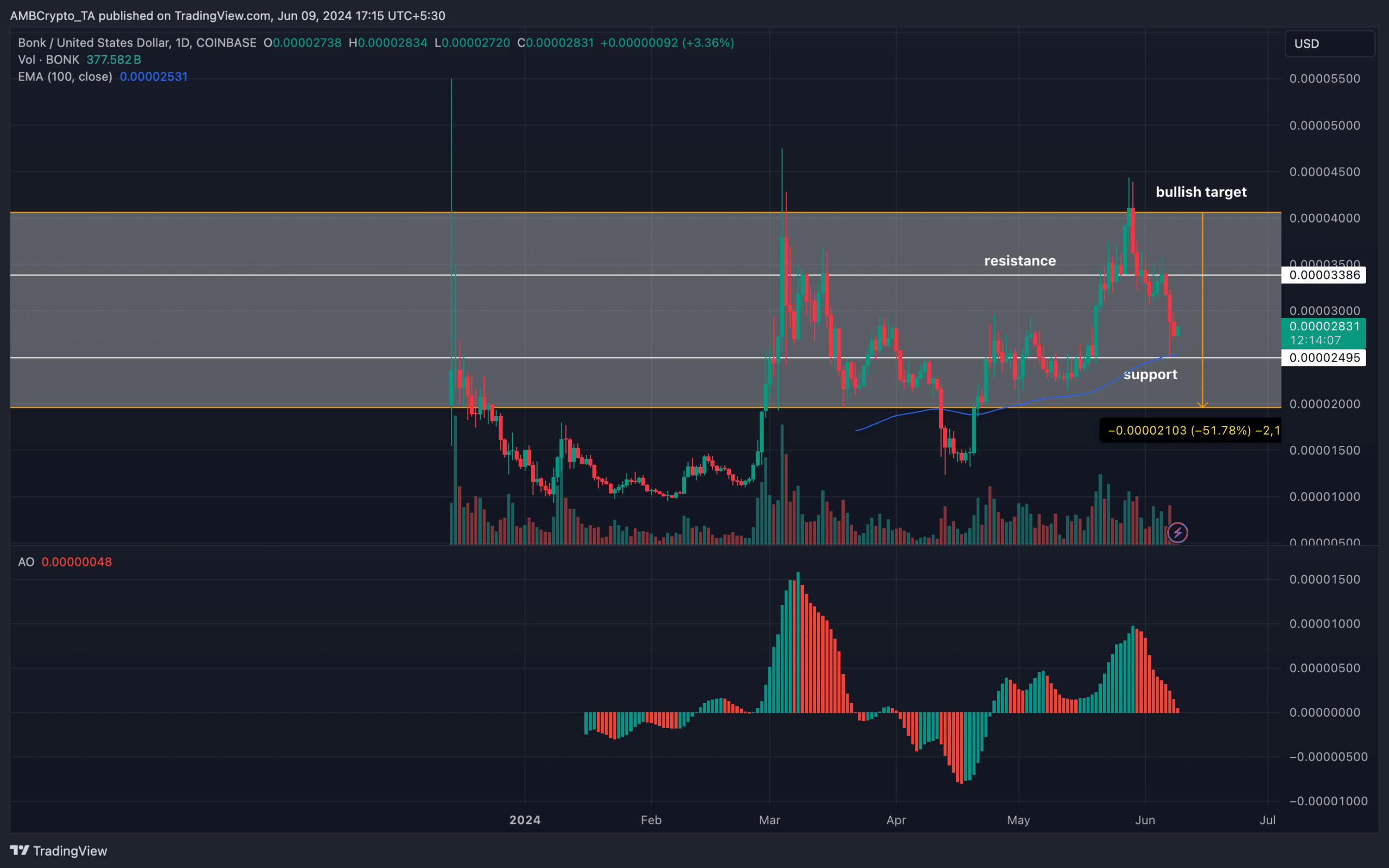

- BONK seems to have provided a buying opportunity between $0.000024 and $0.000027.

- With low readings of the social metrics, BONK might jump to $0.000033.

Bonk [BONK] has gotten close to a point that could trigger a rebound, according to AMBCrypto’s daily chart analysis. At press time, BONK traded at $0.000027, sitting above the 100 EMA.

If the price of a cryptocurrency is above the 100 EMA, it means that the price could go higher, offering a good entry point. However, if the price slips below the indicator, it signals capitulation.

BONK stays above critical zone

On the daily chart, the 100 EMA was at $0.000024, and BONK reached the level earlier. But it did not take long for the memecoin to bounce off that level.

If sustained, the token could be looking at approaching $0.000040.

AMBCrypto found a similar trend on the chart. For instance, the 100 EMA sat at $0.000018 on the 21st of April. By the 26th of the same month, the price had rallied to $0.000029.

Therefore, BONK could be looking at keying into the $0.000033 resistance while using $0.000024 as support.

Source: TradingView

In a highly bullish scenario, the value of the token could break out, and a move to $0.000040 could be validated.

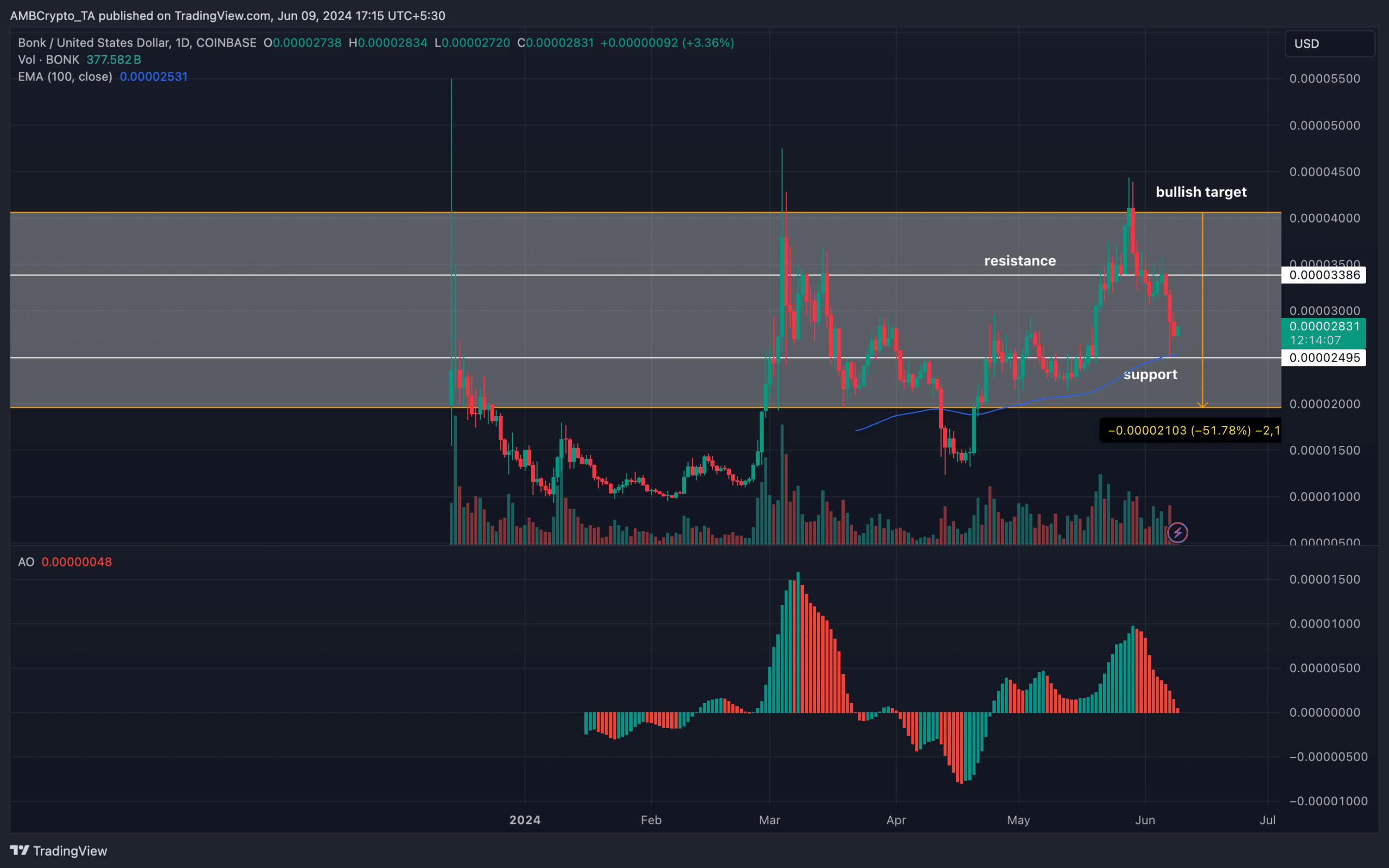

However, it is important to view the price action from an on-chain perspective. In doing this, we look at social volume and dominance.

Everything looks set for the token

According to on-chain data from Santiment, Social Dominance was 0.294%. Social Dominance measures the rate of discussions about a token compared to the assets in the top 100.

For the memecoin, the reading decreased, suggesting that conversations around it were at a low point.

Concerning the price, this signals that attention to the memecoin was dwindling, and it could be a good area to accumulate before a rally begins.

Source: Santiment

It was also a similar situation with the social volume. Social volume tracks arbitrary searches for a cryptocurrency. Hence, the decline here indicates that demand for BONK was mild.

Therefore, the token still offered good entry points.

In addition, AMBCrypto noticed that the token’s volume had fallen. Volume is an important indicator that measures interest in a cryptocurrency.

Therefore, if the volume increases, it means that there is an increase in buying and selling of the token. However, since BONK’s volume decreased, it indicates that interaction with the token was at a low level.

Source: Santiment

Is your portfolio green? Check the Bonk Profit Calculator

In terms of the price, a decreasing volume alongside a low value could trigger a bounce. This is because the position means that the downtrend was weak, and this could give room to BONK’s appreciation.

However, the price prediction could be invalidated if selling pressure increases. But as it stands, bearish dominance was waning, indicating only a little chance of another fall.