- Dogecoin was trading just above a short-term range’s lows

- The confluence with the Fibonacci retracement level offered chances of a bounce for the meme coin

Dogecoin [DOGE] posted losses as selling pressure grew stronger. Bitcoin [BTC] defended the $62.1k support level and bounced by 4.3% to $64.5k in the past 24 hours. However, DOGE was unable to steer clear of the short-term range lows.

The total number of Dogecoin holders increased in April but it might not be enough to justify a price recovery. The market sentiment was still fearful, and the memecoin could be headed for new lows.

Extended consolidation is a possibility for DOGE

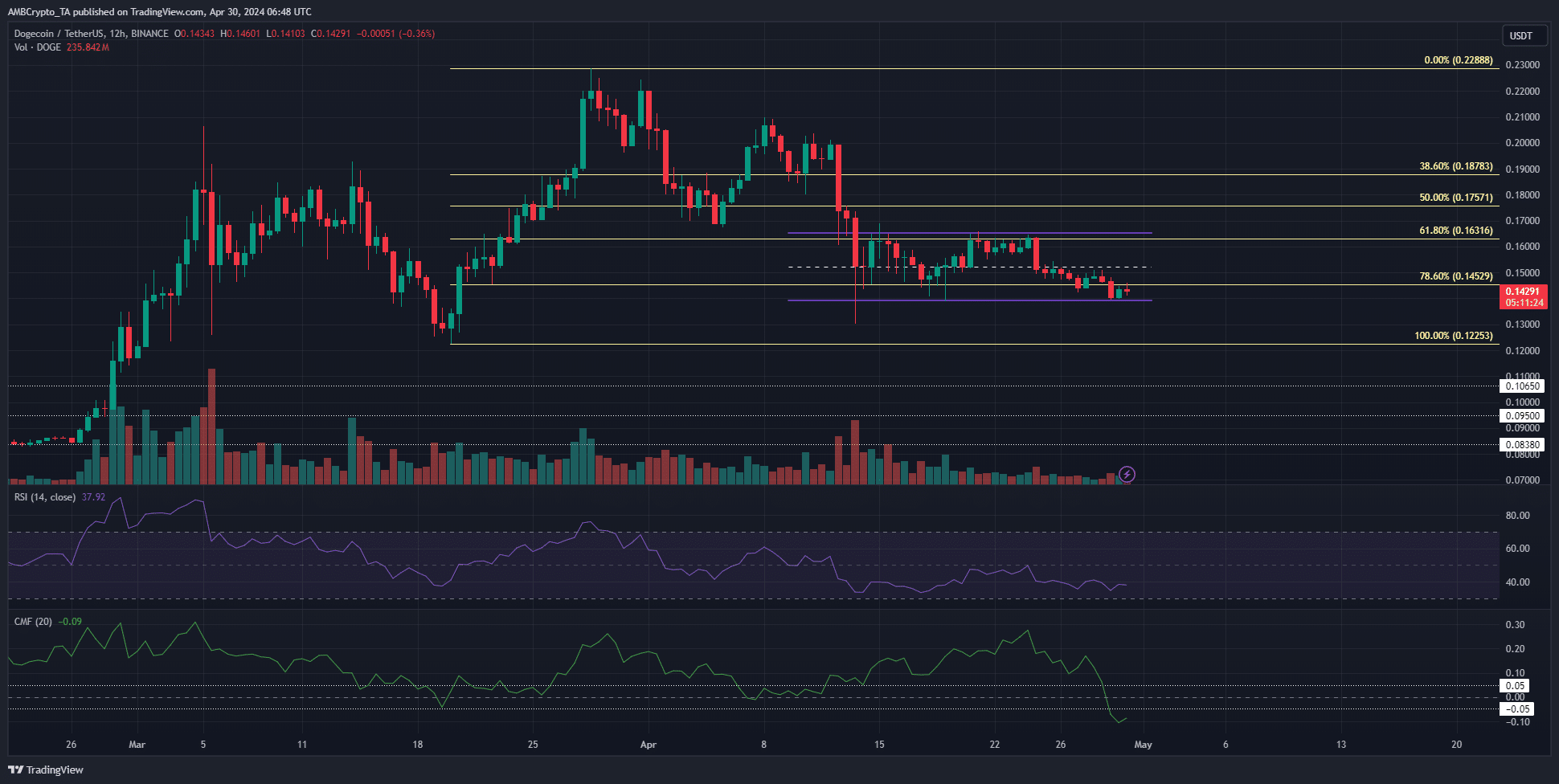

Source: DOGE/USDT on TradingView

A range (purple) was formed between the $0.14 and $0.165 levels. The mid-range has served as support and resistance in April, reinforcing the legitimacy of the plotted range. The CMF was at -0.09 to indicate significant capital flow out of the market.

The H12 RSI was at 37 and indicated steady downward momentum. This was a reflection of the past five days of losses for Dogecoin. The proximity of the range lows to the 78.6% Fibonacci retracement level was encouraging.

It hinted at the possibility of buyers entering the market and arresting further losses. However, the indicators showed more losses were imminent.

Does the futures market support the possibility of a bounce?

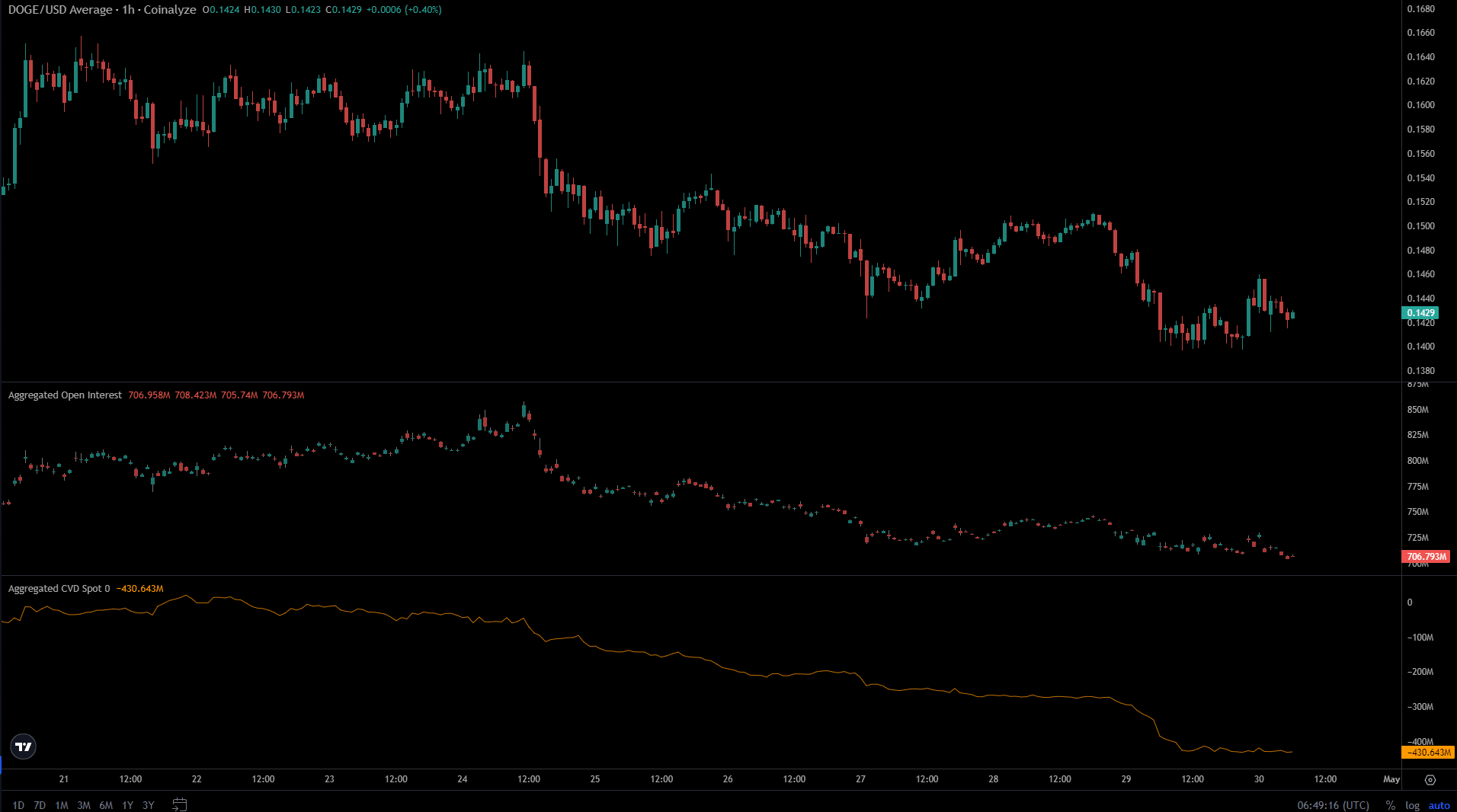

AMBCrypto’s analysis of the Coinalyze data showed that capital inflow into the market was low, adding weight to the CMF’s findings. The Open Interest has steadily trended downward in recent days and showed speculators were not willing to bid.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

The spot CVD has also been in a steady downtrend since 22nd April. In the past 24 hours, the downtrend has halted, replaced by a sideways movement.

If the spot CVD can climb higher from here, it would be an encouraging sight for buyers looking to enter at the range lows.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.