Bitcoin (BTC) has printed a sudden 7% bounce following data from the Bureau of Labor Statistics (BLS) revealing that inflation data cooled in April.

According to the BLS, the Consumer Price Index (CPI), which is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, increased by 0.3%, slightly less than what was forecasted.

Both Bitcoin and stock markets responded well to the data, with the S&P500 reaching new all-time highs above the 5,300 level, and BTC rebounding to $65,152.

With Bitcoin’s halving now in the rearview, analysts are waiting to see how the BTC mining ecosystem will react to its rewards being cut in half, and the effect it could have on the leading crypto asset by market cap.

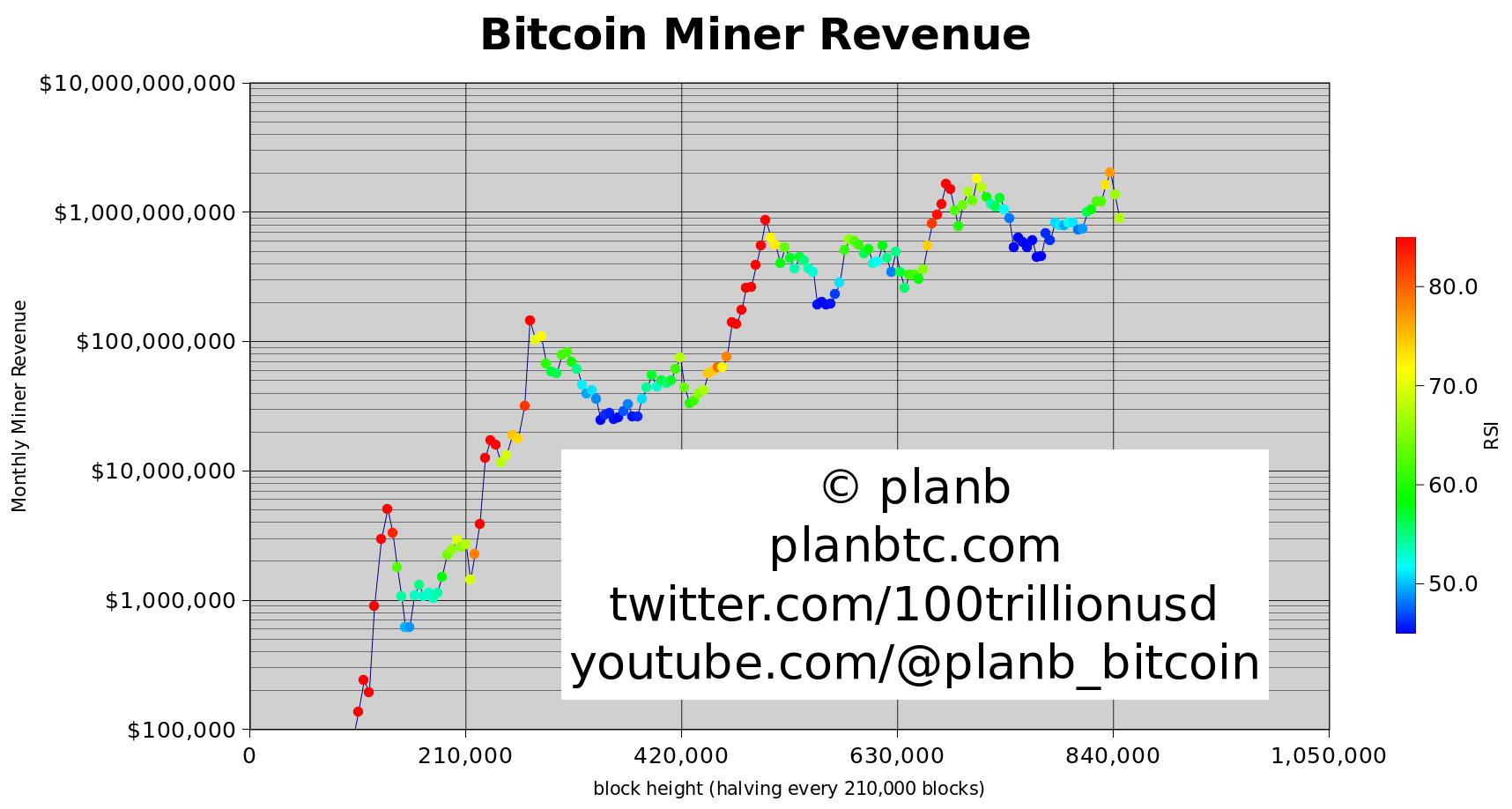

Quant analyst PlanB says that based on the historical correlation between miner revenue and price action, BTC should go “vertical” later in 2024 as the industry’s revenue recovers from the halving.

“Historically, bitcoin miner revenue recovers 2-5 months after a halving, and after that Bitcoin price goes vertical.”

On-chain analyst Willy Woo says that the mining industry could consolidate to fewer, stronger miners who are less likely to sell due to having larger margins and more efficient business models, thus easing sell pressure on Bitcoin.

“Thesis:

Inefficient miners get culled at the halving.

They dump their BTC before dying.

Only the strong ones survive.

They operate on fatter margins so don’t need to sell.

Miner sell pressure gone.

Takes 2-5 months for the new supply/demand to reflect in price.”

Fundstrat’s Tom Lee is also optimistic about Bitcoin miners, saying that miners have the “leverage” to pump the price of BTC further.

At time of writing, Bitcoin is trading at $64,980.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/johavel/maksum iliasin