- Chainlink’s developers put out more code commits than the other two.

- Traction on the network dropped and holder count decreased.

Chainlink’s [LINK] development activity has topped that of Cardano [ADA] and Polkadot [DOT] in the last 30 days. According to on-chain analytic provider Santiment, Cardano was number two in the rankings. Polkadot, which has been top of the table many times, dropped to 6th position.

Development activity looks at public GitHub activity drawn from a project’s repositories A developer’s time is an expensive resource. So, if a blockchain finds itself leading this chart, it means that the engineers trust the mission of the project.

Source: Santiment

Hence, they commit codes to improve the network. But Cardano and Polkadot’s decline does not mean that developers do not find them worthy. It only implies that Chainlink might have more features to ship out than the other two.

Is Chainlink more decentralized?

AMBCrypto checked if the project had any major upgrades coming up. But we could not lay our hands on one. However, we were able to find out the reason all hands were on deck at the cross-chain communication protocol.

For those, unfamiliar, Chainlink is one of the pioneer projects shilling tokenization in the ecosystem. Recently, we reported how projects with such fundamentals caught the attention of TradFi players.

TradFi is a short form for Traditional Finance. With the memo put out, it was only right that the blockchain boosts whatever work it was doing before in that regard.

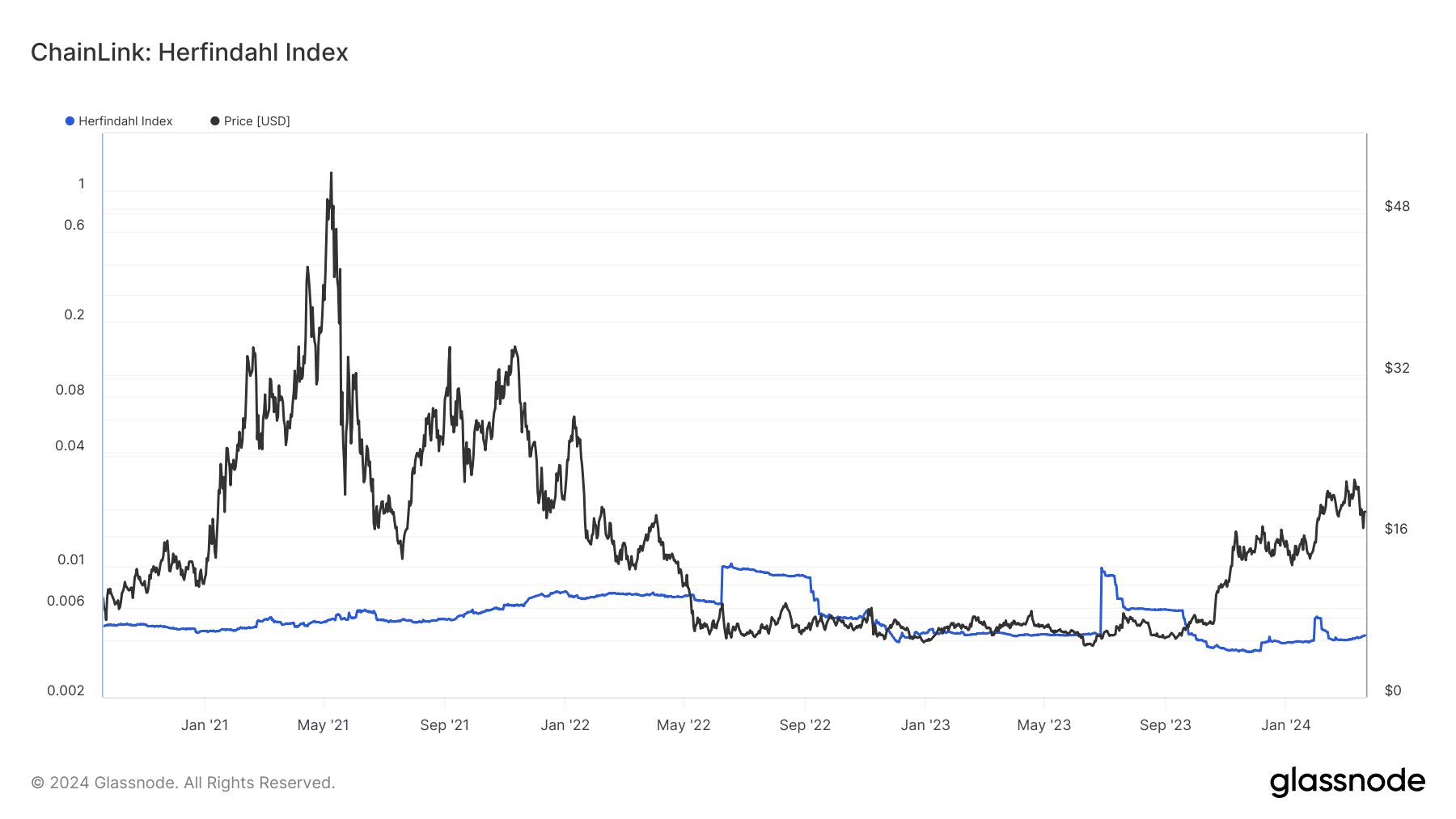

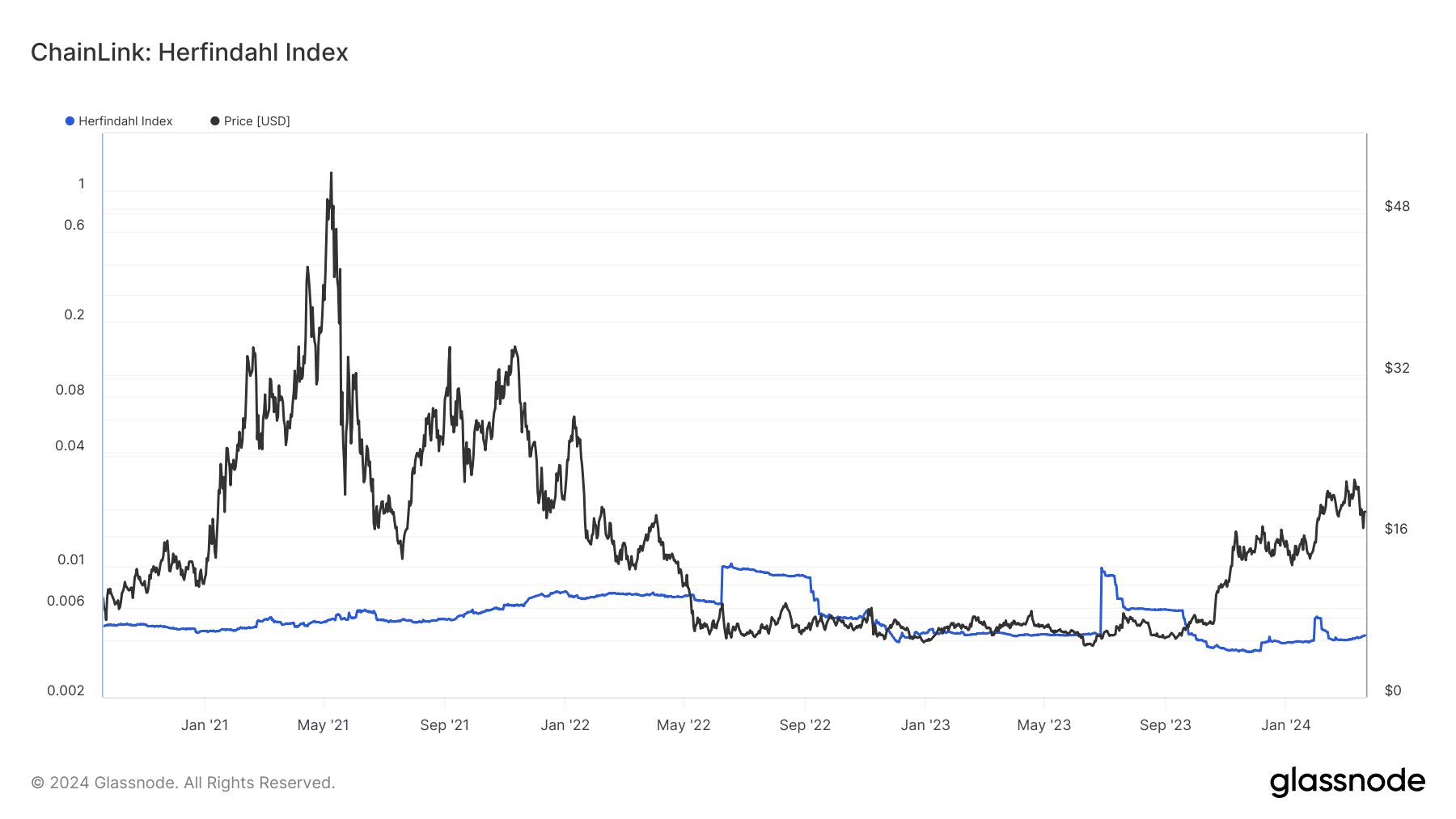

Furthermore, on-chain data from Glassnode revealed that Chainlink was doing well in decentralizing the network. This was because of the signal the Herfindahl Index showed.

Source: Glassnode

Network growth decreases

The Herfindahl Index is the sum of weighted addresses balance on a network. With this calculation, the metric can tell if a project’s decentralization is great or otherwise.

If the score is large, it implies a high supply concentration and uneven distribution. On the other hand, a small score indicates that funds are evenly distributed.

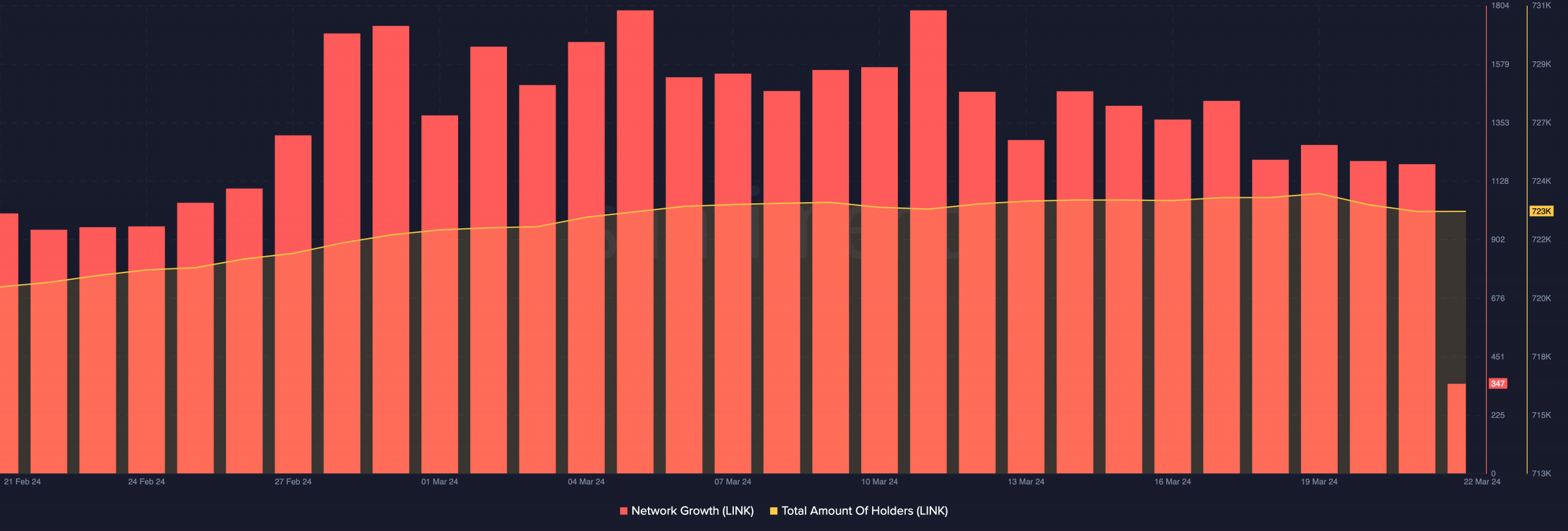

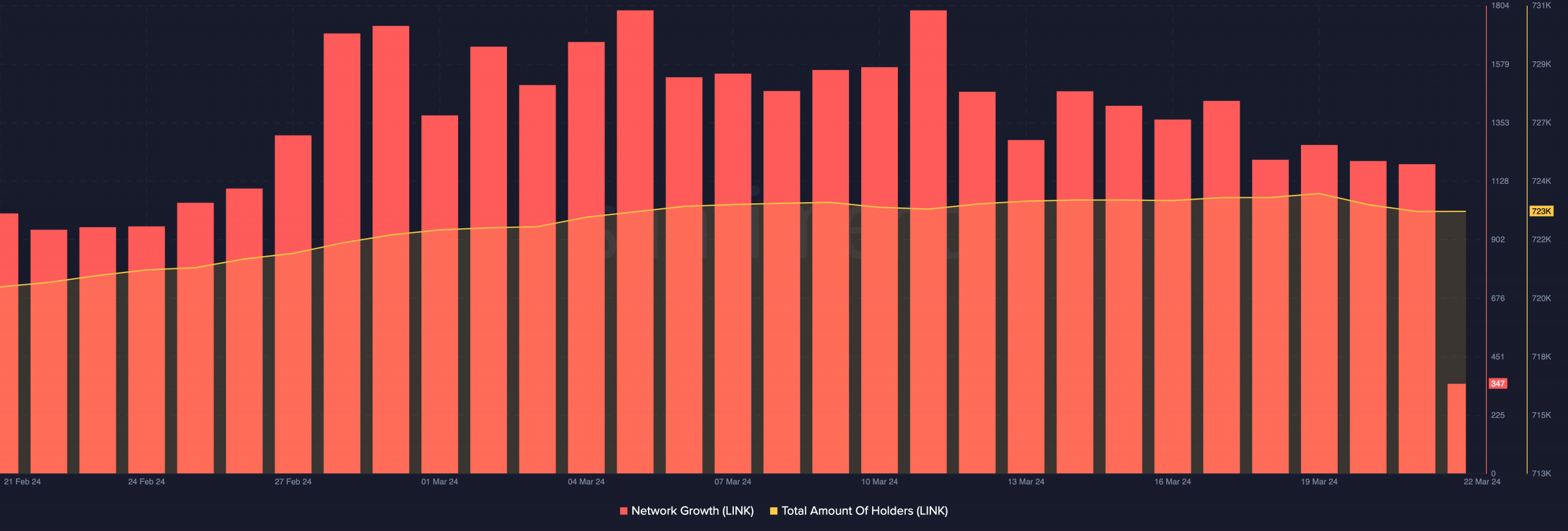

A more decentralized network could foster adoption. Hence, AMBCrypto went ahead to check if the project was getting a lot of traction. Using Santiment’s Network Growth metric, we noticed that the number increased to 1783 on the 11th of March.

Network Growth is the number of new addresses making their first transactions. At press time, the metric had declined to 347, indicating that adoption of LINK had decreased.

In addition, the total amount of LINK holders had reduced.

Source: Santiment

Realistic or not, here’s LINK’s market cap in ADA terms

On the 19th of March, the number of holders was 724,000. But as of this writing, that figure had changed to 723,000, indicating that some had let go of their previous holdings.

Moving on, Chainlink’s rise to the top of development activity is a great milestone. However, if Cardano and Polkadot increase their output, the project might not last long at that peak.