- ETH could rally 90% to $6.5k if it follows Bitcoin’s post-ETF trend.

- ETH demand from U.S. investors was still low to shift market sentiment.

Ethereum [ETH] dropped from $3.5k to $3k two days after U.S. spot ETH ETF launched, about an 8% decline. It was slightly up above $3.2k as of press time.

However, a market observer, Croissant, claimed that ETH’s price action post-ETF launch echoed Bitcoin’s [BTC] pattern after U.S. spot BTC ETFs went live in January.

If the correlation persists, ETH could drop to $2.7k in two weeks before rallying 90%, according to the analyst.

“Ethereum is following the exact same trajectory as Bitcoin after the ETF was approved. -8% ($3143) two days after approval <we are here>, -20% ($2749) two weeks after approval, +90% ($6547) two months after approval.”

Source: X/Croissant

It meant that ETH could hit $6.5k by September. That’s an over 90% rally in two months.

For perspective, BTC dropped from $48k to $40k after the BTC ETF was launched. Two months later, the largest digital asset exploded to $73K in March.

Another renowned analyst, Crypto Kaleo, agreed with the projection.

Can ETH jump 90% and hit $6.5k in two months?

However, it is worth noting that correlation doesn’t always equal causation. Put differently, ETH mirroring the BTC pattern post-ETF doesn’t necessarily mean the outcome could be the same.

That said, as most analysts have predicted, ETH could benefit from expected Fed rate cuts in September. This could boost all risk assets, including crypto.

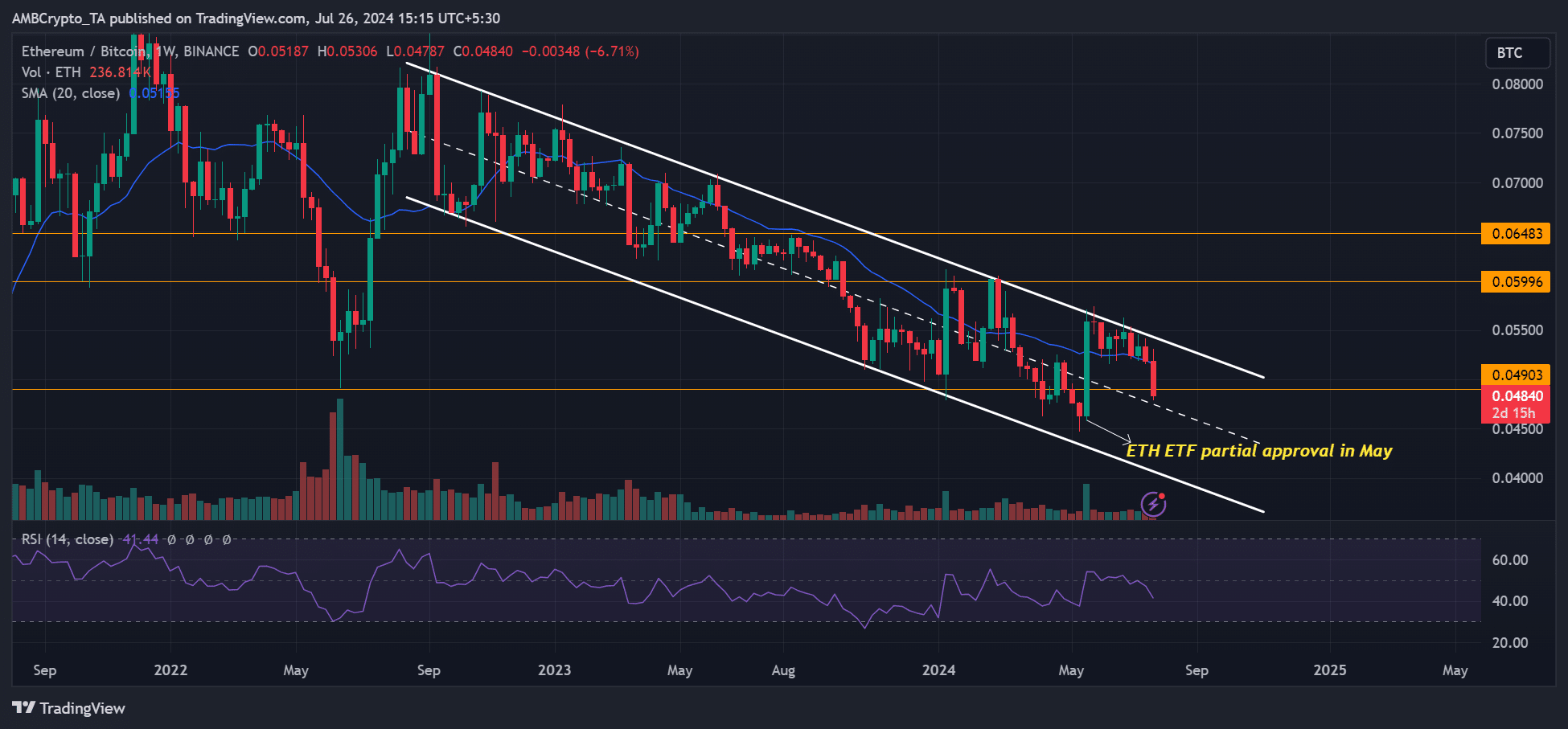

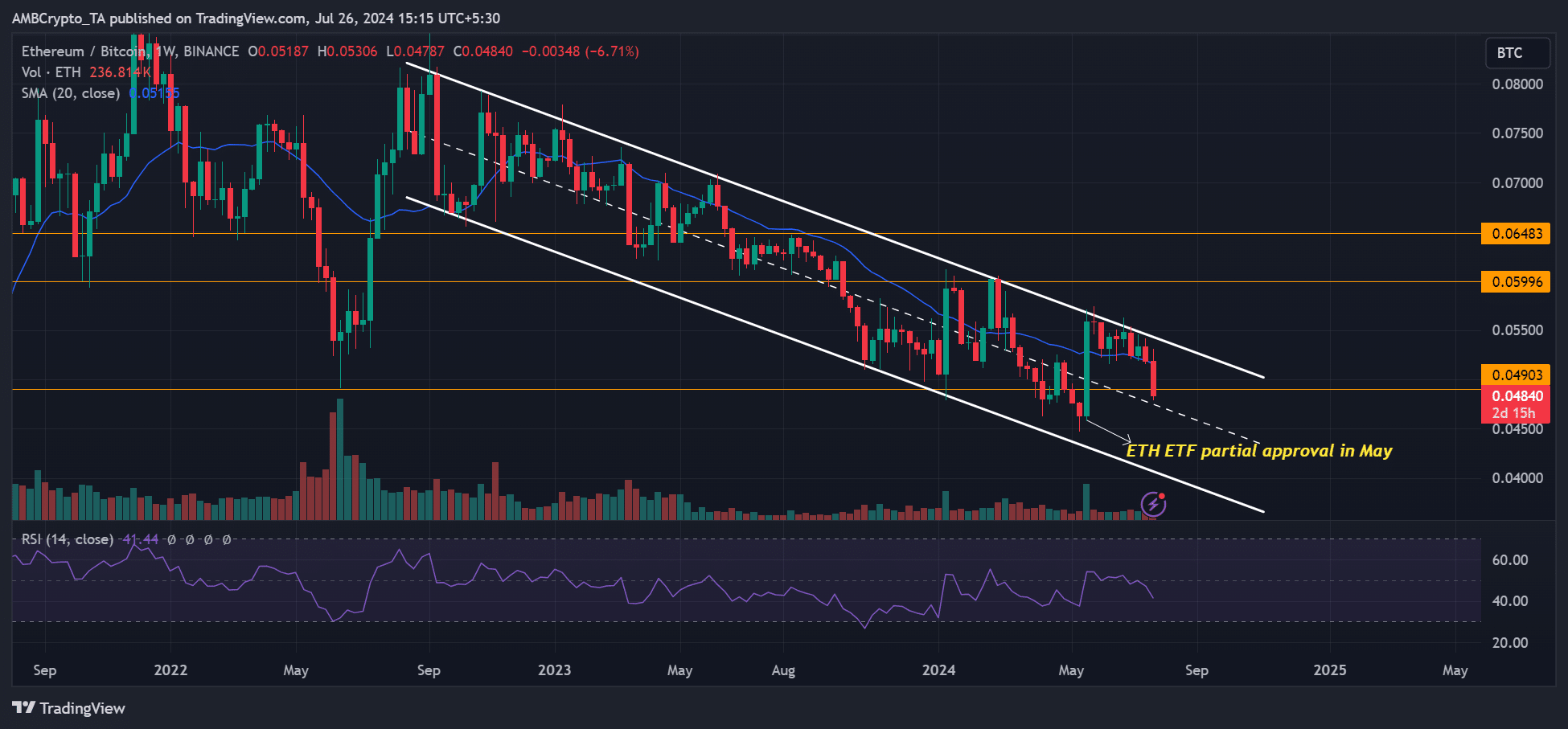

Meanwhile, ETH has been underperforming BTC in its spot ETF debut week, as shown by the ETHBTC ratio declining over 6% on a weekly adjusted basis as of press time.

Source: ETH/BTC, TradingView

A drop below the mid-range level, near 0.045, could weaken ETH even further relative to BTC.

In fact, according to Andrew Kang of Mechanism Capital, there was a high risk of ETHBTC dropping to 0.04 or below, which would make it unattractive as a hedge.

“At that point (below 0.04 ETHBTC), I don’t believe $ETH will be as interesting of a hedge anymore.”

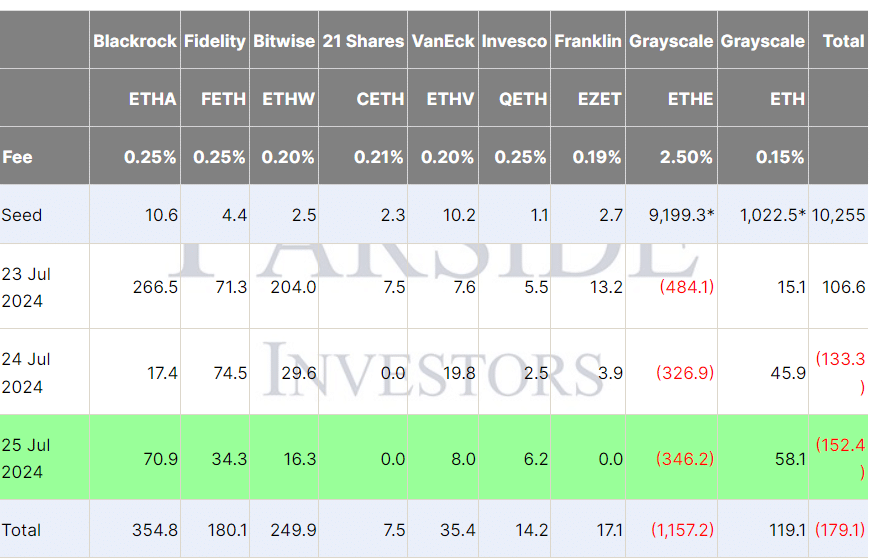

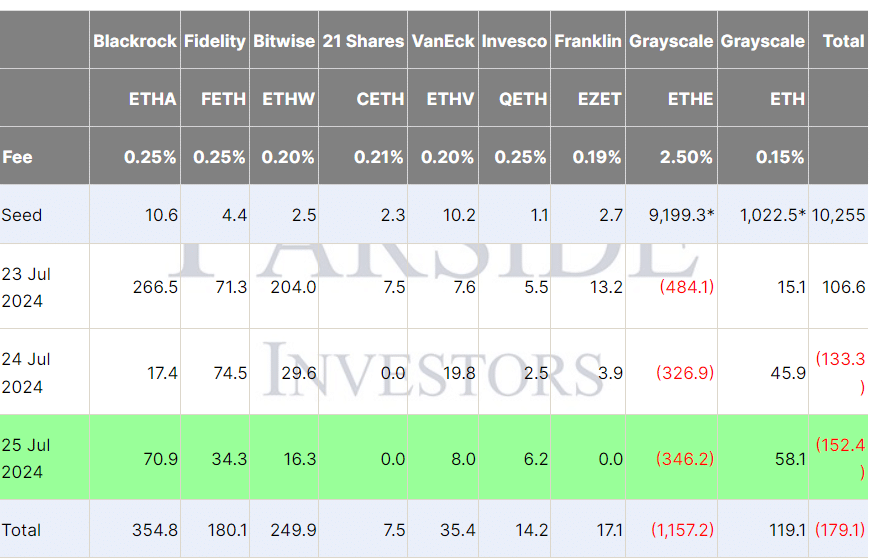

The risk Kang referred to was the U.S. spot ETH ETFs’ net outflows in the past two days. The products saw $133 million and $152 million outflows on the 24th and 25th of July, single-handedly driven by Grayscale’s ETHE bleedout.

Source: Fairside Investors

However, Daniel Yan of Kryptanium Capital was hopeful that the 0.045 level would ease the ETHBTC decline. The jury is still out on whether the ETHBTC will drop further.

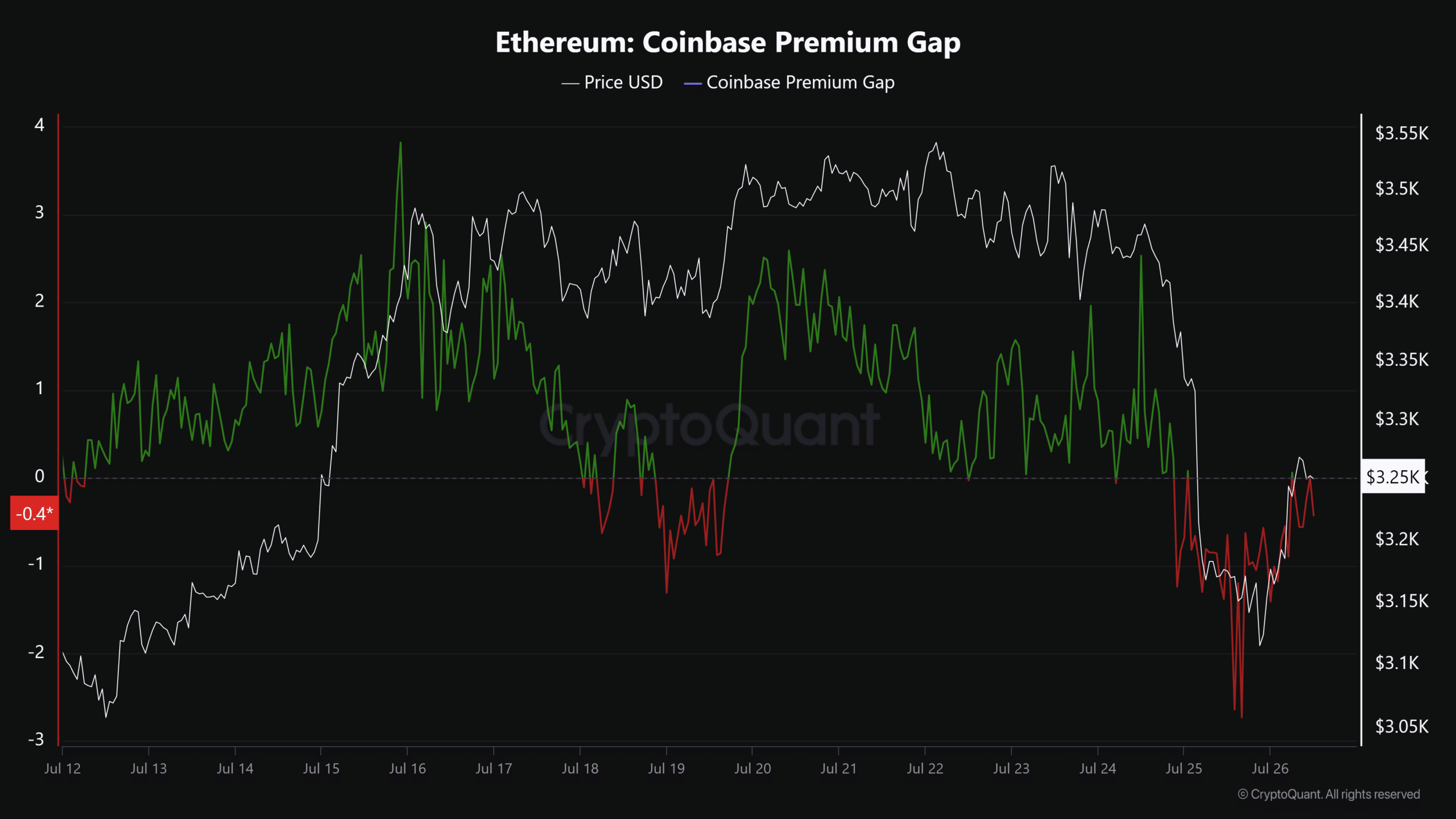

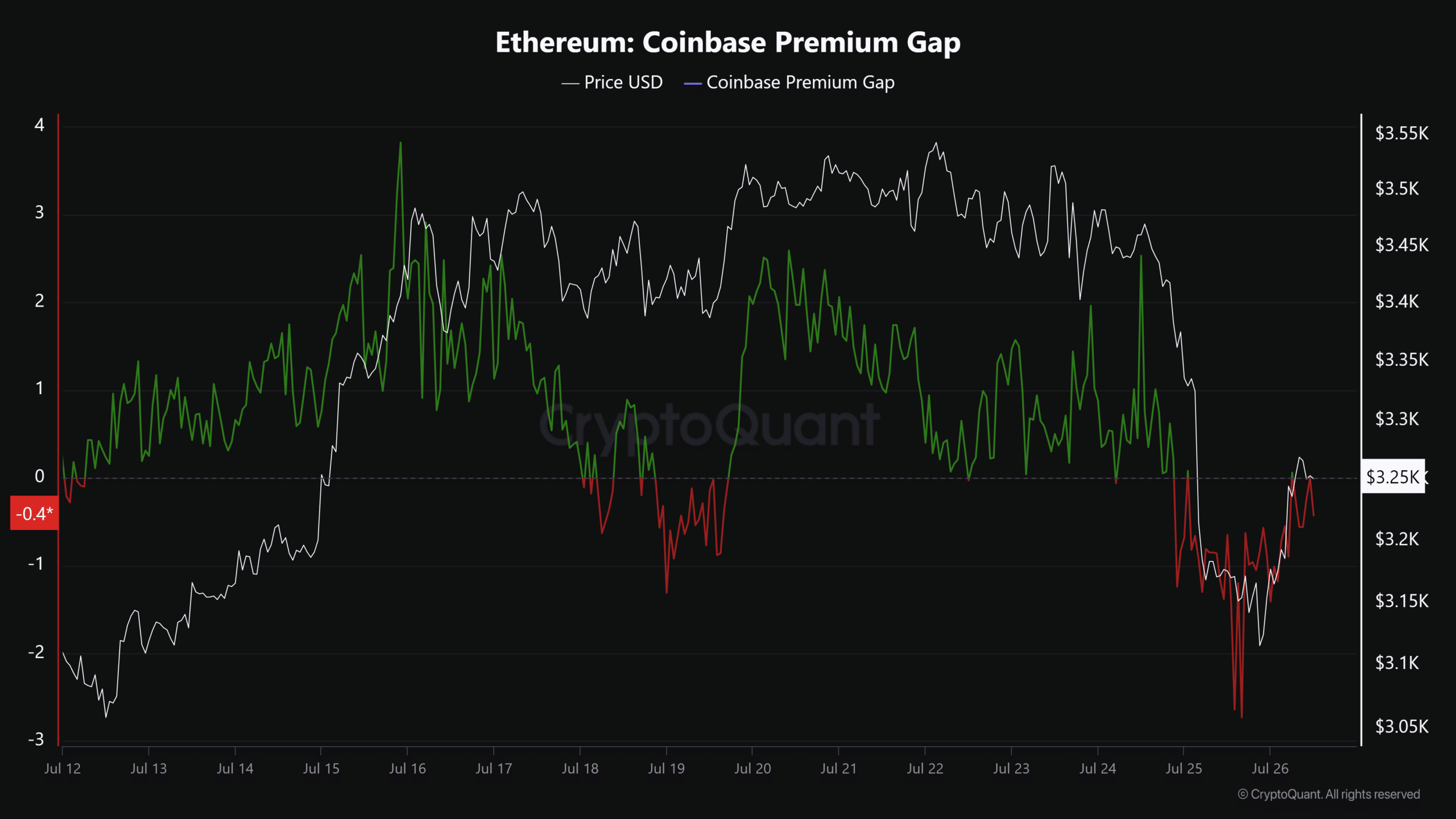

In the meantime, according to CryptoQuant head of research, JA Maartunn, a convincingly bullish reversal for ETH could happen when a strong demand comes from U.S. investors.

As of press time, U.S. demand was still low, as denoted by the low Coinbase Premium Gap.

Source: CryptoQuant