- Ethena, Core, and Pendle had the biggest gains of the week.

- Conflux, Wormhole, and Floki were the biggest losers for the week.

The past week proved to be intriguing for both crypto gainers and losers, with significant assets missing out on top rankings on either side of the spectrum. It was also a week when ‘W’ took an “L.”

Biggest winners

Etherna

Ethena [ENA] emerged as the top gainer for the week, showcasing a trend that any asset holder would welcome.

The chart showed that ENA started the week at around $0.6, swiftly rising to over $0.8 by the 2nd of April.

What’s particularly noteworthy is the significant surge in volume accompanying this price level, soaring to over $2 billion.

By the week’s end, the price surged to around $1.17, marking a remarkable increase of over 70%. This propelled Ethena to claim the title of the biggest winner for the week.

With a market capitalization of $922 million, it also secured the top spot in terms of market cap among the top three gainers.

Core

Core [CORE] presented a mixed performance throughout the week, showing a stronger start but ending on a lesser note.

The token started the week at around $2.5, climbing steadily to over $3.6 by the end of the first day. Subsequently, it surged to over $4 before experiencing a decline.

By the week’s conclusion, CORE settled around $2.6.

Despite fluctuations, CORE secured the second-highest gains for the week, boasting an impressive increase of over 62% in seven days. Its market capitalization stood at around $2.3 billion at the time of writing.

Pendle

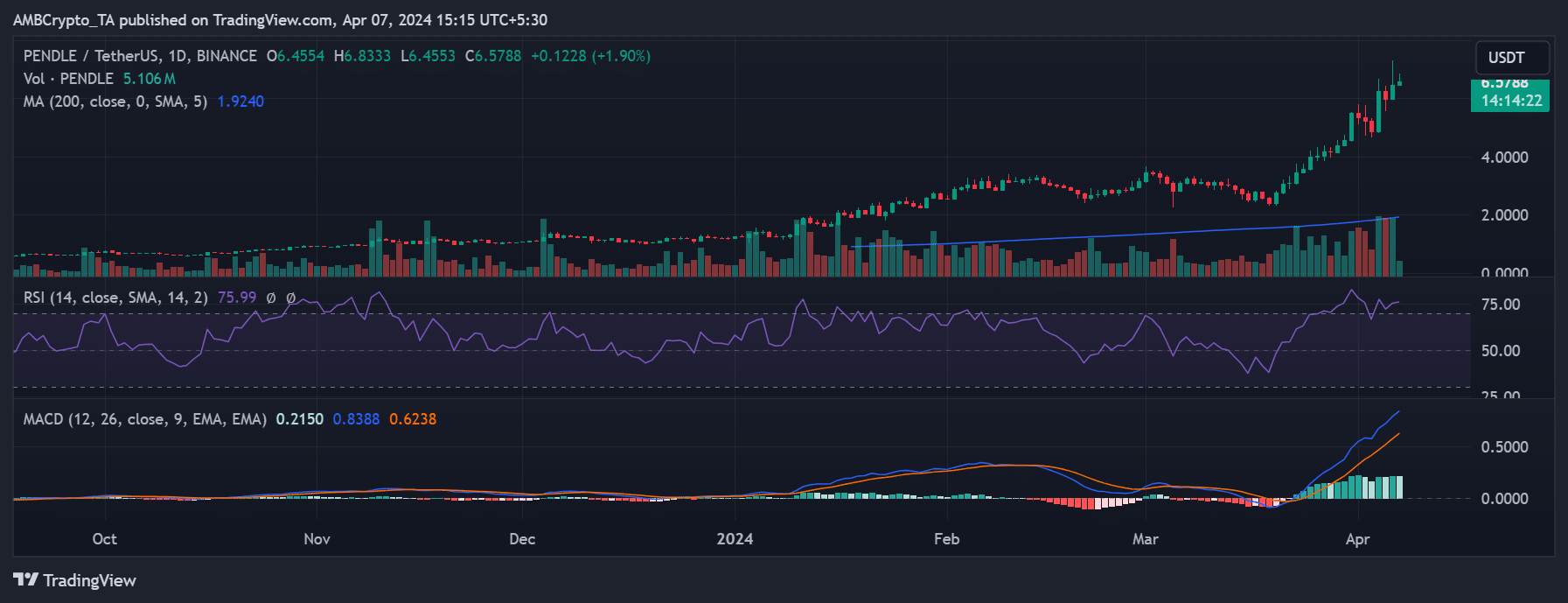

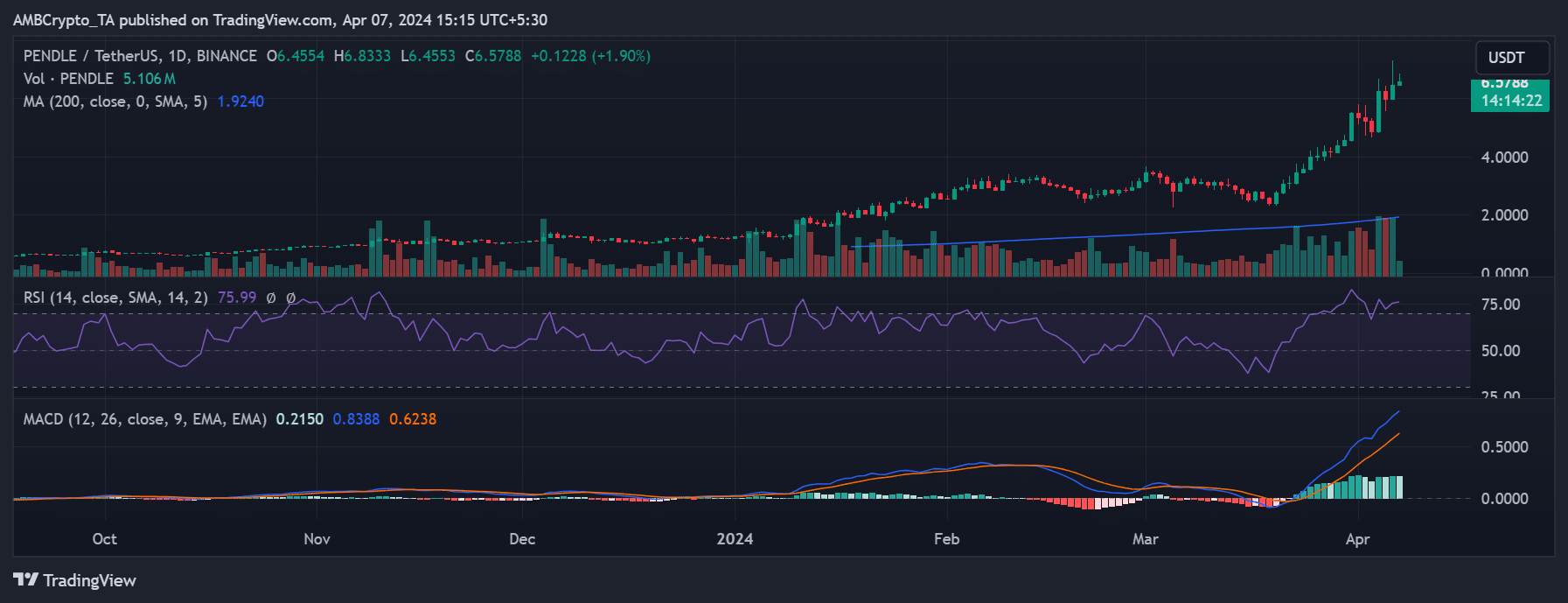

AMBCrypto’s analysis of the Pendle [PENDLE] chart revealed significant fluctuations over the past seven days, securing its position as the third-highest gainer for the week.

Notably, Pendle experienced substantial upward swings from the 4th to the 6th of April. Between the 4th to the 5th of April, PENDLE surged from around $4.9 to over $6.4.

It witnessed another notable uptick, reaching a peak of over $7, resulting in a weekly gain of over 35.5%. At the time of writing, it was trading at around $6.5, boasting a market capitalization of over $1.5 billion.

Source: Pendle/USDT on TradingView

Biggest losers

Conflux

Conflux led the losers’ table with a significant loss of over 24% in the past week, according to data from CoinMarketCap.

Further analysis revealed that CFX began the week at around $0.4, but it had dropped to around $0.36 by the week’s end.

AMBCrypto’s examination of the chart showed a continuous decline in volume alongside the price decrease. At the beginning of the week, the volume was over $74 million, peaking at over $300 million at one point.

However, at the time of writing, the volume had decreased to around $35 million. Furthermore, CFX was trading at approximately $0.36 at the current time.

Wormhole

Earlier in the week, Wormhole [W] launched its token with an initial price of around $1.6 and a market capitalization of over $3 billion. This marked a significant success for the platform.

However, the price experienced a notable decline before the day’s end. By the week’s conclusion, analysis revealed that the price had fallen to around $1.06, resulting in a loss of approximately 22.6%.

Additionally, this decline reduced its market capitalization to around $1.9 billion at the time of writing.

While the Wormhole token launch represented a significant milestone for the platform, it faced a major setback in its first week of trading.

Floki

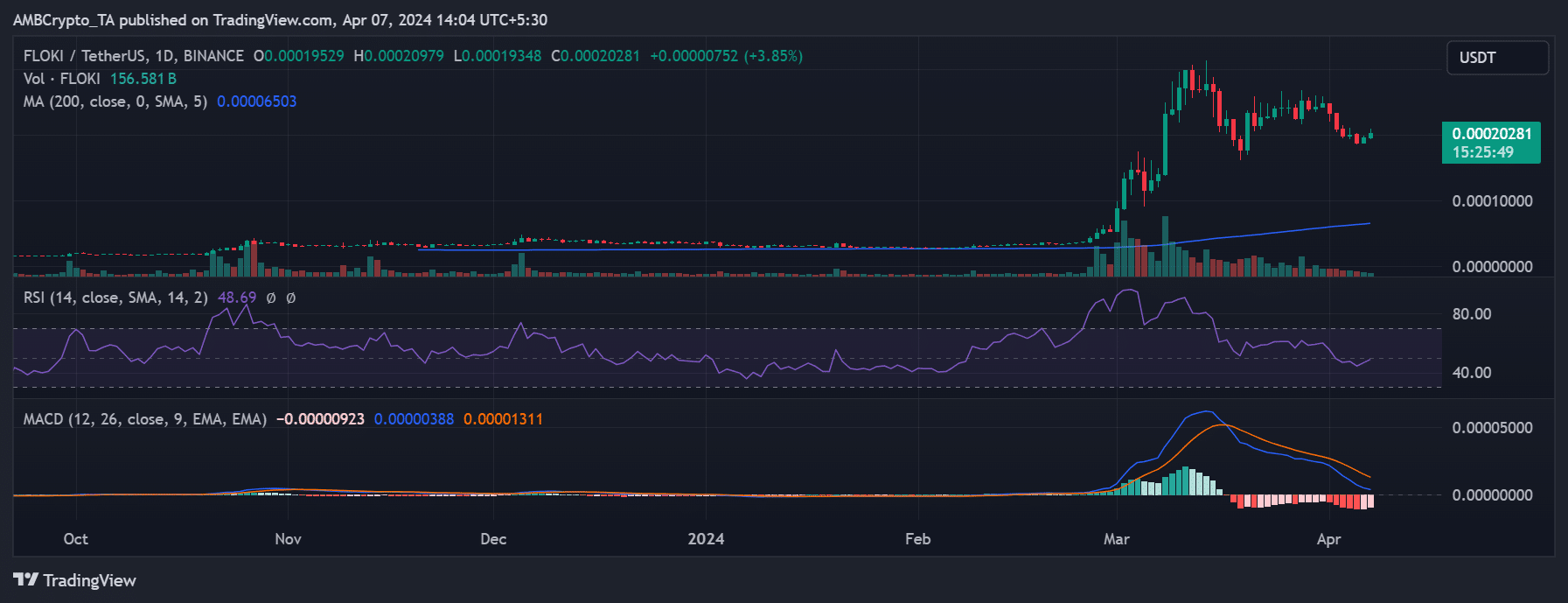

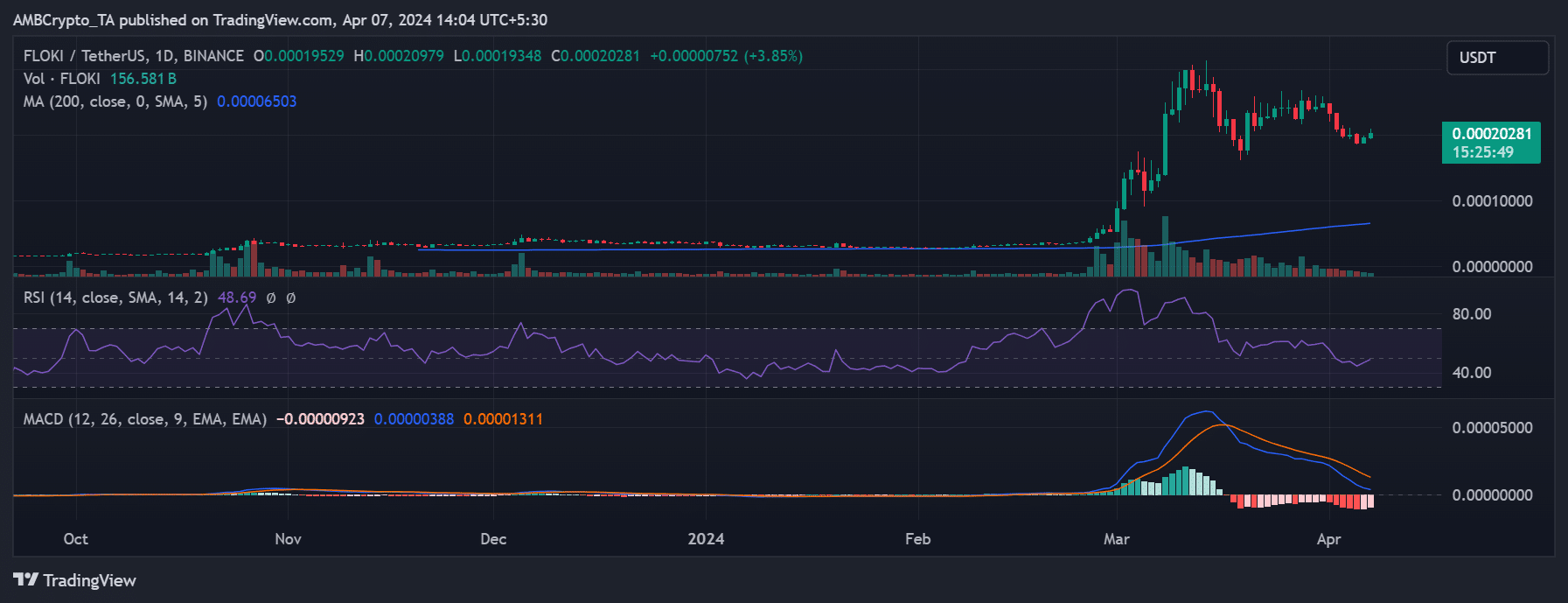

Due to their surging prices, meme coins have garnered significant attention in the crypto space in recent weeks.

However, Floki Inu [FLOKI] couldn’t maintain this momentum and emerged as the third-biggest loser in the past week, experiencing a decline of over 19.2%.

AMBCrypto’s analysis of its daily timeframe chart showed consecutive losses throughout the week. Nevertheless, towards the end of the week, Floki witnessed a notable increase of over 3.8%.

At the time of writing, its upward trend persisted with another increase of over 3%.

Source: TradingView

Its Relative Strength Index (RSI) revealed a decline below the neutral line as its price decreased. However, with the consecutive price uptrends observed, it was nearing a potential climb back above the neutral line.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, it is best to do your own research (DYOR) before making any investment decisions.