- While BlackRock’s ETF inflow increased, GreyScale’s outflow went up.

- A recent analysis revealed that Ethereum price might drop to $2k.

Ethereum [ETH] ETFs have gained a lot of interest from one of the top institutional investors, BlackRock, over the past months. While that happened, the big pocketed players in the crypto space also showed interest in the king of altcoins as they stockpiled ETH.

Let’s have a closer look at what’s going on.

How are Ethereum ETFs doing?

BlackRock’s spot Ethereum (ETH-USD) ETF showed massive interest in ETFs as it registered nearly $900 million worth of inflows in just a matter of 11 days.

In fact, on the 6th of August alone the iChare Ethereum Trust saw an over $100 million inflow.

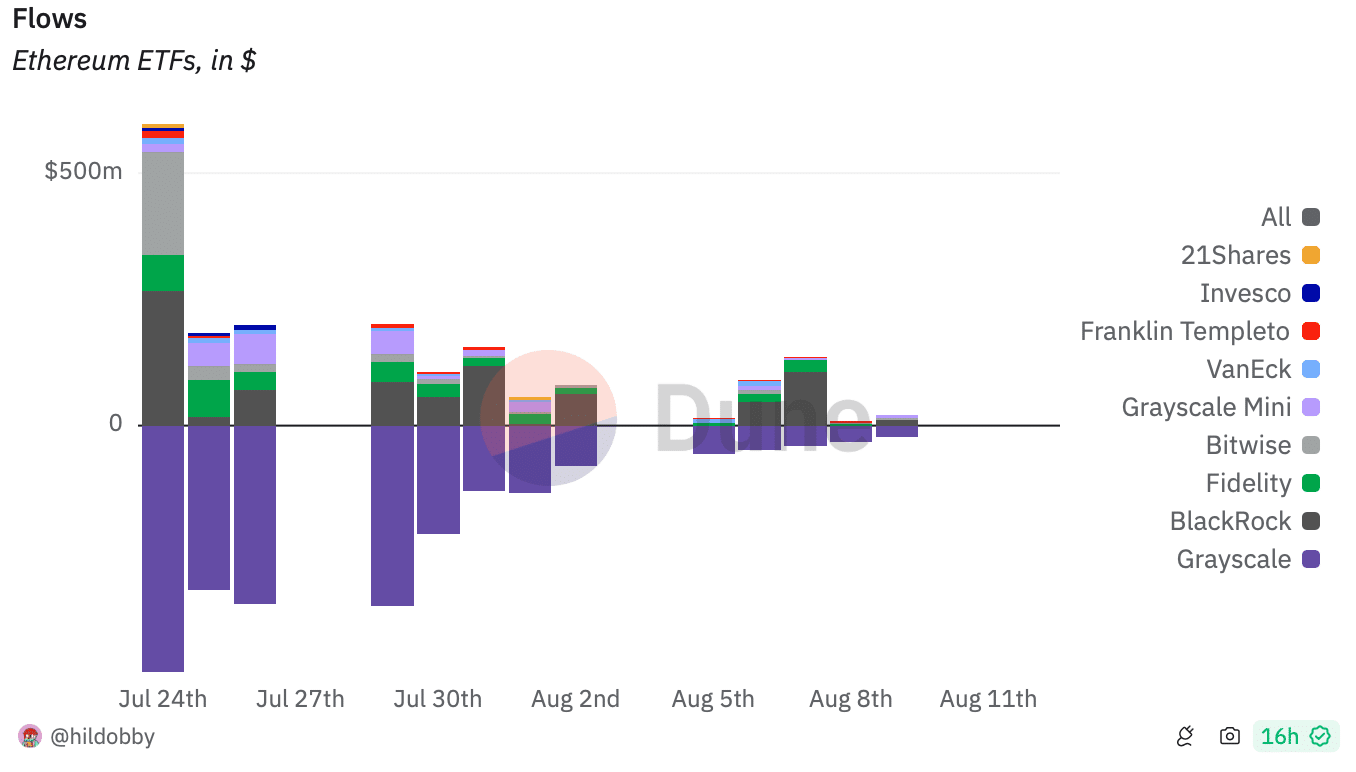

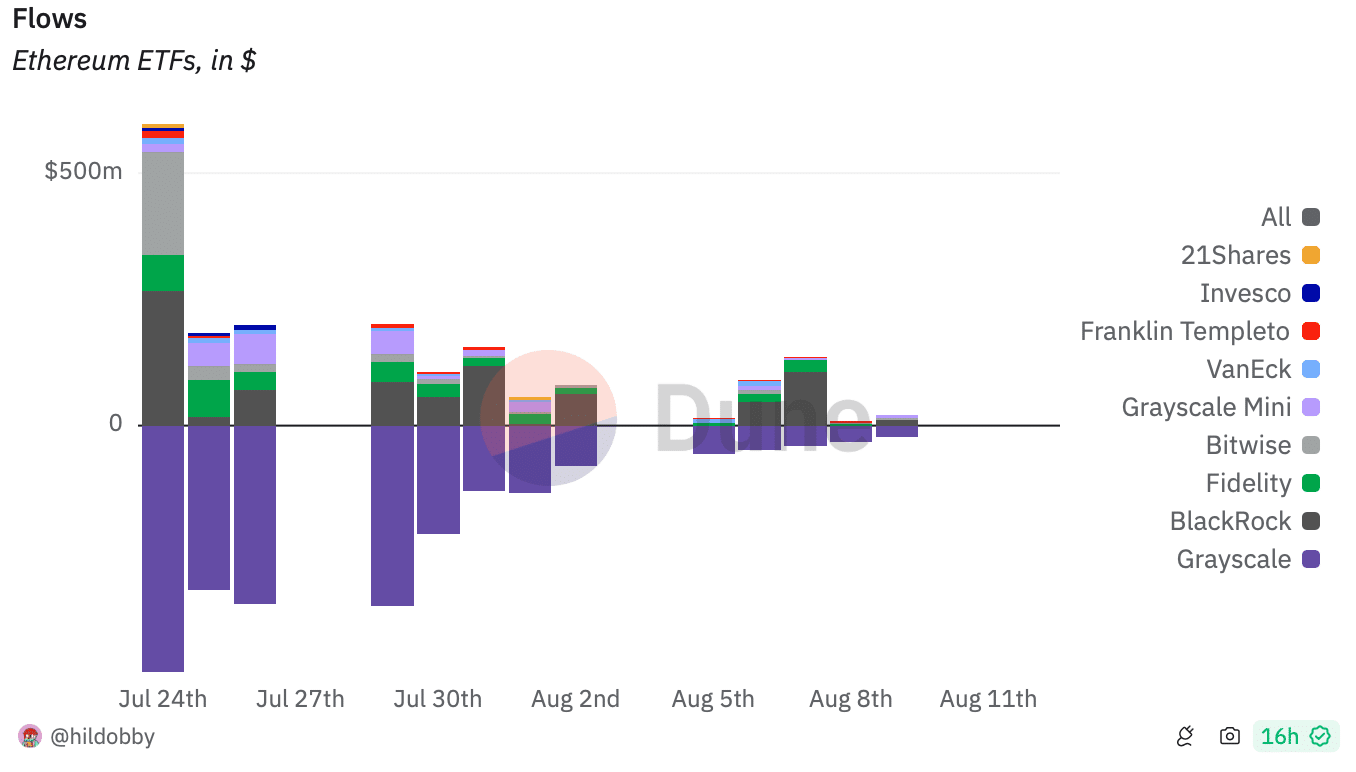

Interestingly, while BlackRock was accumulating, GrayScale, the largest ETH ETF, was selling. For example, BalckRock’s inflow exceeded $12 million on the 9th of August, and GrayScale’s outflow touched $20 million.

Source: Dune

Over the last week, the netflow of ETH ETFs was +31,5k. On the other hand, the overall netflow since launch stands at -124.2k, as per Dune’s data.

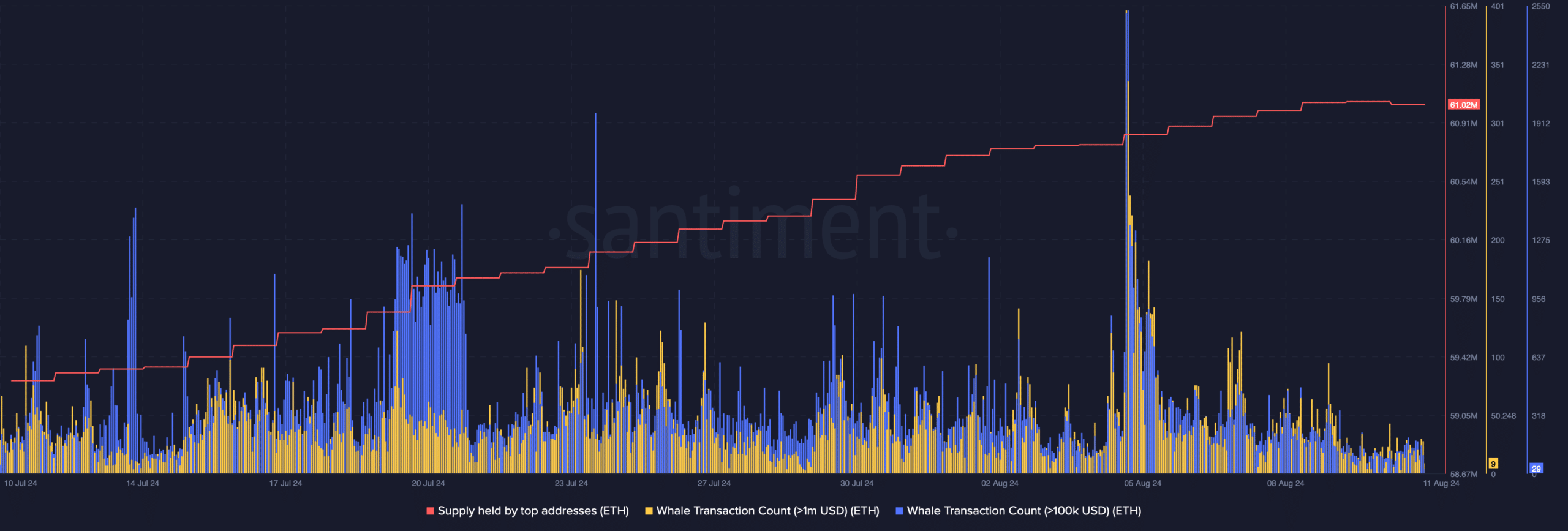

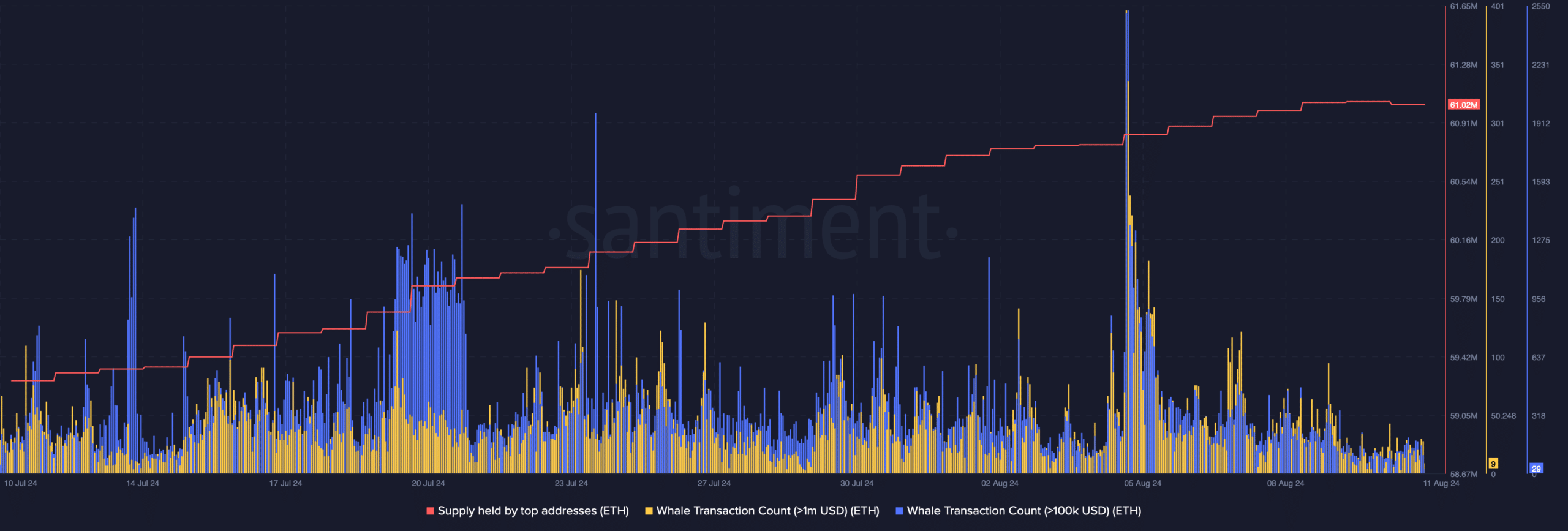

While all this happened, ETH whales increased their accumulation. AMBCrypto’s analysis of Santiment’s data revealed that ETH’s supply held by top addresses increased sharply over the last month.

At press time, the metric had a value of 61.2 million ETH. Its whale transaction count also increased during the same period.

Source: Santiment

A look at ETH’s state

AMBCrypto then checked ETH’s current state to see how the token has been performing on the price front. According to CoinMarketCap, ETH’s price dropped by over 4% in the last 24 hours.

At press time, it was trading at $2,543.14 with a market capitalization of over $305 billion.

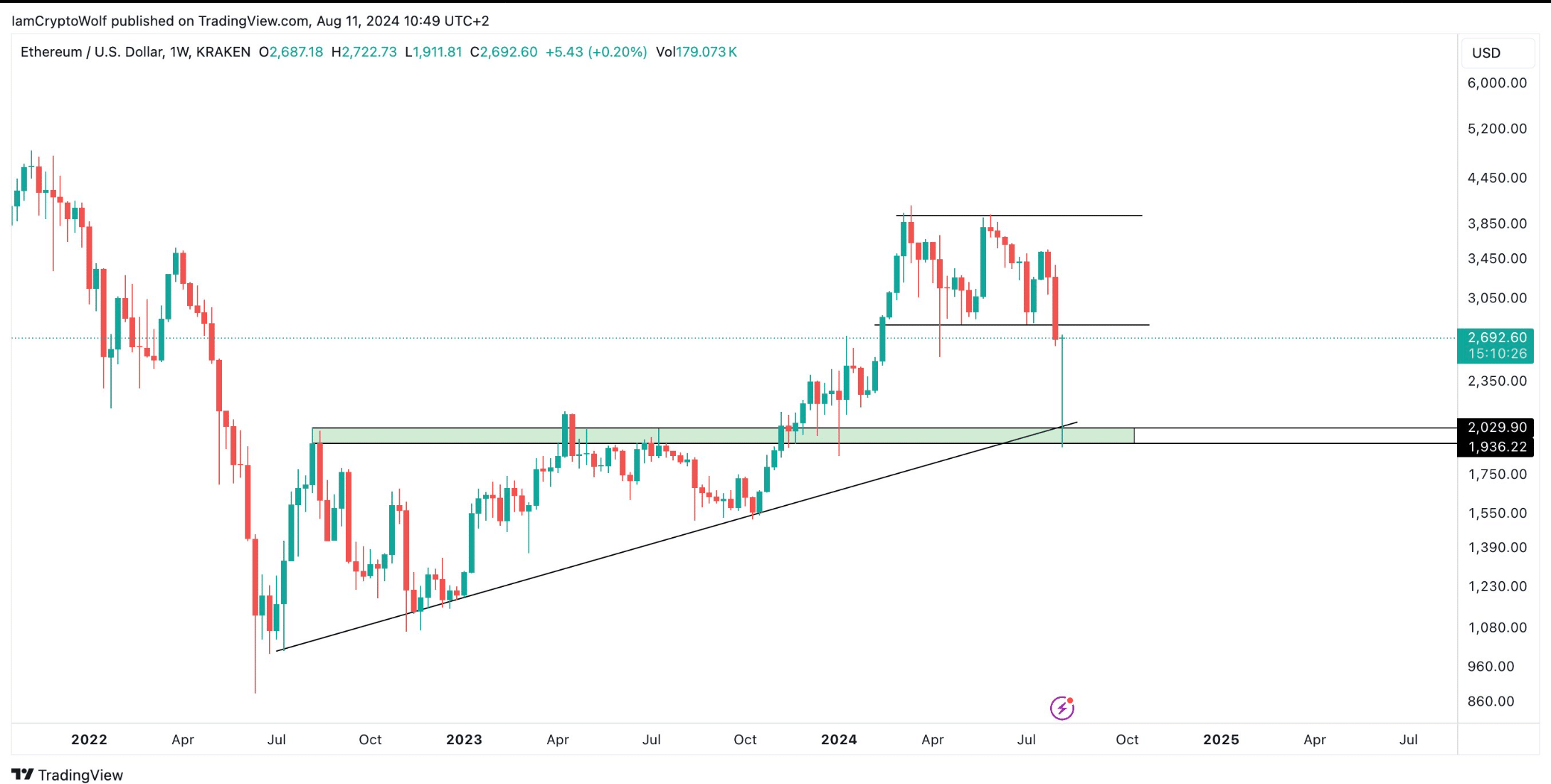

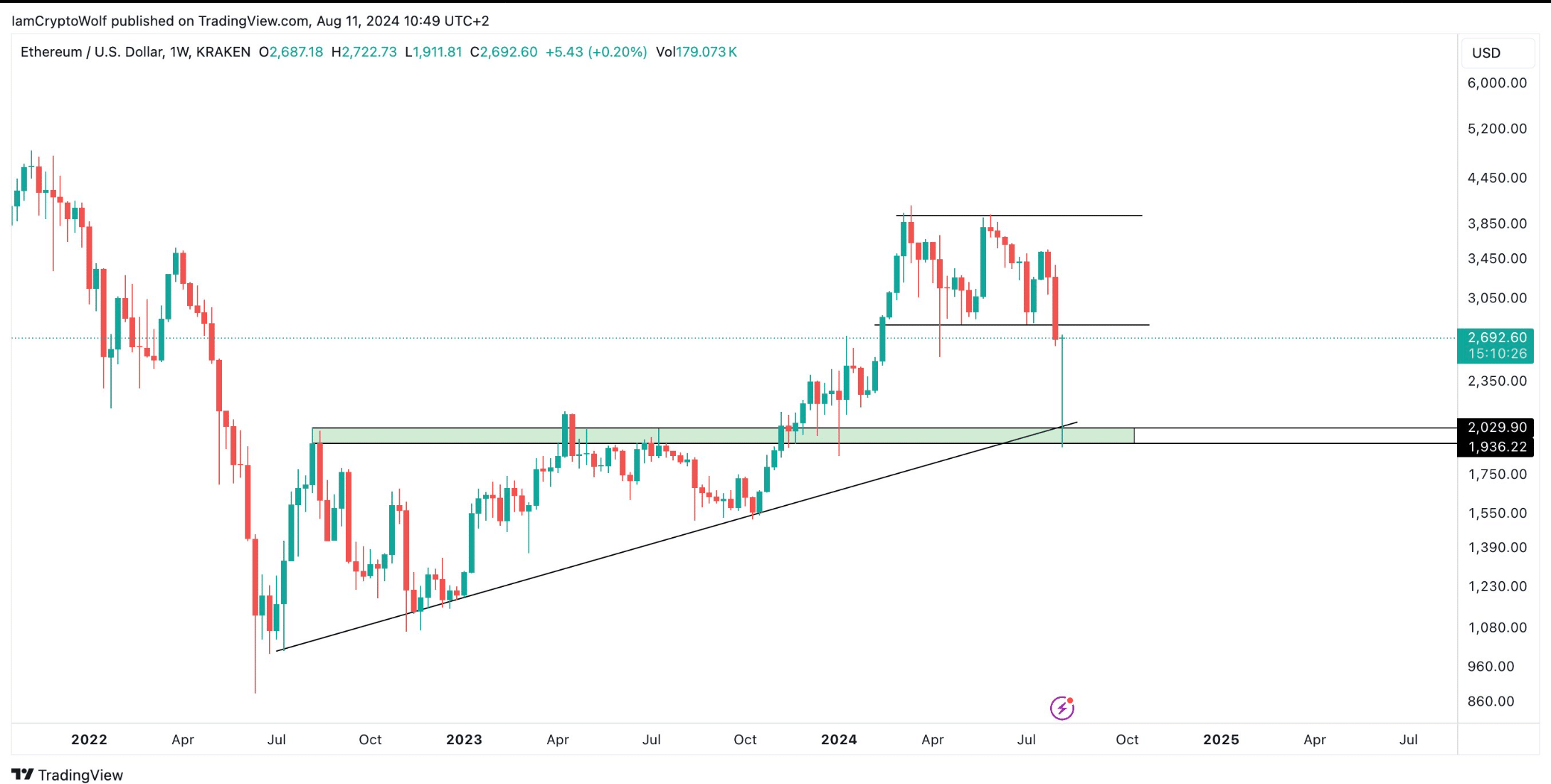

Meanwhile, Wolf, a popular crypto analyst, posted a tweet highlighting a major development. There were chances of a hard redound after ETH retests its ascending triangle pattern.

This meant that ETH might as well plummet to $2k in the coming days or weeks before it starts a long-term bull rally.

Source: X

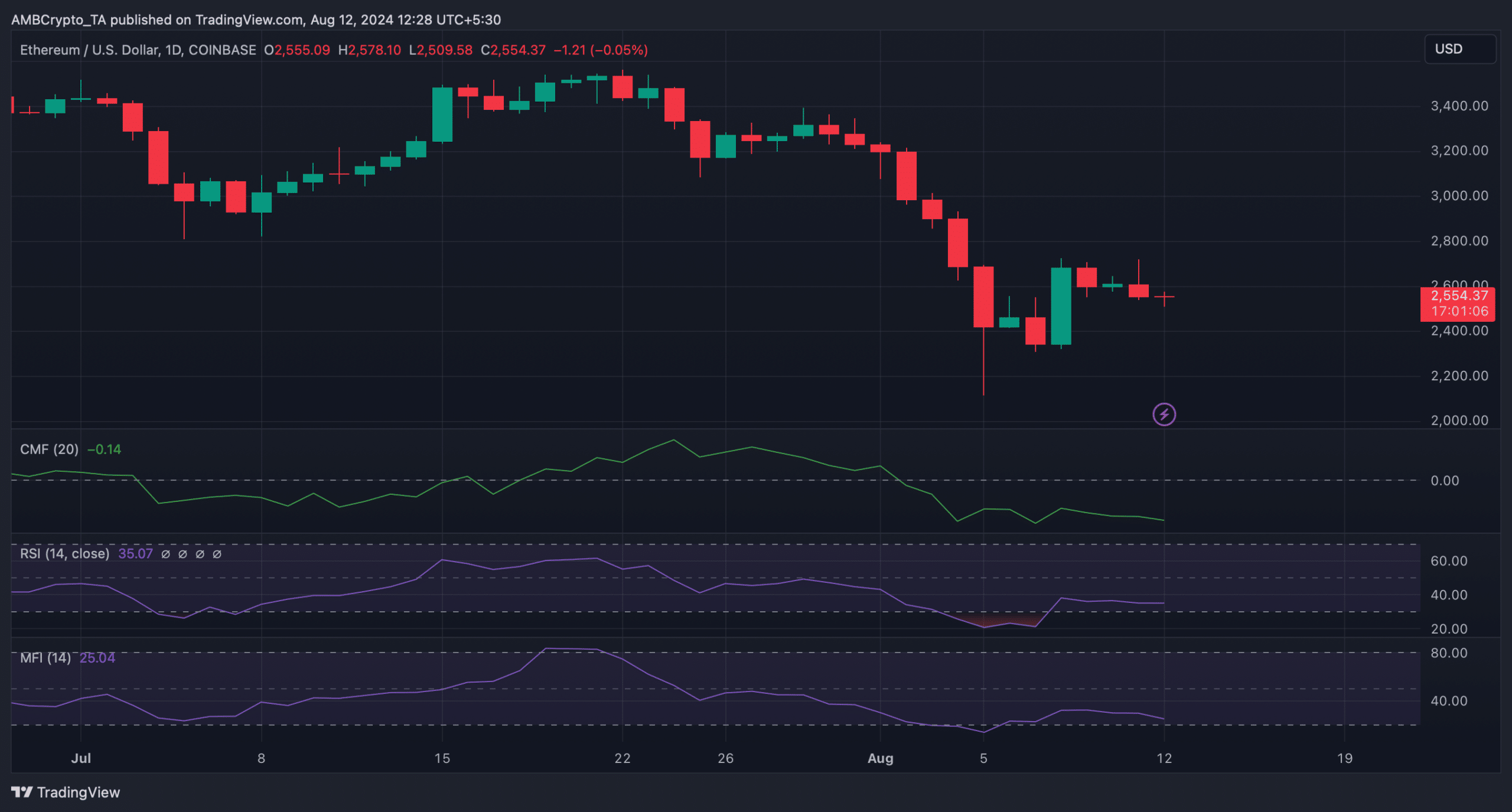

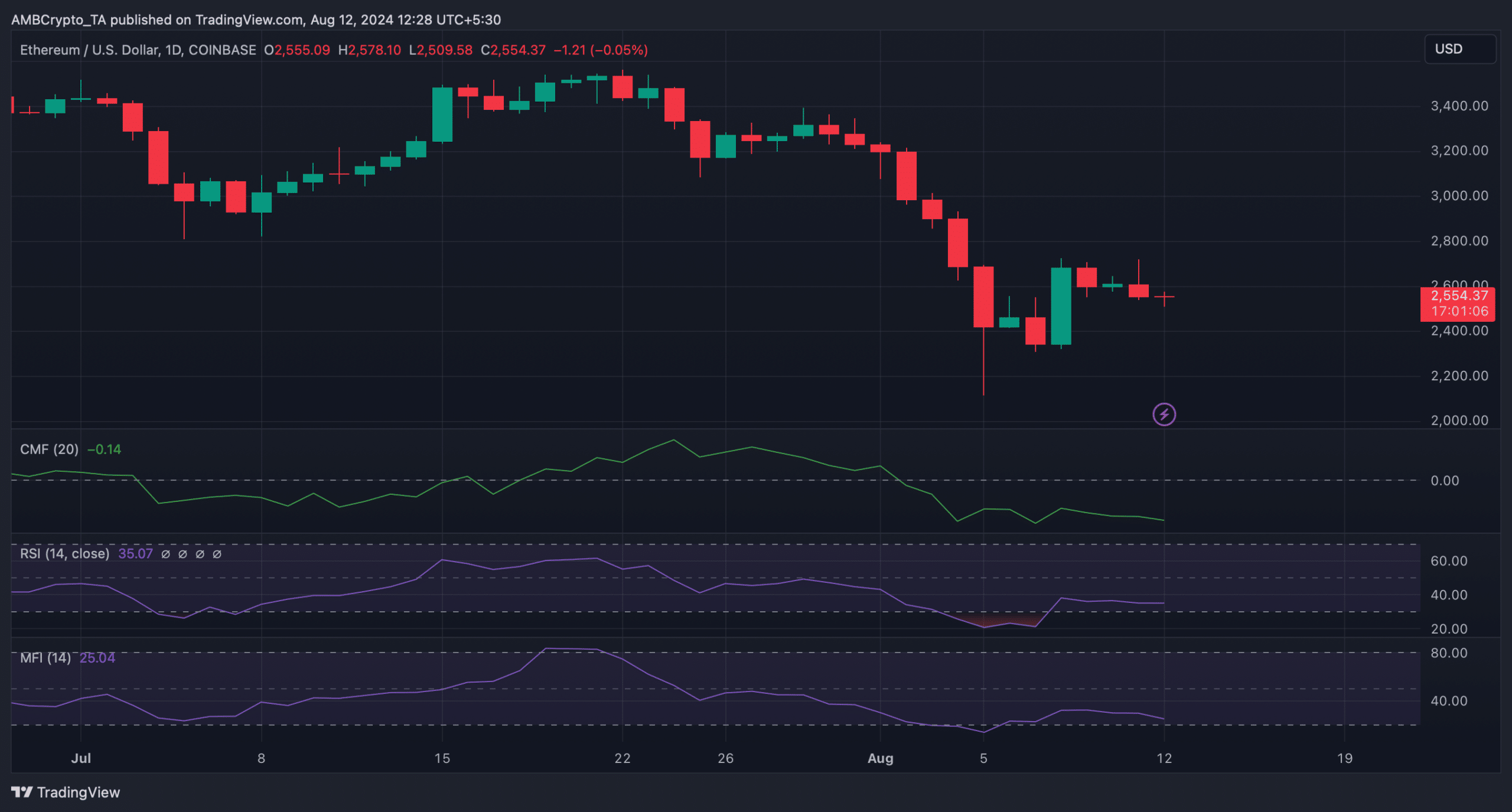

Therefore, AMBCrypto planned to have a closer look at the token’s daily chart to find whether market indicators also hinted at a further price drop towards $2k.

At press time, the Relative Strength Index (RSI) had a value of 35, meaning that it was resting well below the neutral mark of 50.

Read Ethereum (ETH) Price Prediction 2024-25

Additionally, the Chaikin Money Flow (CMF) also went southward, further hinting at a continued price drop.

Nonetheless, the Money Flow Index (MFI) was about to enter the oversold zone. This might increase buying pressure and, in turn, lift ETH’s price.

Source: TradingView