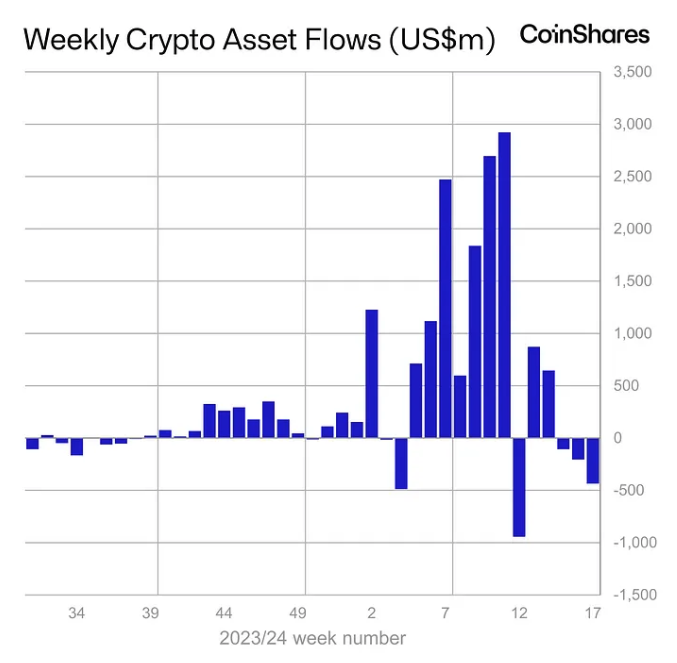

Global crypto investment products at asset managers such as Ark Invest, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered a third-consecutive week of net outflows totaling $435 million last week, according to CoinShares’ latest report.

The figure is the largest since a record of nearly $1 billion in outflows was recorded during one week last month as bitcoin corrected after reaching its latest all-time high of $73,836 on March 14.

Weekly crypto asset flows. Images: CoinShares.

“Trading volumes in exchange-traded products fell to $11.8 billion last week compared to $18 billion the prior week, while bitcoin prices fell by 6%,” CoinShares Head of Research James Butterfill added.

BTC

BTC

-1.13%

/USD price chart. Image: The Block/TradingView.

Grayscale’s outflows decelerate but so do inflows from new issuers

Most of the outflows were from the incumbent Grayscale, which converted its Bitcoin Trust product into a spot bitcoin exchange-traded fund in January. Grayscale’s GBTC contributed $454.1 million in outflows last week alone. However, this was the lowest level for nine weeks, Butterfill pointed out.

“While Grayscale’s outflows continue to decelerate, we have also seen a deceleration in inflows from new issuers, which saw only $126 million in inflows last week, compared to $254 million the week prior,” Butterfill added.

BlackRock’s IBIT spot bitcoin ETF witnessed three days of zero flows last week as its 71-day inflow streak — putting it in the top ten ETFs of all time — came to an end. Fidelity’s FBTC and Valkyrie’s BRRR also witnessed their first daily outflows last week.

Overall inflows for the spot bitcoin ETFs have slowed considerably since peaking at a net daily inflow of $1.05 billion on March 12, according to The Block’s data dashboard.

US-based bitcoin products continue to dominate

Regionally, the U.S.-based crypto investment funds continued to dominate, representing $388 million in weekly outflows. However, year-to-date inflows remain at a record $13.6 billion, Butterfill noted. Germany and Canada-based products saw outflows of $16 million and $32 million, respectively, while Switzerland and Brazil bucked the trend, registering $5 million and $4 million worth of inflows.

Bitcoin products witnessed the most outflows last week, totaling $423 million, followed by $38 million from ether-based funds. However, altcoin investment products, such as Solana, Litecoin and Chainlink funds, saw inflows of $4 million, $3 million and $2.8 million, respectively.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.