- A dormant wallet transferred 8,000 BTC, valued at roughly $536.5 million.

- It suggests a renewed interest in BTC as new and former investors engage with the market.

The cryptocurrency market has been navigating through turbulent waters, with Bitcoin [BTC] struggling to retest its previous highs.

Currently, Bitcoin is trading at approximately $67,302, marking a near 6% decrease over the past week, and a slight drop of 0.7% in just the past 24 hours.

This downturn was part of a broader decline across the crypto market, which has seen its total valuation dip to around $2.57 trillion—a 1.3% fall within a day.

New activity: Significant whale movement

Amidst this broader market pullback, an intriguing development occurred involving a long-dormant Bitcoin wallet. This wallet, which had not seen any activity since December 2018, suddenly transferred 8,000 BTC, valued at roughly $536.5 million.

The transaction was initiated from a wallet associated with Coinbase’s cold storage, moving the funds directly to a known Binance deposit address.

The sequence of these transactions raises several questions about the intentions behind them and their potential market impact.

Initially received in multiple tranches in late 2018, when Bitcoin’s price hovered around $3,750, these coins have appreciated significantly.

The transaction from the dormant wallet did not include any test transfers, which is often unusual for movements involving such significant sums.

Historically, when dormant wallets with large balances become active, it often signals potential selling pressure in the market, especially if funds are moved to exchange addresses.

This pattern suggests that the wallet owner could be gearing up to cash out, capitalizing on the nearly 1,700% price increase since the BTC was first acquired.

Moreover, the activation of such wallets can sometimes coincide with broader market movements. Chainalysis reports that nearly 1.8 million Bitcoin addresses have been inactive for over a decade, representing a substantial $121 billion in potential market value.

Not all of these wallets will become active—many are likely inaccessible due to lost private keys—but those that do can significantly impact market dynamics.

Uptick in Bitcoin network participation

The recent transaction coincides with an uptick in overall market activity.

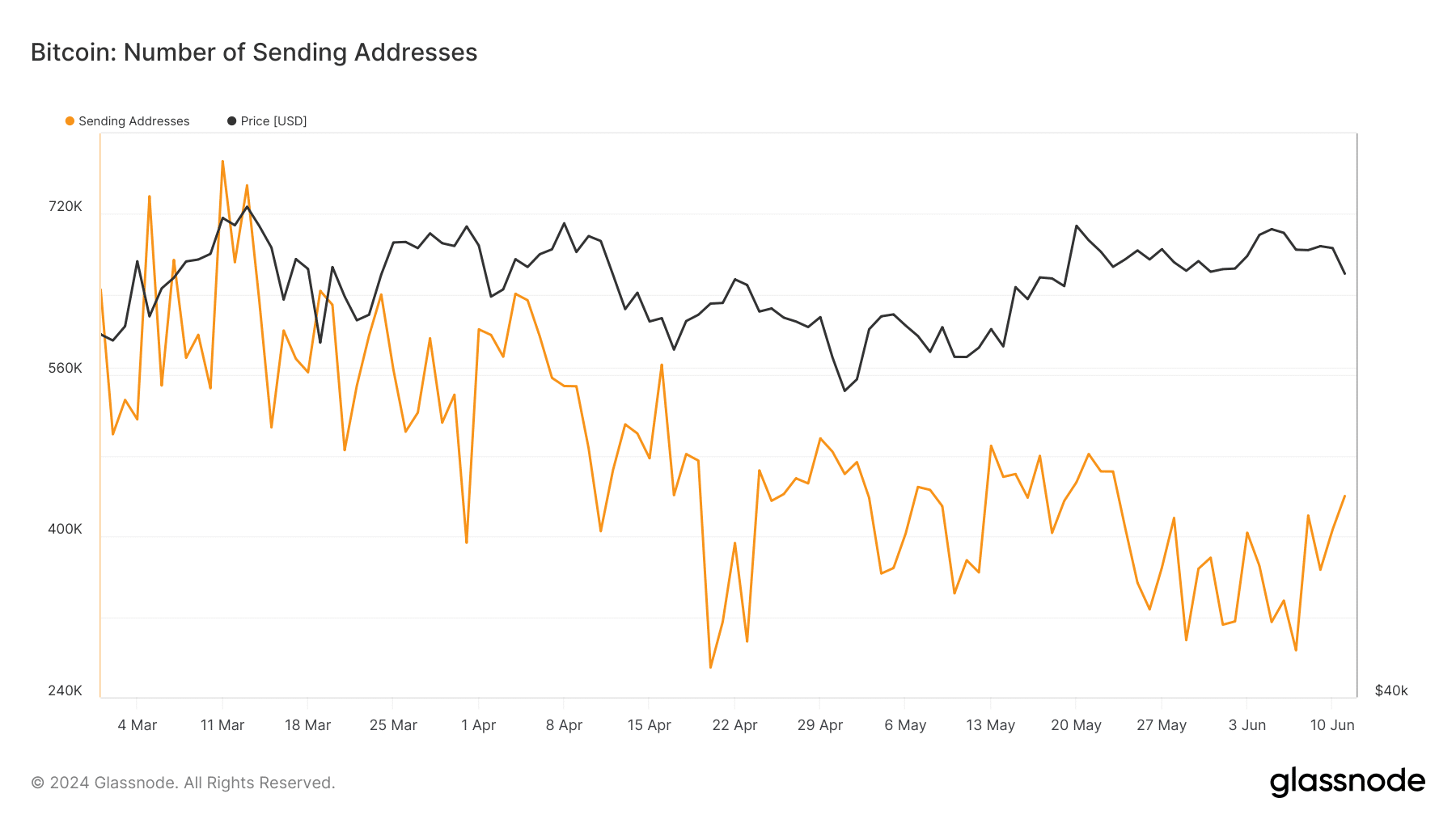

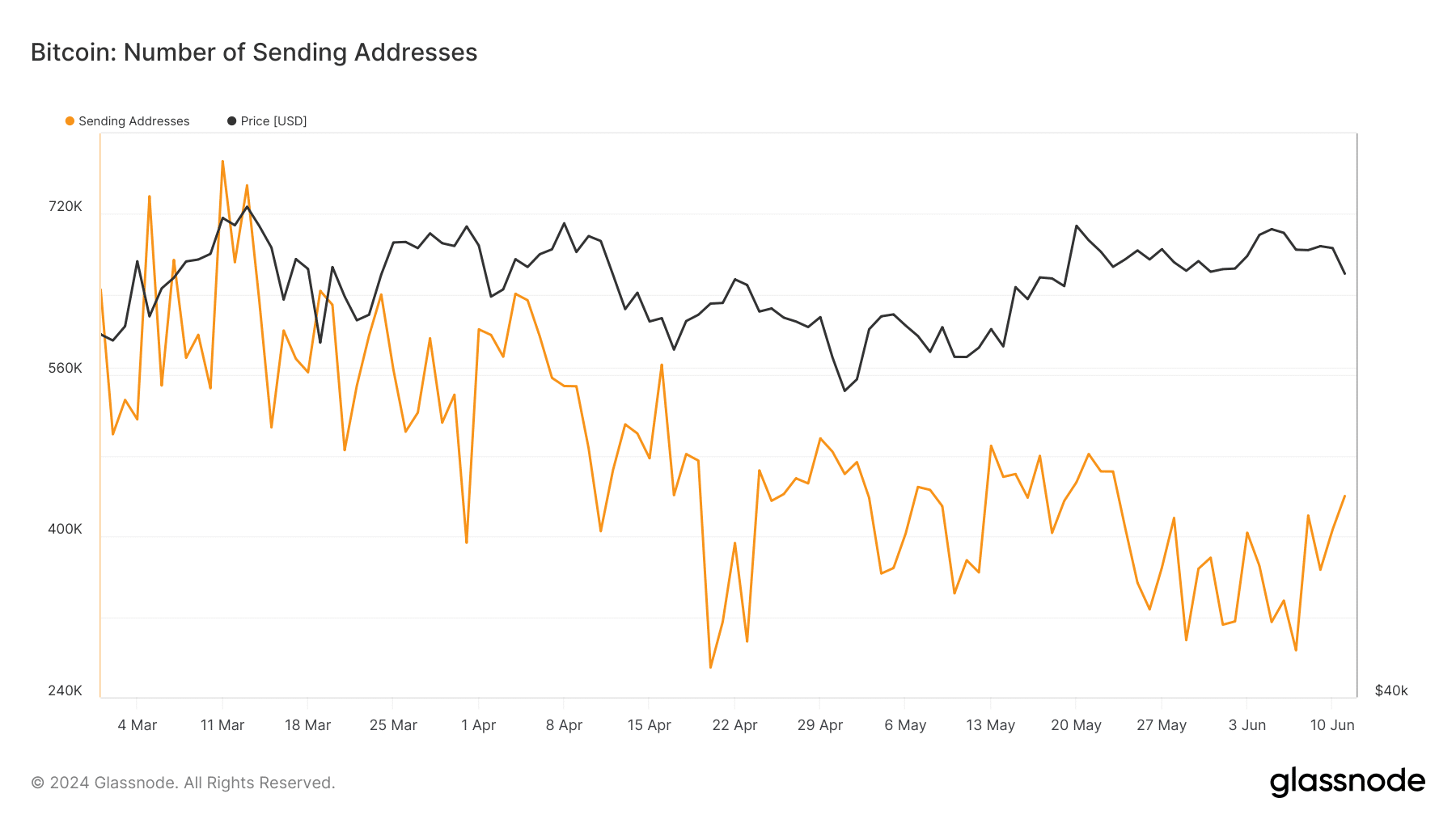

Data from Glassnode reveals an increase in the number of active sending addresses on the Bitcoin network, rising from below 300,000 to over 400,000 recently.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-2025

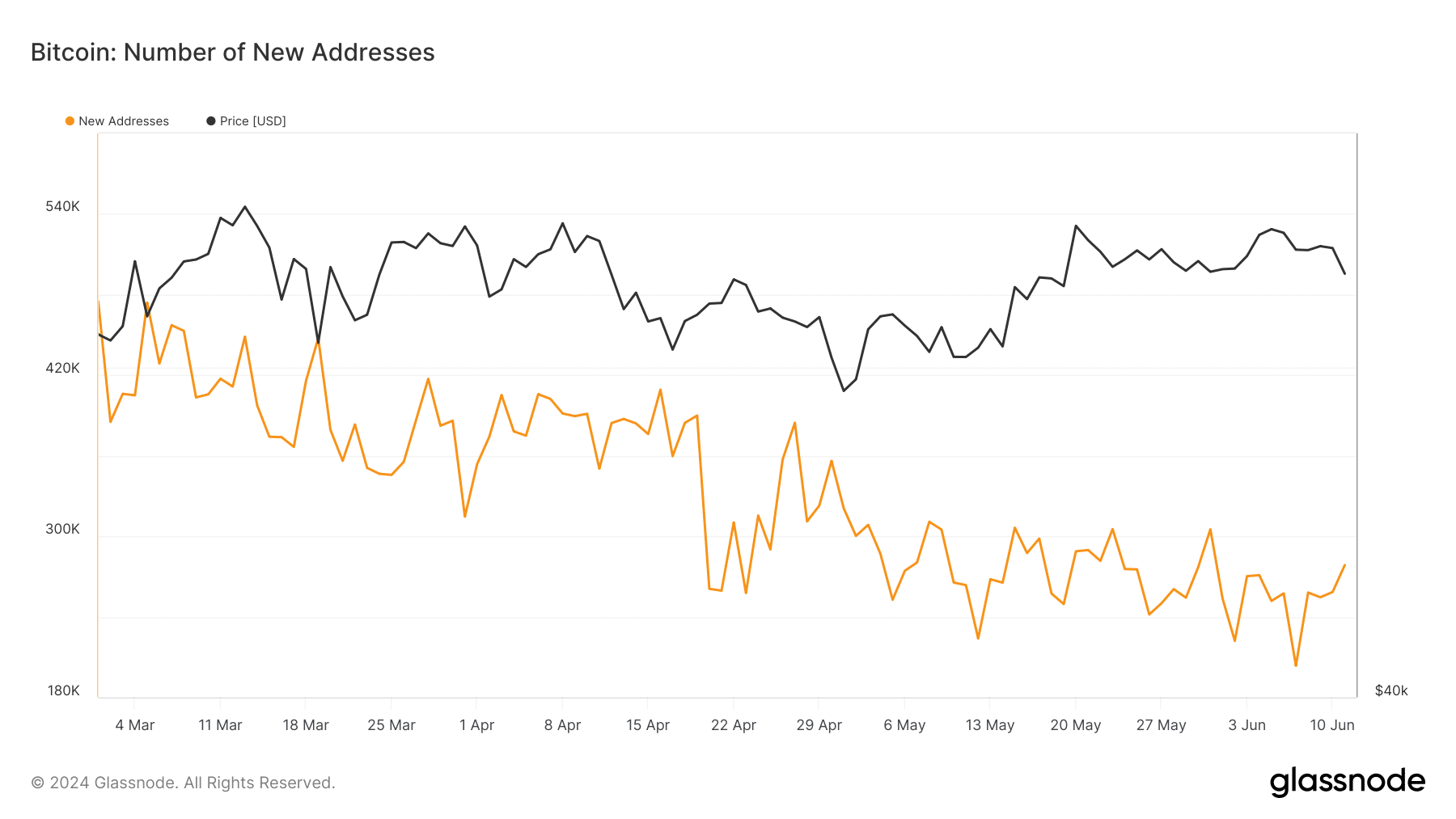

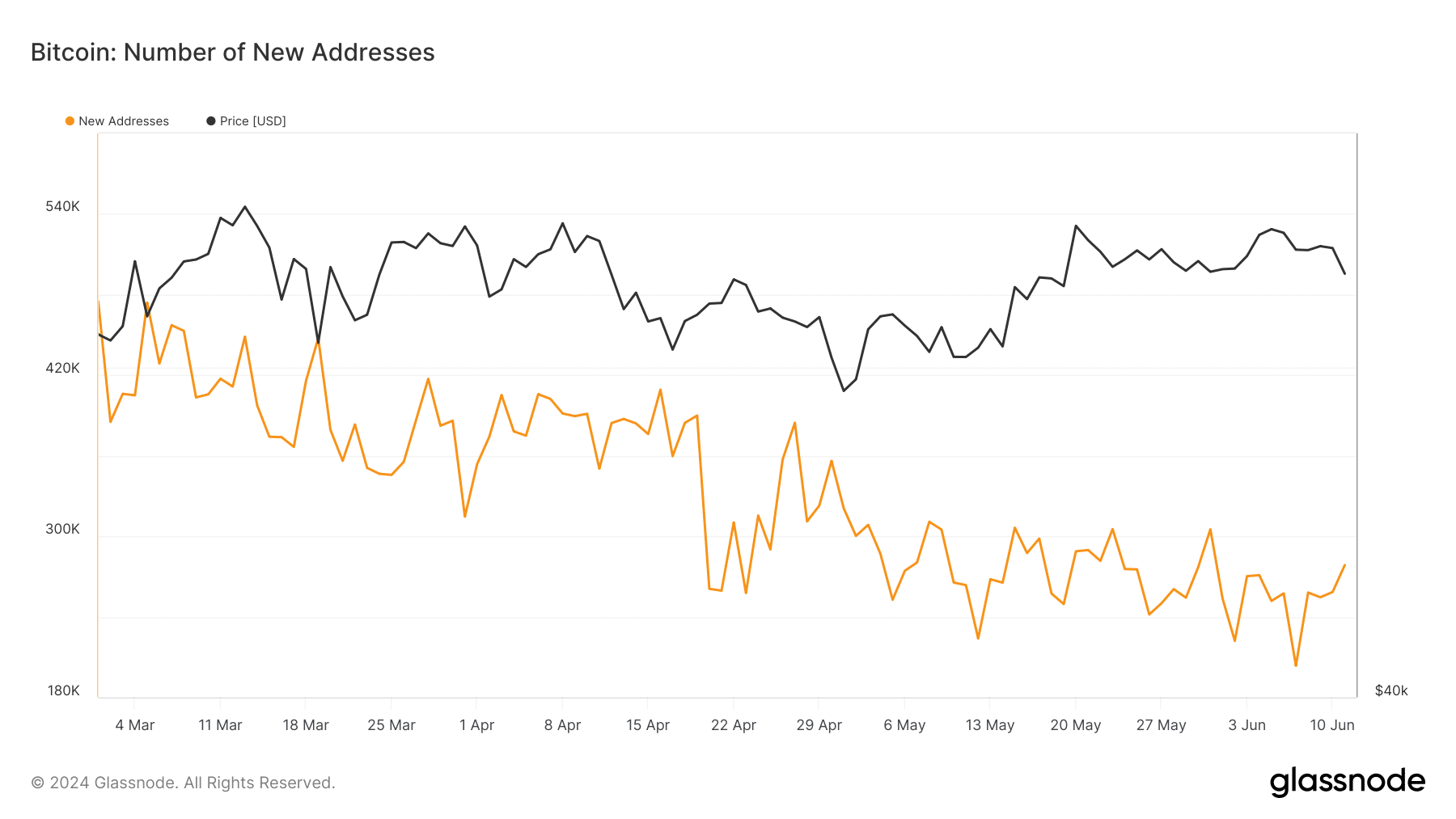

This resurgence in active addresses, coupled with a noticeable rise in new Bitcoin addresses—from 203,000 to 278,000—suggests a renewed interest or possibly speculative activity as new and former investors engage with the market.

Source: Glassnode

While it is uncertain how this single transaction might influence Bitcoin’s overall market standing, AMBCrypto recently highlighted the importance of Bitcoin maintaining its robust support level to sustain an upward trend.