- Base hit new TVL and stablecoin marketcap highs as bullish excitement returned to the market.

- Performance stats confirmed healthy improvement in confidence and network utility

The tides have changed in September in favor of crypto bulls and Base is among the networks that have been capitalizing on this shift. This is evident by looking at the resurgence of robust network activity.

Base has been positioning itself as one of the fastest growing Ethereum layer 2s. The network’s recent performance is evidence that the network will likely benefit immensely as the market continues to heat up. Hence, it’s worth looking at how it has faired lately in key areas.

BASE sees surge in network activity

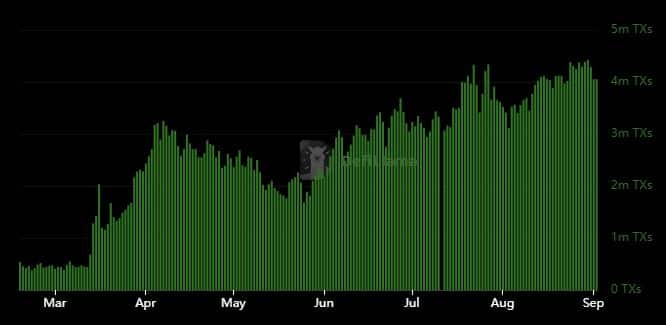

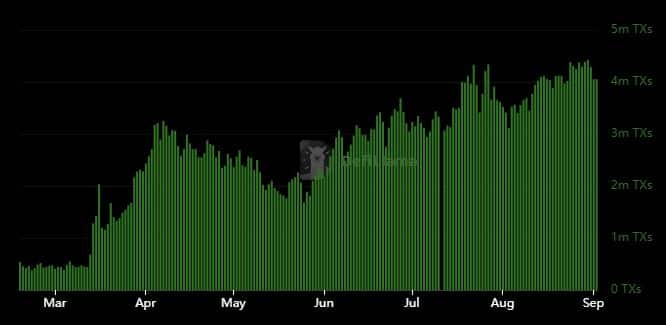

Base transactions have been steadily growing over the last few months, especially since March 2024. In fact, DeFiLlama revealed that the Ethereum Layer 2 network averaged less than 500,000 transactions per day before mid-March.

However, that changed and transactions have been steadily growing since. It recently reached new highs above 5 million transactions per day.

Source: DeFiLlama

The chart revealed that Base transactions have been growing even during bearish times. However, the resurgence of bullish activity has supercharged its network activity. The impact of market swings was more evident in the volume and stablecoin data.

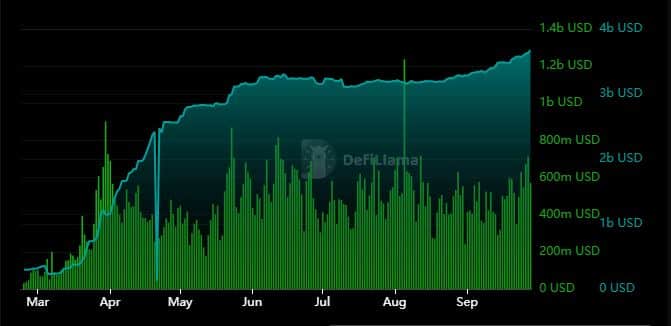

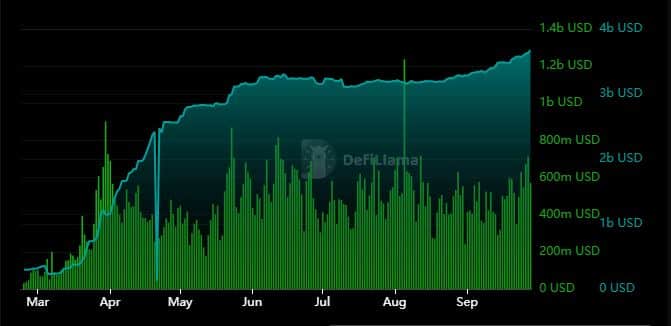

On-chain volume demonstrated significant correlation with stablecoin growth. For example, the volume and stablecoin marketcap grew exponentially between March and April. Now, while stablecoins levelled out between May and August, their pace of growth accelerated in September.

Source: DeFiLlama

On-chain volume also saw a significant decline between August and mid-September. On the contrary, daily volume registered a significant bounce from below $400 million to over $700 million, as of 27 September.

The network’s stablecoin marketcap hit a new high of $3.67 billion too. To put this growth into perspective, its stablecoin marketcap hovered below $400 million before mid-March.

Robust TVL growth confirms user confidence

While the aforementioned metrics highlighted growing network utility, there is one metric that underscored a strong surge in user confidence.

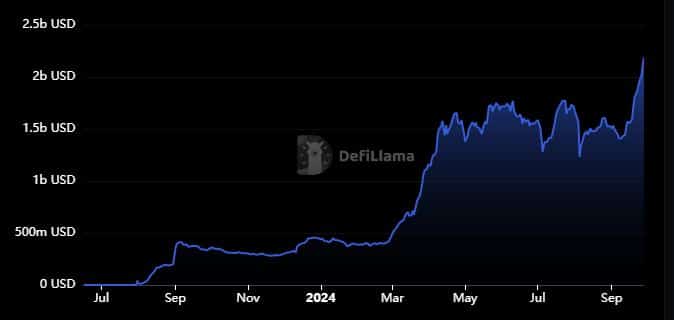

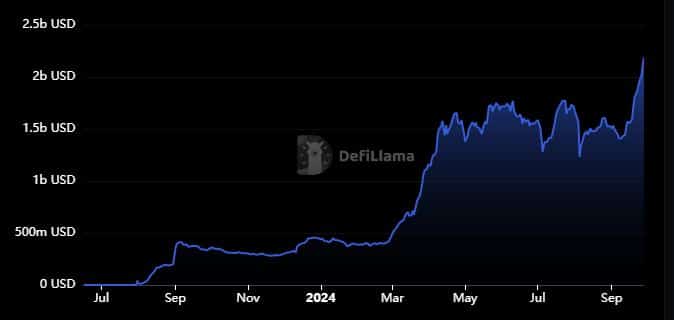

Base’s TVL recently soared to $2.19 billion – Its highest historic level.

Source: DeFiLlama

Base had a $337 million TVL exactly 12 months ago, which means it is up by over 548%. This is a sign of healthy liquidity, one that investors have been willing to invest in.

The network added $780 million to its TVL over the last 3 weeks. This is around the same time that the market shifted in favor of the bulls. This outcome means that Base may see more robust growth in the coming months. Especially if the market continues to heat up.