Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

No single entity, interest group, or political faction defines (or dominates) the blockchain industry. But despite all differences, positive and negative, there is a shared mission—achieving mass adoption.

You might also like: Is investing in classic stocks always safer than defi? Not exactly | Opinion

More people, businesses, and communities must benefit from crypto and blockchain tech worldwide. To achieve this fully, anyone should be able to build high-quality dApps and on-chain tools. Devs must have the freedom to express themselves in any language and on any chain. They should be able to build once and deploy anywhere.

While the recent institutional uptake and political attention might seem exciting, they are mostly driven by vested interests. What’s ‘crypto-friendly now’ does not mean crypto-friendly five years from now, as Vitalik Buterin pointed out. Good dApps, however, are actual manifestations of blockchain’s principles and potential. Once deployed, they can continue serving the community on pre-defined terms enforced by censorship-resistant blockchains—ideally, even when the original creator is not there, as with Bitcoin (BTC).

Thus, the endgame is empowering developers (and users). No single interest or agenda, political or technological, shall determine the path forward. In its purest form, crypto is an expression of freedom—freedom from intermediaries and censorship, freedom to express through code.

DApps make blockchain real—and valuable

Blockchain tech must solve real, day-to-day problems to transition from speculative adoption to long-term mass/retail adoption. However, the recent spike in financial nihilism and meme coin adoption shows that people care more about speculation than foundational principles.

Yet speculation without actual underlying value is unsustainable. Only those apps and platforms that generate value through fees, transaction volumes, etc., will still be around in ten years or more. As of August 7, 2024, Uniswap, for example, collected about $13 million in weekly fees—that’s hundreds of millions in annual revenue. With the 10x price-to-earnings heuristic often applied to high-growth tech companies, it seems Uniswap (UNI) $4.5 billion valuation is on par, and the market is pricing it appropriately.

DApps make crypto or blockchain tech usable for end-users. They bring the power of immutable code—which doesn’t need intermediaries—to the masses. Trading, lending, gaming, rideshares, etc., can all happen without any single entity opaquely and unfairly extracting value.

Given crypto’s roots in Bitcoin and close proximity to money, finance was the first industry to be disrupted. But the recent rise of decentralized gaming, socials (DeSoc), physical infra (DePIN), AI, etc., on cost-effective and high-throughput chains like Base or Solana shows how the tech has a much wider scope than disrupting financial products/processes.

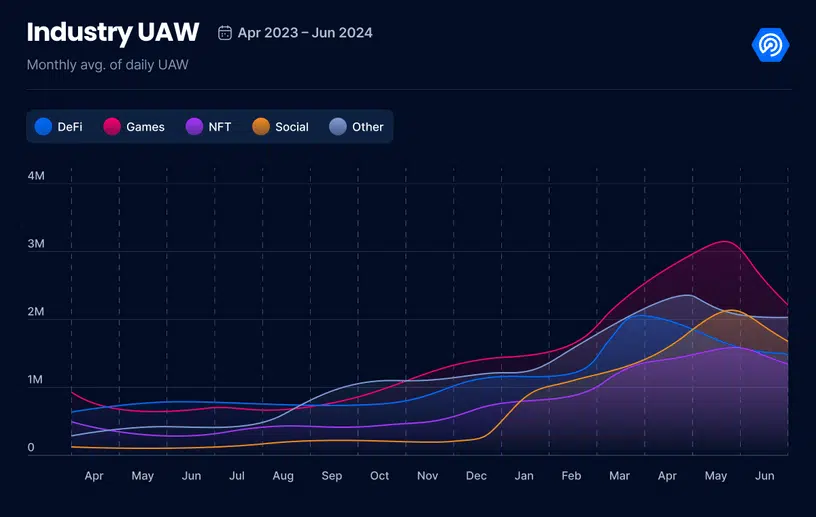

That’s why there is a rising demand in the global dApp industry, where daily unique active wallet interactions reached an all-time high in Q2 2024.

Industry unique active wallets | Source: DappRadar

Landline telephones took 99 years to reach peak adoption. Automobiles took 78. Computers, however, crossed 89% adoption in 24 years. Whereas social media and tablets achieved a similar feat in 14 and 7 years, respectively.

This shows how newer technologies have achieved majority adoption in significantly less time than their predecessors. But key ‘enablers’ must be present for this, which dApps can be for blockchain tech.

From user-friendly graphical interfaces to making backend components frictionless/invisible to end-users, dApps are inevitable. And those who say blockchain needs more dApps and less infra are quite right from this view.

Anywhere, anytime, all at once

As crypto continues to grow, a lot of talented devs have entered the space, including some of the brightest minds from Google, Meta, IBM, etc., like the founding team at Aptos and Sui, among others. Great things have happened as a result. Move rising like a phoenix from Diem’s ashes and SVM from FTX are two prime examples of a new generation of devs picking alternatives to the EVM status quo. Lowering the barriers to dApp development is mission-critical now so more projects can emerge.

For a long time, the Ethereum Virtual Machine has been the only standard available to blockchain developers. Along with Solidity, the EVM was built to deploy and run custom programs on Ethereum. Likewise, there is ‘Solana VM’ on Solana, ‘Move VM’ on Aptos or Sui, Web Assembly on Cosmos, etc. Although these are great innovations with many merits, they have caused fragmentation and vendor lock-in. EVM-based dApps can’t run natively on Solana, and SVM-based dApps can’t use Ethereum, Binance Smart Chain, or other EVM-powered platforms.

Meanwhile, deploying dApps on multiple chains is very cumbersome and unfeasible due to high costs. For one, devs have to create and maintain multiple code bases. Thus, truly multi-chain and interoperable dApps take a lot of work to come by. Projects like AAVE or Pancakeswap are exceptions, as they have the necessary resources for multi-chain deployment. However, even for them, innovation in non-EVM code lags behind the EVM code due to high costs and time requirements. Moreover, for end-users, vendor lock-in means they need to use multiple wallets and hold assets from various ecosystems because their favorite dApp, wallet, or token doesn’t support the new chain they want to use.

Devs want freedom from such walled gardens for the sake of blockchain’s long-term progress if not anything else. They must be able to build an application once and offer it to users across ecosystems, asset classes, and VMs—not just one. Users have a similar need.

Abstracting wallets, chains, and even VMs is a viable solution. It will let developers build dApps on any VM in any programming language and run them on every other chain or VM. That, too, with little or no additional costs and security compromises.

Further, abstracting away the underlying complexities will allow anyone to build robust dApps with a few clicks. That will change everything. Web3 will mirror web2’s performance and speed after the mass market adoption of container technologies like Kubernetes, which helped get rid of public cloud vendor lock-in. To the extent that builders can utilize different chains/platforms for different aspects of their dApps based on specific needs and demands, such as Solana for high-frequency transactions, Ethereum for settlement finality and data availability, and so on.

Solving vendor lock-in will improve the developer and end-user experience. Everyone can reap the benefits of the underlying tech stack and that’s the path to mass adoption. More dApps can enter the market than ever before. All of them won’t be great. But the more there are, the higher the chances of finding the next gamechanger.

Read more: DAOs and centralized organizations must work in tandem | Opinion

Alejo Pinto

Alejo Pinto is the co-founder and chief growth officer at Pontem Network, a product development studio building Move, SVM, and EVM-compatible products to enable a more developer- and user-friendly web3. He has an extensive background in the tech industry, including a significant stint at IBM, where he gained valuable experience in blockchain applications.