- Despite ETF inflows and SEC’s Ethereum ETF approval, the crypto market faced a downturn.

- Traders foresee Bitcoin’s rise even as BTC dropped to $67k.

Despite Bitcoin [BTC] spot exchange-traded funds (ETFs) witnessing inflows totaling $107.9 million on the 23rd of May, BTC appears to be facing a bearish trend.

Along with Bitcoin, major altcoins were also in the red, signaling a crypto bloodbath.

Analysts foresee Bitcoin’s bullish trend

Despite significant selling pressure, some traders anticipate a “massive leg up soon.” Offering further analysis on BTC’s current price action, Mags, a crypto trader, elaborated.

Source: Mags/X

Reiterating the same viewpoint, Jelle, an independent analyst drew a pattern with BTC’s previous cycles and said,

“Bitcoin is still following a similar path to 2016-2017. Once that 2021 ATH breaks, there will be no stopping the king. Bring on $100,000.”

Source: Jelle/X

What’s on the price front?

Contrary to widespread expectations of Bitcoin’s bull run, the leading cryptocurrency at press time was down by 3.71%, trading at the $67,000 level.

However, despite BTC’s negative price action, key technical indicators such as the Relative Strength Index (RSI) remaining above the 50-level mark and the Moving Average Convergence Divergence (MACD) line positioned above the signal line confirm bullish sentiment.

Source: TradingView

Bitcoin’s growing investor sentiment

In fact, during Anthony Pompliano’s recent livestream with Jack Mallers, Founder & CEO of Strike, Pompliano questioned Mallers about the rationale behind Wall Street’s preference for Bitcoin over other assets.

To which Mallers replied,

“I think it’s the best expression of fiat debasement. It is the antithesis of fiat currency. It has no Central Bank, it has no government, its monetary policy is fixed, its supply is capped, it’s everything that fiat isn’t. And so, if your problem is fiat debasement then it’s best expressed through Bitcoin.”

He even went further and added,

“I think Bitcoin hits 250 to a million in this cycle.”

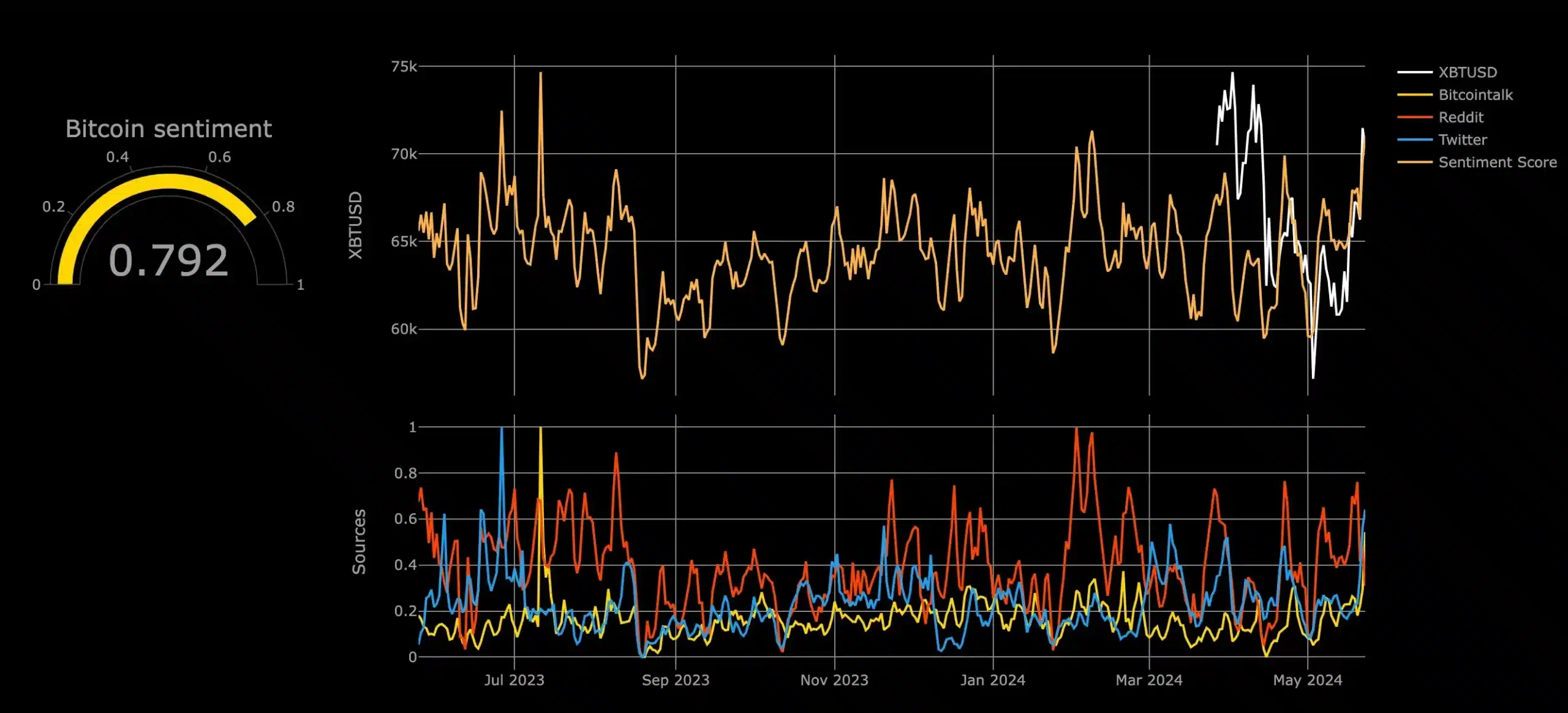

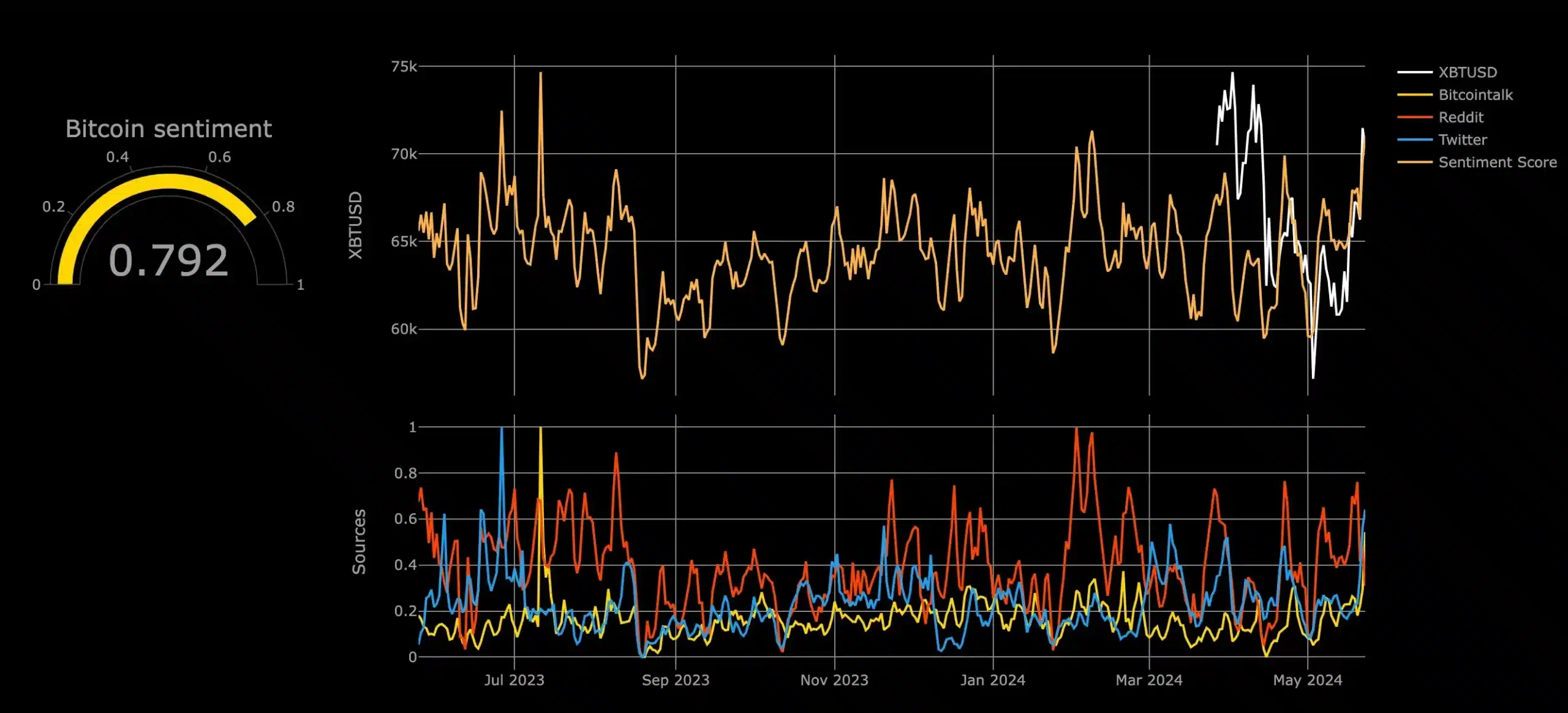

These exchanges suggest a looming bullish trend for Bitcoin, which was further confirmed by Augmento’s data on social media discussions.

In conclusion, with a BTC sentiment score of 0.792 on Augmento’s scale, where 0 is extremely bearish and 1 is extremely bullish, the latest data indicates a prevailing bullish sentiment for Bitcoin.

Source: Augmento/X