Pseudonymous analyst Rekt Capital says that one benchmark indicator is signaling that Bitcoin (BTC) is currently undervalued, with more upside to be captured.

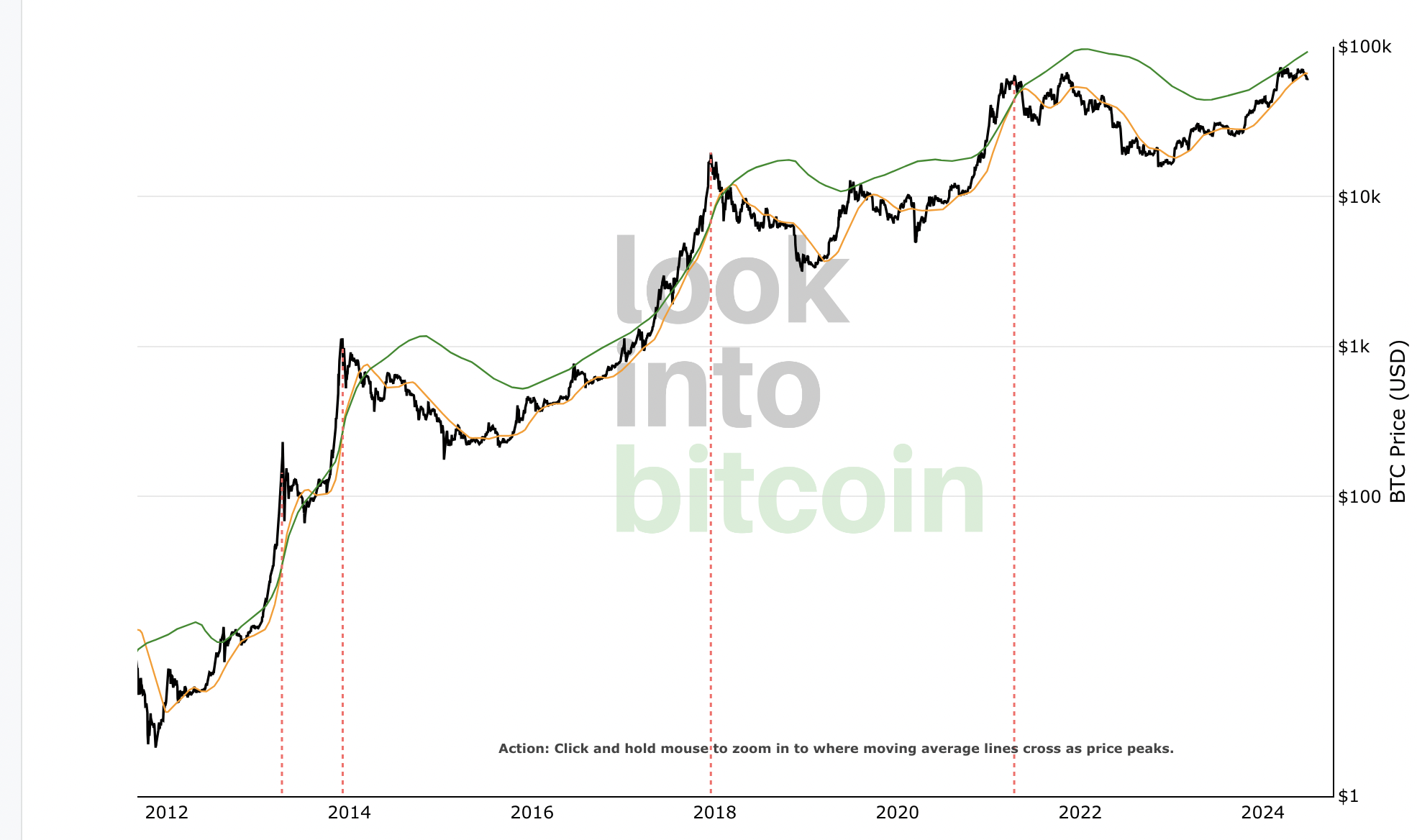

In a new video update, the analyst takes a look at the Pi Cycle top indicator, which has been used on Bitcoin for nearly a decade.

The Pi Cycle top indicator uses the 111-day moving average (DMA) and a multiple of the 350 DMA.

According to Rekt Capital, price trading below the 111 DMA has historically been a “bargain” opportunity for BTC bulls.

“If we’re thinking about this halving year, then holding this moving average (111 DMA) is quite important and we’ve seen small deviations and a deviation below the orange moving average has historically been a bargain buying opportunity.

We’re currently seeing this deviation for the first time in 2024.

Throughout 2017, any deviation below the orange moving average has been a fantastic buy-side opportunity. This is probably going to be the moment of absolute extreme fear and capitulation on the sell side.

On the upside, we tend to see revisits of the green moving average, and when we do see these revisits, we tend to reject on the first time of asking. On the second time or third time of asking, we break beyond this green moving average. We’re probably going to be able to over-extend beyond there, like we’ve seen many times in the past.”

At time of writing, Bitcoin is trading at $63,278.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3