- ADA whales have intensified coin accumulation.

- This has occurred amidst the steady drop in the altcoin’s value.

Cardano [ADA] whales have continued accumulating the altcoin despite the 30% decline in value in the last month.

In a post on X (formerly Twitter), on-chain data provider IntoTheBlock noted that in the last week, ADA had recorded a daily average of $13.84 billion in large transactions.

It added further that this represented one-third of Bitcoin’s [BTC] current volume, five times more than Litecoin’s [LTC] volume, and over sixteen times that of leading meme coin Dogecoin [DOGE].

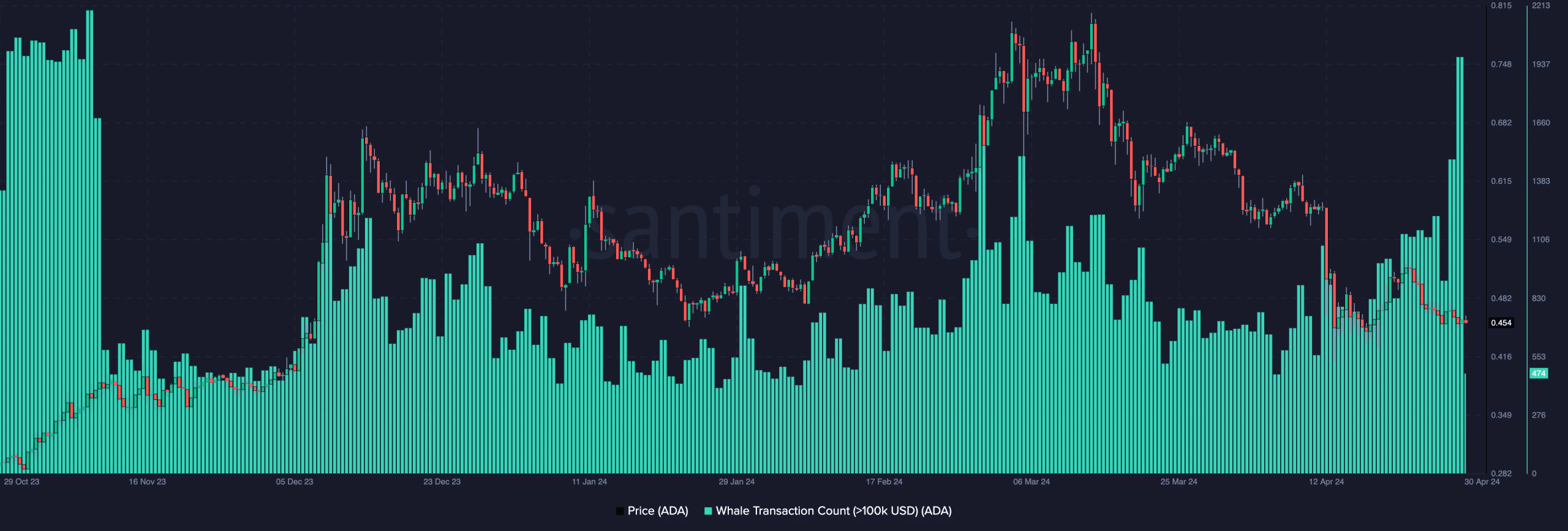

Also, Santiment’s data showed that the coin witnessed a surge in its daily count of whale transactions that exceeded $100,000 on 29th April. On that day, these transactions totaled 1,776, the coin’s highest daily count since 8th November 2023.

Source: Santimennt

According to the data provider, “These spikes in whale activity historically correlate with potential price reversals.” Is ADA poised for a rally in the short term?

ADA may extend losses

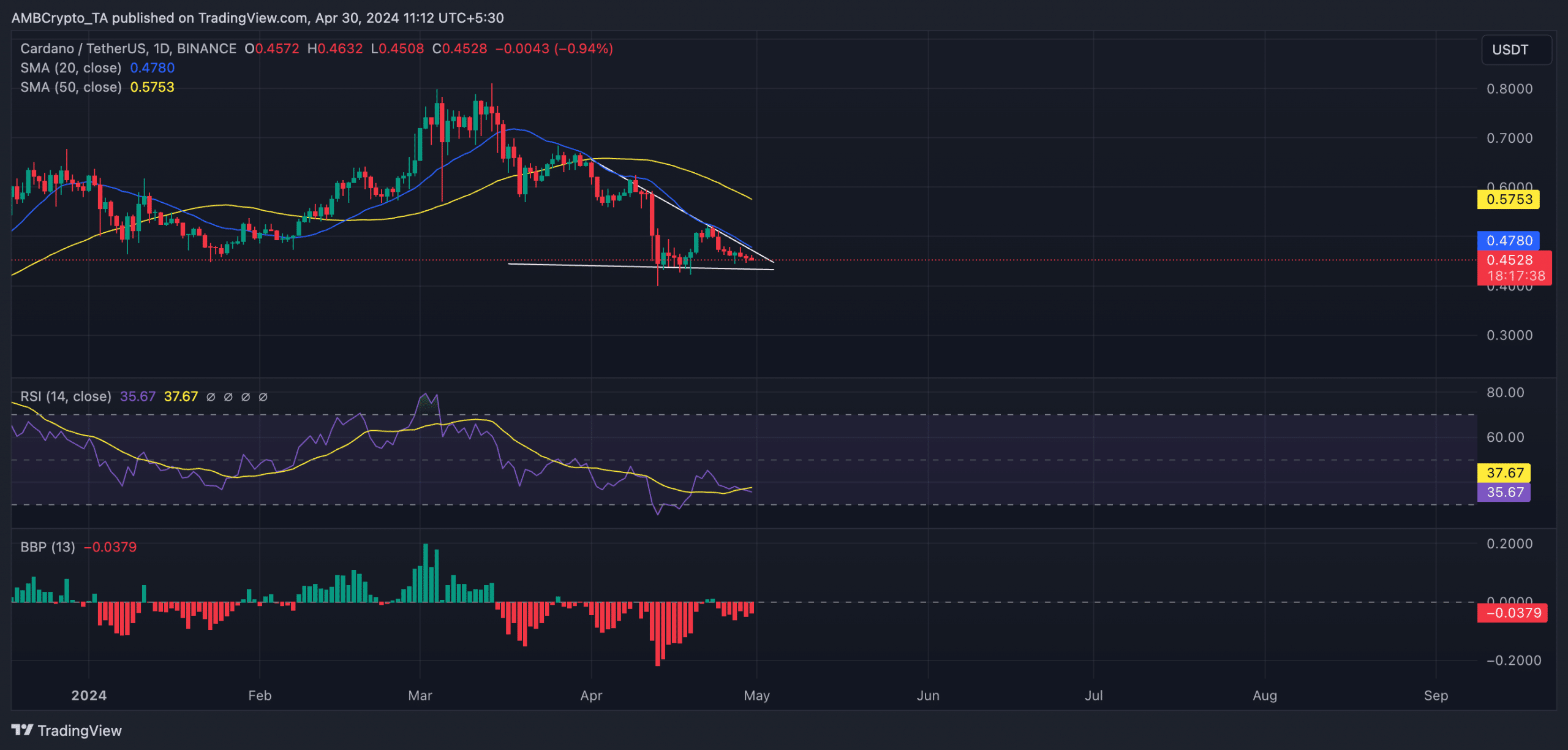

At press time, ADA exchanged hands at $0.45. An assessment of its performance on a 1-day chart showed the coin’s price positioned below its 20-day and 50-day moving averages (MAs).

These MAs often serve as support levels. So, when an asset’s price drops to these levels, it usually suggests a temporary pause in the price decline as buyers step in. However, if the price breaks below these MAs with strong selling volume, it could confirm the downtrend signal.

ADA’s price trended below these MAs on 1st April. The decline in its Relative Strength Index (RSI) indicator confirmed the accompanying hike in the coin’s selling pressure since then.

ADA’s RSI was 35.67 at press time, suggesting that the coin would soon become oversold if selloff momentum persisted.

Since its price broke below the MAs on 1st April, ADA’s price has fallen by double digits, according to CoinMarketCap’s data.

Confirming the decline in ADA accumulation, the value of its Elder-Ray Index was negative at press time. It has posted only negative values since 15th March, a few days after the coin’s price peaked at a year-to-date high of $0.77 before trending downward.

The indicator measures the relationship between the strength of an altcoin’s buyers and sellers in the market. When its value is negative, bear power dominates the market.

Read Cardano’s [ADA] Price Prediction 2024-25

However, the prolonged decline in ADA’s value has led to the forming of a descending triangle.

If sentiment changes, the coin’s price can bounce off support at $0.45, trend upward to exchange hands at $0.49, and even climb above $0.52.

Source: ADA/USDT on TradingView