- LINK experienced a sharp bearish reversal, losing most of its gains from earlier in the month.

- There is a decline in trading volume and a predominance of bearish positions in the derivatives market.

After staging a remarkable recovery with the bulls, Chainlink [LINK] seems to have decided to ditch them and side with the bears for now, as it shed almost all of its gains in May.

Taking a look at LINK’s monthly chart, we see an odd pattern forming. At the start of May, there was a sudden huge rally followed by an equally dramatic retracement.

Chainlink’s bearish U-turn

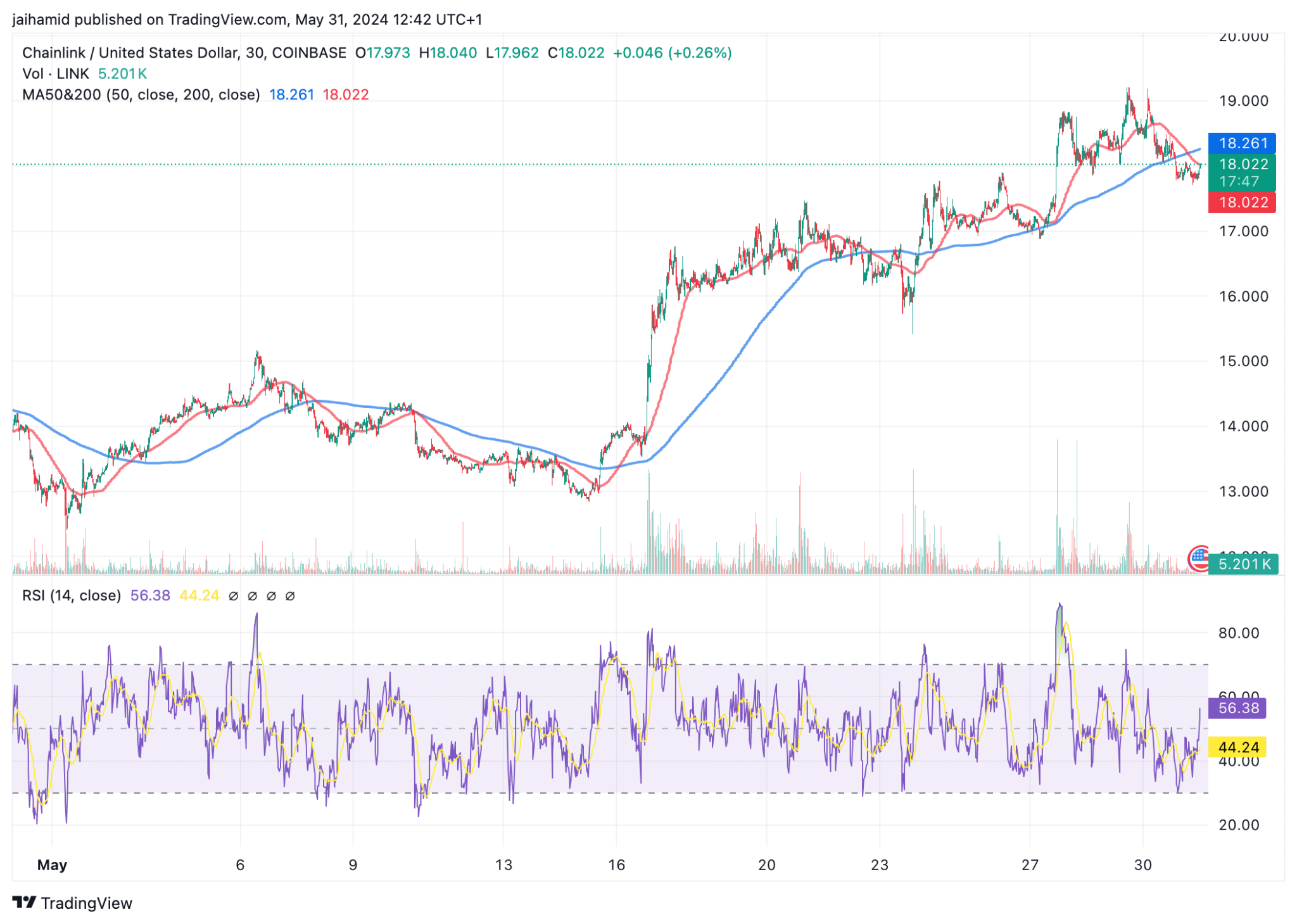

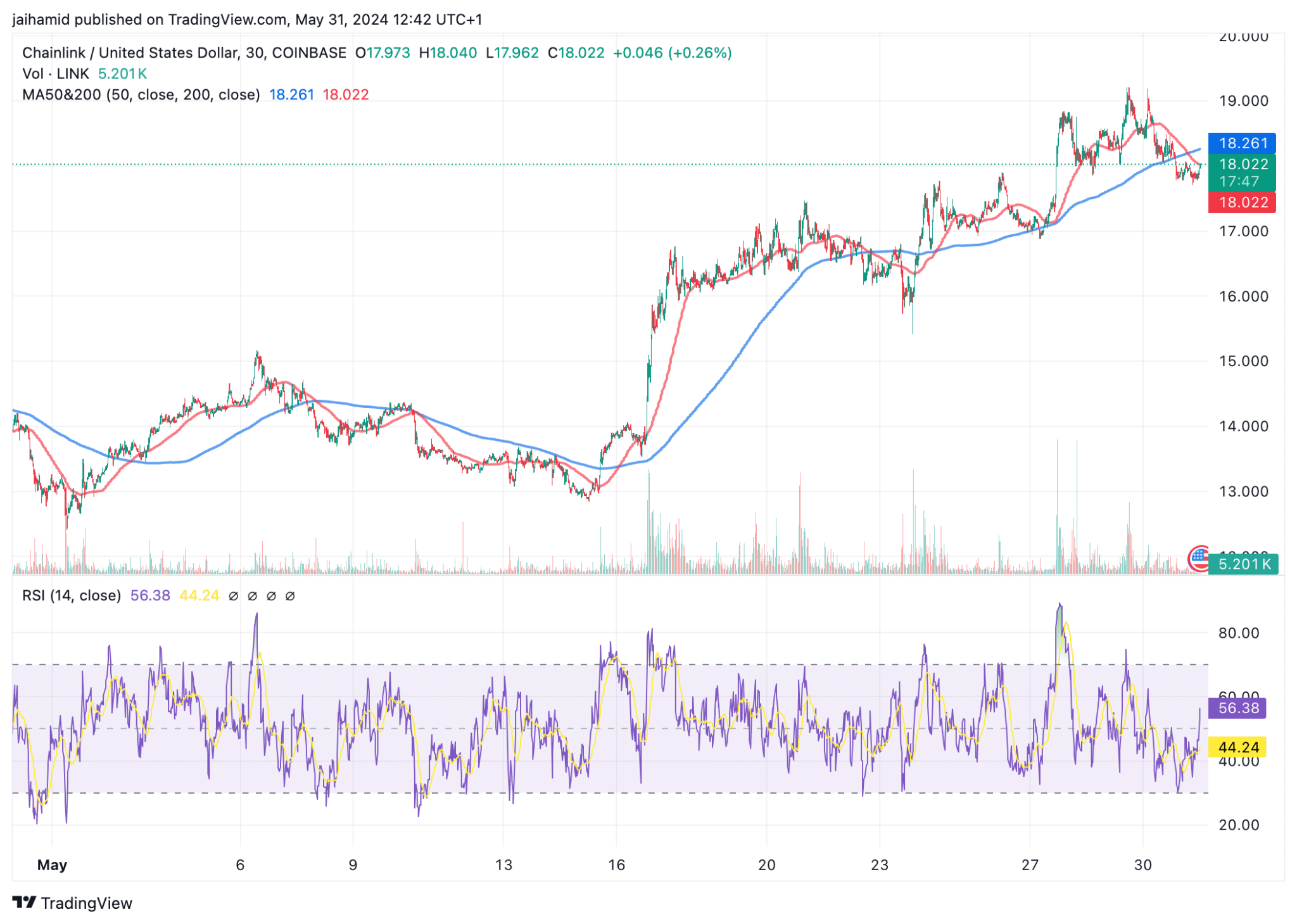

Chainlink exhibited strong bullish momentum initially, which is evident from the sharp rise in its price, which culminated in a peak around mid-May. This was clearly caused by the broader bullish sentiment in crypto markets.

Source: TradingView

However, starting on 27th May, the price action took a stark turn, with Chainlink relinquishing most of its gains in subsequent weeks.

The moving averages (MA50 in red and MA200 in blue) have shown a crossover, typically interpreted as a bearish signal in technical analysis. The price has dipped below both the MA50 and MA200, reinforcing the bearish sentiment around LINK.

The Relative Strength Index (RSI) also aligns with this sentiment, oscillating around the mid-line and trending downwards, suggesting a loss of upward momentum and bearish dominance.

Source: Coinglass

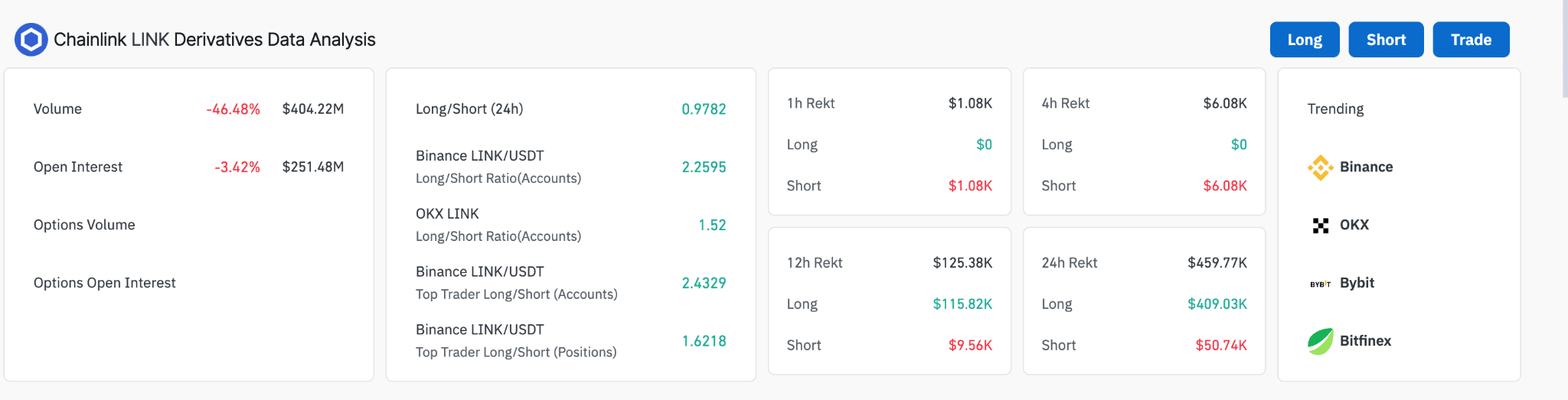

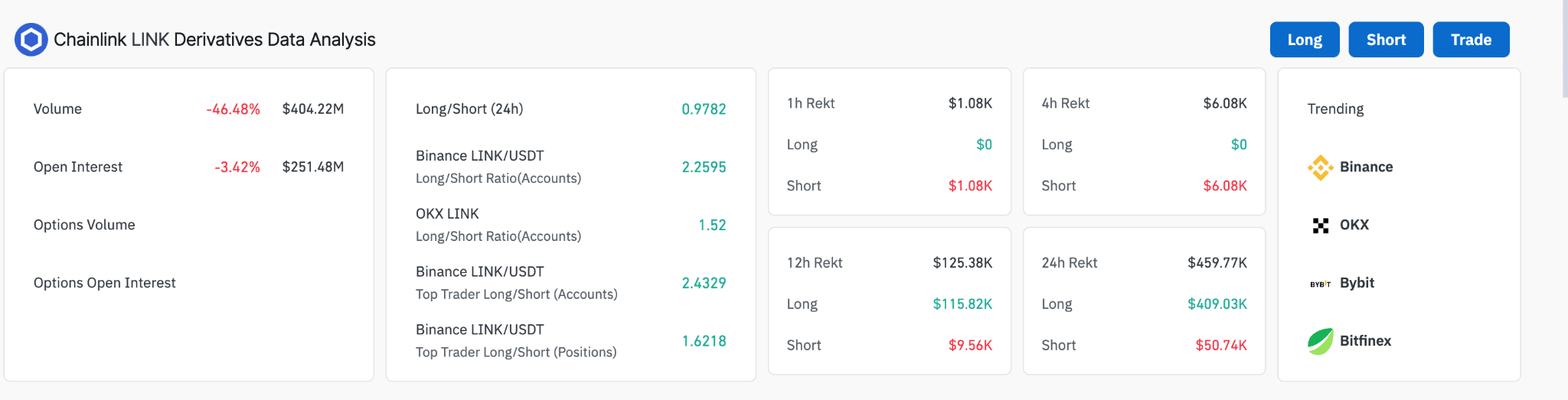

Turning our attention to LINK’s derivatives market, we see that trading volume has plummeted by 46.48%, indicating a huge pullback in trader activity and a swift change in market dynamics from earlier bullish fervor.

The long/short ratio remains below unity in the 24-hour window, showing a predominance of bearish positions.

Specifically, on Binance and OKX, although the top traders seem to maintain a slightly bullish outlook compared to the overall market, the dominance of short positions among general traders points towards a mixed sentiment at best.

Source: Coinglass

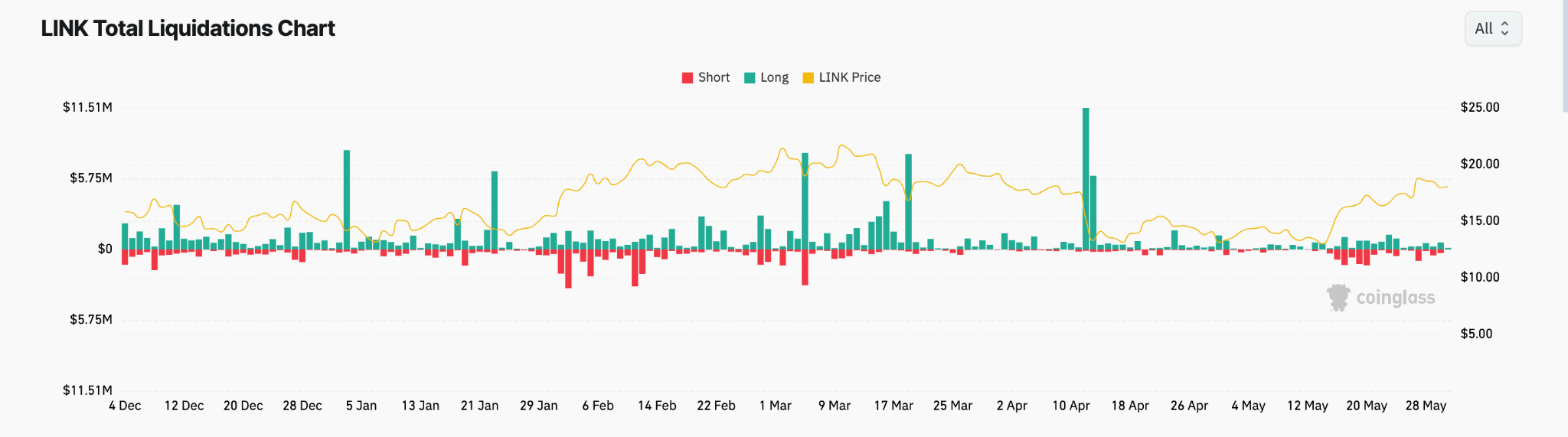

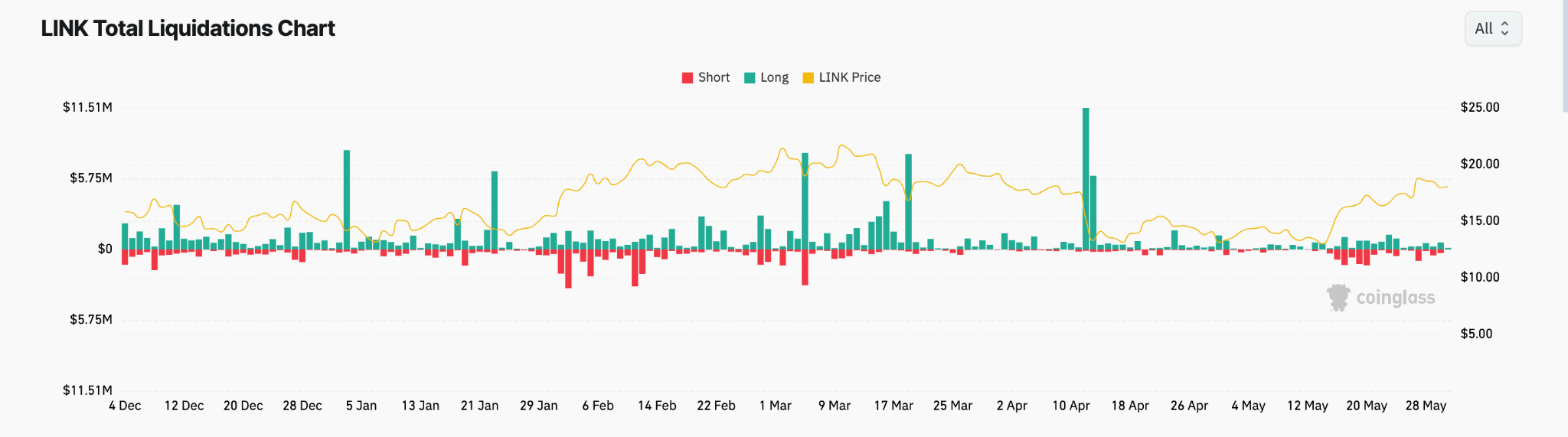

LINK’s liquidation chart shows a market where the bulls are frequently punished by rapid price corrections, leading to financial losses.

Is your portfolio green? Check out the LINK Profit Calculator

This erratic behavior, compounded by a recent downtrend in overall trading volume and open interest, is reason enough to believe that LINK will hang with the bears for quite some time.

Hitting $20 before Ether ETFs start trading seems highly unlikely.