- ADA’s price has rebounded to $0.48, allowing investors who bought at this price to break even.

- Analysts highlight the ADA/BTC ratio reaching a low point, indicating a likely rally for ADA.

Cardano [ADA] has surged back to the $0.48 price point, which is a major turnaround as billions in investments move from loss to potential profit.

This comeback comes at an important time for holders who bought at or above this threshold, changing the sentiment from red to a promising green.

Breaking even and beyond

Investors who placed their bets on ADA at the average price of $0.48 are now seeing their patience pay off. With the token reclaiming that value, those previously underwater are finally breaking even.

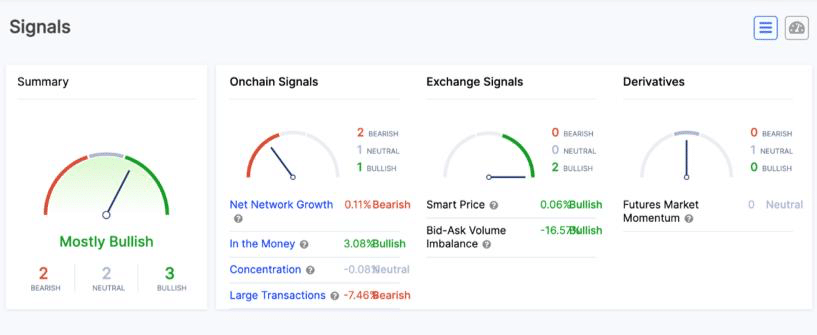

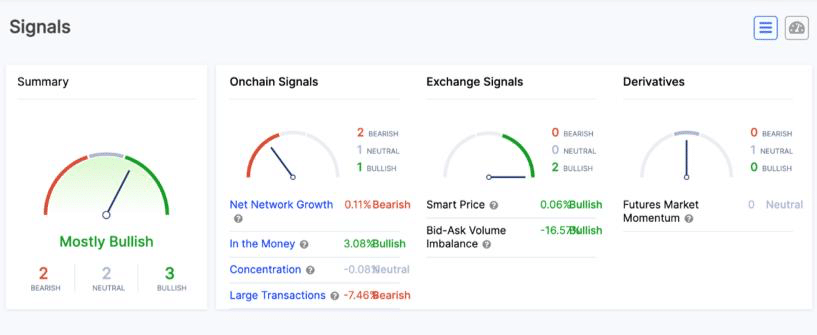

A predominantly bullish sentiment is showcased by IntoTheBlock’s data, which indicates a “Mostly Bullish” outlook by investors at press time.

This upswing is underpinned by a modest 0.11% net network growth and a 3.08% increase in holders ‘In the Money,’ meaning that a larger number of investors are seeing profits.

Source: IntoTheBlock

However, investors should remain cautious, as the dashboard also reveals a -7.46% drop in large transactions, suggesting a decrease in major institutional activities.

Furthermore, a notable bid-ask volume imbalance (-16.57%) points towards potential selling pressure.

This means it is necessary to be vigilant of market dynamics in order to ascertain the sustainability of this rally in ADA’s price.

ADA’s resilience and outlook

The one-hour ADA trading chart showed an uptick in price movement, briefly touching the $0.48 mark before consolidating around $0.4776 at press time.

The volume spike accompanying the price rise confirmed strong buyer interest at lower price levels. But the bulls are still not in full control.

This consolidation indicates a balancing act between the bulls and the bears, with neither side taking definitive control.

Source: TradingView

Read Cardano’s [ADA] Price Prediction 2024-25

Given the current consolidation pattern and the observed trading volume, ADA may continue to test the $0.48 resistance.

If buyer momentum increases, breaking this level could see further gains, otherwise, expect some sideways movement as the market seeks new catalysts or data points to drive the next price action.