- A bullish flag pattern appeared on the weekly altcoin market capitalization chart.

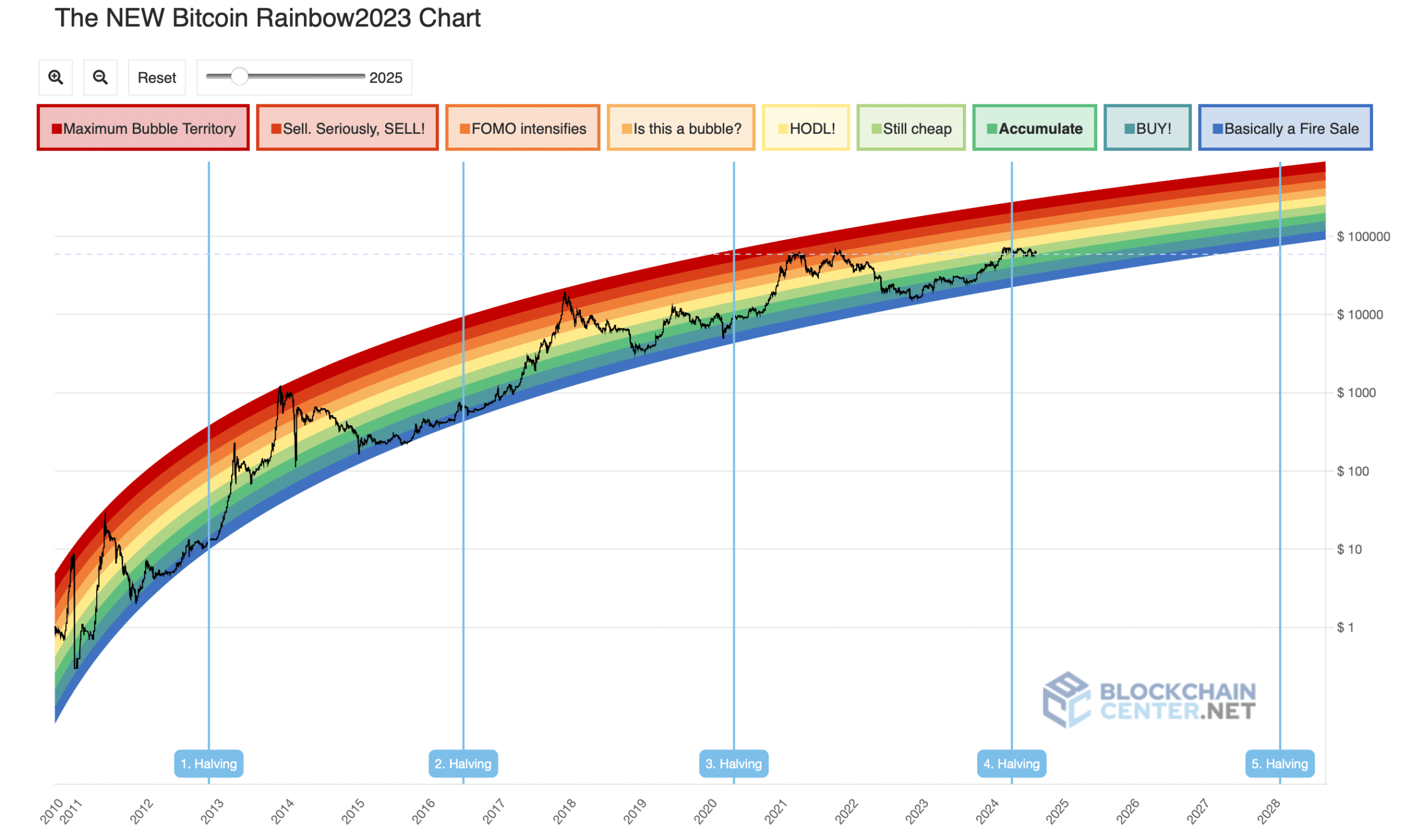

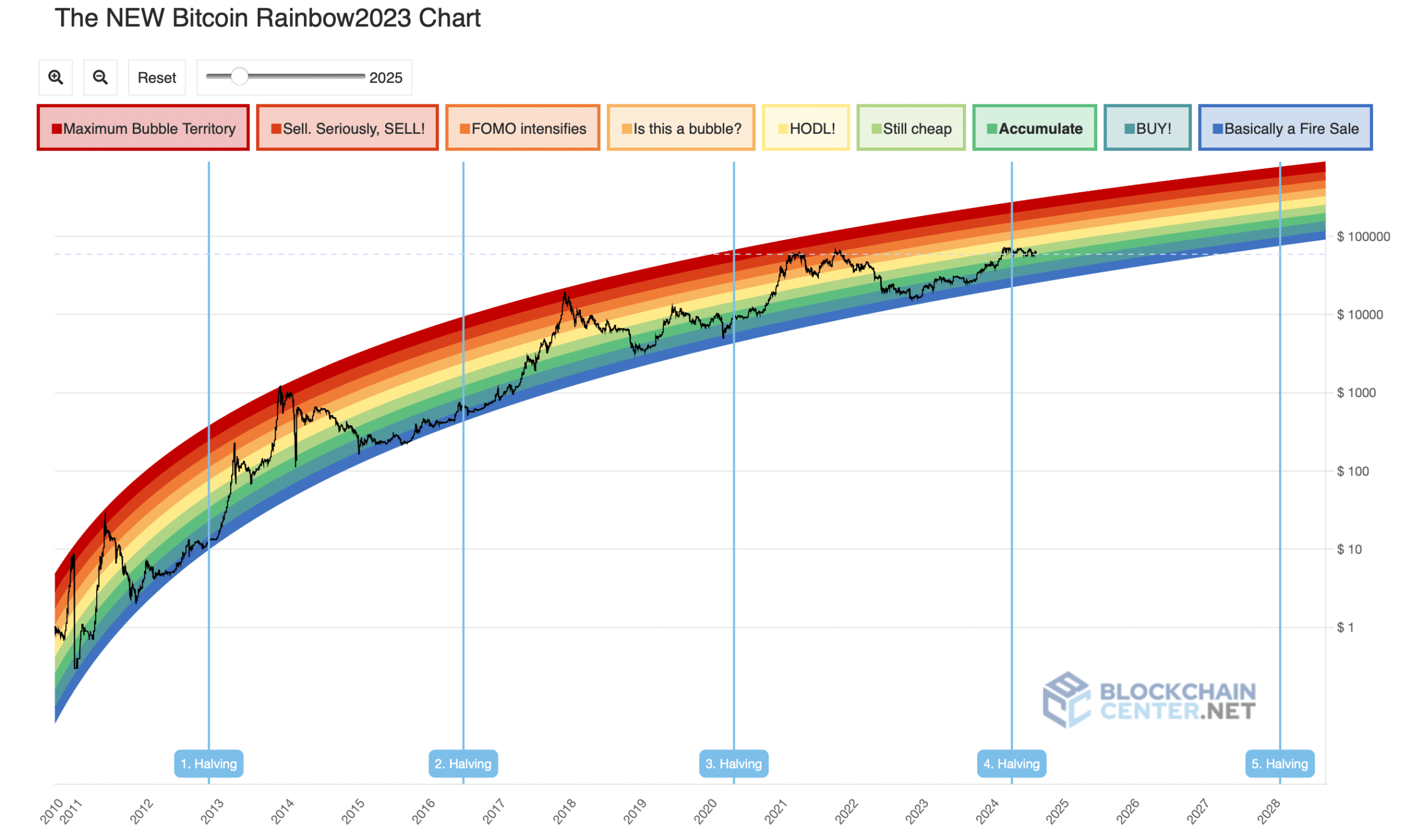

- The Bitcoin rainbow chart suggested that BTC was in the “still cheap” phase.

The crypto market has witnessed multiple upswings this year, but none of them lasted long. Most of these price increases were followed by corrections. However, things in the last quarter of the year might be different.

This seemed to be the case as several factors hinted at a long-term bull cycle, which had potential to push the market to new highs. Let’s have a closer look at what was hinting at a crypto bull run in the coming months.

Bitcoin to lead the next crypto bull run?

Bitcoin [BTC] surprised investors this year as it managed to reach an all-time high of over $72k during the first quarter. Ethereum [ETH], the king of altcoins, also gained bullish momentum during that time but failed to test its ATH by a huge margin.

Nonetheless, BTC soon dropped from that level and has somewhat been struggling. For instance, in the last 24 hours alone, BTC’s price dropped by 5% and was trading at $59,097.36.

ETH’s fate was similar, as it witnessed a 7% price dip. At press time, ETH had a value of $2,458.85.

However, the upcoming months might be different, as BTC might be planning a massive rally if historical data is to be believed. Bitcoin has always gained bullish momentum after a few months of its halving.

In fact, BTC has always hit an ATH after halving. To be precise, after BTC’s 2nd halving on the 9th of July 2016, BTC turned bullish and reached an ATH in December 2017.

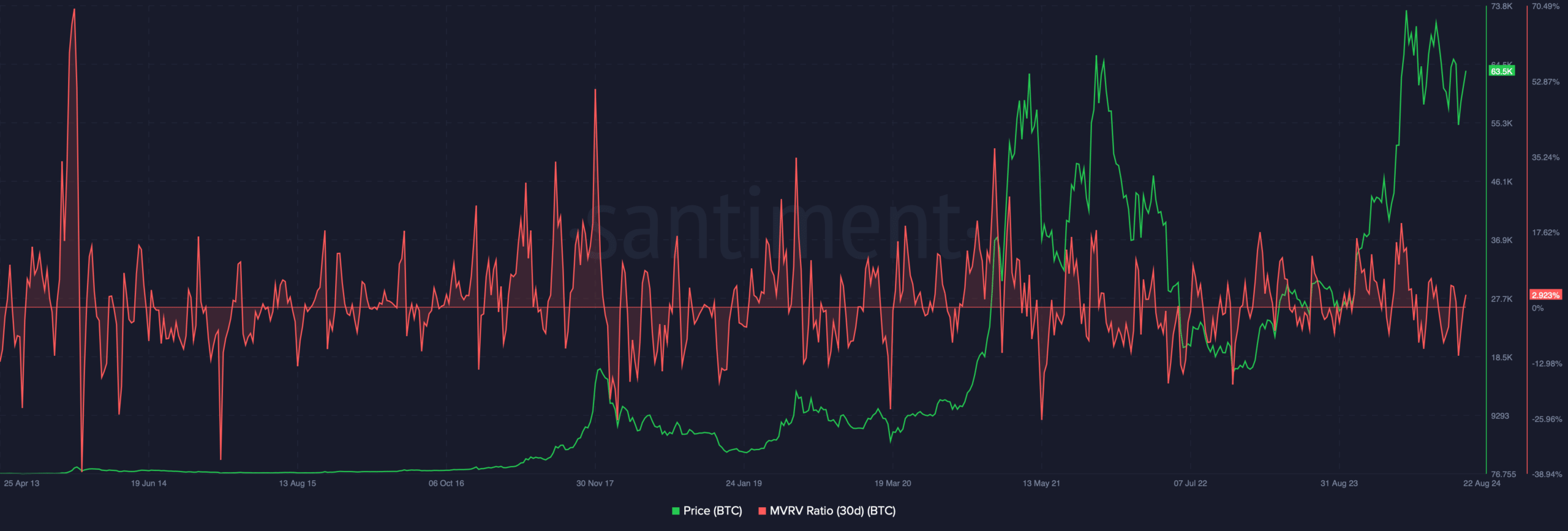

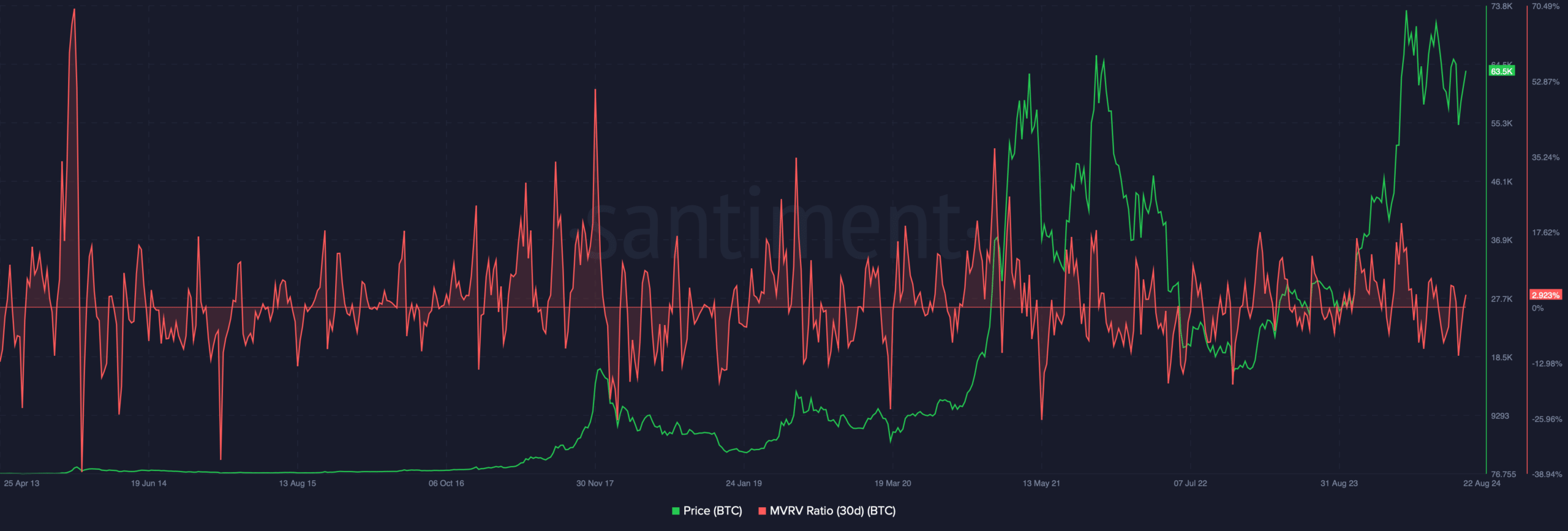

Source: Santiment

Similarly, after its third halving on the 11th of May 2020, BTC gained bullish momentum in October 2020 and reached an ATH a few months later. Since BTC’s latest halving happened in April 2024, the chances of BTC showcasing a bull run in Q4 2024 were high.

Another interesting metric to keep an eye on is the MVRV ratio. A close look at the metric suggests that it goes above 30% each time BTC reaches an ATH.

At press time, BTC’s MVRV ratio had a value of 2.92%. This clearly suggested that BTC was awaiting a price increase in the coming months.

Apart from that, AMBCrypto’s look at the Bitcoin Rainbow Chart revealed that BTC was in the “still cheap” phase. This indicator also suggested that investors should consider buying the coin before it turns bullish.

Source: Blockchaincenter

Altcoins are also planning a rally soon

Generally, the market tends to follow BTC as it is the largest crypto. Therefore, in case of a BTC bullish breakout, the chances of altcoins also turning bullish were high.

Nonetheless, altcoins also have a trick up their sleeves, hinting at a bull run. AMBCrypto’s look at the weekly altcoin market cap chart revealed a bullish flag pattern.

Source: TradingView

The bullish pattern emerged in March, and since then the altcoin market cap has been consolidating inside it. If a bullish breakout happens in the upcoming months, then investors would witness a major rise in the altcoin market cap.

In fact, a breakout could allow the altcoin market cap to reclaim $1.24 trillion before it begins its journey towards its ATH of $1.58 trillion.

However, things in the short term might not be good, as there were chances of the market cap dropping to its support level of $702 billion. At that level, the market cap graph might rebound and head towards the upper limit of the bullish flag pattern.

The altcoin season index continued to remain in BTC’s favor as it had a value of 24. A number closer or higher than 75 indicates an altcoin season.

Source: Blockchaincenter

Why memecoins have great potential

While most eyes were on top cryptos like BTC and ETH, investors shouldn’t belittle memecoins as these cryptos have had promising performance over the last several months.

Apart from top memes like Dogecoin [DOGE] and Shiba Inu [SHIB], Solana [SOL]-based memecoins have recently gained much traction.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

For reference, dogwifhat [WIF] has displayed more than 800% price rise since its inception in 2024. POPCAT, which was one of the latest additions to SOL’s meme ecosystem, showcased even better performance as its value surged by 4184% since launch.

Therefore, while we monitor the performances of top market cap cryptos, it will also be crucial to see how the namecoin market does during the next crypto bull run.