The falling price of Bitcoin is affecting the whole crypto token ecosystem. Dogecoin has fallen by 19.66% this week. Even though it tried to give some bullish pump, it failed to rise. Multiple factors on the chart show there might be another fall incoming. Let’s explore why the chart is giving bearish signals.

Bearish Signals in Charts

Daily Doge chart shows that the price has created a falling wedge pattern that symbolizes an upcoming fall in price. Currently, this price has received support of a trendline initialized in January this year. Dogecoin is trading at a price of $0.11 at the time of writing and is trying another attempt to rise. If we look closely we can see that there is no immediate support from any moving average. All the daily moving averages have suppressed the price.

RSI has fallen to 40 points. If the trend line fails to hold the price, the nearest support lies around $0.08. This is the same zone that helped the price to bounce back in the beginning of July.

Moving to a 4-hour chart clears more information. Moving average 20 has crossed down all other crucial moving averages. Even 50 MA has crossed down the 100 MA and if the price does not take a turn sooner, it will fall below 200 MA in the upcoming week. To prevent this, the price of Doge must close above $0.118. But looking at the liquidation data, it does not seem to happen anytime soon.

Massive Dogecoin Liquidations Revealed

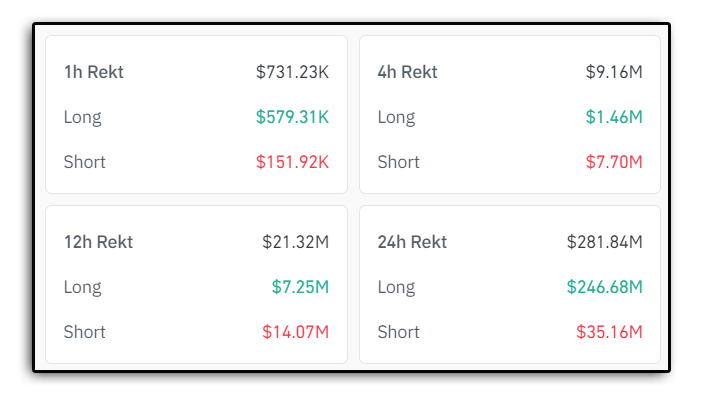

In the last 2 days, a total of around $ 360 Millions worth of Doge trades have been wiped. Data from Coinglass shows that $59.07 Million of shorts and $299 Million of longs were liquidated. Just in the last 24 hours, $246.84 millions worth of longs were washed off, which is very high as compared to the $35.16M of shorts. This gives a clear understanding of the negative sentiment of the market.

The address profitability data by IntoTheBlock shows there are 11.43k Doge wallets that purchased around $24.95B worth of token between the price range of $0.0109664 and $0.120035. This should create a support point at the current level. In the last 7 days around $16.46M worth of tokens have been moved out of the exchanges. Such actions represent accumulation. When the market is in high fear, whales tend to buy in and move funds out in their self custody. This is a positive thing out of all the fear factors surrounding the market.

The in/out data shows that 74% active doge wallets are in the money at this price and 25% are still at loss. This is yet another negative signal as the holders who are in profit tend to do a sell off during market plummet and wish to rebuy at a lower price.

What the Data Tells Us About Dogecoin’s Future

Analyzing the charts and the liquidation data gives a clear signal of bearish sentiment that can lead to more downtrend. However, there are still some positive signs that can help the price to hold and move up again. If the market recovers and more buying pressure comes in, the price will surely rise. The $0.11 price level is very crucial to hold, as falling below it will push the price of Dogecoin to $0.08, making it somewhat difficult to recover in the upcoming weeks.

Also Read : Bitcoin Price Crashes 10%—Experts Predict Further Decline to $57K