The decentralized finance (DeFi) ecosystem is undergoing a shift towards more rational investments and maturing confidence, according to Exponential.fi’s latest report “The dawn of a new era in DeFi: From winter chills to summer thrills.” As the ‘DeFi Winter’ weakens its grip, the report states that the path ahead is a ‘hot bull summer’.

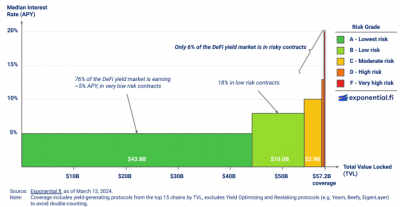

Investors are now showing a marked preference for security, with a significant 75% of DeFi’s total value locked (TVL) flowing into pools offering a modest annual percentage yield (APY) of up to 5%. This conservative shift is particularly noticeable in Ethereum staking pools and highlights a broader trend: the move from yield chasing to a desire for predictability and safety.

Protocols like Lido are becoming the go-to for many, underscoring a preference for established platforms over speculative ventures.

Optimism and confidence

The report reveals the growth trajectory of DeFi’s TVL in yield-generating protocols soared by over 125% between Q3 2023 and Q1 2024, rising from $26.5 billion to $59.7 billion. “This resurgence signals a return of confidence and liquidity to the DeFi markets,” stated Exponential.fi’s analysts.

Moreover, the nature of DeFi protocols’ means to generate yield is evolving. The market is gradually pivoting towards lower-risk ventures like staking and secured lending, while interest in complex sectors like insurance and derivatives appears to be waning.

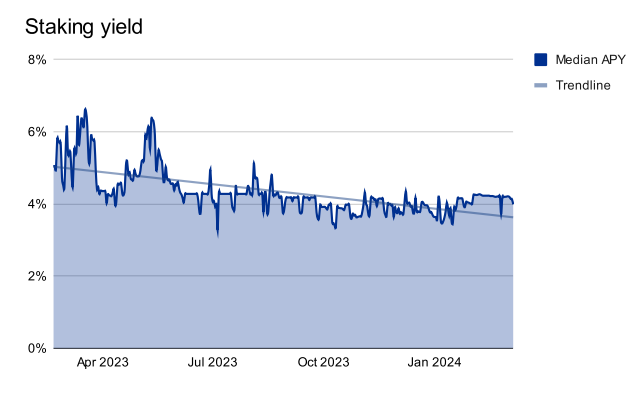

Ethereum’s shift to a Proof-of-Stake model after ‘The Merge’ has also been a game-changer for DeFi. Staking has emerged as a foundational element, attracting an ever-growing portion of DeFi’s TVL. The introduction of restaking through platforms like EigenLayer is pushing the boundaries further, offering higher yields through additional network security but with added risk.

Another hot sector of the decentralized finance ecosystem over the past months is lending. Driven by a collective appetite for risk and higher yields, innovations in the sector are plentiful, with platforms like Ethena offering compelling returns through a mix of staking and futures contracts. The advent of isolated markets is enhancing platform security, encouraging more users to engage with DeFi lending without the fear of losing their collateral.

The market is also looking for new ways to solve old pains, such as the challenges of impermanent loss, which is the devaluation of a token locked in a liquidity pool. Advancements in DeFi are paving the way for more efficient capital utilization, with the introduction of concentrated liquidity models and the growing popularity of stable pools suggesting that the sector is finding ways to mitigate risks and adapt to the evolving market landscape.

Interoperability through cross-chain solutions also saw developments, the report points out. The rise of Layer-2 blockchains and a move towards more secure and efficient bridging models are fueling the growth in the bridging sector, filling the gaps between networks and facilitating smoother transactions across the blockchain landscape.

The report concludes by mentioning the shift from rewards-based yields to those driven by actual on-chain activity marks a maturing DeFi market, which shows evolving sophistication.