Bitcoin (BTC) the world’s biggest cryptocurrency has been moving sideways continuously for the last 48 hours. This sideways movement in BTC is causing billions of dollars worth of short-term long positions to be at risk of liquidation due to high leverage.

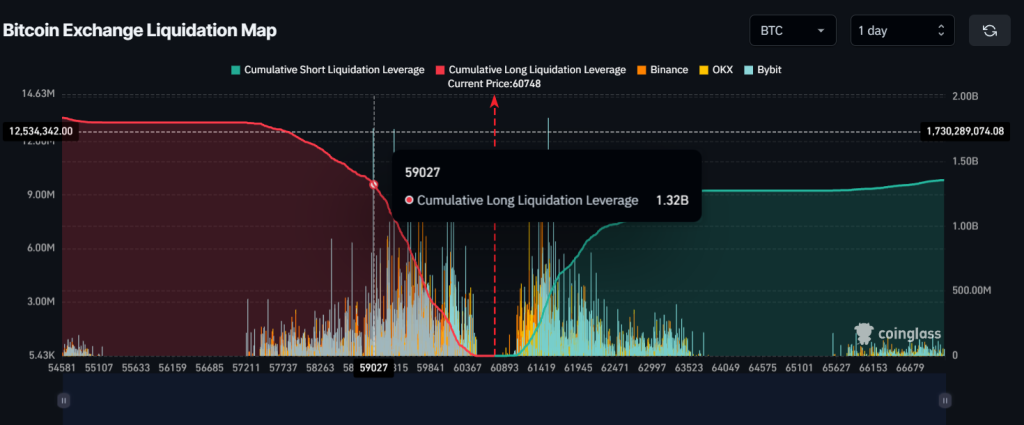

$1.32 billion BTC Positions at Risk of Liquidation

According to the on-chain analytic firm CoinGlass, over $1.32 billion worth of long positions will be liquidated if BTC crosses or reaches the $59,000 level. Currently, long position holders believe that BTC won’t fall to or reach the $59,000 level, following this they are highly leveraged.

Bitcoin Technical Analysis

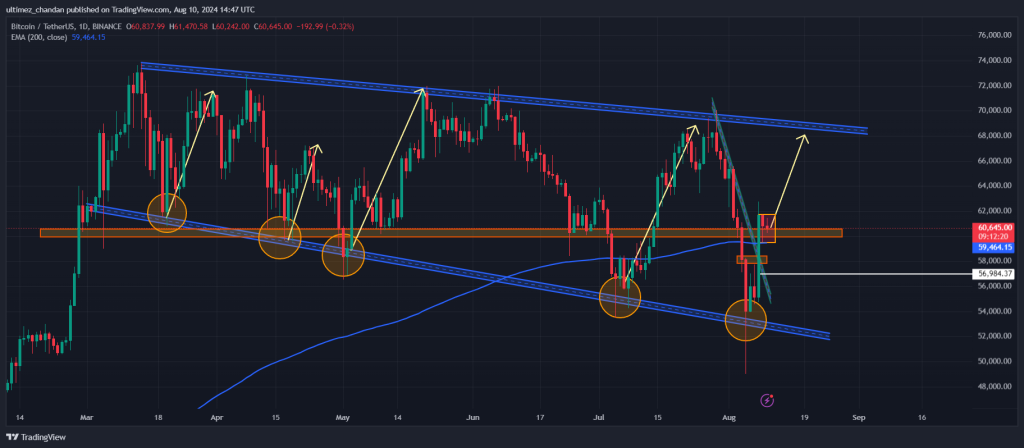

However, expert technical analysis suggests that the $59,000 level is strong support for Bitcoin (BTC), with the 200 Exponential Moving Average (EMA) also providing strong support for buyers at this level.

In this current situation, BTC looks bullish and there is a high chance it could soar to the $65,350 level if it gives a breakout of $61,770. Based on the historical data or price momentum, whenever BTC consolidates in a tight range it tends to experience an upside rally. However, this market is expecting something similar to a prior rally.

BTC Whales Activity

Amid this price consolidation, whales have moved nearly $200 million worth of BTC to various centralized exchanges, including Coinbase and Kraken. Additionally, two dormant wallets holding nearly $16 million worth of Bitcoin have been activated after 10 years.

Market Overview

At the press time, BTC is trading near the $60,600 level and has experienced a price decline of 0.25%, in the last 24 hours. Meanwhile, its trading volume has also declined by 45% during the same period. This fall in trading volume suggests fear of price drops that cause lower participation from traders and investors.

Apart from BTC, other top cryptocurrencies including Ethereum (ETH), Solana (SOL), and BNB (BNB) are struggling. In the last 24 hours, ETH, SOL, and BNB have experienced a price surge of 1.6%, 0.5%, and 2.5% respectively.