- EigenLayer’s deposits equated to about 4% of ETH’s total circulating supply.

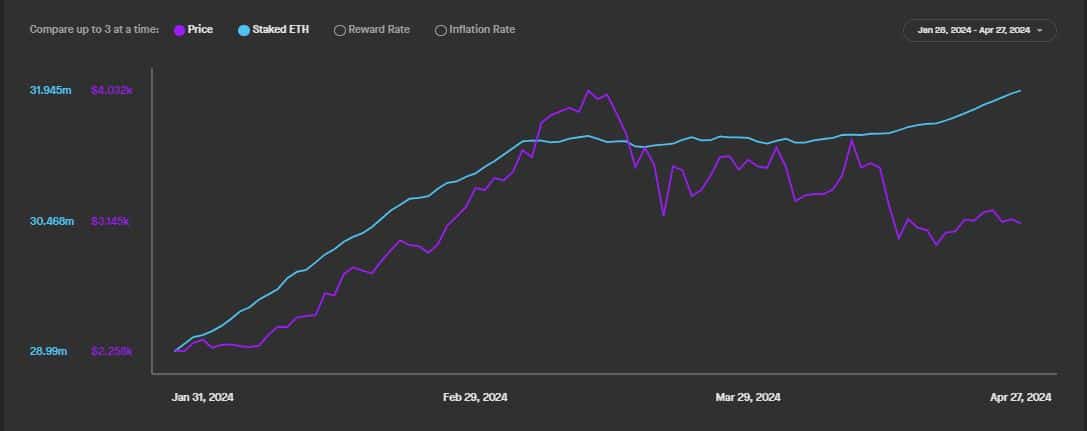

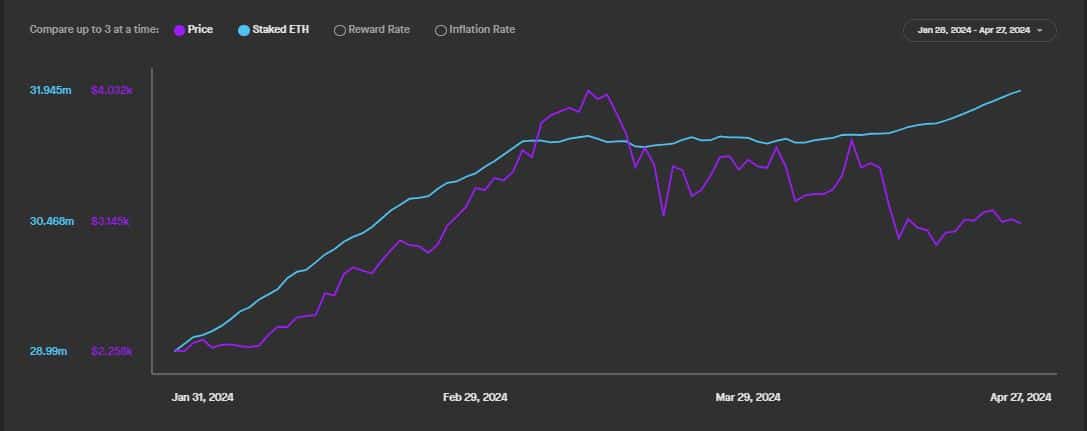

- Due to EigenLayer, staked ETH supply has risen 1o% YTD.

EigenLayer has attracted more than $15 billion in deposits in just over a year since its launch, emerging as one of the most successful decentralized finance (DeFi) projects in recent times.

The restaking protocol’s total value locked (TVL) has exploded 14x since the start of the year, a feat that made it the second leading DeFi project by TVL, according to AMBCrypto’s analysis of DeFiLlama’s data.

The deposits equated to about 4% of Ethereum’s [ETH] total circulating supply, the asset around which its primary use case revolves.

Source: DeFiLlama

ETH staking gets energized

Restaking, one of the most talked-about topics in the Web3 sector right now, adds value to staked ETH by repurposing it to provide security to applications other than the Ethereum mainnet.

The setup helps stakers earn additional yields on their deposits.

Arguably, EigenLayer, the biggest restaking protocol, has had a cause and effect relationship with ETH staking.

According to AMBCrypto’s analysis of Staking Rewards’ data, staked ETH supply has risen 10% year-to-date (YTD), mimicking the surge in EigenLayer’s deposits.

Source :DeFiLlama

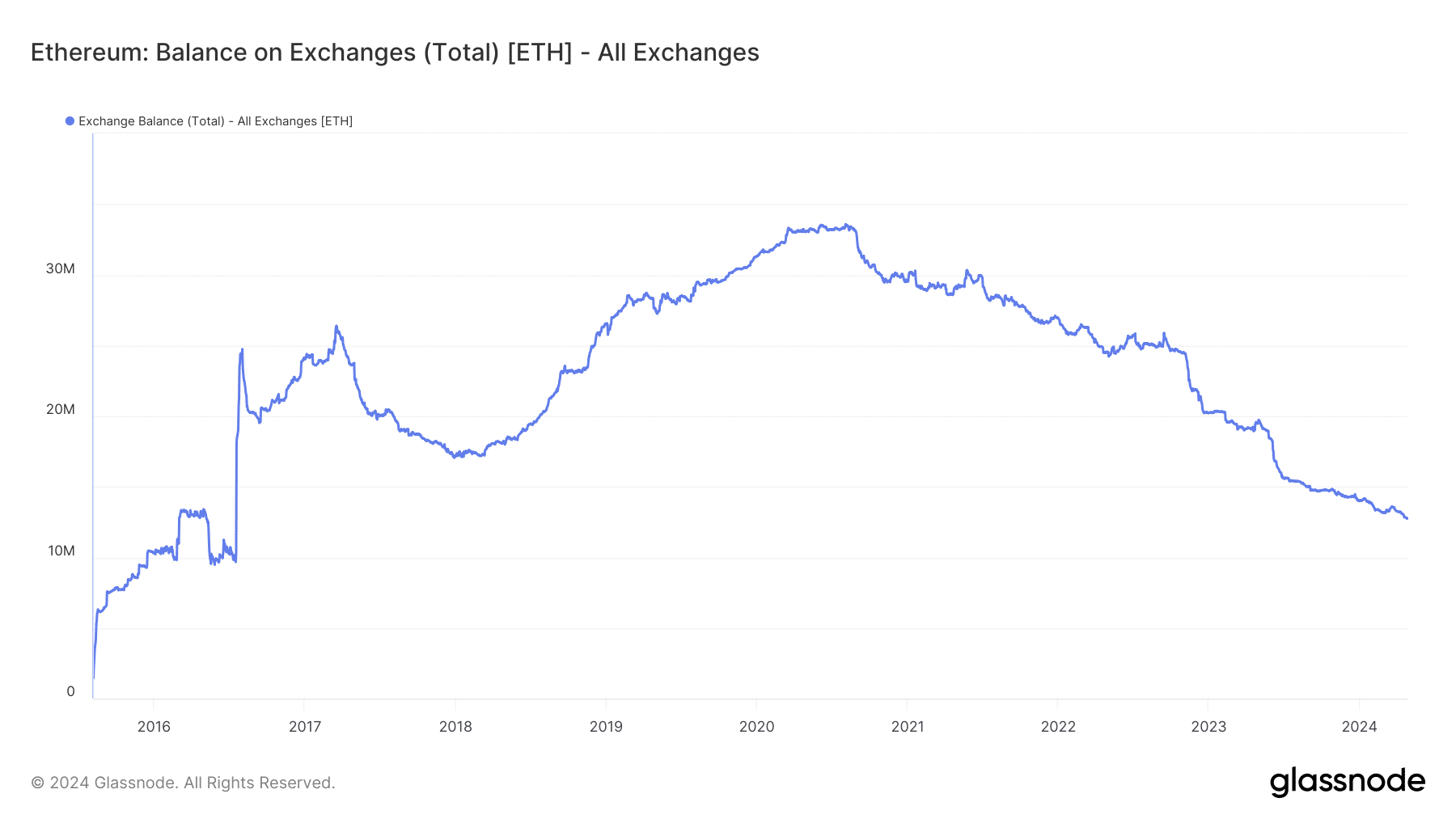

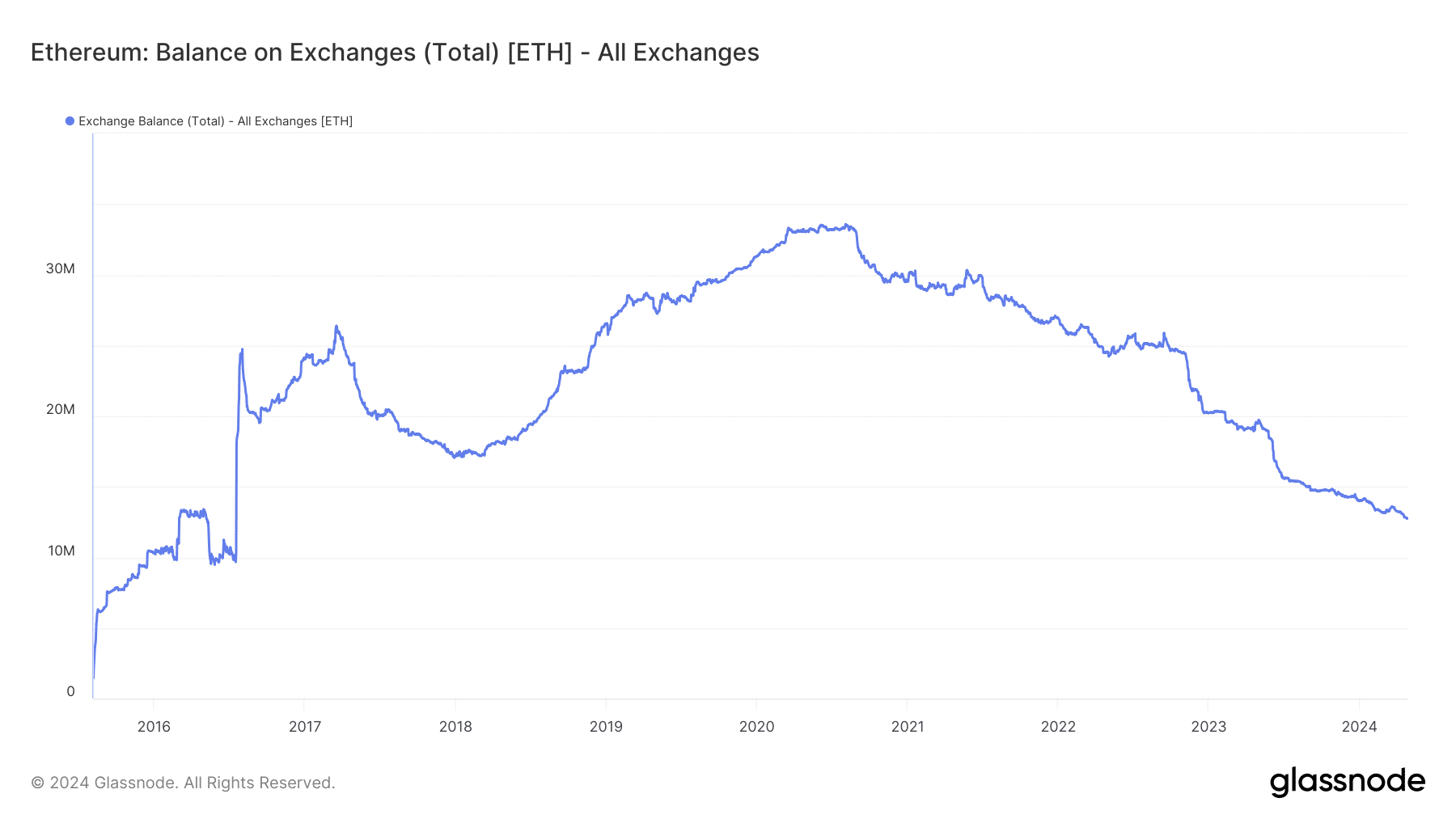

To the contrary, liquid ETH available on exchanges has continued to fall, as AMBCrypto noticed using Glassnode’s data.

EigenLayer’s ascent.

A shift in market structure?

This noticeable divergence underscored ETH’s growing status as a yield-bearing, long-term investment asset, away from its roots in speculative trading.

Additionally, with more and more ETH getting locked up in staking services, the asset was bound to become less volatile, opening itself to a broader cohort of investors.

Is your portfolio green? Check out the ETH Profit Calculator

As of this writing, the second-largest asset was trading at $3,141, following a 2.38% rise over the week, data from CoinMarketCap revealed.

The market sentiment was one of greed, according to the latest readings of the Ethereum Fear and Greed Index, implying that demand for the asset was still strong.