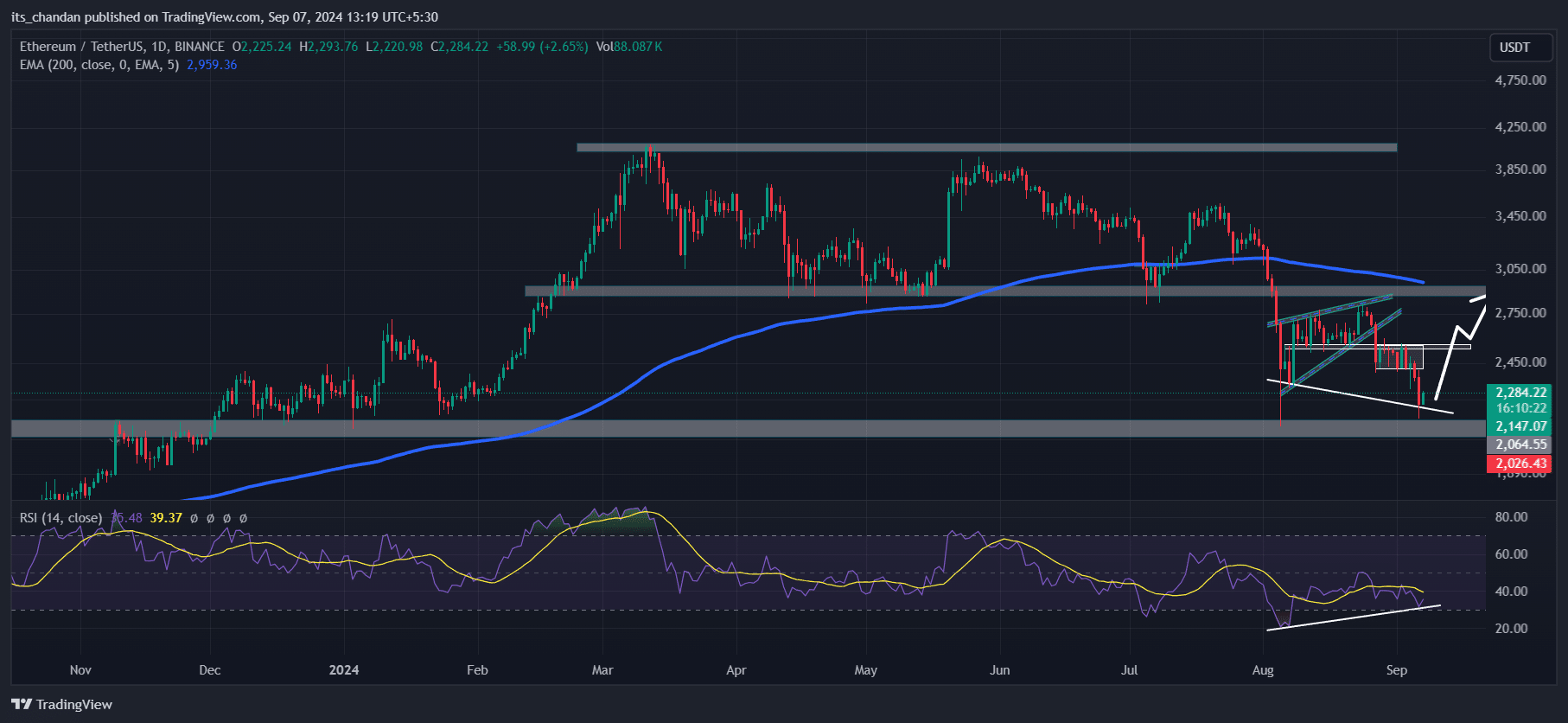

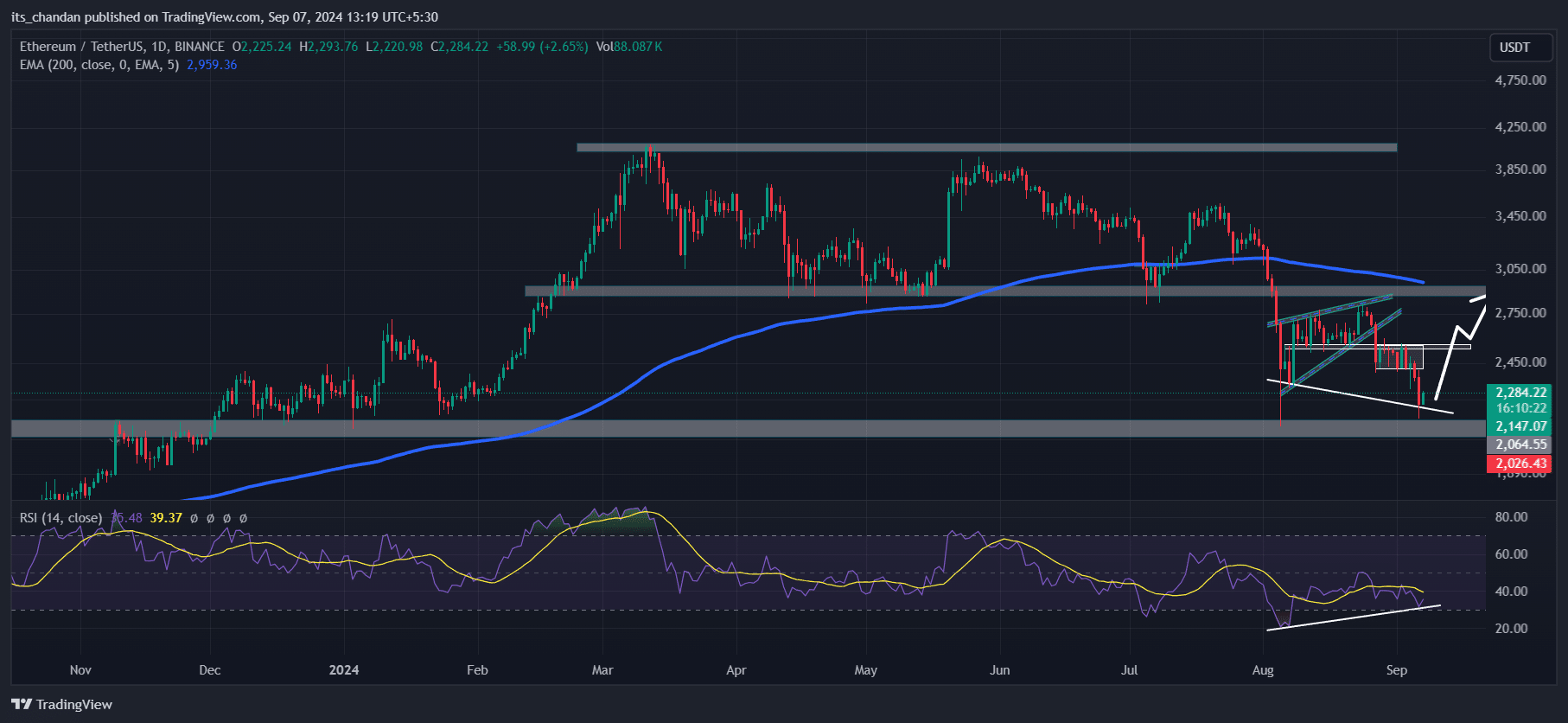

- ETH’s RSI formed a bullish divergence on the daily timeframe

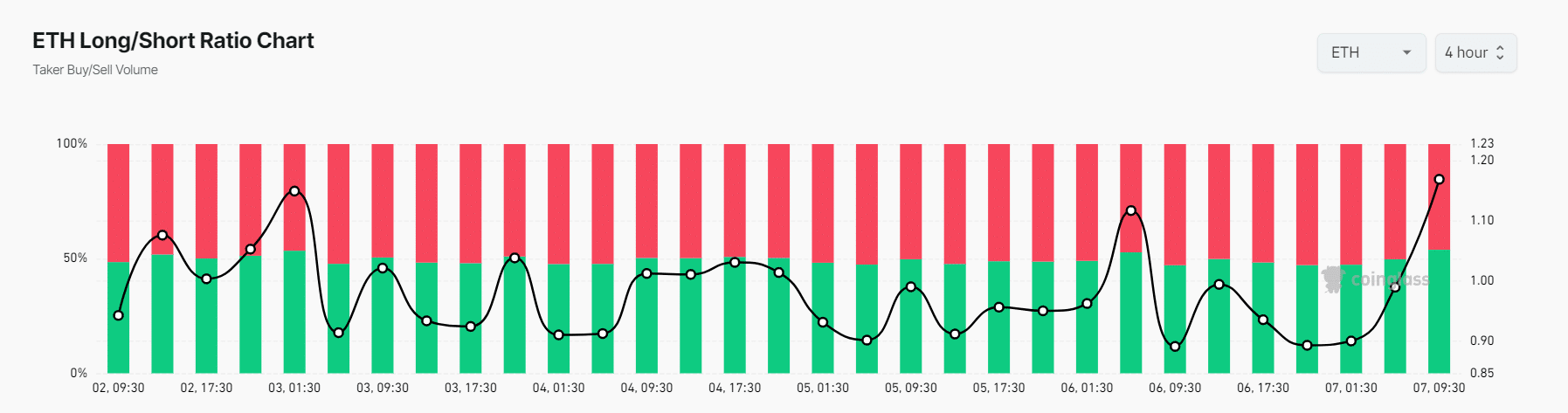

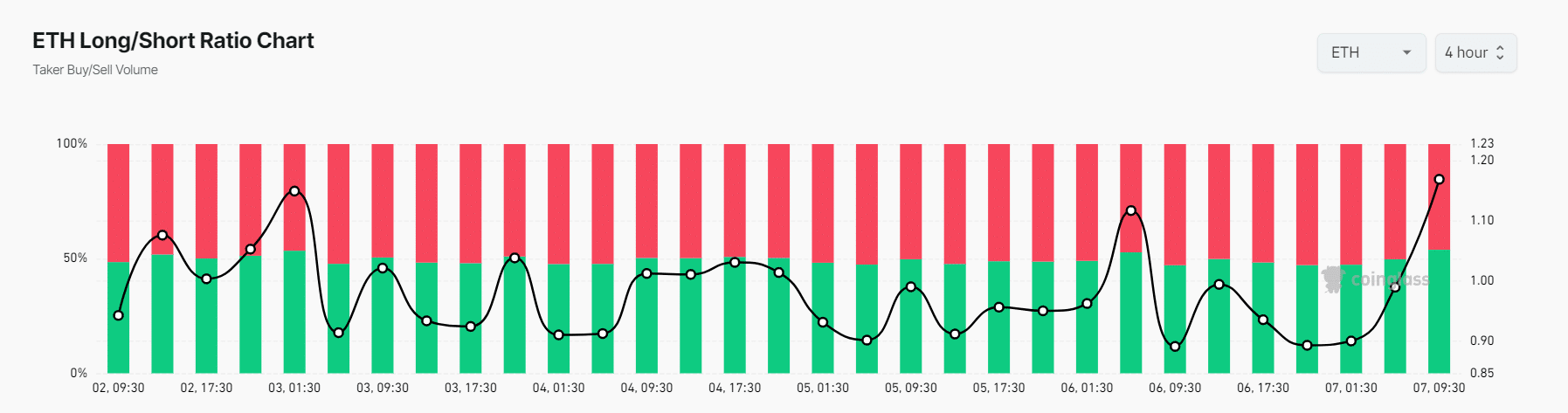

- 53.88% of top traders now hold long positions, while 46.12% hold short positions

In light of the bearish market, Ethereum (ETH), the world’s second-largest cryptocurrency, is being continuously dumped by institutions and whales. This has resulted in notable price drops on the charts.

In fact, according to a post on X (Previously Twitter), institutions dumped a significant 55,035 ETH worth $123 million to Binance, during the Asian trading hours.

Institutions offload millions worth of ETH

The on-chain analytics platform revealed that the institutions involved were Wintermute, a leading algorithmic trading firm, and Metalpha a digital asset manager.

Together, they dumped 46,947 ETH worth $104.74 million and 8,088.8 ETH worth $18.05 million, respectively, in just two hours. This significant dump has the potential to impact the altcoin’s price.

Potential reason behind the recent dump

The potential reasons behind this dump are the ongoing bearish market sentiment, the sustained rise in exchange ETH reserves, and the decline in Futures Open Interest for three consecutive months.

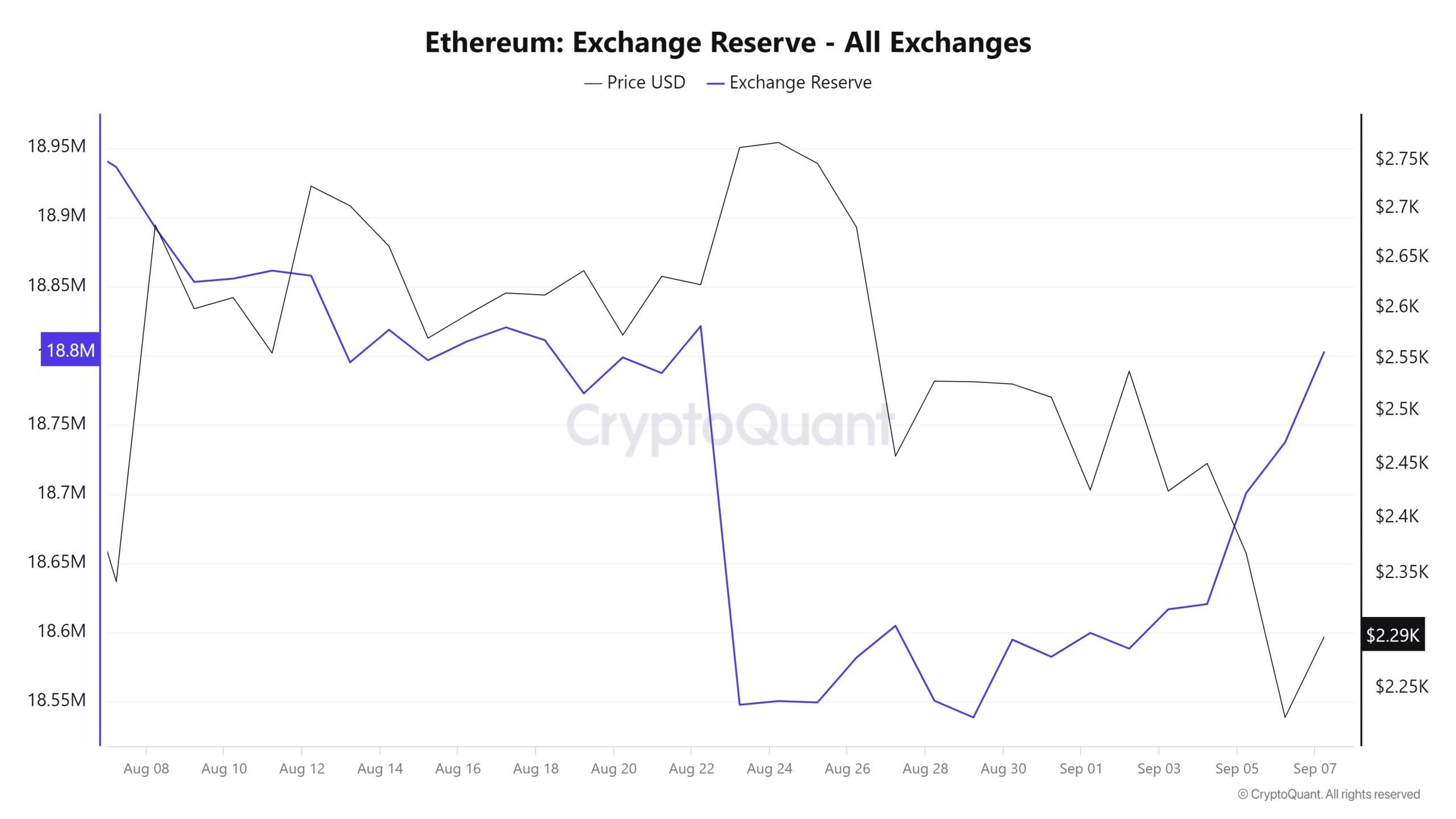

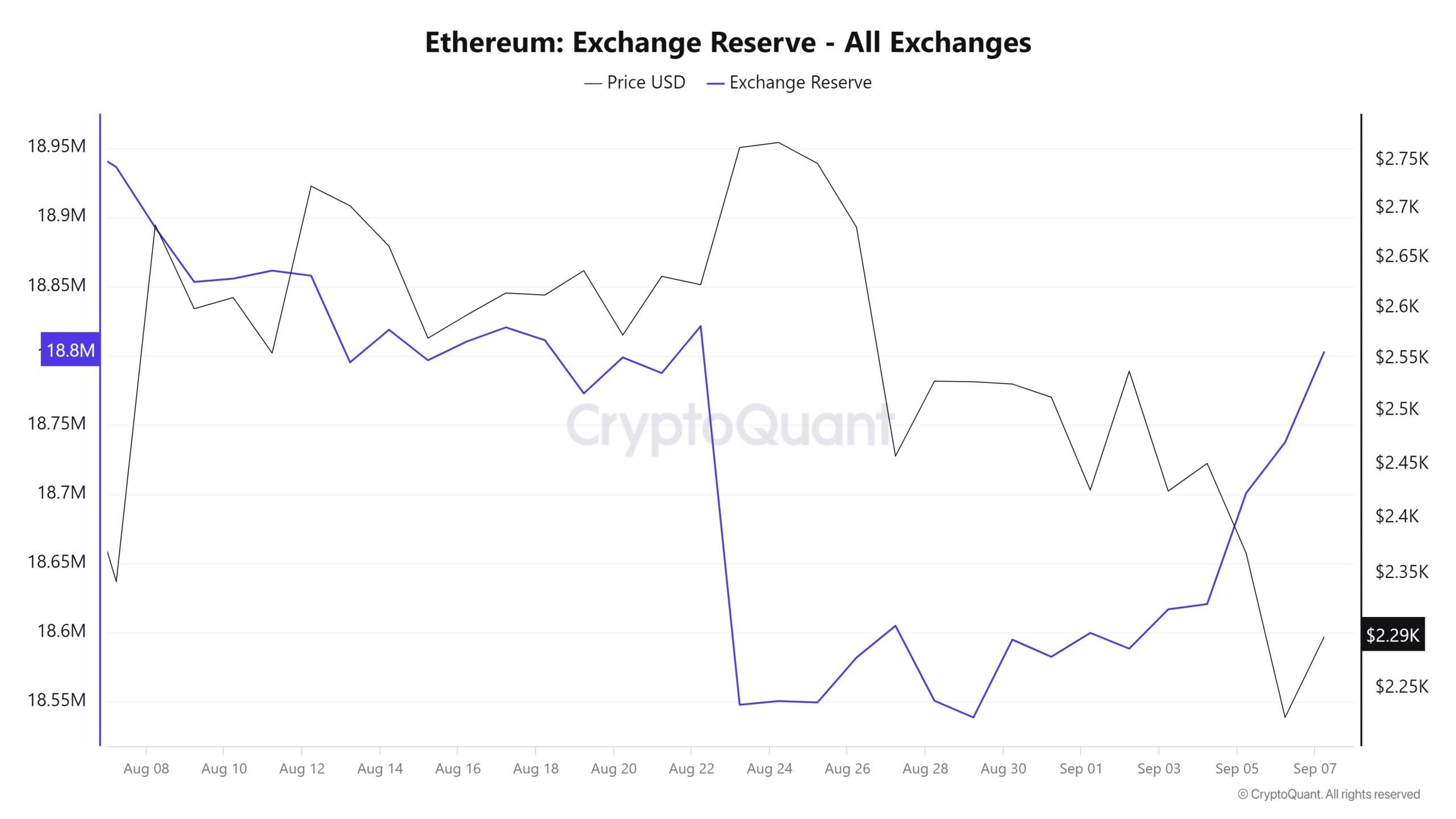

According to CryptoQuant, Ethereum exchange reserves have been continuously rising since 28 August. This means that either whales, investors, or institutions may be moving their assets to exchanges for a potential sell-off.

Source: CryptoQuant

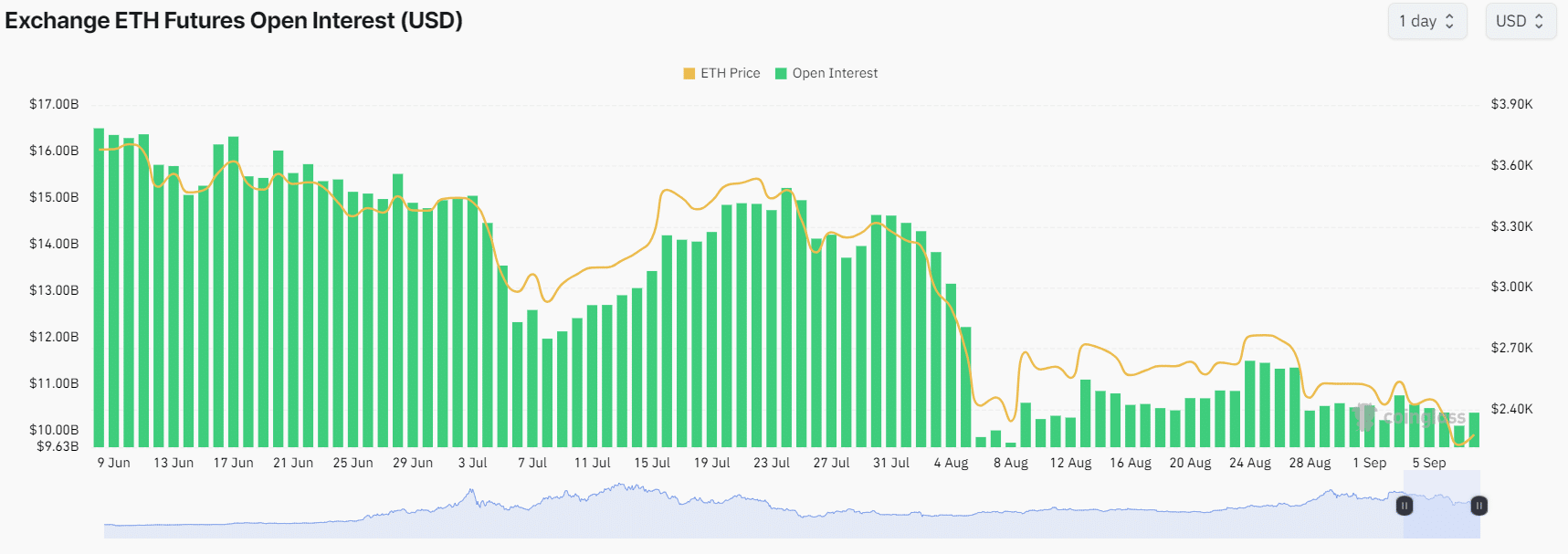

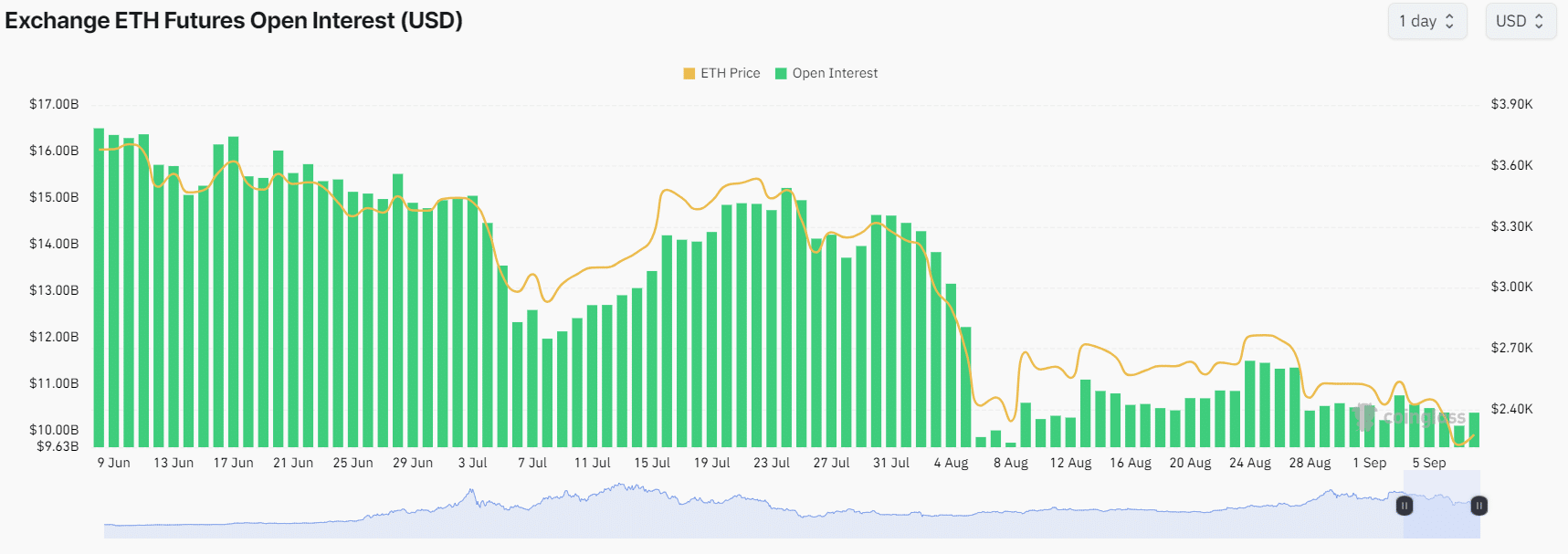

CoinGlass’s exchange Futures Open Interest has been continuously falling too. This underlined either the liquidation of long positions or the expiry of Futures contracts, with no new positions being built.

Source: Coinglass

Here, it’s worth pointing out that September is often considered a bearish month or a period of price correction for cryptocurrencies, before potentially skyrocketing in October.

Ethereum technical analysis and key levels

According to a look at the price charts, Ethereum has retested its crucial support level of $2,140. Since late 2023, this level has acted as strong support for ETH.

However, ETH’s Relative Strength Index (RSI) formed a bullish divergence on the daily time frame, pointing to a trend reversal.

Source: Tradingview

Owing to the recent retest of support and the formation of a bullish divergence, there is now a high possibility that ETH’s price could soar by 25% or 30% to $2,500 or $2,550.

Bullish outlook by on-chain metrics

On the shorter timeframe, ETH had some bullish indicators too.

CoinGlass’s ETH Long/Short ratio, for instance, signaled bullish sentiment. According to the same, this ratio on a four-hour time frame stood at 1.168 at press time (A value above 1 indicates bullish sentiment).

Source: Coinglass

The data also revealed that while 53.88% of top traders held long positions, 46.12% held short positions.

Also, over the same period, total ETH Futures Open Interest increased by 1.80%. This highlighted the participation of traders as ETH revisited its strong support level.

Ethereum’s price performance

At press time, ETH was trading near the $2,280-level, following a decline of 2% in the last 24 hours.

Meanwhile, its trading volume over the same period skyrocketed by almost 100%, indicating higher participation from traders and investors.