- Stocks of Bitcoin miners saw an increase recently.

- BTC has fallen below its support line.

The market cap of US-listed Bitcoin [BTC] miners has climbed to a significant high, according to a recent report. Despite the rising stock prices of these miners, their revenue and reserves have been on a decline in the last few days.

Bitcoin mining stock surges in capitalization

According to analysts at JPMorgan, the market capitalization of bitcoin miners listed on U.S. exchanges hit an all-time high of $22.8 billion as of 15th June.

In the first half of June, the 14 U.S.-listed Bitcoin mining stocks surged, with Core Scientific, TeraWulf, and IREN leading the charge with gains of 117%, 80%, and 70%, respectively, as noted by JPMorgan analysts Reginald Smith and Charles Pearce.

Bitcoin miners see a decline in reserve and revenue

Glassnode’s analysis indicates that the Bitcoin miner balance has been steadily decreasing over the past few weeks. Currently, the reserve stands at approximately 1.8 million BTC, a level last observed in 2021, marking a low not seen in over three years.

This decline suggests that the volume of BTC held by miner addresses is shrinking, indicating an ongoing sell-off from these addresses.

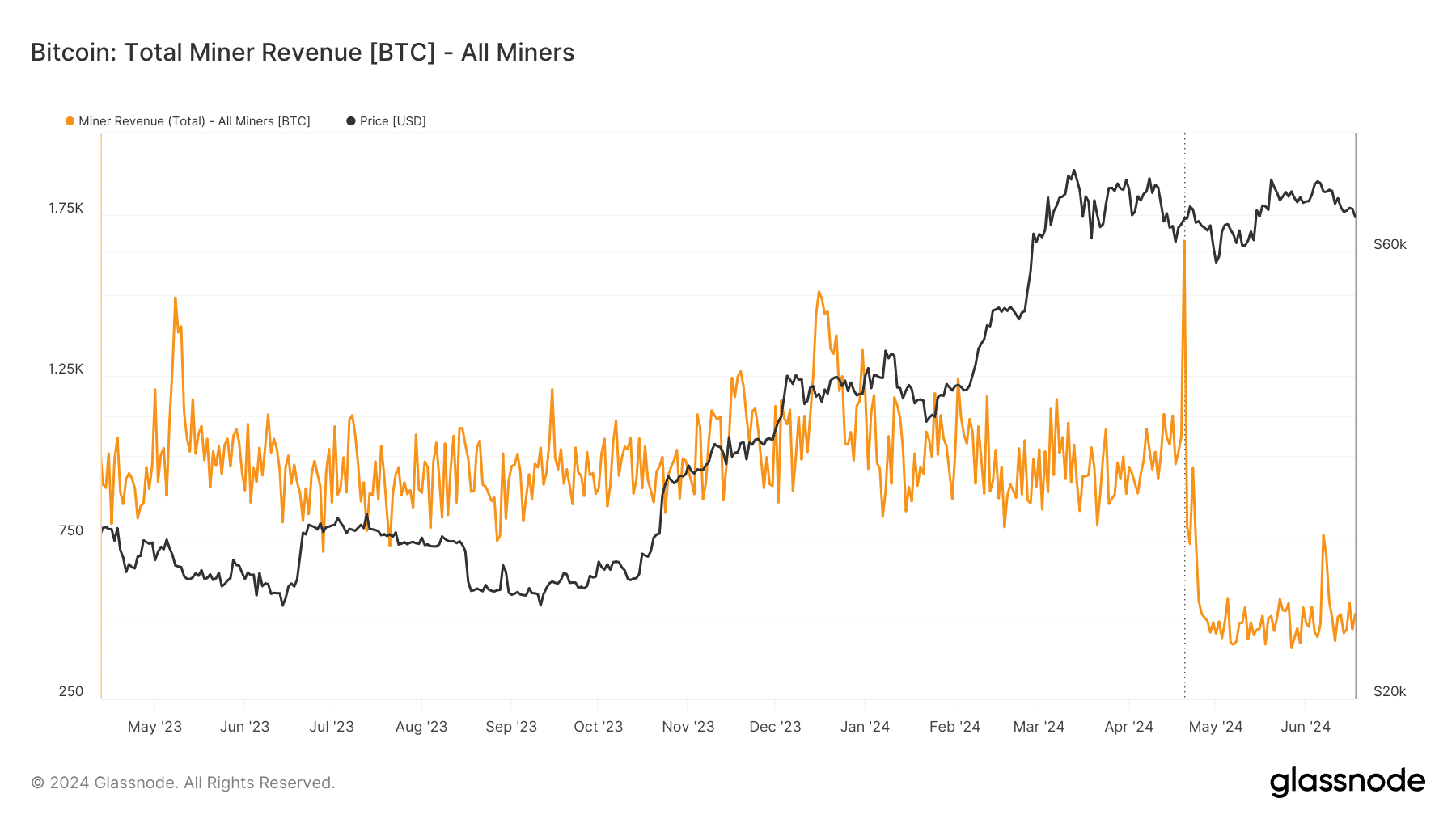

Additionally, an analysis of BTC miner revenue indicates a downward trend in recent weeks.

Currently, revenue stands at approximately 512 BTC, a significant drop from the over 1,000 BTC observed earlier in the year.

While the recent halving event has contributed to this decline, there has also been a general decrease in revenue overall.

Source: Glassnode

Bitcoin falls off support

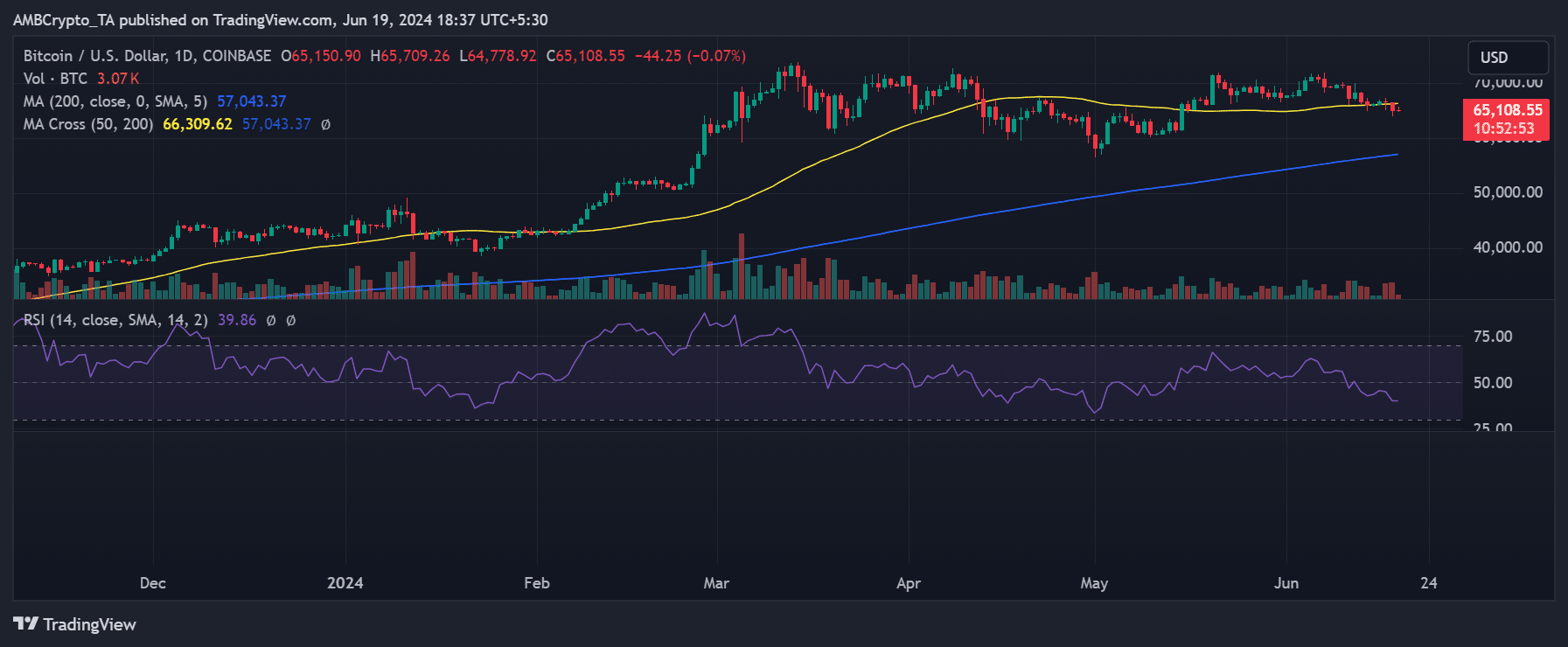

An analysis of Bitcoin on a daily time frame chart revealed a 2% drop on 18th June, bringing its price to approximately $65,152.

Initially, the support level, indicated by the short moving average (yellow line), was around $66,000. However, the price decline pushed it below this support level, which has now turned into resistance.

Source: TradingView

Read Bitcoin (BTC) Price Prediction 2024-25

At the time of writing, Bitcoin was trading at approximately $65,121 and has been unable to break through the new resistance level. The stochastic indicator corroborates the current negative trend, continuing its downward trajectory.

Additionally, a closer examination of the indicator suggests the possibility of another significant price shift soon.