- Activity on the Bitcoin network seemed to be responsible for a large part of miners’ revenue

- Overall activity and NFT interest also declined

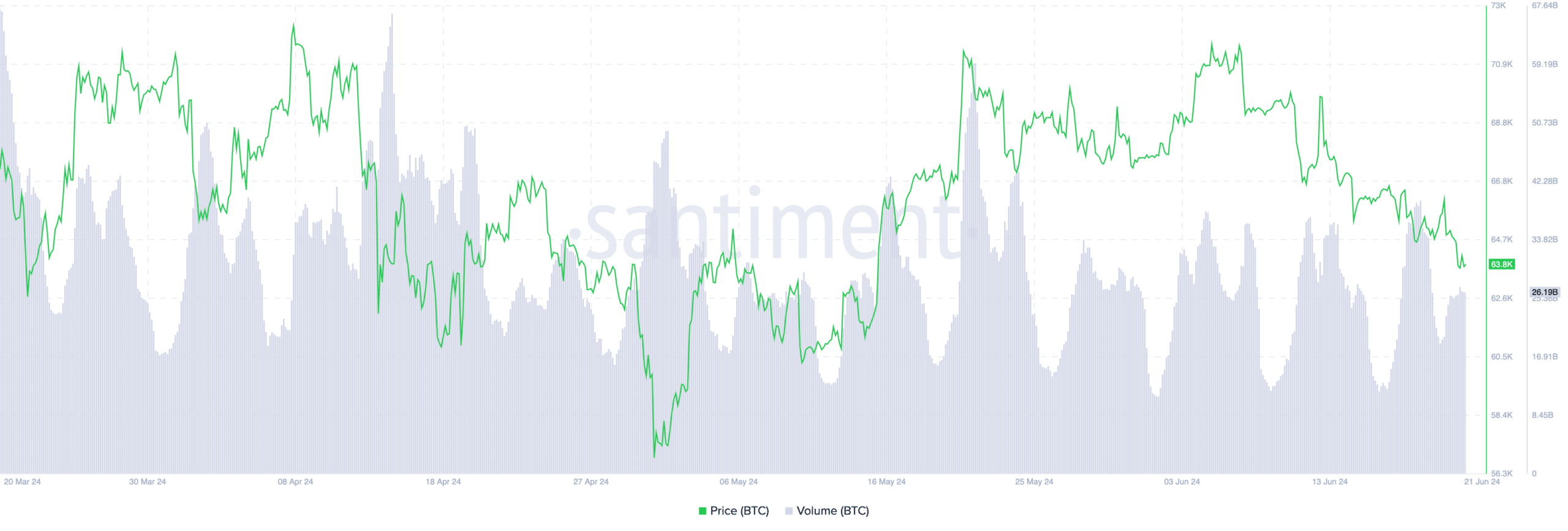

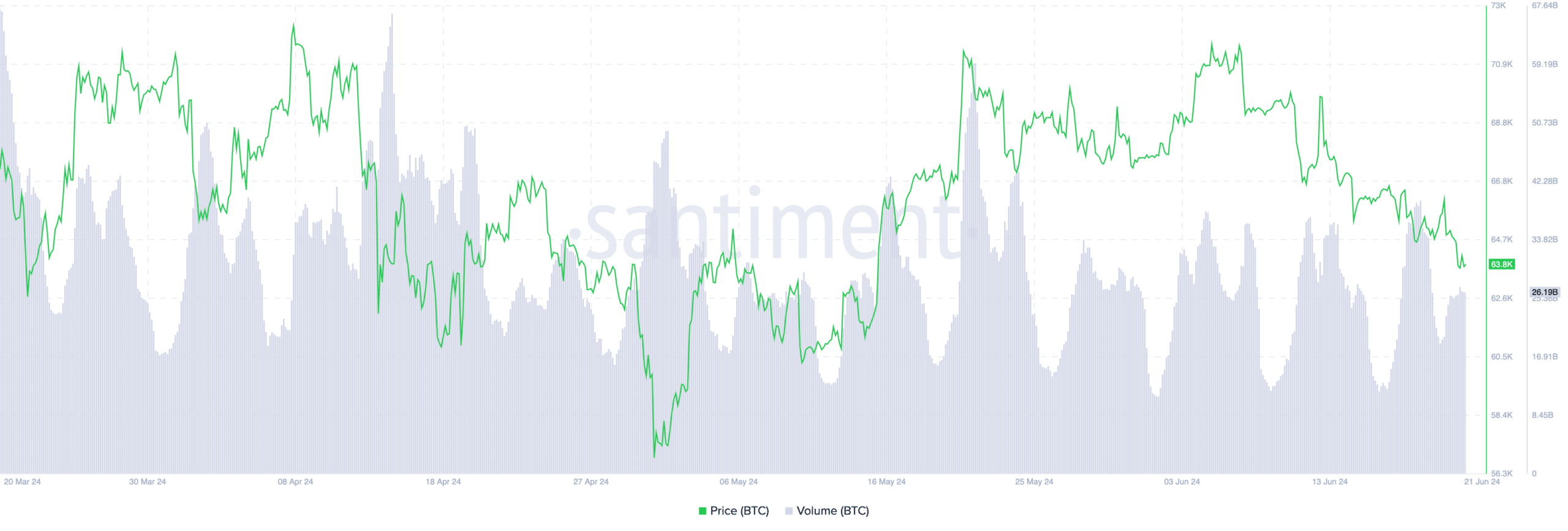

Ever since Bitcoin [BTC] slipped past the $65,000-level, the overall sentiment around the king coin has started to turn negative on the charts.

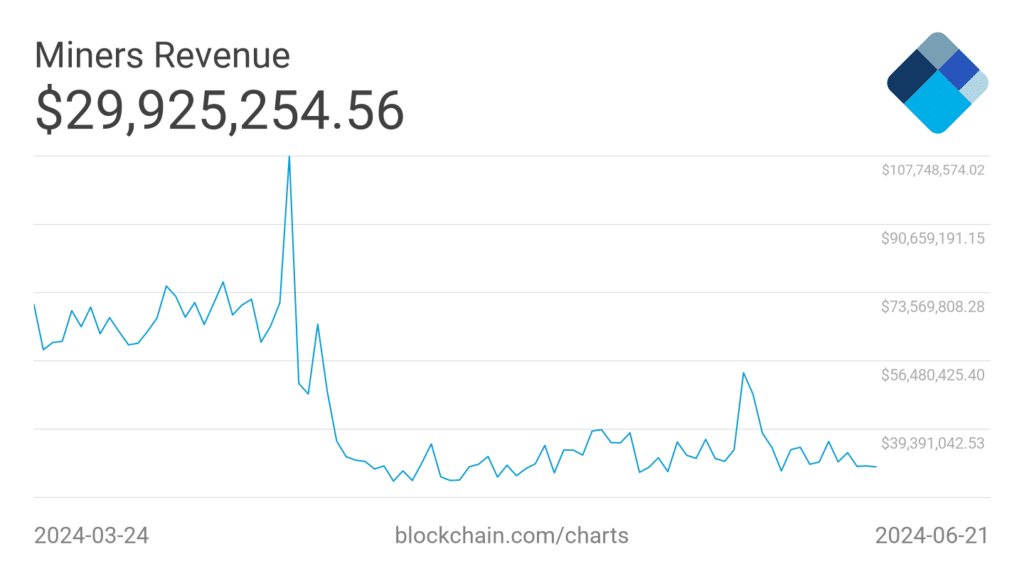

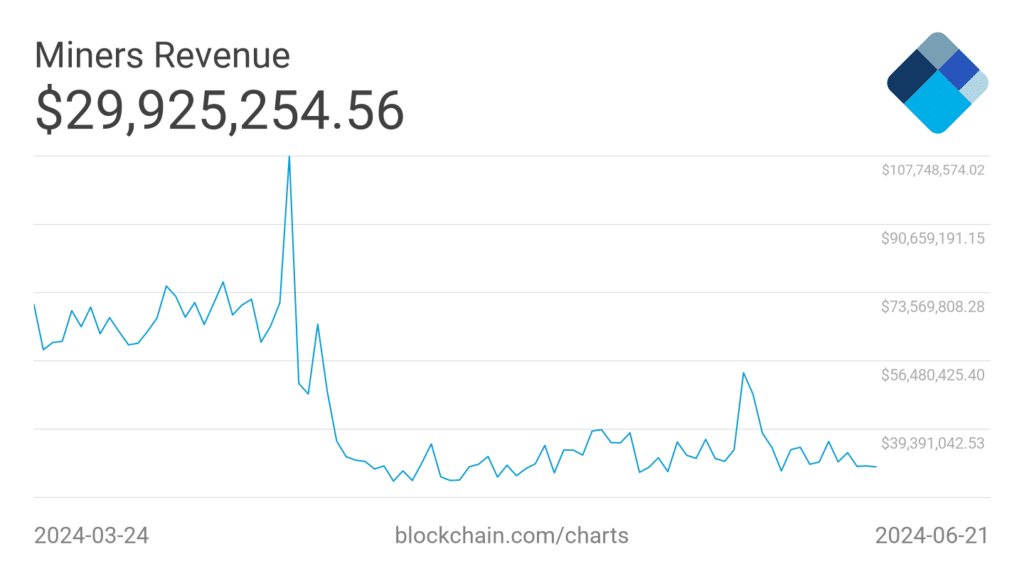

State of the miners

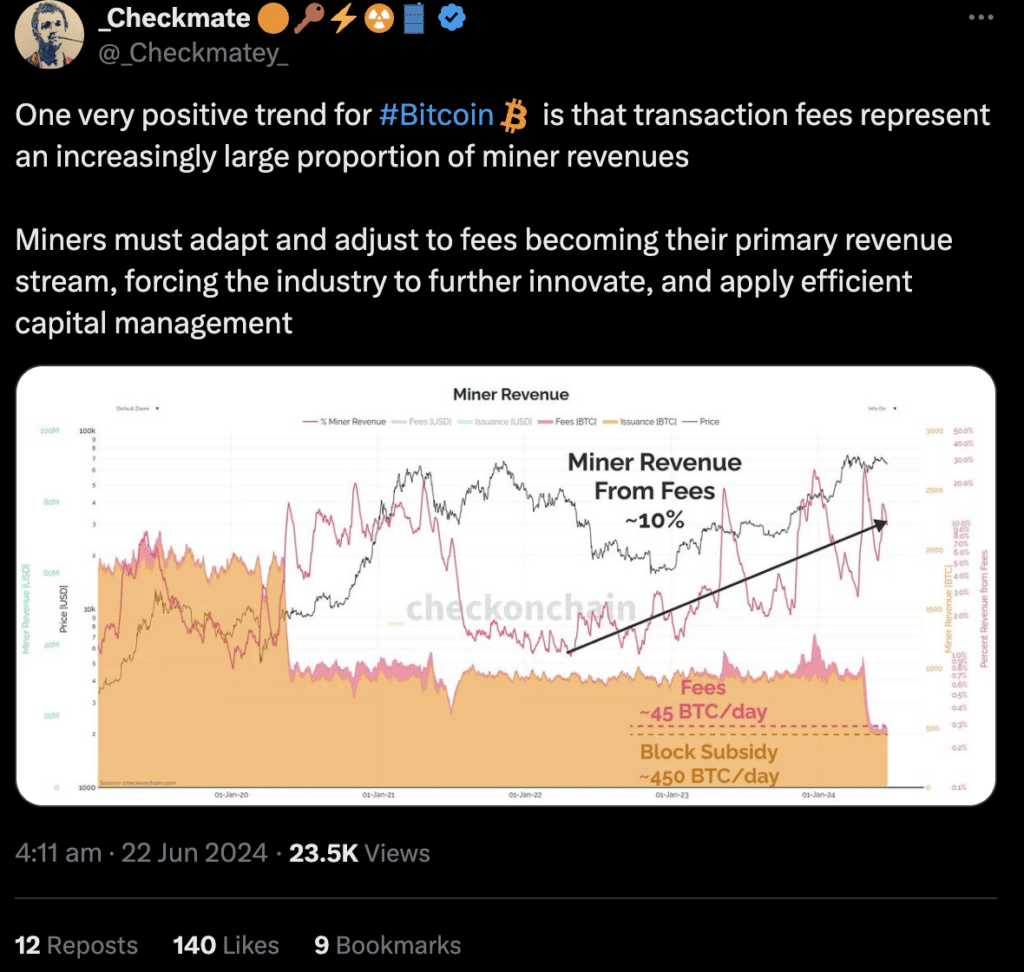

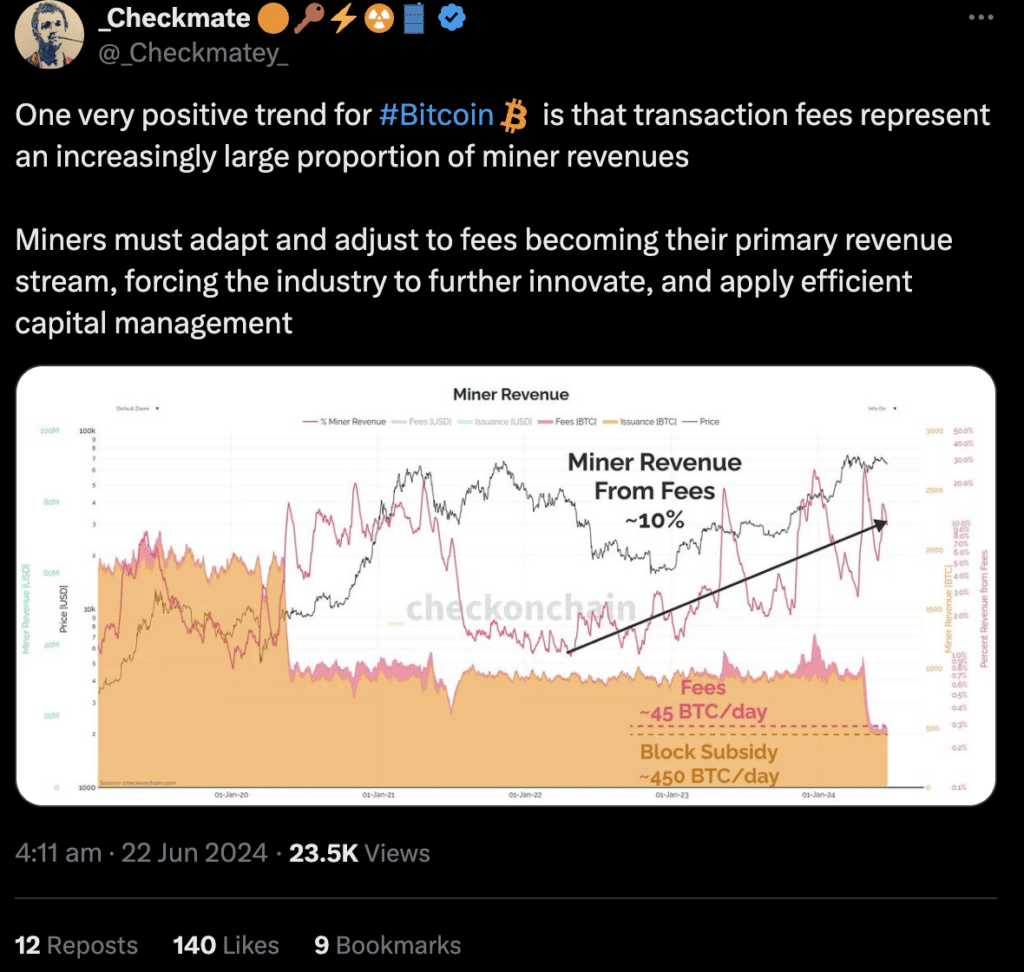

One positive trend that has emerged is that transaction fees are becoming an increasingly significant portion of miner revenue. This trend can be attributed to the limited supply of Bitcoin being created due to the halving and the number of transactions on the network increasing since the beginning of the year. As a result, miners are capturing more value from fees to process transactions.

This shift in revenue stream will necessitate miners adapting to the changing ecosystem. They will need to adjust fees becoming their primary source of income, forcing the industry to further innovate and apply efficient capital management strategies.

In order to remain profitable, miners will likely look for ways to optimize their operations and reduce costs.

Source: X

A major decline in activity

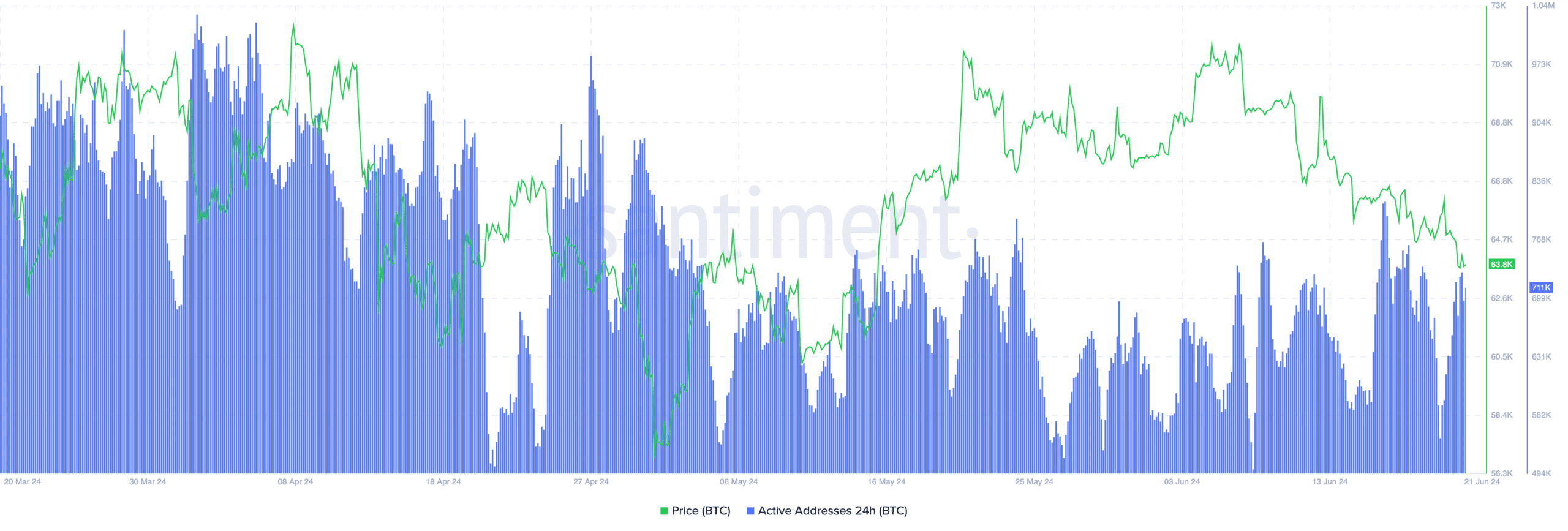

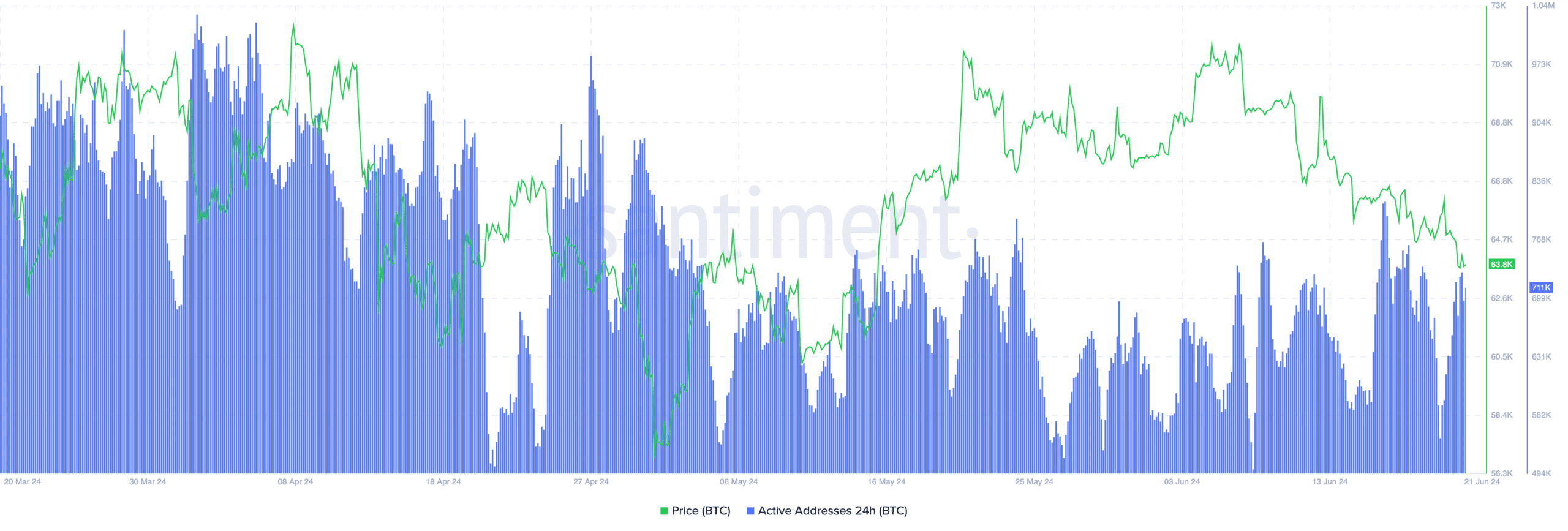

However, this over-dependence on activity on the Bitcoin network can be problematic for the miners as well. For example, AMBCrypto’s analysis of Santiment’s data revealed that the daily active addresses on the Bitcoin network declined materially over the past few months.

If activity on the network continues to fall, so will the ability of miners to generate revenue.

Source: Santiment

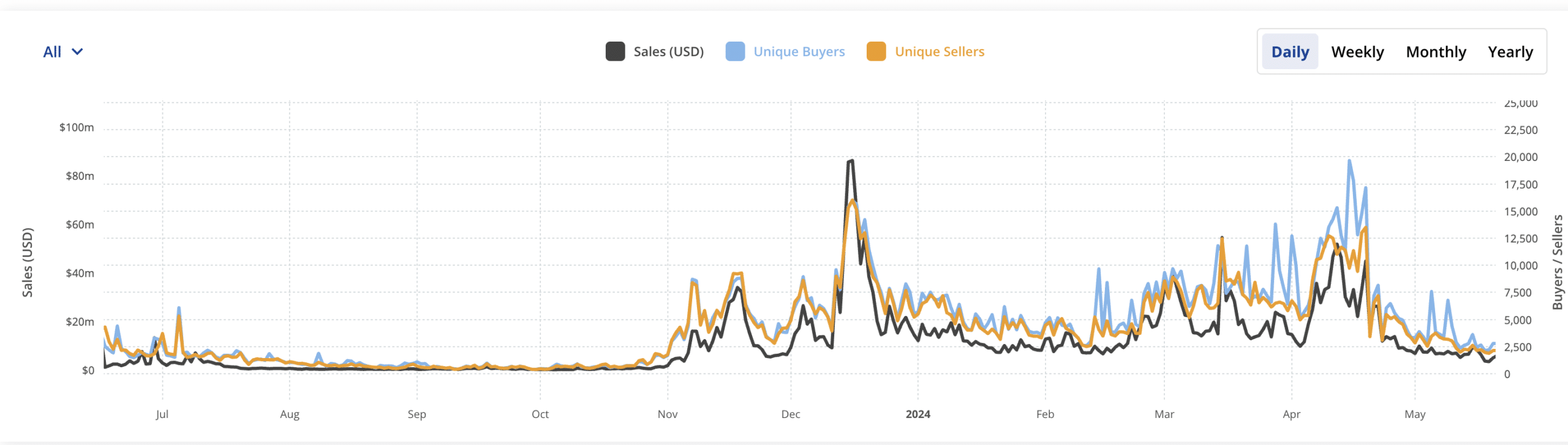

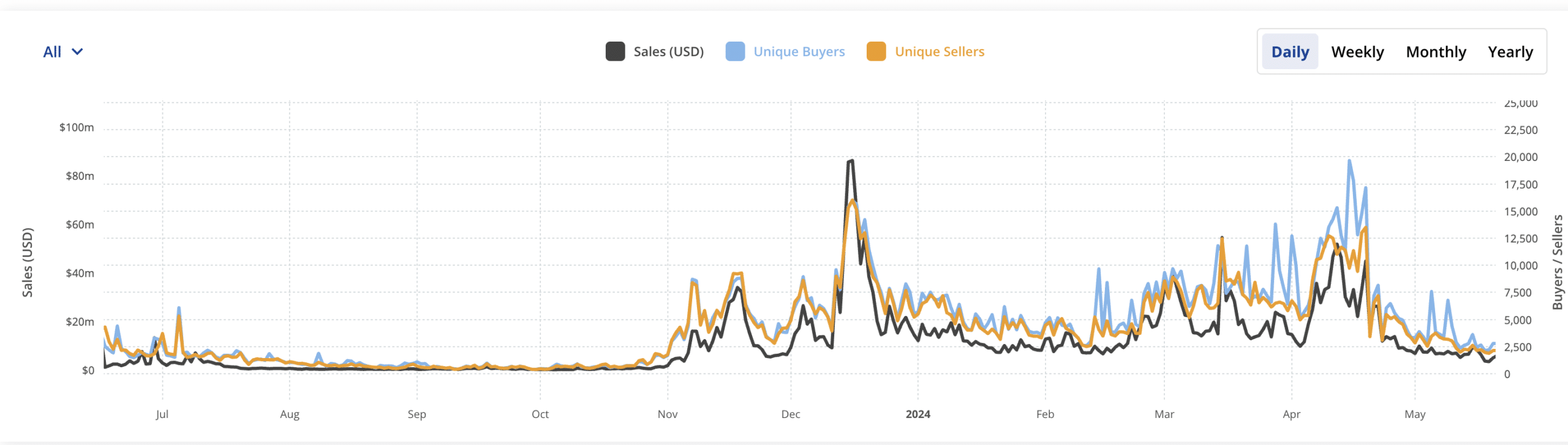

Moreover, the NFT volumes on the Bitcoin network fell materially too.

Just recently, the Bitcoin network lost its top spot in terms of NFT sales to Ethereum. At the time of writing, Bitcoin stood third on the NFT sales front, with Polygon overtaking Bitcoin on the rankings too.

Source: Crypto SlamDue to the declining interest in Bitcoin’s ecosystem, the miners might be affected negatively. Over the last few weeks, the daily miner revenue fell from $50 million to $30 million. If the revenue generated by these miners continues to decline, these miners will be forced to sell their BTC holdings to remain profitable.

Due to this, excessive selling pressure on BTC could pull the crypto’s price lower on the charts.

Source: Blockchain.com

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the time of writing, BTC was trading at $64,262.42, with no major gains seen in the last 24 hours. This corresponded with a 19% fall in the crypto’s volume over the aforementioned period too.

Source: Santiment