The promise of guaranteed high yields with downside protection is often a red flag when navigating a sea of DeFi app marketing speak.

Yields are often exaggerated while risks get buried. It’s easy to promote sky-high APRs when you print your own token to fund temporary incentives.

In the offchain financial world, however, there is such a wild beast emerging from the depths: Shark Fin notes.

DeFi app Cega Finance, a leader in exotic options and structured financial products, launched an onchain version on Ethereum and Arbitrum today.

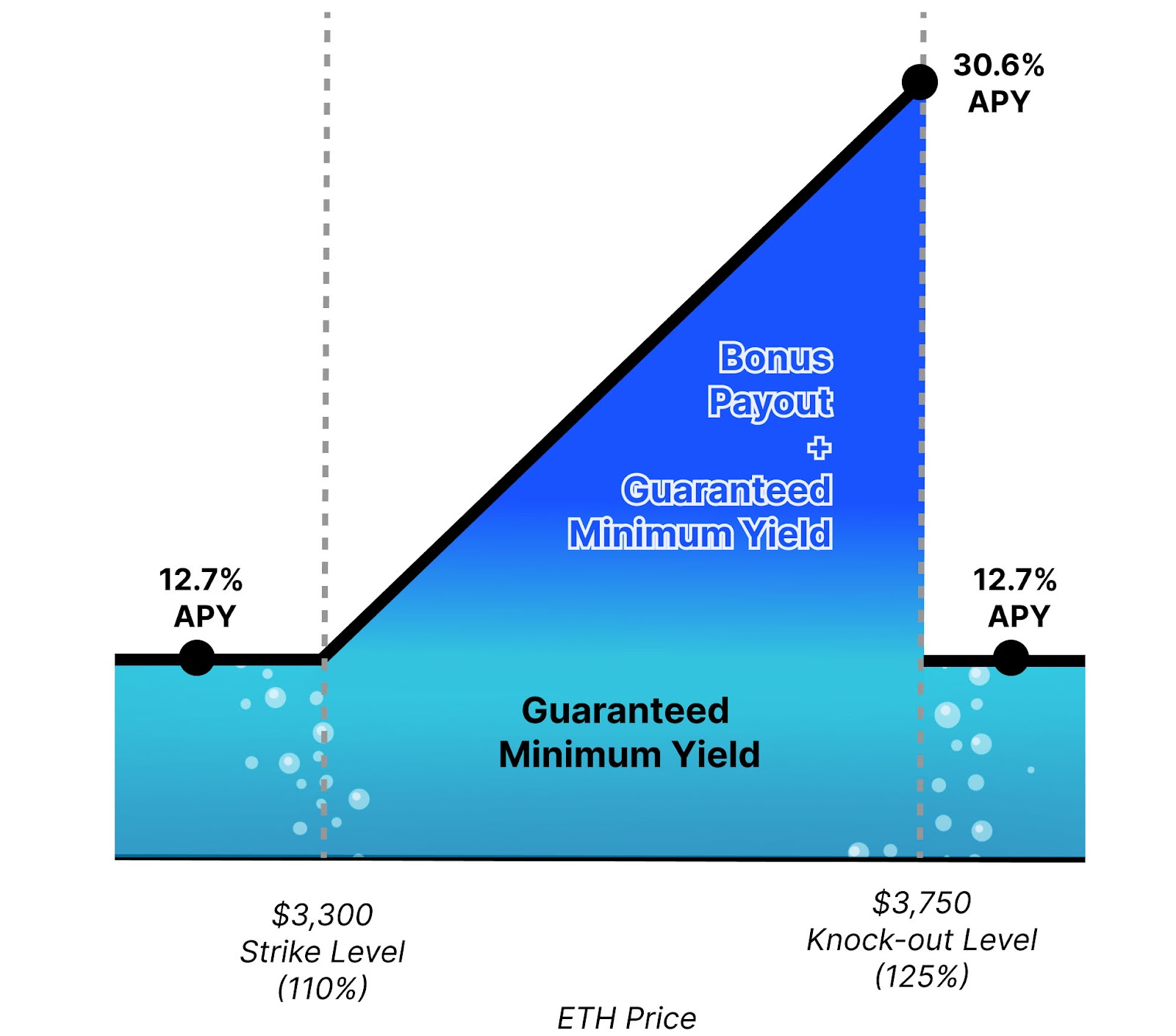

A Shark Fin is a type of structured financial product that offers a unique risk-reward profile. These notes provide investors with enhanced returns if the price of the underlying asset stays within a predetermined range. The name derives from the shape of the payoff diagram, which resembles a shark’s fin.

Source: Cega.fi

The potential returns sharply increase to a peak if the asset’s price remains within the range, and then level off or decline if the price moves beyond the specified threshold. This structure allows investors to benefit from stable market conditions while protecting against significant downside risk.

Cega’s launch provides conservative investors an onchain version with crypto as the underlying assets.

Expansion from Solana to Ethereum

Cega debuted its first four vaults on Solana almost exactly two years ago, but branched out to Ethereum in the second quarter of 2023.

Read more: Solana options protocol Cega comes to Ethereum

The decision to launch on the Ethereum Virtual Machine (EVM) was always part of Cega’s roadmap, but the collapse of FTX in November 2022 prompted Cega to expedite its plans, according to co-founder Winston Zhang.

“We knew that we couldn’t wait, and we wanted to continue growing,” Zhang told Blockworks.

Initially, the team considered expanding crosschain via LayerZero or Wormhole, but ultimately decided to hire a new team of Solidity developers to rebuild on Ethereum.

“While that was a little bit slower, it provides the best affordance for safety and security because we’re able to control the smart contracts design ourselves and not rely on a third party,” Zhang explained.

This transition, which took three to six months, was particularly a response to demand from large-scale investors like DAOs, funds and high-net-worth individuals who prefer the stability of Ethereum.

The decision to add Arbitrum was driven by its strong DeFi community and significant TVL, making it an ideal target audience for Cega’s products. Arbitrum’s growth, fueled by platforms like GMX, aligns well with Cega’s offerings, which appeals to trading aficionados and derivatives enthusiasts.

It’s not a migration — Cega maintains a presence on Solana with thousands of users, and the product will continue to be developed there.

“We are having conversations about what it means to reprioritize the Solana ecosystem and how to think about product parity for some of the new products that we’ve launched on Arbitrum and [Ethereum] mainnet,” Zhang said.

Making complex products accessible

One of the biggest challenges Cega faces is how to simplify complex financial products for their non-professional users. They made a conscious effort to create intuitive visualizations and straightforward documentation to avoid overwhelming users with technical jargon.

Typically reserved for accredited investors in traditional finance, the goal is to make this class of investment tools accessible to everyone, regardless of investment size.

“The products that we’re building are ultimately derivatives products, but they add a number of benefits for the end user that they can’t get from existing [perpetual futures] platforms or vanilla options platforms,” Zhang said.

The new “Shark Bull” vaults target users who might typically have capital on lending platforms like Aave, and want to increase their stablecoin yield without taking directional risk to crypto markets.

These vaults offer 100% principal protection with a guaranteed yield of 12.7%, and the potential for up to 30% returns under certain circumstances by combining lending and options strategies.

Stablecoins’ lending yield forms the baseline return, while a portion of the yield is used to purchase out-of-the-money (OTM) call options on crypto assets — the “bull” component, driving the high bonus payouts if prices rise.

The lending counterparties in this case are not smart contracts but major crypto market makers, so this introduces some credit risk. Cega facilitates these loans but is not a custodian, and manages the risk through stringent legal agreements and ongoing credit monitoring provided by Credora.

Read more: Bitcoin lenders have a new regulation-friendly option for yield

Cega, based in Singapore, emphasizes compliance with global regulations. These days, that requires geofencing the US-based customers.

Decentralization plans

The company raised a total of $9.3 million from notable investors including Dragonfly and Pantera, and does not yet have a token.

Zhang said his team deliberately avoided participating in the points incentivization game popular over the past year, preferring to focus on providing real sustainable yield.

“We’re actually really proud of that,” Zhang said.

Even without incentives, the platform has about $16.6 million in TVL currently, and about $404 million in cumulative trading volume.

Looking ahead, Cega does plan to launch a token while maintaining its core values of responsibility and prudence, Zhang said.

“There’s way too many protocols in crypto and in DeFi that just aren’t built on real foundations,” he said, citing the project’s published values.

“There just have been way too many examples in the ecosystem of carelessness, and lack of responsibility, and that is not us.”