- Expectations associated with Spot Ethereum ETFs are high on the back of their launch

- Ethereum’s utility, adoption, transactions, and fees could come in handy for the altcoin

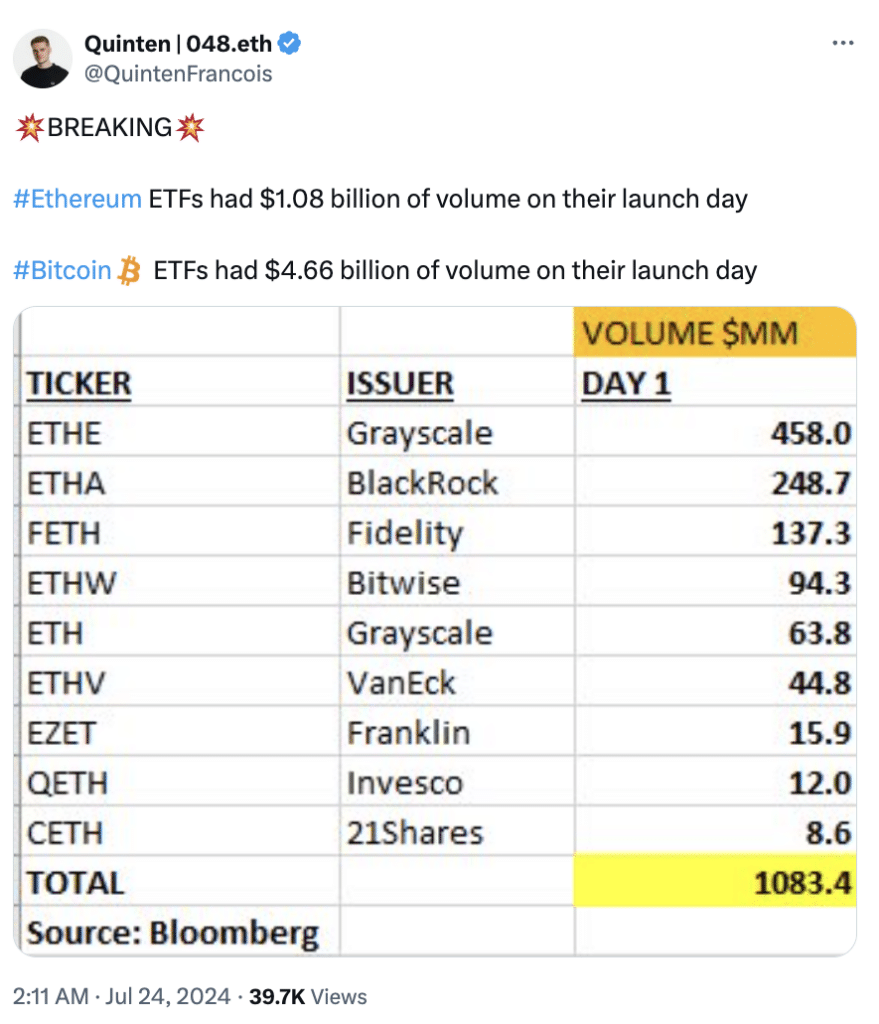

It has been more than 24 hours since Ethereum ETFs went live, with initial reports being fairly promising. In fact, the first day of trading reportedly yielded over $1 billion in trading volume.

Ethereum ETFs’ trading volumes on the first day of trading suggests that it is off to a good start. However, can it build up and surpass Bitcoin ETFs in terms of demand and volume? Maybe, but it’s worth noting here that Ether’s spot ETF volumes were just a quarter of what spot Bitcoin ETFs registered in the first day of trading.

Source: X

Bitcoin may have the first mover advantage, but Ethereum also has some strengths that may bolster its volumes and spot demand going forward. Here are some of the key factors that may allow Ethereum to give Bitcoin a run for its money in the spot ETF segment.

Ethereum shines in utility

The newly launched ETF will expose Ethereum to traditional investors. Their criteria for investment is different from what the crypto market is used to. For example, they tend to focus on organic growth factors and this is where Ethereum takes the cake.

The network supports smart contracts. As a result, its ecosystem has grown immensely over the years, with over 4,000 Dapps at press time. Those Dapps support robust demand for ETH in the form of gas fees.

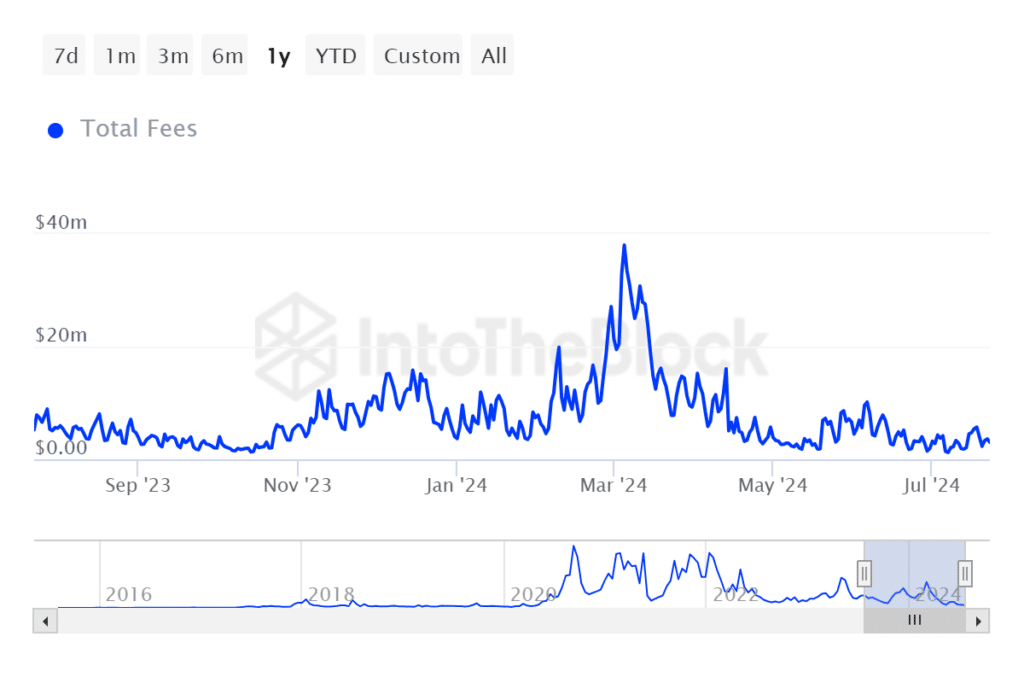

For context, Ethereum fees ranged from as low as $1.22 million to as high as $38 million in the last 12 months.

Source: IntoTheBlock

Additionally, Ethereum’s staking model which provides opportunities for passive income is comparable to dividends in traditional finance. Traditional investors may find that appealing.

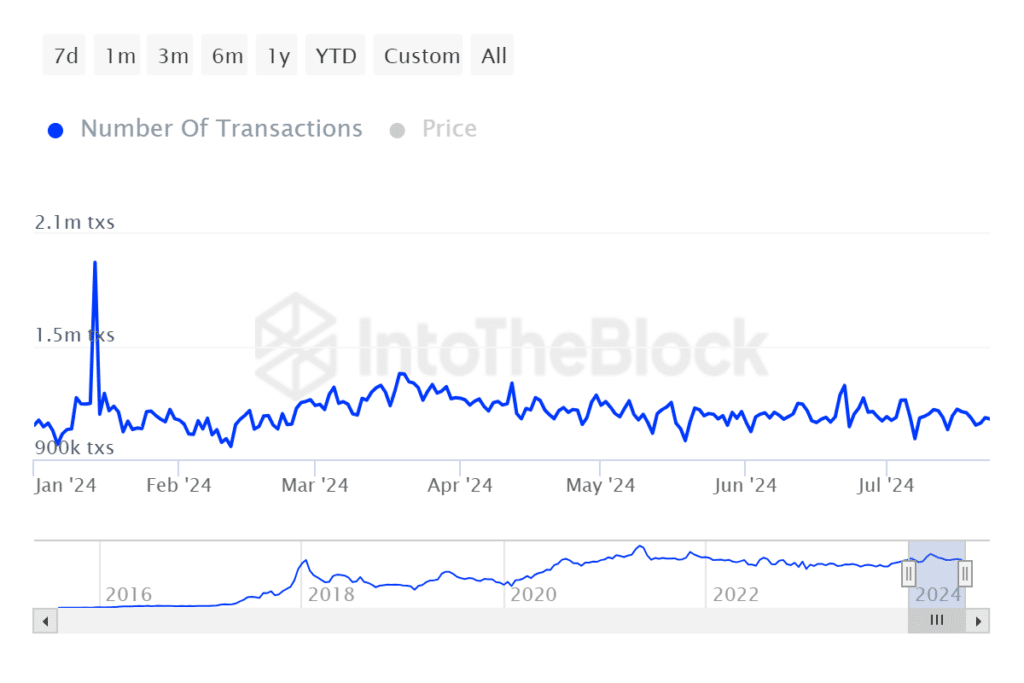

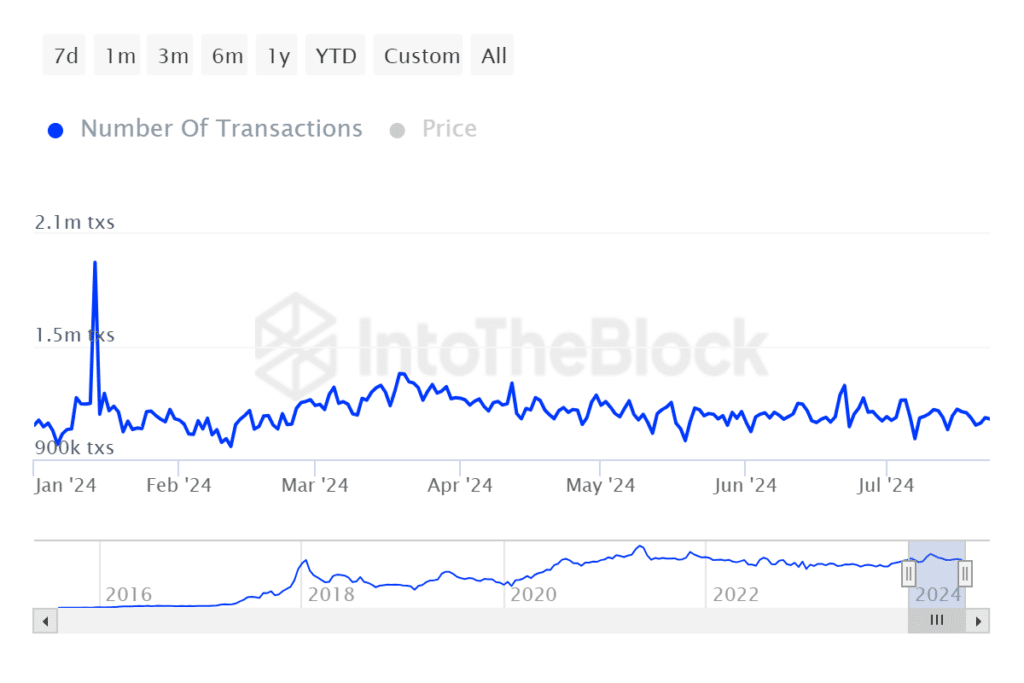

Ethereum transactions also present a healthier image than Bitcoin transactions. The latter has been struggling to hit more than 500 daily transactions on a YTD basis. On the contrary, Ethereum’s YTD daily transactions average over 1 million.

Source: IntoTheBlock

The utility, fees, and transactions underscore key areas where Ethereum outperforms Bitcoin.

A look at the cryptos on the price front might be useful too. ETH trades at a value considerably lower on the charts, compared to BTC ($3,450 versus $66,422 at press time). This may enhance the perception that investing in Ethereum ETFs may provide investors with higher gains.

After all, profit is the name of the game.

Easier said than done

Ethereum can hold its own against Bitcoin based on what we have seen above. However, BTC already has a strong lead and its first mover advantage means many traders may prefer it to the second option. In addition, Bitcoin’s network also has its winning points such as the proof-of-work system which is perhaps, the peak of decentralization.

Bitcoin also continues to register an influx of institutional demand, despite Ethereum ETFs’ rollout. The next few weeks or months should offer a clearer picture regarding which of the two coins will outperform the other on the ETFs’ demand front.