- NYSE cleared the listing of Bitwise and Grayscale ETH ETFs.

- However, the prevailing market sentiment showed uncertainty.

For the last two months, the market has been eagerly awaiting the launch of Ethereum [ETH] ETFs. Since the SEC’s green light, speculation has affected the ETH market with increased volatility.

After the launch of Bitcoin [BTC] ETFs six months ago, Ether ETFs are now entering the market with high expectations within the crypto community.

NYSE clears Bitwise, Grayscale ETH ETFs

On the 22nd of July, the NYSE confirmed the listing and registration of the common shares for the two funds.

The NYSE approval came after CBOE announced the preparation for the loss of five spot ETH Exchange-traded funds.

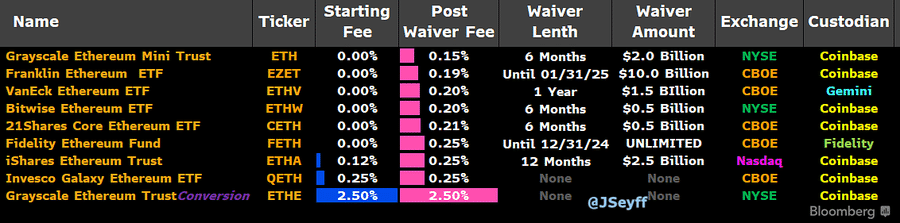

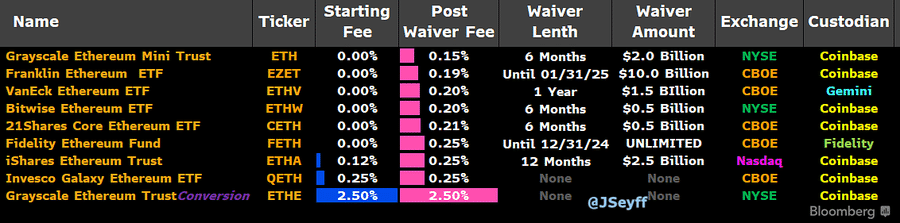

According to the CBOE list, Grayscale and Bitwise were listed with post-waiver fees of 0.15% and 0.20%. Also, Coinbase will act as the two ETFs’ custodians.

The approval and clearance of ETH ETFs have paved the way for institutional investors to access and invest in BTC and ETH, the two largest cryptos by market cap.

Source: X

Predictions of inflows

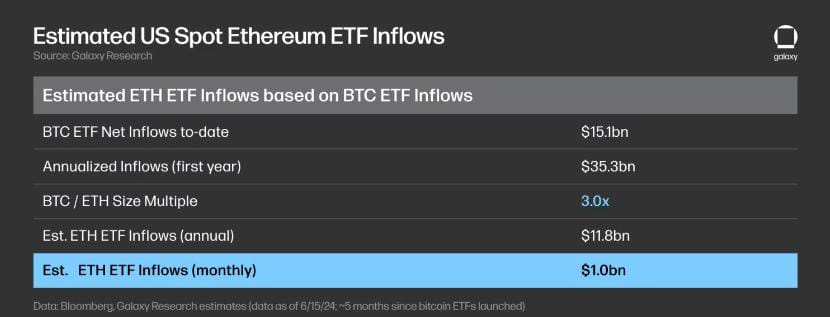

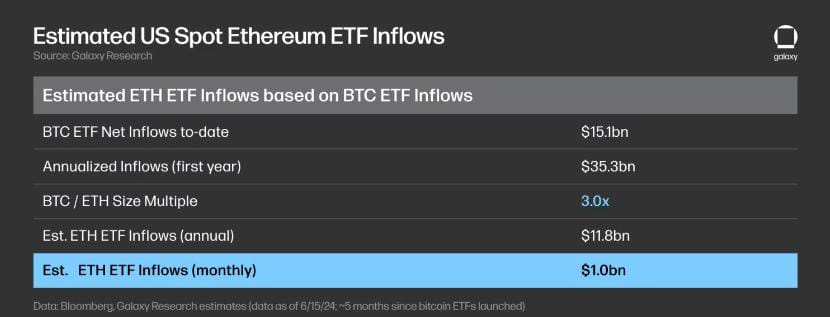

With the launch of ETH ETFs, market speculation and predictions are high regarding the anticipated funds. On their analysis, Perfumo estimated a $750 million to $1 billion inflow every month over the next six months.

Citigroup estimated around $4.7 billion to $5.4 billion over the next six months. However, Bitwise is more optimistic, estimating $15 billion in ETH ETF inflow by May 2025.

Although the launch of ETFs paves the way for institutional investors, the BTC ETFs market is largely dominated by retail traders. The market expects the same trend to continue with Ether exchange-traded Funds.

Source: Galaxy

Impact on price charts

As of this writing, ETH was trading at $3437.57 following a 1.75% decline in the last 24 hrs. Its market cap has declined by the same percentage on daily charts to $412.8 billion, according to CoinMarketCap.

However, Ether’s trading volume has surged by 30% on daily charts to $19.5 billion.

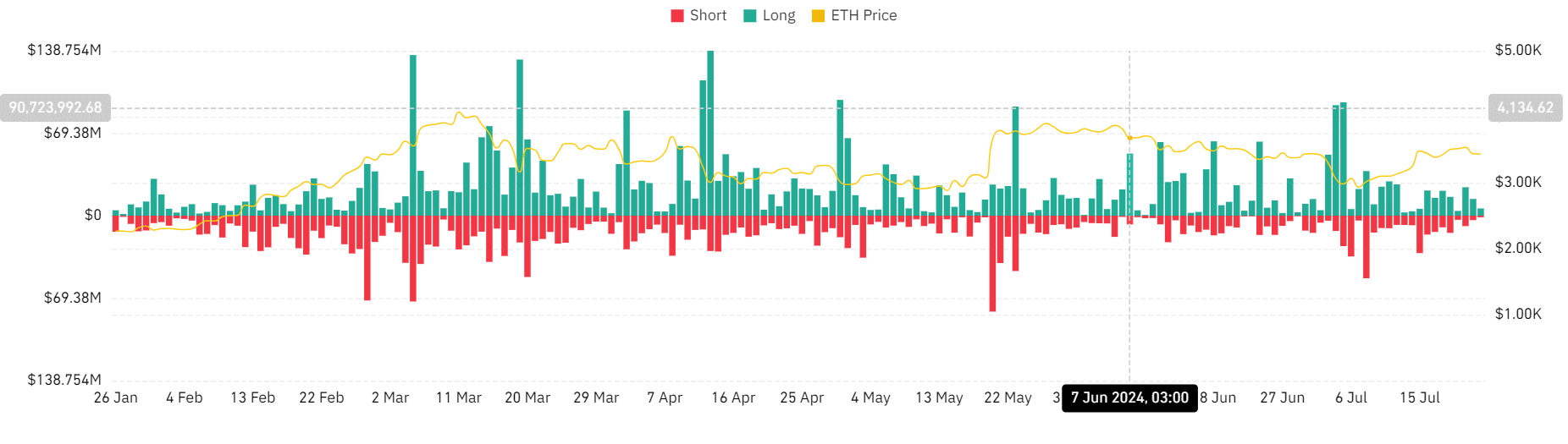

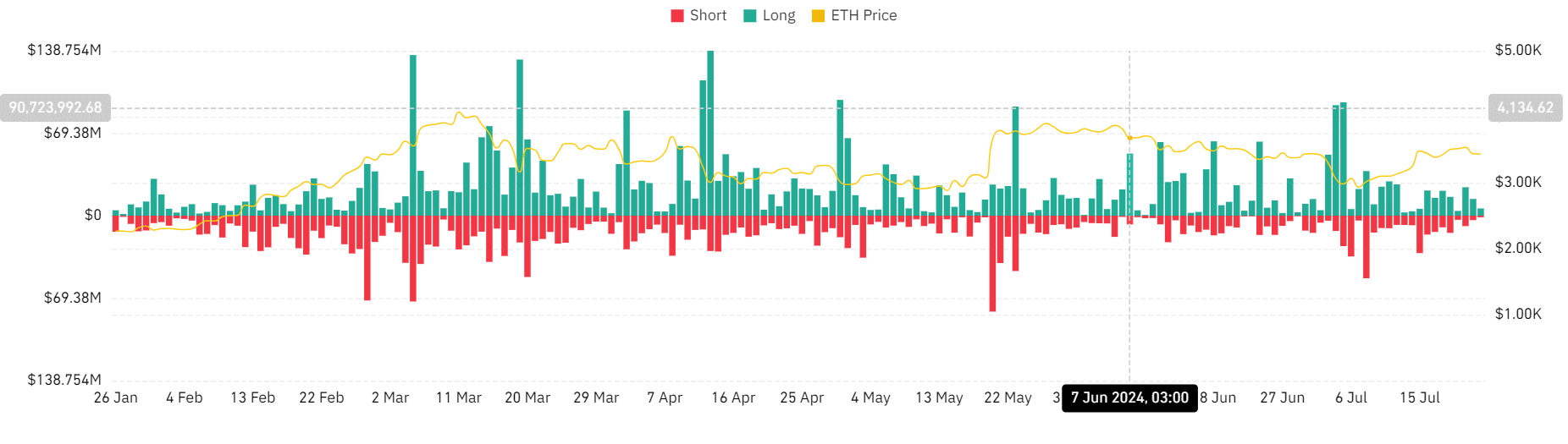

Source: Coinglass

According to AMBCrypto’s analysis, ETH was experiencing high volatility despite the confirmed launch of ETFs.

Looking at Coinglass, Ether experienced high liquidation rates for long positions, a bearish signal. At press time, long positions were at $6.04 million, with short positions at $1.34 million.

This showed that investors were forced to close their positions at a loss without opening new positions.

Equally, long position holders were unwilling to pay premium to hold their positions, suggesting a lack of confidence in the altcoin’s future direction.

Source: Tradingview

The Directional Movement Index confirmed this uncertainty, with the negative index at 21.53, which sat above the positive index of 19 at press time.

The chart indicated that the positive index had been declining for the past week and closing towards neutral on a downtrend.

Read Ethereum’s [ETH] Price Prediction 2024-25

Therefore, despite the confirmed Ether ETFs, the market remains uncertain and may experience more volatility until the prices stabilize.

However, it’s important to note that BTC prices gained over 50% after the launch of ETFs, reaching an all-time high of $73k. Ethereum is also likely to take the same path, with 8% gains in the short run.