- The Bitcoin miner reserve has increased to its highest level since April.

- BTC has fallen below $70K once again.

Recently, Bitcoin [BTC] mining difficulty has decreased, but miners’ revenue has also declined.

Despite this drop in revenue, miners have yet to start selling off their holdings, even with BTC falling below the $70,000 mark. They are choosing to hold onto their Bitcoin for now.

Bitcoin mining revenue and difficulty declines

According to data from Blockchain.com, Bitcoin mining difficulty has remained flat for several days.

The chart analysis shows that the difficulty began decreasing around the 7th of May and continued until the 10th of May. Since then, it has stabilized.

This implies that solving the block puzzle to add new blocks now requires less time and fewer resources.

Additionally, over 30 days ago, BTC miner revenue surged to over $107 million but then experienced a sharp decline, dropping to $26.4 million by the 1st of May.

At press time, it was attempting to recover, likely supported by the recent rise in BTC prices, and sat around $34.1 million. This level of revenue is similar to what it was in December 2023.

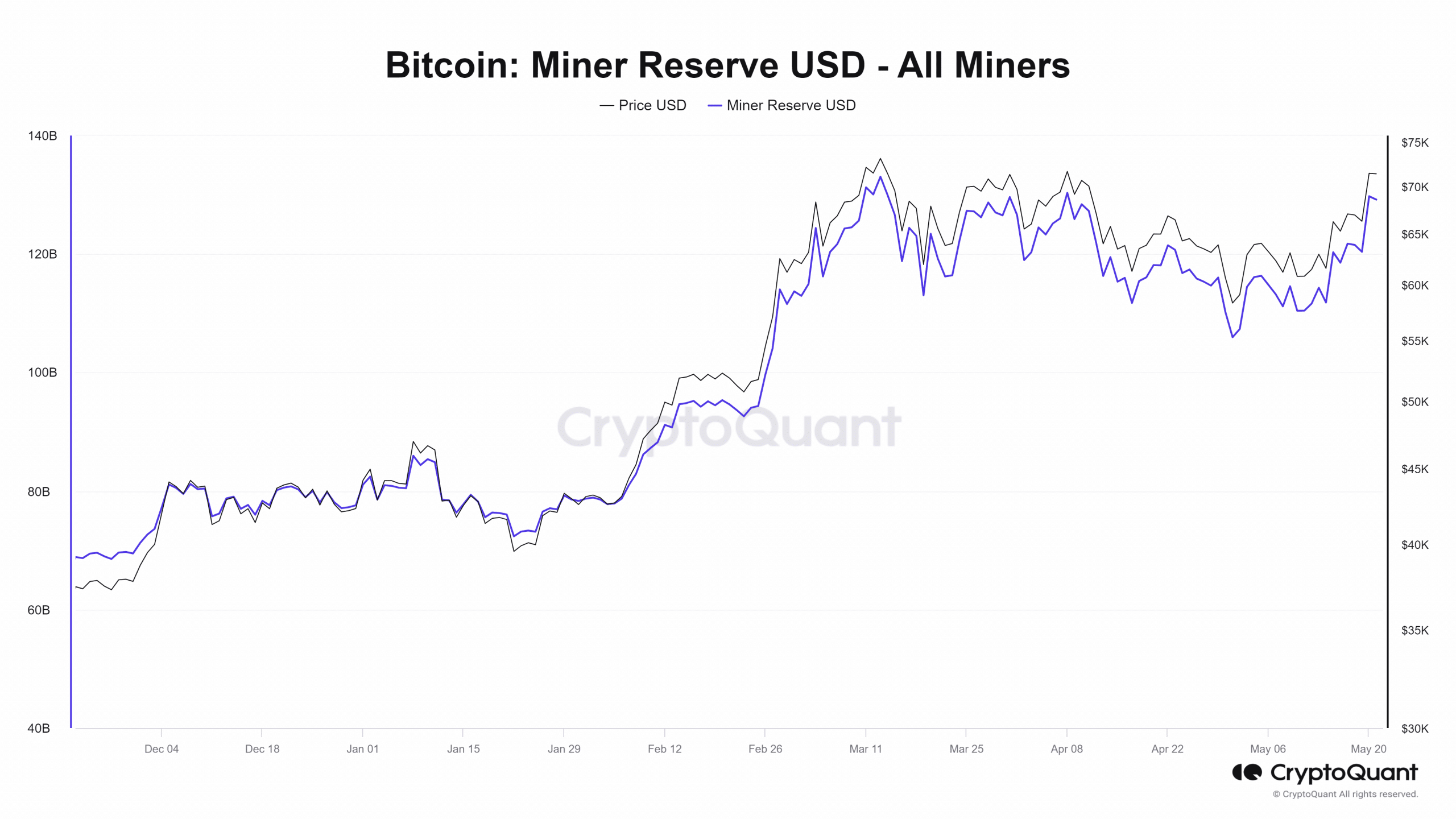

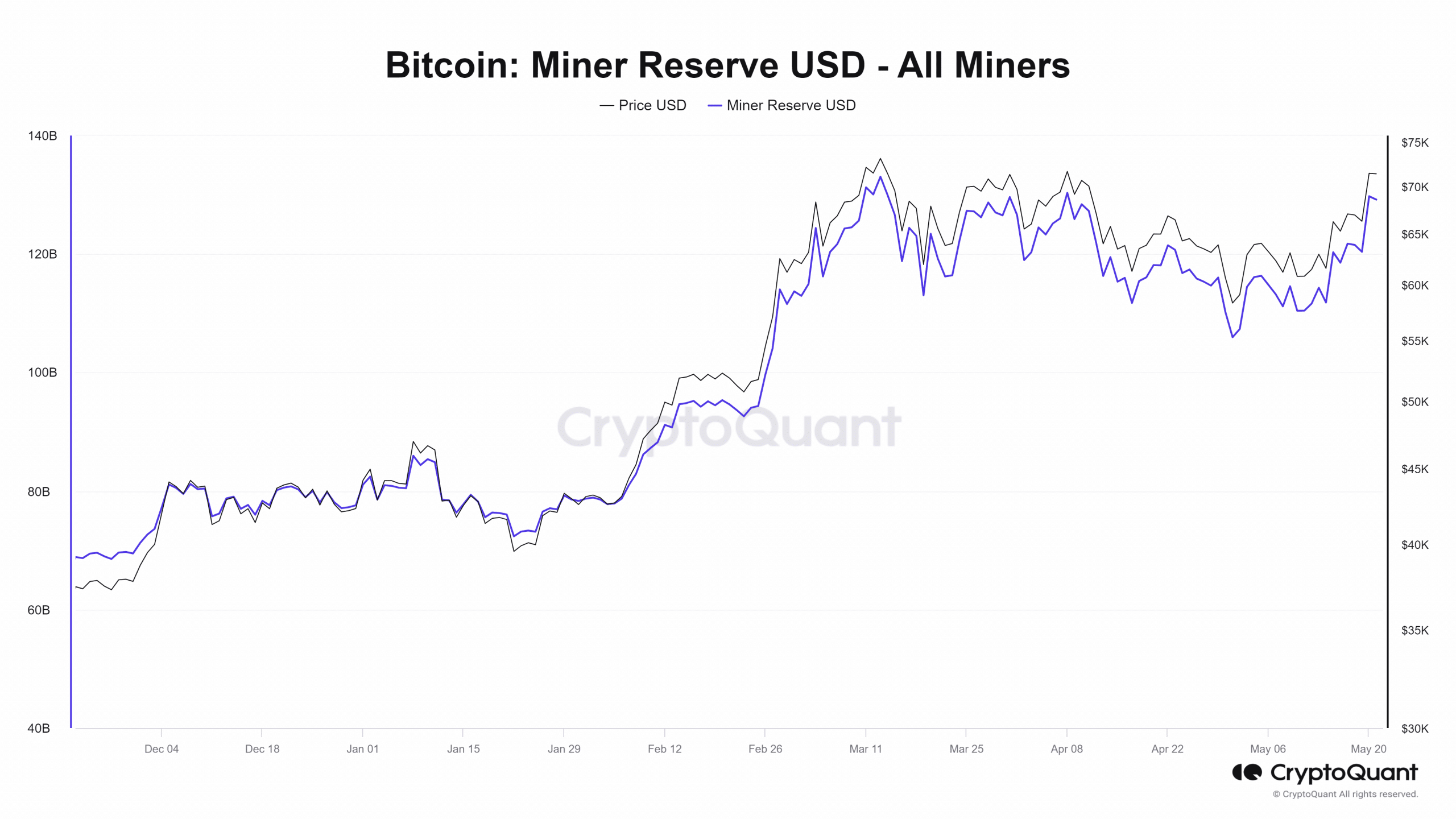

Miner reserve increase in value

AMBCrypto’s analysis of the Bitcoin miner reserve indicated that it has remained stable over the past few days, holding around 1.816 million BTC at press time.

Although there have been occasional declines, the reserve has maintained this level since the 6th of May.

However, the value of this reserve has significantly increased in recent days. The chart showed that the reserve’s value rose from approximately $120 billion to over $129 billion by the 20th of May.

As of this writing, the reserve’s value is around $129.2 billion.

Source: CryptoQuant

Bitcoin falls below $70k

The increase in the value of the Bitcoin miner reserve is due to the spike in BTC’s prices. On the 20th of May, the price of BTC surged from around $66,000 to over $71,000, a rise of more than 7%.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, at press time, BTC had fallen back to approximately $69K, with a decline of 2% in the last 24 hours.

This price range means that miners’ holdings have become more valuable, even if the volume of their holdings has not significantly increased.