- Long-term holders have begun to distribute their coins.

- On-chain data suggested that Bitcoin was overheated.

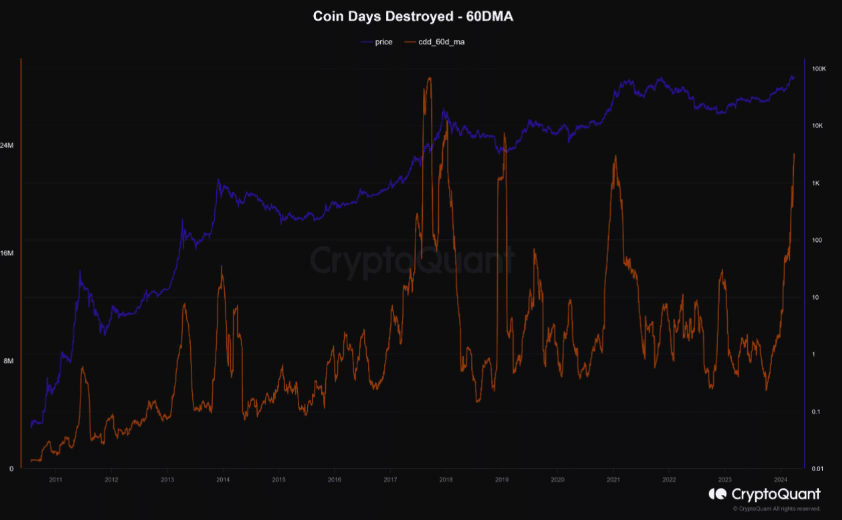

Bitcoin’s [BTC] Coin Days Destroyed (CDD) has hit a five-year high, according to data from CryptoQuant. Maartunn, an author of the on-chain analytic platform, also discussed this in a recent piece.

Coin Days Destroyed measures the number of days Bitcoins have been inactive multiplied by the volume transacted.

Historically, when the CDD hits a peak on the 60-day Moving Average (MA), it means that long-term holders are distributing their coins.

Source: CryptoQuant

When this happens, Bitcoin experienced a significant correction. Maartunn, in his post also admitted it saying,

“This pattern indicates that during the bullish phase, there is a distribution of older coins. In historical contexts, it may take up to 5 months for Bitcoin to reach its peak.”

Cuts in the middle

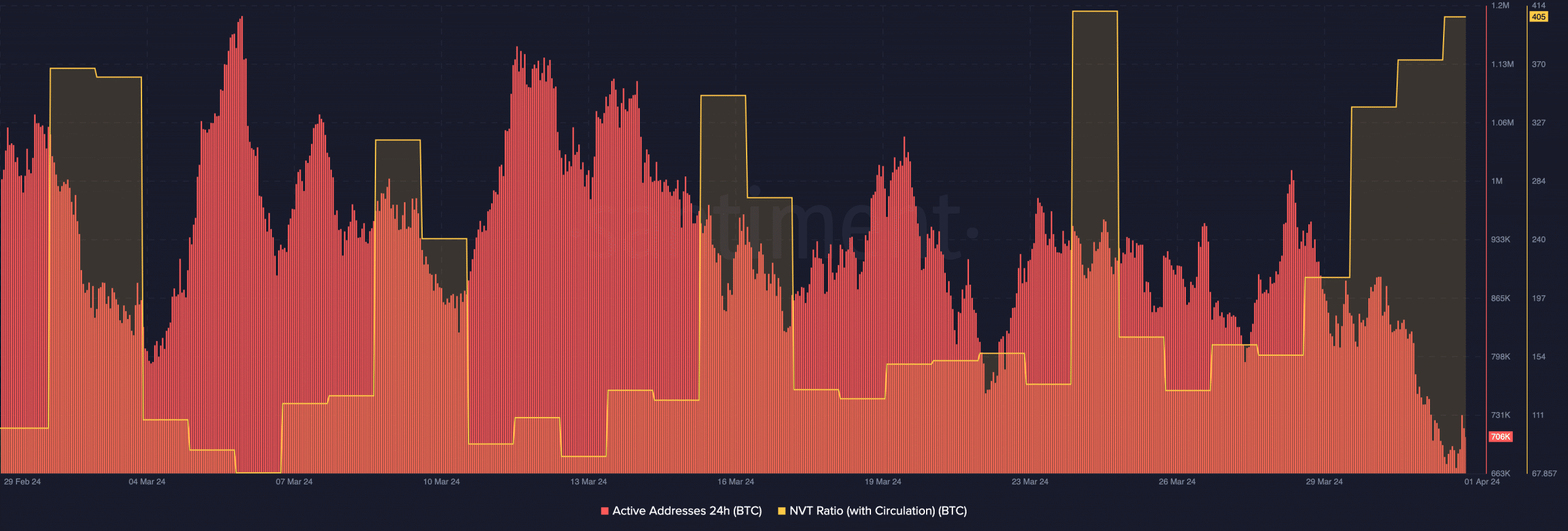

At press time, BTC changed hands at 69,663, indicating that the coin has been moving sideways in the last 24 hours. Further insights into Bitcoin’s on-chain status showed that activity on the network had decreased.

As of this writing, the 24-hour active addresses were 706,000. A few days back, the metric was above 1 million. Therefore, the recent decrease implies that BTC’s successful transactions have declined.

If the network lacks impressive activity, then the price might be affected since demand might be low. Should this be the case, the price of Bitcoin could drop below $69,000.

Besides the active addresses, AMBCrypto also looked at the Network Value to Transactions (NVT) ratio. This metric tells if an asset is overvalued or undervalued, depending on the capacity to transact coins.

A low NVT ratio suggests that transaction volume is growing faster than the market cap. In this instance, investor sentiment might be termed bullish.

Source: Santiment

However, Bitcoin’s NVT ratio was high at 405, indicating that investor sentiment was bearish. This relatively high network ratio was a sign that BTC was overvalued, considering the current market condition.

It’s either here or there

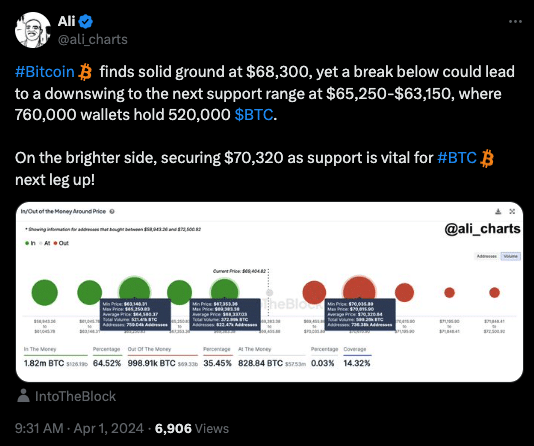

Crypto analyst Ali Martinez, in a post on X (formerly Twitter), also shared his short-term view on Bitcoin.

According to Martinez, the price of the coin might drop to $63,150 if bulls fail to hold on to the $68,300 support.

On the other hand, the analyst mentioned that Bitcoin’s price might move higher if the coin retests $70,320.

Source: X

From the look of things, Bitcoin’s price might decrease before the halving, which is due on the 19th of April. According to history, the coin experiences high volatility whenever the halving approaches.

Is your portfolio green? Check out the BTC Profit Calculator

This time, it might not be different. But it seemed like Bitcoin was almost done with its pre-halving rally, and a downturn could be next.

In the meantime, BTC might surpass the $70,000 region this cycle. However, the current conditions suggest that it might only happen after the four-year event.