- Ethereum fear and greed index is transitioning gradually.

- ETH token summary, on-chain signals and false break-out suggest price set to surge.

The Ethereum [ETH] Fear and Greed Index logged 38 at press time, reflecting neutral sentiment in the market from the extreme fear sentiment a week ago.

With Ethereum’s price at $2705 at the time of writing this article, this balance between fear and greed suggests growing investor confidence.

This sentiment indicates that Ethereum might soon test and possibly break the $2.8K resistance level, highlighting positive momentum for Ethereum and the broader cryptocurrency market.

Source: Ethereum Fear & Greed Index on X

ETH/USD approaching resistance

Ethereum recently broke through the $2.8K support level, which has now become a critical support point as the market recovers from this week’s crash.

The key question is whether the current price action will break this resistance but Ethereum’s confidence has gradually increased, recovering from a weekly low and closing strongly bullish. This rally suggests a potential breakout above support is imminent.

The brief dip below $2.8K could be seen as a false breakout, indicating a possible reversal as the price quickly moved back above this level.

Source: TradingView

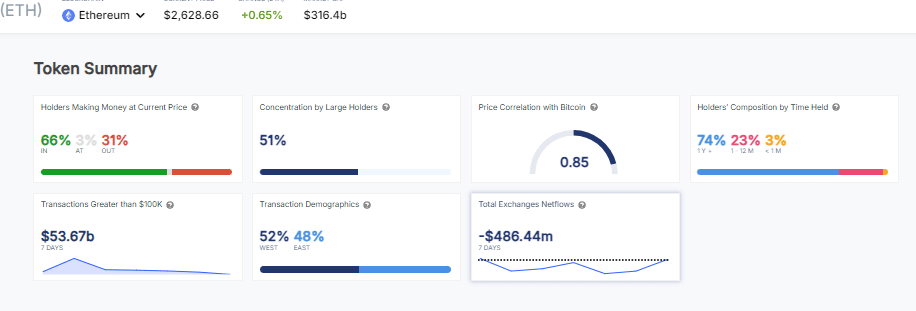

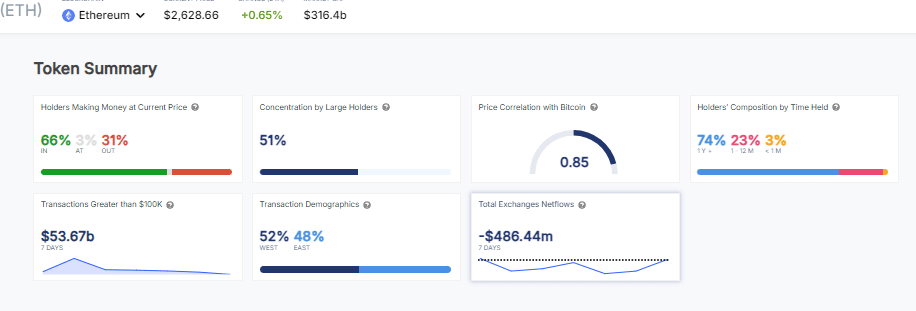

Token summary

A recent analysis of the Ethereum ecosystem suggests that ETH could surpass the $2.8K resistance level as confidence grows.

Currently, 66% of total holders are profitable, and 51% of ETH is concentrated among large holders.

Source: IntoTheBlock

Ethereum’s price closely follows Bitcoin with a correlation of 0.85, and 74% of holders have kept their assets for over a year.

In the last week, transactions over $100K totaled $53.67 billion. These factors indicate a strong possibility that Ethereum will break through this critical resistance level, reflecting increasing confidence in the asset.

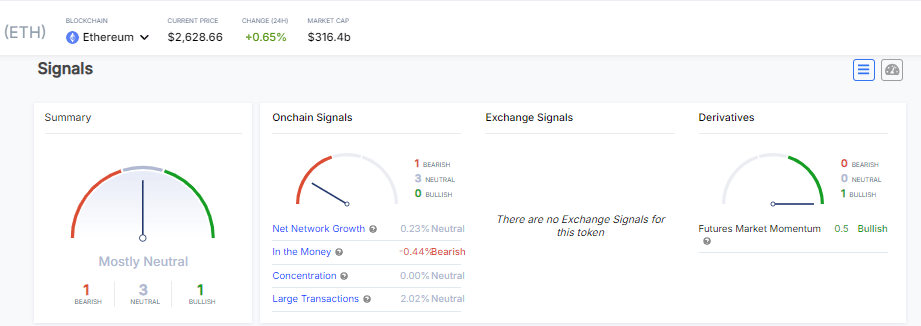

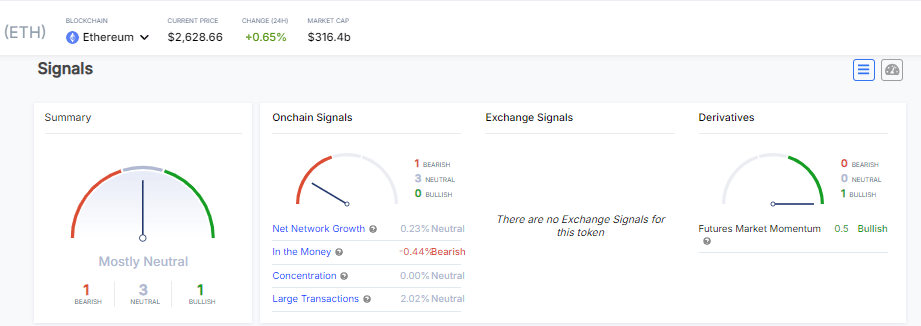

On-chain signals

Ethereum’s on-chain indicators show a neutral stance for both buying and selling. Network growth is steady at 0.23%, with in-the-money transactions slightly down at -0.44%.

Source: IntoTheBlock

Read Ethereum (ETH) Price Prediction 2024-25

Concentration and large transactions also remain neutral, with readings of 0% and 2.02%, respectively.

However, the futures market shows a slight bullish momentum of 0.5%, suggesting Ethereum might soon break the $2,800 resistance level as confidence in ETH assets grows.