- SEC asks exchanges to update their 19b-4 filings amidst Ethereum ETF approval concerns.

- SEC’s Ethereum classification questions complicate ETF approval prospects.

As anticipation builds for the approval of the Ethereum [ETH] Exchange Traded Fund (ETF), regulators have initiated new hurdles in the path forward.

The United States Securities and Exchange Commission (SEC) has issued a directive for various exchanges to swiftly update their 19b-4 filings.

SEC Form 19b-4 filings are used by securities exchanges to propose changes to their rules.

These filings are submitted to the SEC for approval to ensure that any rule changes protect investors and maintain fair and efficient markets.

Nate Geraci, President of The ETF Store, highlighted,

Source: Nate Geraci/X

Positive sentiments persist

This isn’t the first time the SEC has scrutinized Ethereum. Recently, the SEC’s questioning of Ethereum’s classification as a security has sparked significant speculation about the extent of the agency’s authority.

To which, Joe Lubin, CEO of Consensys, on a recent edition of “Bankless” had claimed,

“The U.S. is trying to disconnect from Ethereum.”

Joining a similar line of thoughts, Laura Brookover, Senior Counsel at Consensys, in a separate episode of “Unchained,” claimed,

“If Chair Gensler gets away with misclassifying Ether as a security it’s really catastrophic in the United States.”

Despite the odds, social media is buzzing with optimism about the potential approval of the ETH ETF. Anthony Pompliano, put it best when he said,

“If they approve the Ethereum ETF, they are approving the entire industry. This is the last dam to be broken.”

Lingering doubts

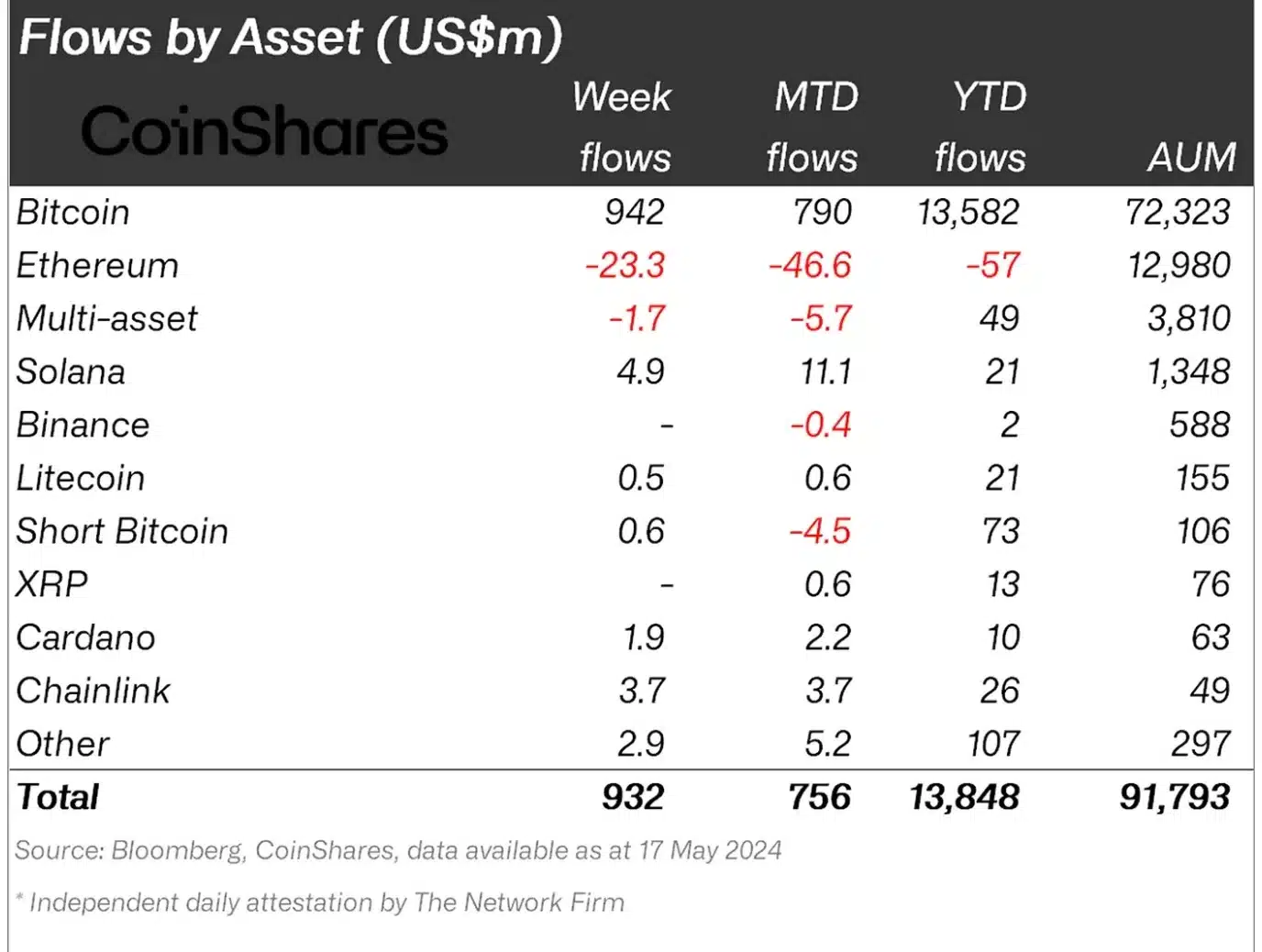

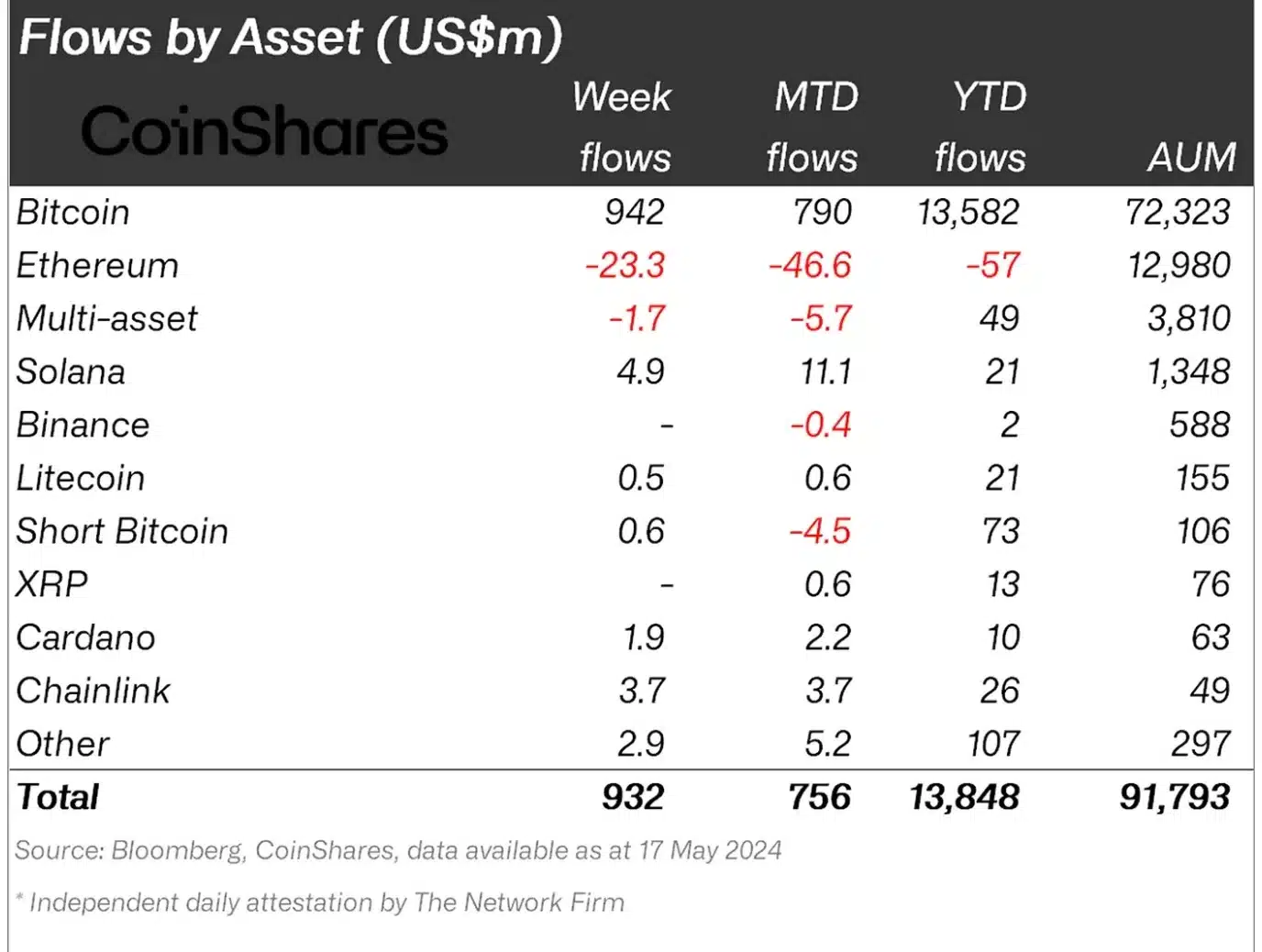

However, data from CoinShares painted a completely different picture.

According to AMBCrypto’s look at data by CoinShares, Ethereum was still experiencing bearish sentiment regarding the potential SEC approval of a spot-based ETF this week.

As a result, outflows for the week amounted to $23 million.

Source: CoinShares