- Solana has weakened against Ethereum on the price charts

- However, SOL maintained a bullish sentiment and market structure.

The ongoing speculation on Ethereum [ETH] ETF approval could threaten Solana [SOL] price prospects, at least in the short-term, per some market watchers.

SOL has since become a target of social media dunk as the market increasingly adapts to the possibility of an ETH ETF. One Solana builder and user, Nigel Eccles, commented,

‘As a Solana maxi who has been building on Solana since 2021, hearing the ETH ETF news has been incredibly tough. Like I thought ETH was finished and Solana was the future.’

Eccles added that an ETH ETF approval would sanction ETH as the legitimate smart contract chain. As a result, he would rather pivot to it than stick to Solana,

‘But it’s not too late to pivot to the government-sanctioned chain. So, as of now, I’m dumping my Solana bags and going all in ETH’

Is ETH eclipsing SOL?

Following the ETF development, on Monday and Tuesday, SOL underperformed ETH on the price chart. On the weekly chart, performance stood at 29% and 25% for ETH and SOL, respectively, per CoinMarketCap data.

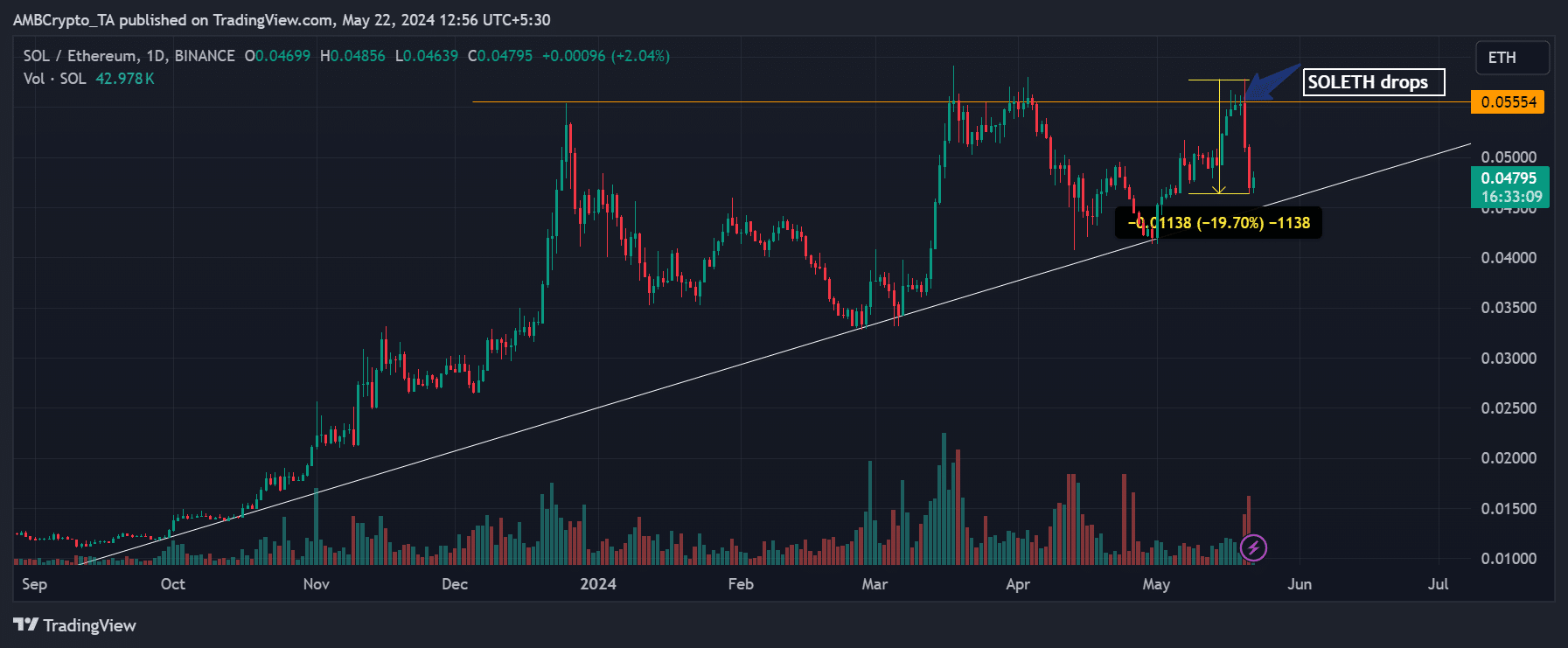

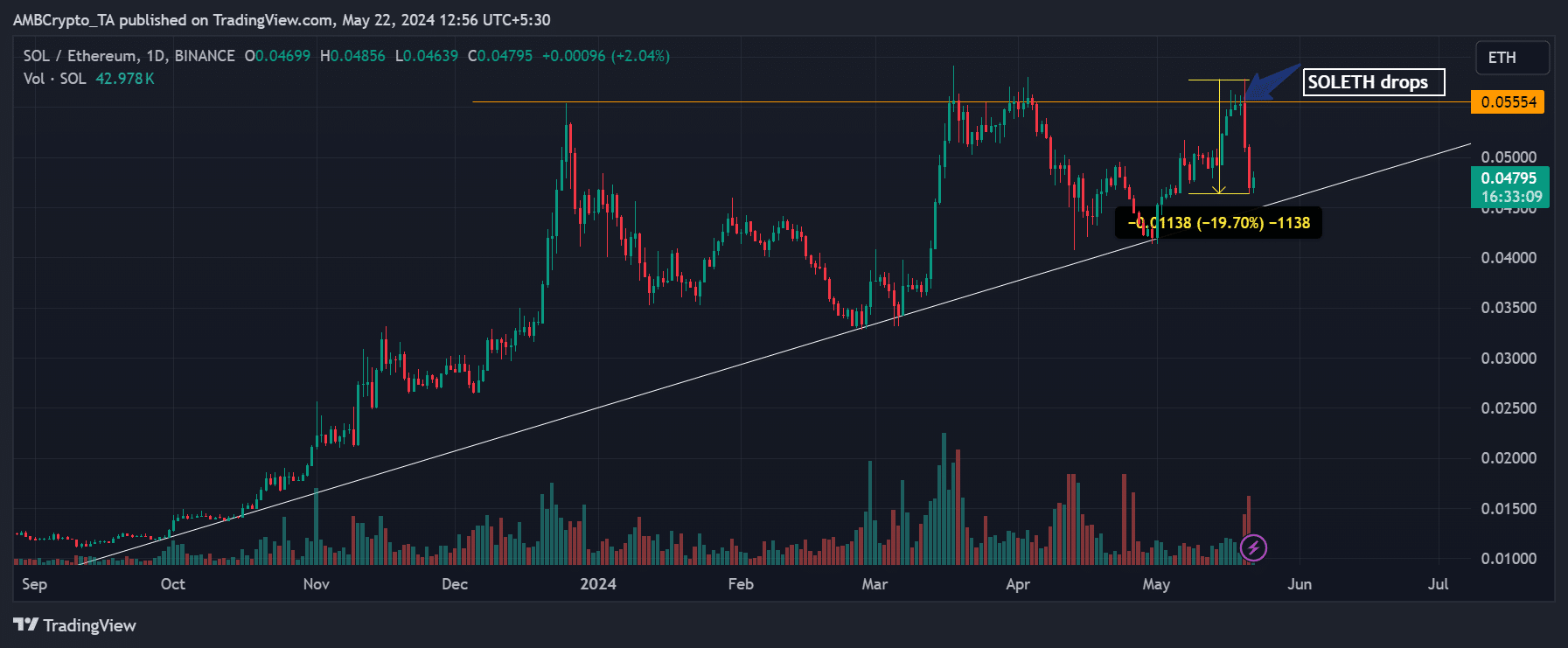

On a granular level, the SOL/ETH ratio showed that SOL weakened against ETH at the start of the week.

Source: SOL/ETH ratio, TradingView

For the uninitiated the SOL/ETH ratio tracks SOL’s performance against ETH. A rising value indicates that SOL outperforms ETH, while a drop in the ratio shows a weakening SOL against ETH.

That said, the SOL/ETH ratio dipped by 19%, from 0.05 to 0.046, before attempting a rebound at press time. It meant that SOL shed 19% of its value against ETH.

So, the two red daily candlesticks showed that SOL underperformed ETH on Monday and Tuesday. At the time of writing, ETH traded at $3.7K, up 2% in the past 24 hours, while SOL traded at $180, down below 0.5% over the same period.

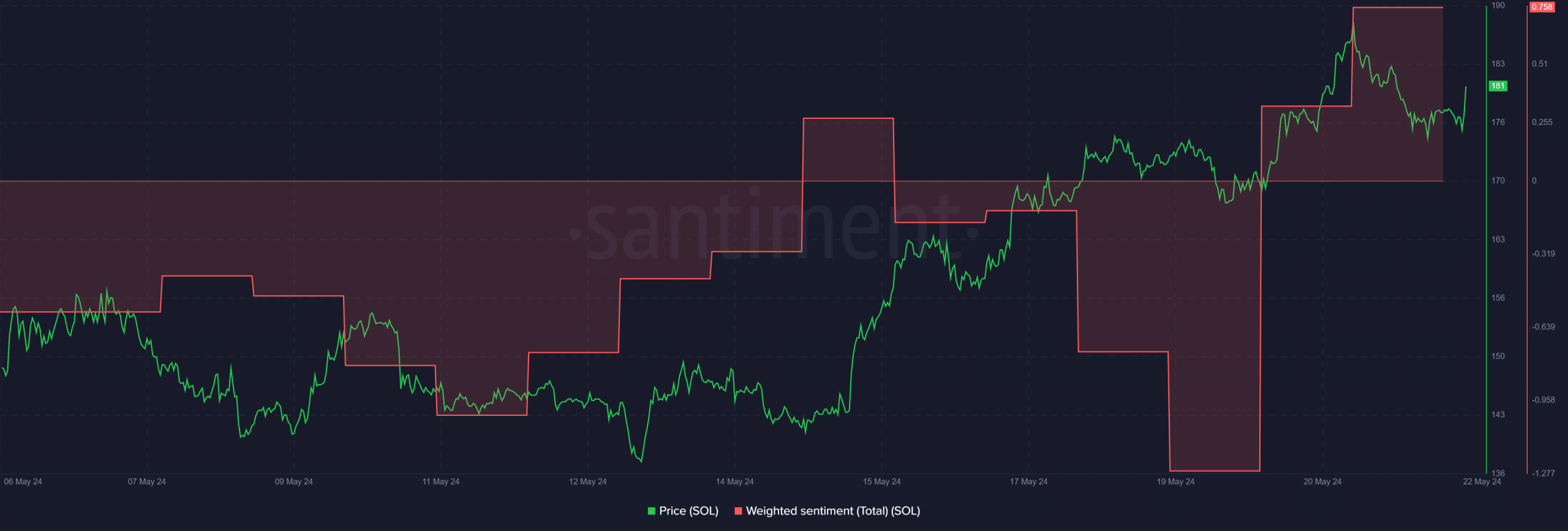

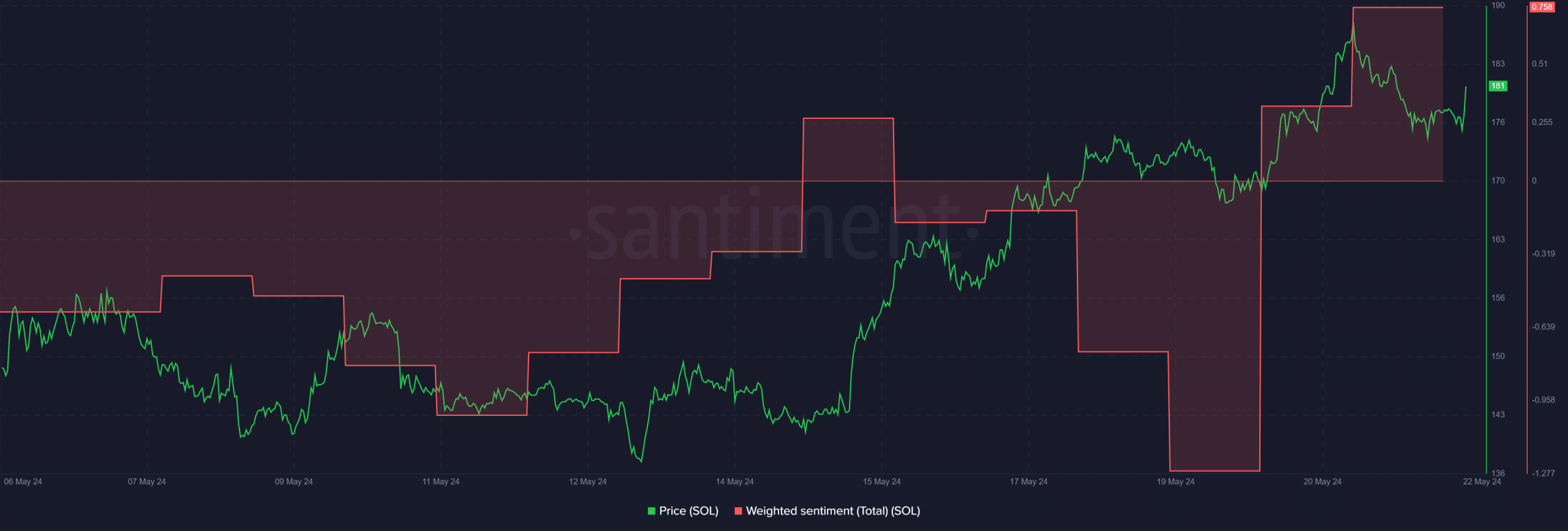

Despite the slightly dismal performance against ETH and Eccles’s pessimistic view on ETH ETF’s impact on SOL’s prospect, market participants were still bullish on the home of meme coin trading, as shown by the positive Weighted Sentiment.

Source: Santiment

Additionally, SOL maintained a bullish market structure on higher timeframe charts and could eye the $200 mark if the bulls defended the $180 as short-term support.

That said, market players were still bullish on SOL amidst ETH ETF speculation, unlike Eccles’s negative take on the situation.