- ETH has struggled to initiate an uptrend on the charts

- Most market indicators and metrics looked bearish

At press time, Ethereum’s [ETH] daily and weekly price charts remained green. However, the trend might be short-lived. In fact, as per a recent analysis, there may be chances of ETH dropping to $2.7k before it even begins a bull rally. Hence, AMBCrypto checked ETH’s current state to better understand what to expect in the short-term.

Bears v. Bulls for Ethereum

Ethereum was somewhat bullish on the charts in the last 24 hours, with its price hiking by just over 1%. According to CoinMarketCap, at the time of writing, ETH was trading at $3,035.04 with a market capitalization of over $364 billion.

However, bears might soon step up, with a recent analysis suggesting that ETH might drop to $2.7k. Crypto Tony, a popular crypto-analyst, recently shared this projection, highlighting ETH’s possible future trajectory. As per the tweet, ETH’s price will first reach its support level of $2.7k, before beginning a rally, which might allow it to touch $5.4k.

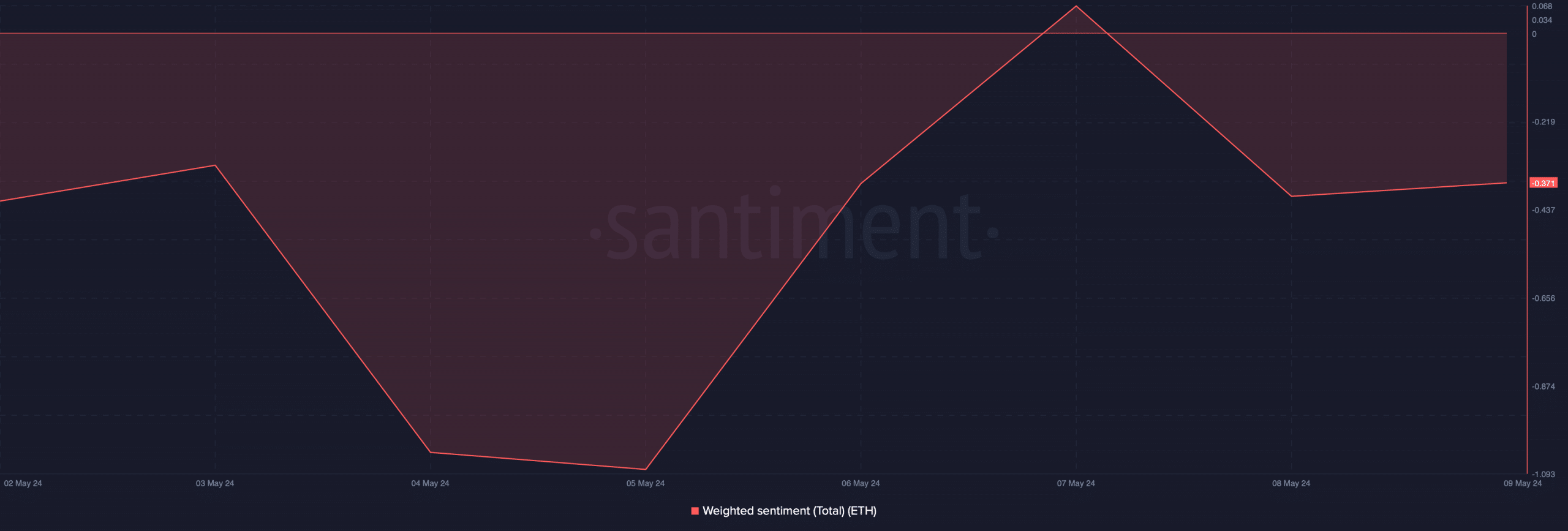

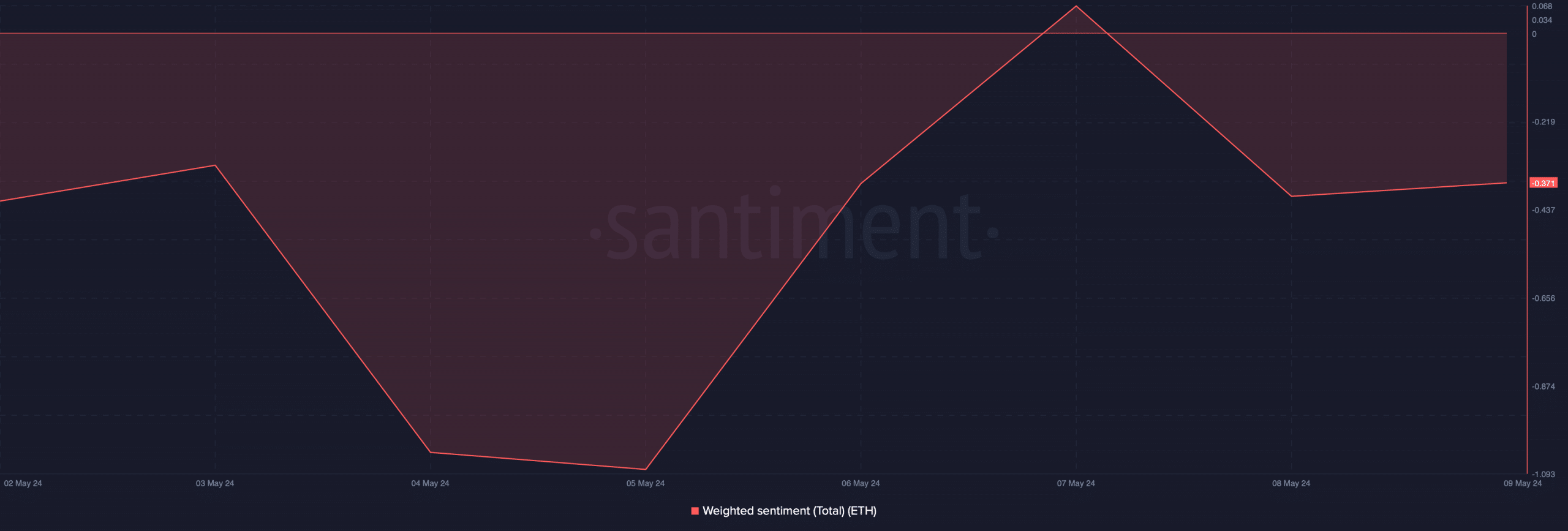

The possibility of ETH dropping to $2.7k seems likely since investors’ confidence in the token has fallen dramatically. AMBCrypto’s analysis of Santiment’s data also revealed that ETH’s weighted sentiment was in the negative zone – A sign that bearish sentiment retained its dominance in the market.

Source: Santiment

Apart from that, quite a few other metrics also looked somewhat bearish too.

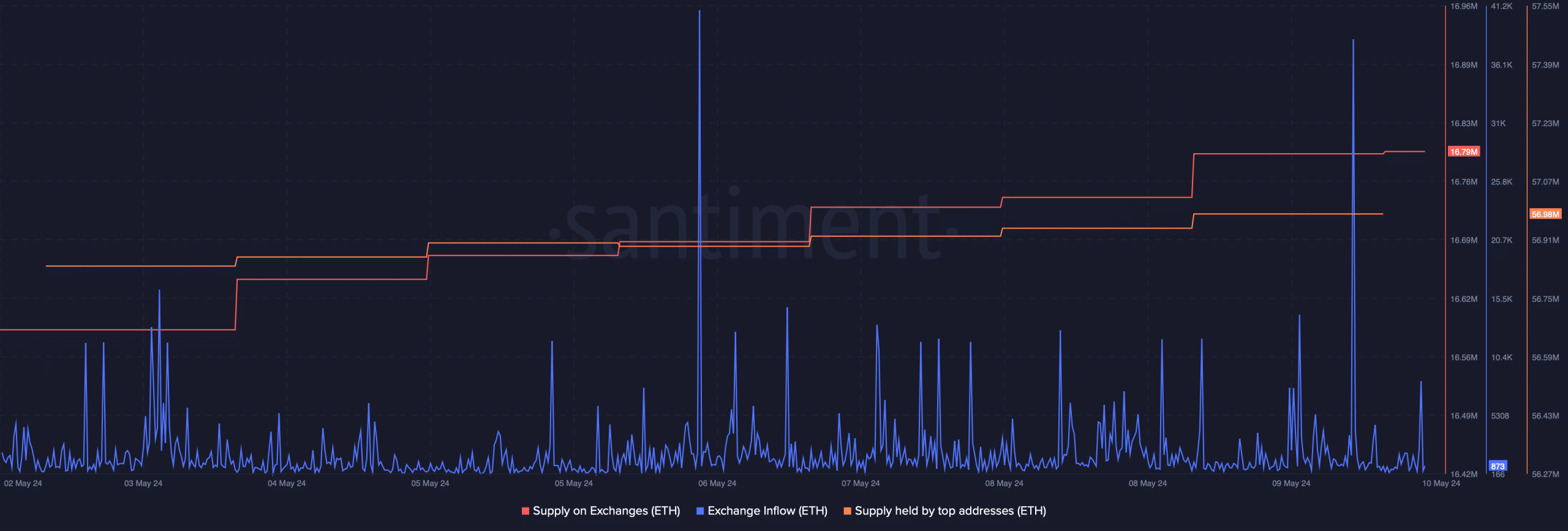

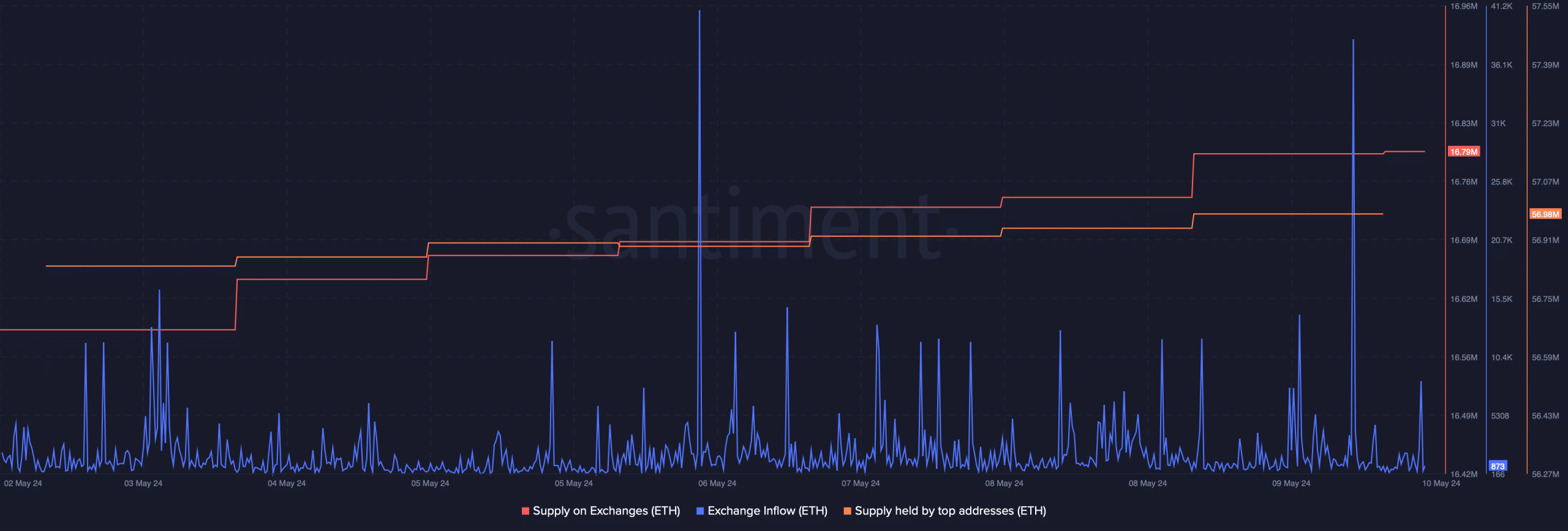

For example, ETH’s exchange inflow spiked, reflecting a hike in selling pressure. The fact that investors have been selling ETH was further proven by its supply on exchanges, which increased over the past week.

Notably, while investors sold their holdings, whales went the other route as they kept accumulating – As evidenced by the slight rise in the supply held by top addresses.

Source: Santiment

Future targets

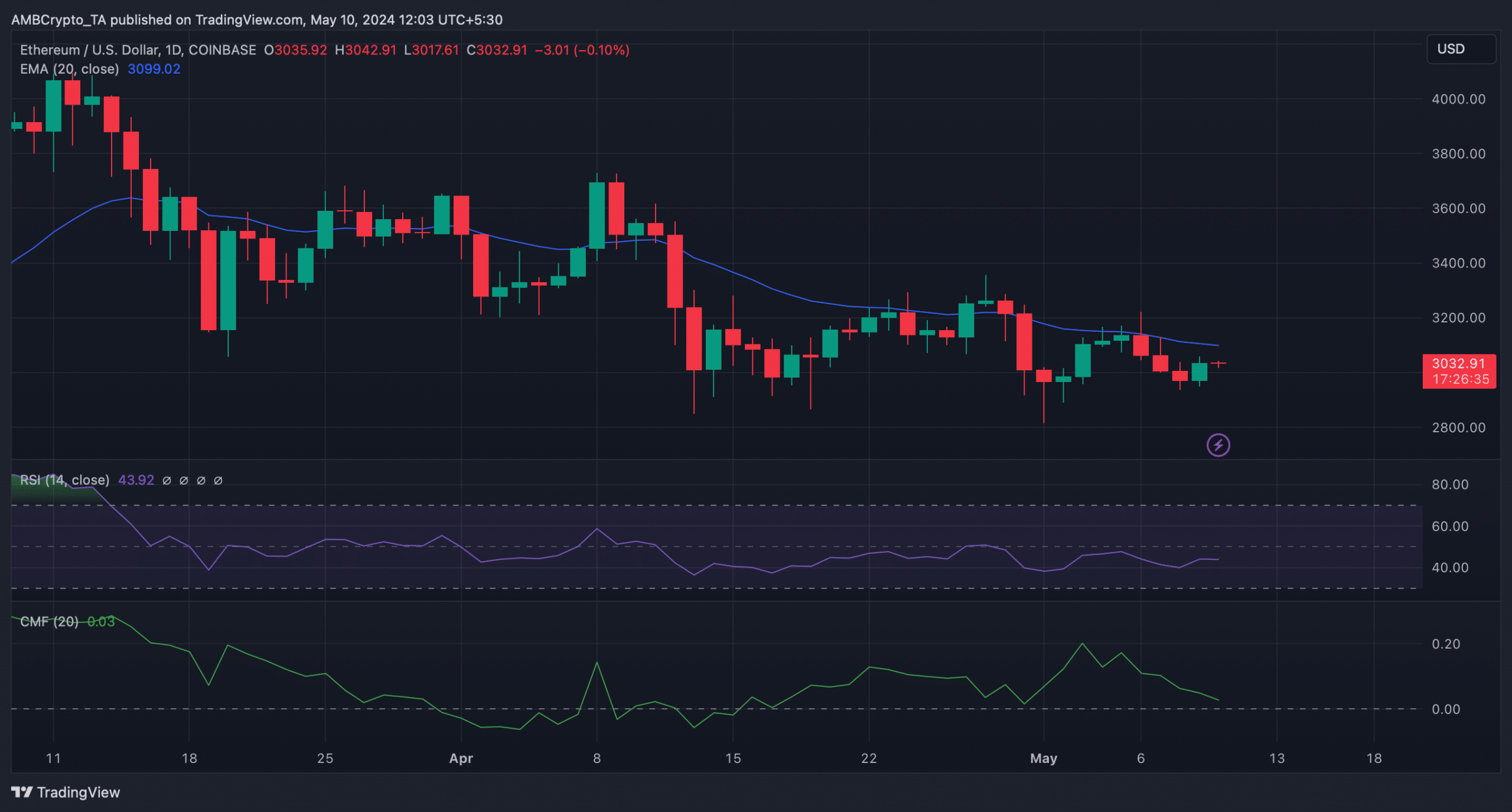

AMBCrypto reported previously that the crypto-market was bearish on Ethereum. To see whether that was still the case, we then analyzed ETH’s daily chart. As per our analysis, market indicators continued to remain bearish.

The token’s price was resting lower than its 20-day Exponential Moving Average (EMA). The Relative Strength Index (RSI) was under the neutral level. Additionally, ETH’s Chaikin Money Flow (CMF) also went south, suggesting that the chances of ETH dropping to $2.7k were high.

Source: TradingView

Is your portfolio green? Check out the ETH Profit Calculator

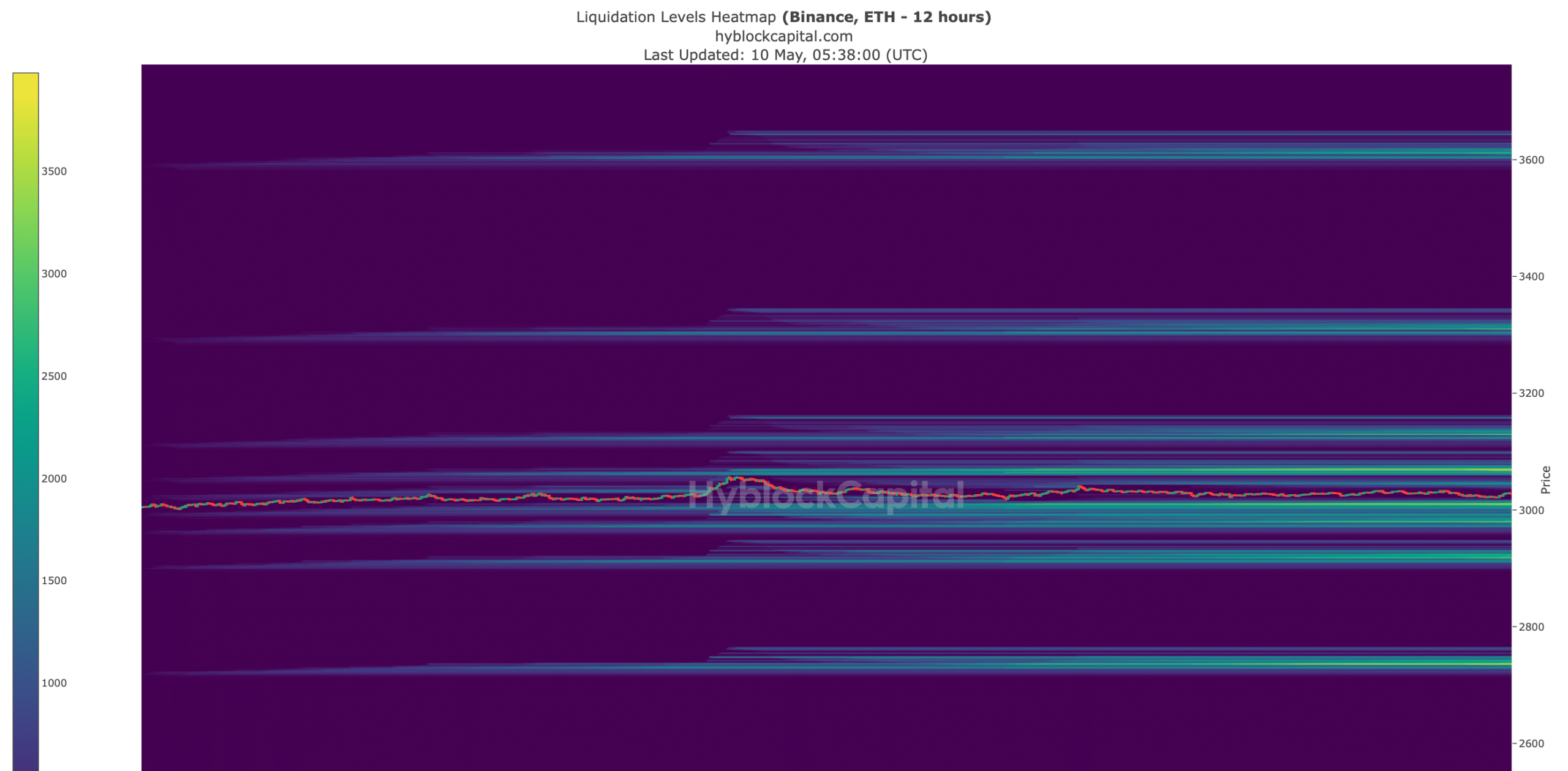

That being said, investors should not worry about ETH’s price trend being all bad since there is a possibility of a trend reversal before $2.7k.

If ETH manages to test its support near $3k, then the scenario might turn bullish. A drop below that level would result in ETH touching yet another resistance near $2.92k, depending on whether it might rebound if things fall into place.

Source: Hyblock Capital