The “basic laws of supply and demand” are primed to act in Bitcoin’s (BTC) favor, according to a popular crypto analyst.

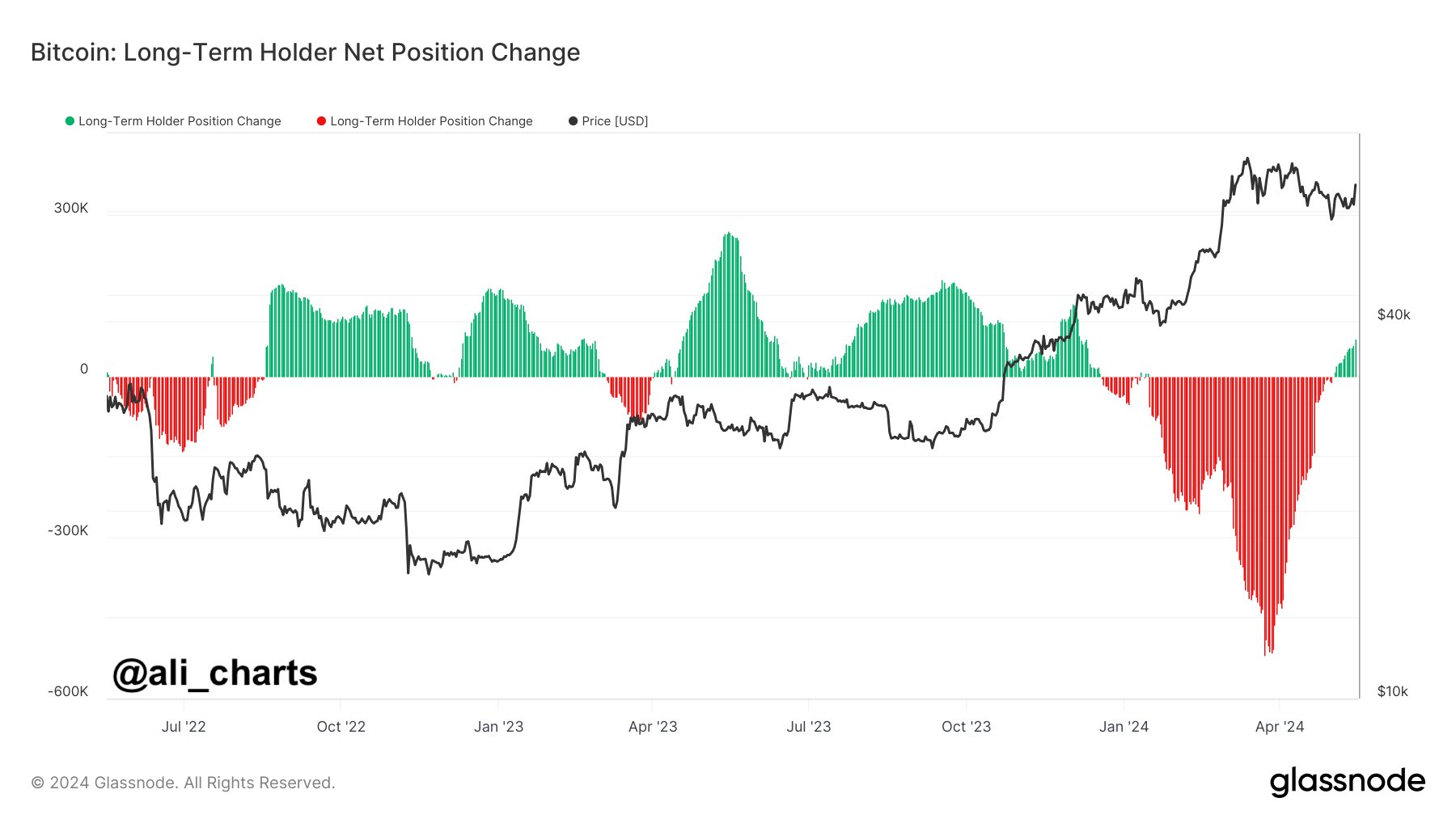

The trader Ali Martinez tells his 62,300 followers on the social media platform X that Bitcoin flooded the market after the top crypto asset hit an all-time high of more than $73,700 in March, putting most long-term holders in profits.

“The rising supply of BTC on the market surpassed the demand levels, leading to a corrective phase that saw the price of Bitcoin dip below $57,000. This drop brought Bitcoin below its Short-Term Holder Realized Price, creating a sense of fear in the market, given that short-term holders are more prone to sell based on price volatility.

The Short-Term Holder Realized Price, which currently stands at $60,500, served as an accumulation point despite investors’ fears. Indeed, long-term holders felt comfortable adding more than 70,000 BTC to their positions at these levels after realizing profits in March.”

The realized price is the average price of Bitcoin in circulation calculated based on the price at which they were last moved. The short-term holder realized price is the average acquisition price of all the Bitcoin acquired in the past 155 days.

Martinez predicts that demand for Bitcoin will begin to outstrip supply.

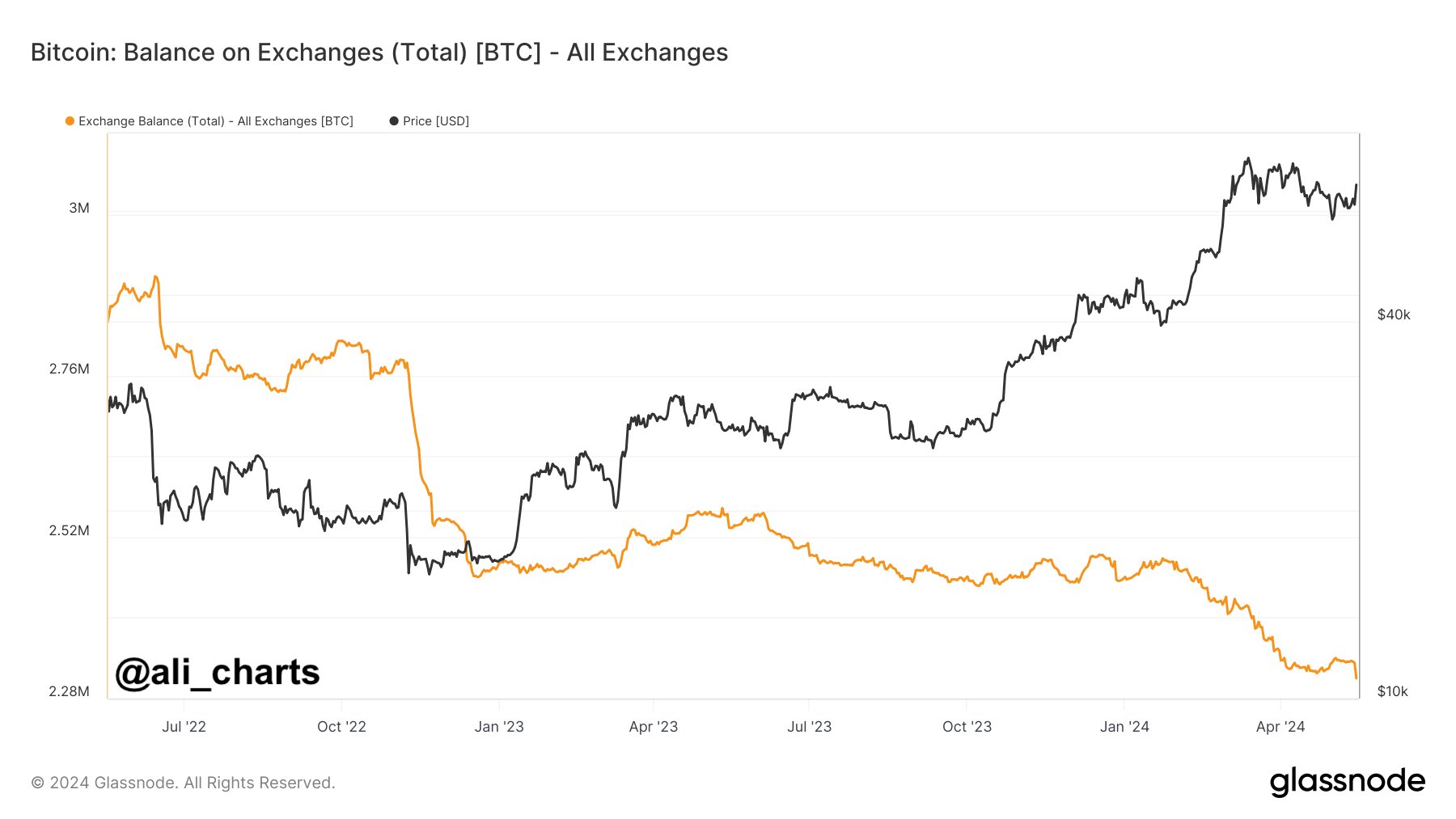

“Observing Bitcoin’s Balance on Exchanges can corroborate these supply and demand dynamics. Since early May, more than 30,000 BTC have moved to private wallets for long-term holding, showing confidence among holders in Bitcoin’s future value.”

BTC is trading at $65,411 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney